Accounting of funds in the current account is carried out in order to ensure the correct reflection of the organization's cash settlement, credit and other financial transactions. The main legislative document for non-cash payments is Regulations of the Central Bank of the Russian Federation No. 2-P dated April 12, 2001. To summarize data on ruble funds, account 51 “Currency accounts” is used, for foreign currency accounts – account 52 “Currency accounts”. Let's consider the procedure for generating standard transactions for accounting for transactions on a current account and the features of synthetic as well as analytical accounting.

Objectives of cash accounting in an organization

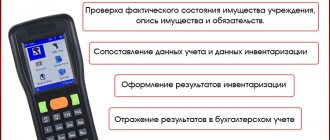

Let's consider the main tasks of cash accounting in the accounting department of an organization:

- documenting cash flow at the cash desk;

- exercising control over the intended use of funds;

- making payments to suppliers, contractors, personnel;

- making payments on financial obligations to creditors and investors;

- ensuring the safety of funds and documents;

- analysis of directions for using funds.

Accounting for cash in the organization's cash register

The movement of cash, monetary documents and foreign currency is reflected in the balance sheet in account 50 “Cash”.

| Debit | Credit | |

| Account 50 "Cashier" | Receipt of funds to the enterprise's cash desk | Disposal, cash payment |

Additional subaccounts can be opened for account 50:

- 50/1 – “Organization cash register”. The subaccount reflects the movement of funds in foreign currency.

- 50/2 – “Operating cash desk”. This subaccount reflects the movement of funds from transport and communication organizations: piers, stations, river crossings, ticket offices, etc.

- 50/3 – “Money documents”. Monetary documents such as: state are reflected. duties, bills of exchange, air tickets, etc.

Accounting for cash in the cash register. Typical wiring

One of the most common transactions is “Receipt of funds to the enterprise’s cash desk from a current account.” To reflect this operation, use the following entry.

To reflect revenue from the sale (sale) of goods or provision of services, the following standard entry is used. This wiring is used for retail trade.

The receipt of funds from the wholesale sale of goods is recorded in the form of the following two transactions. First of all, the buyer is presented with an invoice to pay for the product, which is reflected in the first posting; when the goods are shipped, a second posting is made, reflecting the receipt of funds from the buyer.

If the goods were paid for by the buyer in advance (before shipment), then the receipt of funds is reflected in subaccount 62.1 (“Calculations for advance payment”). For more information about settlements with customers, read the article: → “How to keep accounting records of settlements with customers?”.

Accounting of cash transactions. Examples

Example No. 1. Accounts for accounting for advance payments and VAT

Let's consider a typical accounting problem. The company received an advance payment for the delivery and shipment of products in the amount of 500,000 rubles. including VAT in the amount of RUB 50,000. This transaction must be reflected in the accounts. The table below provides a solution to this problem of accounting for advance payments and VAT.

Example No. 2. Accounts for accounting for investments in the authorized capital of an organization

The charter of the organization (LLC) determined the authorized capital in the amount of 50,000 rubles. When registering the company, the authorized capital was paid in the amount of 30,000 rubles, which is at least 50% of the declared amount (based on Law No. 14-FZ “On Limited Liability Companies”). Contributions from the founders to the company's cash desk are provided, which amounted to 20,000 rubles after registration of the company. Let's look at what operations and postings are necessary to register this situation.

Example No. 3. Working with accountable persons of the organization

The accountable person of the organization was given funds for the purchase of office supplies in the amount of 1000 rubles. After purchasing the goods, a purchase report was drawn up with a sales receipt for the amount of 800 rubles. The resulting balance was handed over to the organization's cash desk.

It should be noted that only employees of the organization who receive funds on account for the purchase of material assets and travel expenses can be accountable persons. Transactions with accountable persons are reflected in account 71 – “Settlements with accountable persons”. Let's consider what operations and postings will reflect this situation.

