End of article. Starts at No. 3, 2022

Benefits of actual material cost estimates for orders

The relationship between order costs and accounting

Calculation of the cost of steam production and other services

Opening the nth number of orders for auxiliary production is not enough - it is important to reliably generate costs for orders, plan and control material costs per order, link orders with correspondence accounts in accounting and organize cost calculations.

We generate actual estimates of material costs

Let's consider an important point - the accumulation of costs for auxiliary production orders. The primary documentation must indicate the order number (code).

In order to correctly post costs using the order-based accounting method, it is necessary to correctly write out the primary documents - in accordance with the Order Book and regulatory and technical documentation.

Materials and spare parts consumed during the work by auxiliary production areas are assigned to orders in one of the following ways:

- at the time of release (checkout, acceptance and transfer) from the warehouse to production on the basis of invoices, requirements, limit cards, permits to replace material. This method is acceptable if auxiliary production shops immediately consume the supplies received from the warehouse when performing work, for example, for repairing or connecting equipment;

- at the time of write-off according to the volume of work actually performed on the basis of work orders (see example below), reports, lists of defects, certificates of work performed. This method allows you to strictly control the stock (remainders) and consumption of material assets in auxiliary production workshops and involves the organization of in-shop storerooms, as well as the daily write-off of actually consumed material assets, which, if there is a significant movement of them, requires the presence of a storekeeper on staff.

In the first part of the “Work Order for auxiliary production” the following is indicated:

- number and full name of the order;

- type of malfunction;

- a brief description of the work performed;

- Full name of workers, number of hours worked.

If necessary, indicate the name and inventory number of the equipment on which the repair was carried out.

During one work shift, workers can perform work on several orders, work in teams, in pairs or independently. For example, for order 216 “Repair and maintenance of equipment for the thermal-humidity processing of products,” the relay replacement was carried out by two electricians, spending a total of 3 hours. This ensures the labor costs for orders.

In the second part of the order, according to the types and volumes of work, spent material assets are written off for orders. For order 216, for example, two relays were written off in the amount of 3,720 rubles.

The third part of the order reflects material assets that have been dismantled (removed) from the equipment and that must be taken into account. This is a used electric motor, the functionality of which can be restored after rewinding (valued at 350 rubles). It was dismantled during work under order 224 “Repair and maintenance of general industrial operating systems.”

As a result of assigning material costs to orders, we obtain summary data on material costs for orders of auxiliary production (Table 3). According to the data in Table. 3 repair shop 03/05/2019, using invoice No. 43, received 214 clutch couplings worth 15.4 thousand rubles from the warehouse to order. for repair of equipment of the mixing workshop.

Based on the data on material costs presented in table. 3, generate estimates of actual costs. Let's look at some of them.

Example 1

Control of production costs and WIP balances for orders for the manufacture of spare parts

By order 203 “Pulley 117.09.002” the machine shop produces spare parts for non-standard equipment of the main production.

Data selection from table. 3 shows that materials in the amount of 259 rubles were written to order 203. (Table 4). During the reporting period, 2 pulleys were delivered to the warehouse. According to the standards, it is necessary to write off 18.5 kg of metal in the amount of 197.5 rubles to the cost of manufactured products.

When including materials in the picking list, deviations from the norms are taken into account. So, according to the cutting card, the part was made from a piece (remnant), so the cost included not 7.5, but 7 kg.

In work in progress for order 203 there will be 6.5 kg of metal worth 61.5 rubles. (see Table 4). Taking into account the balances on the order, the economic planning department generates a limit and intake card for the release of materials to continue work on the order or prohibits the release of materials to auxiliary production.

In this case, according to the order log of auxiliary production (see Table 1, part 1 of the article), the order is open for 10 pulleys, only 2 have been manufactured and delivered to the warehouse, 8 more need to be manufactured. The limit and intake card allows the release of metal in the following quantity:

- Circle 16 st. 40X: norm per unit - 3 kg, card limit - 3 × 8 = 24 kg;

- Circle 42 st. 20: norm - 2.5 kg, limit - 20 kg;

- Sheet 6: norm - 3.75 kg, limit - 30 kg.

Example 2

Estimate of material costs for improving fixed assets

To calculate the cost of improvements that must be attributed to the cost of fixed assets, an estimate of actual material costs is required.

For order 210 “Modernization of roller crusher No. 1” (Table 5), material costs amounted to 52,332.6 rubles. The work was carried out by three auxiliary production shops. Let’s assume that as of the date of the estimate (03/25/2019) the work is completed.

