| Several years have passed since the creation of the Customs Union, one of the goals of which was to reduce the tax burden in the relationships between economic entities of its member states. During this time, we gained some experience in solving a number of problems, including those related to taxation. | Articles on the topic: -VAT on the sale of exported products -The procedure for restoring “customs” VAT -The procedure for accounting for VAT when exporting goods |

We encourage you to take a look at what regulators have to say about some of these issues.

About preferential rates.

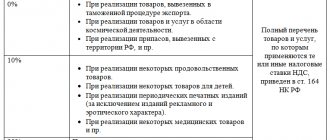

According to paragraph 5 of Art. 2 of the Protocol of December 11, 2009 “On the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods in the Customs Union” (hereinafter referred to as the Protocol on Goods) the amount of indirect taxes payable on goods imported into the territory of one member state CU from the territory of another CU member state are calculated by the taxpayer at the tax rates established by the legislation of the CU member state into whose territory the goods are imported.

Consequently, when importing goods into the territory of the Russian Federation from Kazakhstan or Belarus, the VAT rates established by Art. 164 of the Tax Code of the Russian Federation, including zero or equal to 10%, if the relevant conditions for their application are met.

That is, the preferential rate (10%) established for a number of food products and goods for children in paragraphs. 1 item 2 art. 164 of the Tax Code of the Russian Federation, can also be applied for the specified import, but it must be taken into account that the nomenclature of such goods must correspond to that given in Decree of the Government of the Russian Federation of December 31, 2004 No. 908 “On approval of lists of codes for types of food products and goods for children subject to value added tax at a tax rate of 10 percent” (hereinafter referred to as Resolution No. 908).

It is not always possible to apply the same benefit when importing from a CU member country for a product that, being produced on the territory of the Russian Federation, is taxed at a preferential rate. The fact is that for this it is necessary that both the name and the code of the Commodity Nomenclature of Foreign Economic Activity of the Customs Union [1] correspond to the commodity subitems provided for this product in Resolution No. 908, taking into account various additional criteria. Otherwise, a rate of 18% is applied (letter of the Federal Tax Service of Russia dated March 14, 2013 No. ED-4-3/4184, Ministry of Finance of Russia dated February 5, 2013 No. 03 07 15/2499).

The calculation of “import” VAT has changed

The tax base for “import” VAT must be determined on the date of registration of imported goods (Clause 2, 4, Article 2 of the Protocol on CU Goods). And VAT must be calculated on the cost of imported goods, increased by the amount of excise tax (if these are excisable goods). It should be defined as the transaction price payable to your supplier under the terms of the contract (Clause 2, Article 2 of the Protocol on CU Goods).

Attention! “Import” VAT should be calculated only on the price of the goods and the amount of excise tax, without taking into account transport and other additional costs.

The new rule is very beneficial for importers of Belarusian goods - after all, previously “import” VAT had to be paid on the amount that, in addition to the cost of purchased goods and excise taxes, was included (Clause 2 of Section I of the Regulations on the procedure for collecting indirect taxes (Appendix to the Agreement with Belarus)) :

— costs of delivery of goods, including transportation, loading and forwarding services;

- sum insured;

- the cost of containers and other reusable packaging that is not subject to return, if this container is a single unit with the goods;

— cost of packaging, including the cost of work.

Note

The basis for contracts for the manufacture of goods, leasing contracts, commodity exchange contracts, as well as commodity credit (commodity loan) agreements must be determined in a special manner (Clause 2, 3 of Article 2 of the Protocol on CU Goods).

Services and place of sale.

When assessing VAT on services, the place of sale is of significant importance - the application of the zero rate in relations between business entities from different countries depends on this. Of course, the rules established by the organizers of the Customs Union contain certain nuances in this sense.

For example, the imposition of this tax on services for holding exhibitions depends on the purpose of these exhibitions. If they are carried out as advertising, then Art. 1 and 3 of the Protocol of December 11, 2009 “On the procedure for collecting indirect taxes when performing work and providing services in the Customs Union” (hereinafter referred to as the Protocol on Services). According to them, advertising services include services for the creation, distribution and placement of information intended for an indefinite number of persons and designed to generate or maintain interest in an individual or legal entity, goods, trademarks, works, services, by any means and in any form. The place of sale of advertising services provided to a taxpayer of a member state of the CU is always recognized as the territory of that state.

As a result, VAT for the provision of such services is levied in a member state of the Customs Union, the territory of which is recognized as the place of sale of services, in accordance with the tax legislation of this state (Letter of the Ministry of Finance of Russia dated June 26, 2012 No. 03 07 15/68 [2]).

But the place of sale of services for organizing exhibitions in the field of culture and art is determined by the place where these exhibitions are actually held (clause 3, clause 1, article 3 of the Protocol on Services). Article 3 of the Protocol on Services lists other types of work and services for which the place of sale is recognized as the territory of a CU member state.