Example No. 4. Accounting for an organization's investments

The organization made a contribution to a joint activity with an individual entrepreneur on the basis of a simple partnership agreement. The contribution was made in cash in the amount of 500,000 rubles. Based on the results of production activities, an income of 25,000 rubles was received, credited to the organization’s cash desk. Next, the organization issued a loan to an individual entrepreneur in the amount of 80,000 rubles, part of which was repaid in a month. The amount of funds received amounted to 20,000 rubles. Let's consider the postings for this economic situation.

The organization can issue loans to both individual entrepreneurs and firms, and its own personnel for the purchase of housing, household appliances, etc. based on the concluded agreement. To record these transactions, use subaccount 73.1 - “Settlements on loans provided.”

Postings to current account

Accounting for funds in the current accounts of the company, including separate divisions and branches, is maintained by a responsible employee. Below are the incoming transactions on account 51.

Receipt to current account - postings:

| Type of operation | Debit | Credit |

| Cash was deposited into the account from the company's cash desk, including through collection | 51 | 50 |

| A loan issued to another legal entity has been repaid | 51 | 58 |

| The previously transferred advance payment from the supplier was returned | 51 | 60 |

| Received payment for products from the buyer | 51 | 62 |

| Received a loan – short-term/long-term | 51 | 66/67 depending on term |

| Received compensation for expenses from the Social Insurance Fund | 51 | 69 |

| Part of the authorized capital was contributed as a contribution from the founder | 51 | 75 |

Accounting for cash flows in transit

Funds are transferred to current accounts directly by the organization's bank tellers or collectors. Funds received from the sale of goods or services, transferred to collectors and not yet credited to the current account are reflected in account 57 - “Transfers in transit”.

Example No. 5. Cash flow accounts in transit

Based on the concluded agreement between the organization and the bank, the company hands over its proceeds twice a day. The first time the payment is made directly by the cashier, while the second time the proceeds are collected by the bank's collector. So, on June 1, revenue was received in the amount of 75,000 rubles, of which 25,000 rubles. was handed over by the cashier and 50,000 rubles. handed over to the collector. Since the funds were transferred to the collector in the afternoon, this operation will be reflected as funds in transit and their arrival will be reflected the next day. Let's look at the wiring for this situation.

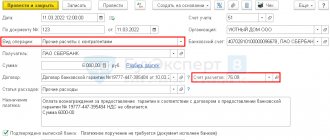

Accounting for current account transactions

According to the Chart of Accounts (approved by Order No. 94n dated October 31, 2000), synthetic accounting of transactions on the current account is carried out by entering transactions in active accounts 51, 52 in order of calendar order. The grounds for reflecting information are the following supporting documents:

- Statements of company bank accounts.

- Payment orders/requests.

- Cashier's checks.

- Collection.

- Other.

In this case, analytical accounting of transactions on the current account is carried out separately for all existing accounts of the enterprise. A debit means an increase in funds, a credit means a write-off/decrease in the balance. Each standard entry must be accompanied by primary documentation that confirms the facts of the organization’s economic activities.

Note! Additionally, account 55 “Special accounts” can be used, designed to record the movement of monetary documents in the form of checks, letters of credit, deposits, etc. Accounting for this account is carried out similarly to regular current accounts.

Accounting for funds in foreign currency accounts

Foreign currency accounts are necessary to carry out financial relations with foreign companies. For this purpose, accounting accounts are opened:

- Current foreign exchange account – accounting for transactions within the country;

- Transit account – accounting for the receipt of funds from the export of products/services.

- Special account – accounting for receipt of foreign credits, loans, transactions with foreign securities, etc.

Example No. 6. Accounting for the movement of funds in a foreign currency account

The organization trades with foreign companies and has sold export products in the amount of 200,000 euros. A grant was also received to modernize the production line in the amount of 100,000 euros. When shipping the products, customs payments for control in the amount of 5,000 euros were erroneously transferred. From the organization's foreign currency account, transfers were made to the current account for shipped products in the amount of 10,000 euros. The exchange rate of the Central Bank of the Russian Federation is 50 rubles. for 1 euro.