The economist compares the actual estimate with the planned estimate. If there are discrepancies, he asks questions to the head of the relevant workshop and takes action (for example, it is necessary to find out why, for order 210, the repair shop wrote off an automatic gearbox worth 45.6 thousand rubles, which was not included in the plan).

Example 3

Estimate of material costs for the repair of a priority piece of equipment

At the stage of opening orders, we determined which repair costs should be attributed to a specific piece of equipment. As a rule, cost objects are chosen:

- priority technological equipment on which the implementation of the production program depends (Table 6);

- new, newly commissioned equipment - to form a regulatory framework;

- equipment under warranty from the manufacturer or contractor after repair - to control the types of work and costs for spare parts;

- equipment that requires expensive spare parts and components for repair.

To complete the first two tasks, order 213 “Repair of an automated brick molding line” was opened. The cost of repairing the line during the reporting period amounted to 10,160 rubles, the electrical shop replaced an expensive control unit - 5,300 rubles. (Table 6).

To ensure uninterrupted operation of the equipment, technical specialists form a repair stock based on the data in table. 6 (for example, provide a supply of pumps and bearings).

Example 4

Estimate of material costs for repairs in the main production workshop

To generate an actual estimate for repairs, select material costs for all orders with the “repair” type for one customer.

Table 7 presents the actual estimate for the mixture preparation workshop. During the reporting period, costs amounted to 26,311.97 rubles, with the main contractor—the repair shop—accounting for 24.9 thousand rubles.

Table 5 is used to plan repair costs.

Algorithm for planning repair costs:

1) select orders for which you need to plan costs (in our case - all repairs, Table 1, part 1);

2) we submit the actual estimate for the reporting period (Table 7) to the chief mechanic or the head of each auxiliary production workshop for analysis;

3) technical specialists for each item or group of spare parts give a conclusion - plan a similar quantity for the next reporting period (bolts, electrodes), exclude (they have only been replaced and repairs will not be required soon (conveyor belt), there are no important spare parts that have not been replaced for a long time - must be added to the procurement plan;

4) based on data received from technical specialists, economists plan repair costs for the main production workshop (depending on the requirements - by groups of spare parts or enlarged).

For example, technical specialists excluded the conveyor belt and coupling from the plan for the next reporting period, and added carbide plates worth 10 thousand rubles. The total planned material costs for the mixture preparation shop for the next reporting period will be:

26,311.97 – 870 – 15,400 + 10,000 = 20,041.97 thousand rubles.

For your information

The considered set of estimates for orders and cases of their application is not exhaustive; depending on the specifics of the activity at each enterprise, it is different.

Cost estimates for auxiliary workshops should be reflected in cost estimates for the maintenance and operation of equipment, for preparation and development of production, shop, general plant expenses and in calculations of other comprehensive expenses. To do this, the total cost of auxiliary workshops should be:

- assigned directly to customer workshops;

- distributed by drawing up a special calculation of the use of their products, works and services in areas.

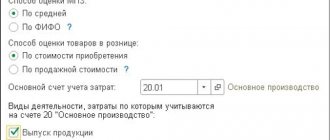

1.3) Closing 23 accounts for 44

In the current example, the support production OS provides some services to the business unit. From the point of view of Integrated Automation 2.4, the provision of such a service will be an expense. Its amount will be formed only based on the results of work at the end of the month. This means that in order to attribute a service to account 44, the document “Production without an order” and proper registration of the cost item are also required.

An expense item for a commercial division should have the following settings:

Expense type - “Business expenses”, specify the distribution settings “Write off to financial result”, in our example the expense will be distributed to areas of activity in accordance with the revenue received.

On the “Regulated Accounting” tab, data for tax reporting, as well as accounting accounts, are entered; in the current example, account 44 is closed using direct costing to account 90.07.1.

After filling out the cost item, a basis is formed for determining consumption through the document “Production without an order.” One document is generated for one area of activity. If the 44th invoice at the end of the month must be distributed to all areas of activity in accordance with the necessary rule, then it is not recommended to fill out the corresponding field on the “Additional” tab in the “Production without an order” document.

On the “Main” tab, the auxiliary department is indicated in the corresponding field (otherwise account 23 will not be included in the loan posting).

On the “Products” tab, in the “Direction of output” column, indicate “Write off as expenses”, fill in the “Recipient/item and analytics/accounting account” column with the recipient department, as well as the expense item with accounting account 44, created earlier.

Document postings will be generated in the previously created document “Production without an order” only after the routine operation “Distribution of costs and calculation of cost” is completed as part of the closing of the month, that is, at the moment when the cost of an hour of fixed assets is generated. The subconto “Direction of activity” will not be filled in, because in the settings, the expense on account 44 should be distributed on 90.07 to areas of activity, according to the revenue received.