For example, the place of implementation of development work performed by a Belarusian organization for a Russian organization is recognized as the territory of the Russian Federation, and taxation of this work is carried out in accordance with the Tax Code of the Russian Federation. According to Art. 161 of the Tax Code of the Russian Federation in this case, the Russian organization is a tax agent obligated to calculate and pay VAT to the budget of the Russian Federation (Letter of the Ministry of Finance of Russia dated July 5, 2013 No. 03 07 13/1/26068).

If the services are not listed in paragraphs. 1 – 4 p. 1 tbsp. 3 of the Protocol on Services, then in accordance with paragraphs. 5 clause 1 of this article, the place of sale of work (services) is recognized as the territory of a member state of the Customs Union, the taxpayer of which carries out the work (renders services) [3]. In this case, services are not subject to VAT in the Russian Federation (Letter of the Federal Tax Service of Russia dated May 31, 2012 No. ED-3-3/ [email protected] [4]).

Commission agreement.

What if a Russian organization sells goods to buyers from another CU member state through a commission agent who is a resident of that other state? Confirmation of the right to apply the zero VAT rate occurs practically in the usual manner typical for the export of goods from the Russian Federation to a member state of the Customs Union.

According to Art. 1 and 2 of the Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated January 25, 2008 “On the principles of levying indirect taxes on the export and import of goods, performance of work, provision of services in the Customs Union” (hereinafter referred to as the Agreement), the export of goods is understood to be documented confirmed export of goods sold by taxpayers of member states of the Customs Union from the territory of one member state of the Customs Union to the territory of another member state of the Customs Union.

Documentary confirmation consists of submitting documents as specified in paragraph 2 of Art. 1 of the Protocol on goods to a list supplemented by agreements between a foreign commission agent and foreign buyers (Letter of the Ministry of Finance of Russia dated May 29, 2012 No. 03 07 15/54 [5]). Without such agreements, it is difficult to confirm the fact of export of goods from the Russian Federation to another state.

The procedure for paying indirect taxes no longer depends on the country of origin of the goods

The previously valid Russian-Belarusian Agreement applied to transactions with those goods that were produced in Russia or Belarus (Federal Law of December 28, 2004 N 181-FZ).

Therefore, tax authorities often demanded from Russian importers of Belarusian goods a certificate of origin of goods in the ST-1 form (it could be obtained from the Chamber of Commerce and Industry of the Republic of Belarus). And despite the fact that this requirement is unlawful, only after the presentation of the certificate did they put a mark on the application for payment of indirect taxes, which the Belarusian exporter needed to confirm the zero VAT rate (Question 1 Letter of the Federal Tax Service of Russia dated 08.08.2006 N ШТ-6-03/ [ email protected] ).

For reference

Members of the Customs Union are Russia, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan (Treaty on the Establishment of the Eurasian Economic Community of October 10, 2000).

The new procedure for paying indirect taxes applies to all goods produced both in the countries of the Customs Union (Russia, Belarus and Kazakhstan) and in other countries (except for goods transiting to the Russian Federation) (Clause 2 of the Decision of the Interstate Council of the EurAsEC dated November 27, 2009 N 17).

Sold it - paid the tax.

The goods were initially imported from a CU member state into the territory of the Russian Federation for participation in an exhibition or to a storage warehouse, but for the purpose of further sale. At the time of subsequent sale of such goods, it must be taken into account that, in accordance with clause 1.4 of Art. 2 of the Protocol on Goods, if a taxpayer of one CU member state acquires goods that were previously imported into the territory of this CU member state by a taxpayer of another CU member state, indirect taxes on which were not paid, then VAT is paid by the taxpayer of the CU member state to the territory from whom the goods were imported is the owner of the goods.

In this case, VAT is collected by the tax authority of the CU member state into whose territory the goods are imported, at the place of registration of the taxpayer - the owner of the goods. The owner is understood as a person who has the right of ownership of goods or to whom the transfer of ownership of goods is provided for by an agreement (contract) (clause 2 of the Protocol on Services).

Thus, in this situation, indirect taxes are paid to the tax authority by a Russian taxpayer purchasing such goods on the basis of an agreement (contract), including one concluded after the date of import of goods from the territory of another CU member state.

In accordance with Art. 147 of the Tax Code of the Russian Federation, the place of sale of goods is considered to be the territory of the Russian Federation if, at the time of the start of shipment or transportation, the goods are located on its territory. That is, in the general case, the territory of the Russian Federation is not recognized as the place of sale of goods shipped from the territory of another CU member state and intended for sale to Russian economic entities, and Art. 161 of the Tax Code of the Russian Federation in terms of establishing the obligation for Russian taxpayers to pay VAT as a tax agent does not apply.