It should be noted that the recalculation of the value of assets (cash) is carried out on the day of the transaction. Let's look at the transactions under these conditions.

Example No. 7. Accounting for foreign currency purchases

The company purchased foreign currency in the amount of 10,000 euros. at the rate of 60 rubles. for 1 rub. The official exchange rate according to the Central Bank of the Russian Federation is 50 rubles. for 1 euro. The bank purchasing the currency was paid a fee of 1%.

When purchasing funds, it is necessary to estimate their current value on the day of the transaction; for this purpose, data from the Central Bank of the Russian Federation on exchange rates is used. When receiving foreign currency, an exchange rate difference arose, which led to non-operating expenses, which were reflected in account 91.2. Let's look at the postings for these transactions.

Author: Ph.D. Zhdanov Ivan Yurievich

What are cash and cash equivalents?

Another issue of accounting educational program. In simple language with examples for those who have just started studying accounting, want to learn something new about familiar accounting categories, or simply learn how to read a balance sheet.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog at The Clerk I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Today we will look at the most pleasant type of assets - cash and cash equivalents. A company's cash can exist in different forms.

Cash in the cash register. We are not talking about the cash register that we see in retail stores. If a company carries out cash transactions, it must have a place to conduct such transactions. The manager must determine such a place. Ideally, this is a room with an iron door and a window in it for issuing and receiving money. But if worst comes to worst, an ordinary safe will do.

At the end of each day, the cash balance may be kept in the cash register, not exceeding the limit established by the head of the company. Above this, cash can only be left on paydays. The rest should be handed over to the bank and kept in a current account. This is a requirement of Bank of Russia Directive No. 3210-U dated March 11, 2014. Formulas for determining the cash limit are also given there.

Cash documents at the cash desk. These are documents purchased by the company and have a nominal value. You can use them to get a product or service. For example, these are postage stamps or gasoline coupons. They are accounted for according to the same rules as cash and are valued at par.

Non-cash money in current accounts. Such accounts are intended for settlements with counterparties, and the company may have several of them. In 2022, having a couple of checking accounts is a good option. Elvira Sakhipzadovna regularly deprives banks of their licenses, and banks no less regularly block company accounts under the pretext of suspicious receipts and payments. Therefore, not putting all your eggs in one basket is a good option. But not free.

Foreign currency in foreign currency accounts and at the cash desk. Federal Law dated December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control” prohibits settlements in foreign currency between residents, except for the cases listed in Article 9. But settlements with foreign counterparties can be made in foreign currency. For this purpose, foreign currency accounts are opened. Sometimes currency ends up in the cash register. For example, when you need to give an employee money for a business trip abroad.

In accounting, currency is converted into rubles at the Bank of Russia exchange rate. Due to exchange rate changes, the same amount in foreign currency costs different amounts of rubles on different dates. Exchange rate differences affect the financial results of the company.

Example:

On January 1, 2022, there was $1,000 in the foreign currency account. The dollar to ruble exchange rate was 61.91. Today the rate is 75.24. This means that the company made a profit of 13,330 rubles. (RUB 75,240 - RUB 61,910).

Cash equivalents. These are financial investments that can be easily sold for a known amount. For example, this is non-cash money on bank deposits. They can be quickly pulled out of there, and the terms of the agreement with the bank determine how much money the company will receive depending on the date of withdrawal. This also includes short-term, low-risk securities. For example, federal loan bonds or Sberbank bills.

Translations are on the way. An accounting category invented in order to see what amounts belong to a company, but it cannot yet manage them. For example, the buyer paid for the goods with a bank card, and the money has not yet been credited to the bank account. Or cash proceeds are sent with collectors to the bank. There is no more money in the cash register, but there is still money in the current account.

So money is the most pleasant asset, but not the easiest.

In the next issue of educational program I will continue to introduce you to current assets. Next up is accounts receivable. Subscribe to our blog, you won't be bored! And if you want to know how online accounting “My Business” helps an accountant take into account current assets, leave your contacts below and we will tell you everything.