As part of the month closure, the document “Distribution of expenses between areas of activity” will be automatically generated:

The document will distribute the expense on account 90.07 by area of activity. In the current example, implementation was completed within a month for only one area of activity.

Now everything is ready to begin closing account 23.

We distribute costs among orders and customers

Opening orders for auxiliary production and accounting for labor costs (see example of work order, work on order 216) allows you to create a cumulative list of costs for orders (Table 8). Note that additional wages, social contributions, and general production costs between orders are distributed in proportion to the basic wages of workers.

For orders that do not require detailed accounting estimates, costs are taken into account only by element. In this case, a statement of costs for orders is sufficient (see Table 8).

Please note: the list does not contain orders where the customer, according to the order log (see Table 1, Part 1 of the article), is the plant as a whole. For example, this is order 224 “Repair and maintenance of general industrial operating systems.” The costs accumulated under this order, together with other general costs (salaries of the chief mechanic department, depreciation of general production buildings) are distributed and included in general production expenses.

We will not consider commercial and administrative expenses (orders 225 and 226).

Thus, according to the statement, the cost of repairing a ball mill for the reporting period is 55,965.82 rubles. (order 212). If a company has an alternative - to use a ball mill or other crushing equipment to produce products, an important criterion for making a decision will be the cost of repair and maintenance. Choose less expensive equipment.

As we have already written (see part 1 of the article), according to the order log, several orders are open for one customer workshop: for a priority fixed asset item, for a group and for all other fixed assets. Therefore, to include the costs of repairs and maintenance of equipment in the customer’s shop expenses, summary data is prepared.

By posting Debit account 20 Credit account 23, 831,040.41 rubles must be included in the costs of the mixture preparation shop. (Table 9). These are the costs of two repair orders (for large manufacturing companies these can be significantly higher). These are mainly direct costs, only general production costs for orders in the amount of RUB 26,561.43. are distributed.

Based on the data presented in table. 8 and 9, we can conclude that labor costs have the largest share in repair costs. They identify the most labor-intensive types of work and take measures to reduce them:

- switch to “lean” repairs;

- change the motivation system for repair personnel;

- introduce piecework and piecework payment systems for repairs, standardize the labor costs of repair personnel;

- refuse scheduled preventative repairs and carry out repairs based on actual breakdowns.

Note!

Attributing repair costs directly to customers using orders allows you to increase the accuracy of calculating workshop costs for each workshop of the main production, moving away from the usual distribution of repair costs (essentially overhead costs) through wages or machine hours.

The problem is relevant if the number of workers in the main and auxiliary production is the same for the following reasons:

- equipment and buildings are worn out and require constant repair and maintenance;

- the main production is automated, so the number of personnel is minimal;

- The company produces products using a unique technology, therefore the company produces non-standard equipment using auxiliary production.

The custom method allows, with high labor costs in auxiliary production, a significant share of general production costs (the main part of them for manufacturing enterprises are repair costs) to be attributed directly to the main production (in our example - 1290 thousand rubles, or 82.98%), and not for auxiliary services (264.7 thousand rubles, or 17.02%; Table 10). This cannot be achieved by taking workers' wages or hours as the distribution base.

For comparison, if labor costs in both industries are the same, then 50% (777 thousand rubles) would have to be attributed to auxiliary ones.

Justified on-demand assignment of repair costs to main production will reduce:

- the cost of production of auxiliary production (spare parts, equipment, modernization and production of non-standard equipment), and, as a consequence, the cost of inventories of own production. At the same time, the cost of finished products of the main production will increase (and justifiably). With highly liquid main products, this will allow optimizing income tax;

- volume of work in progress by auxiliary units.

Of all the auxiliary production areas, the steam power shop accounts for the highest costs for repairs and maintenance of equipment. However, accounting is not limited to this. The costs of the steam power shop must be attributed to the produced products (services), which are also distributed between the main and auxiliary production. These are services for:

- steam production;

- heat supply and heating;

- water production.

Due to the limited format of the article, we will dwell in more detail on the production of steam - we will calculate the cost of this service.

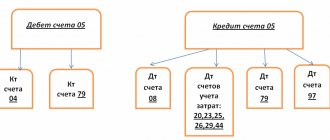

Account 23 in accounting

To account for the costs of auxiliary production in accounting, calculation account 23 is used:

- the debit of the account records the costs of auxiliary production;

- the loan reflects the actual cost of auxiliary production services provided to the main production or third-party customers;

- The account balance at the end of the month shows the value of work in progress:

Analytical accounting for accounting account 23 is carried out by type of production.