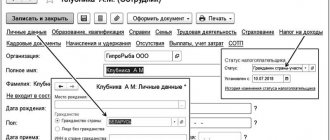

Foreigners and their statuses affecting the calculation of contributions Foreigners - persons who are not citizens

The introduction of the Plato system caused a mixed reaction in society and a large number of disputes,

According to Part 1 of Article 14 of Law 255, benefits for temporary disability, pregnancy and

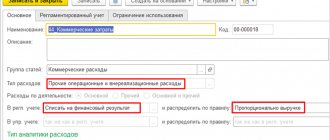

Accounting of funds in the current account is carried out in order to ensure the correct reflection of settlement, cash, credit

Taxation of travel expenses: general rules For an employee sent on a business trip, the employer is obliged to: 1. Pay an average

Before November 2016, paying taxes was much less convenient than in the current year 2022

In this article we will look at the property tax benefits of an organization. For what property?

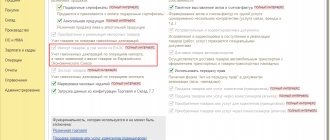

Several years have passed since the creation of the Customs Union, one of the goals of which was to reduce the tax

End of article. Started in No. 3, 2022 Advantages of actual material cost estimates for

All Russian citizens face state duties in one way or another. Payment of this fee accompanies