If the goods were previously exported to participate in an exhibition or placed in a storage warehouse, then the place of sale of such goods is the territory of the Russian Federation and operations for their sale are recognized as subject to VAT in the Russian Federation. For these transactions, a zero tax rate is applied, subject to the submission to the tax authorities of the documents provided for in paragraph 2 of Art. 1 of the Protocol on Goods (Letter of the Federal Tax Service of Russia dated April 10, 2012 No. ED-4-3 / [email protected] [6]).

When is VAT charged on exports?

In accordance with Art. 2 of the Agreement, when exporting goods from the Russian Federation to the territory of another CU member state, a zero VAT rate can be applied if the documents provided for in clause 2 of Art. 1 Protocol on goods .

But this document does not establish the moment of determining the VAT base.

In this regard, the Ministry of Finance in Letter dated July 11, 2013 No. 03 07 13/1/26980 for this purpose prescribes to be guided by Art. 167 of the Tax Code of the Russian Federation, since according to paragraph 3 of Art. 1 of the Protocol on Goods, the application of VAT when exporting goods is carried out in accordance with the legislation of the member state of the Customs Union from whose territory the goods are exported.

When exporting goods from the Russian Federation, including to member states of the Customs Union, the moment of determining the tax base is the last day of the quarter in which a full package of documents confirming the validity of applying the zero VAT rate is collected. In case of failure to submit the specified documents within the established 180 day period, VAT is subject to payment to the budget for the tax period in which the date of shipment of the goods falls.

What is included in the tax audit procedure for VAT refund upon import

After receiving the declaration, the tax office begins a desk audit and in the process decides whether a refund needs to be made. The inspection lasts two months, but if there are signs of possible violations, this period can be extended to three months. During the process, the tax office performs the following actions:

- Conducts analysis of documents submitted by the importer. Identifies the importer and the sender, checks the compliance of the data, the execution of documents, the fact of concluding an agreement, etc.

- Examines the sender's data. To establish its existence, the tax office can make requests to foreign control authorities.

- Studies the movement of goods and establishes the actual purchaser of the goods: checks accompanying documents, delivery contracts, the route of the vehicle and the passage of control points.

During the audit, the tax office determines the legality of the taxpayer’s claims for VAT refund when importing into Russia. Based on the results of the audit, the tax office makes a decision on full or partial tax refund or refusal within seven days. The money can be returned in three ways: transferred to the company’s account, offset against future payments, or used to pay off tax debts.

If an individual is from the Customs Union...

Is the sale of goods by a Russian organization to individuals who are citizens of other CU member states exempt from VAT? In Letter No. 03 07 14/22219 dated June 14, 2013, financiers explain that this is impossible.

When purchasing goods, such an individual will not be able to provide a Russian organization with documents confirming the actual export of goods from the territory of one CU member state (in this case, the Russian Federation) and the import of these goods into the territory of another CU member state. And the submission of such documents is a necessary condition for applying the zero rate.

When can you argue with the tax office?

Speaking about the refund of import VAT, one cannot fail to mention that there are a number of controversial situations in which the opinions of controllers and taxpayers differ. For example, the import of demonstration samples: as practice shows, inspectors often remove deductions for them, citing the fact that the VAT paid on the import of free samples cannot be reimbursed.

Is it possible to somehow substantiate your right to a deduction in this situation? Undoubtedly. It is only necessary to clarify that the samples received free of charge are planned to be used in the sale of similar goods. And since the sale of analogue goods is subject to VAT, it means that the samples were also purchased for taxable transactions. Therefore, the deduction is legal.

From resident to non-resident.

According to the Ministry of Finance, the Protocol on Goods is applied if operations for the sale of goods exported from the territory of one CU member state to the territory of another CU member state are carried out between taxpayers registered with tax authorities located in the territories of different states

(Letter dated March 14, 2013 No. 03 07 08/7842).

In our opinion, in this document, in order to apply a zero VAT rate, there is no mandatory requirement that the buyer must be a resident of another state.

But with the approach of the Ministry of Finance, it turns out that operations for the sale of goods exported from the territory of the Russian Federation to the territory of another state - a member of the Customs Union, within the framework of contractual relations between Russian organizations registered with the tax authorities of the Russian Federation, as well as goods exported from the territory of such a state beyond limits of the territory of the Customs Union, under agreements of a Russian organization with foreign persons who are not taxpayers of the member states of the Customs Union, are subject to VAT in the manner prescribed by the Tax Code of the Russian Federation.

It is worth recognizing a more definite situation in which a Russian organization enters into an agreement with a foreign person who is not a taxpayer of a member state of the Customs Union, and the consignee is a taxpayer of Belarus or Kazakhstan. The zero VAT rate is applied by a Russian organization in case of payment of this tax when importing goods into a CU member state by a foreign person (if it is registered with the tax authorities of this CU member state) or by a Belarusian (Kazakhstan) organization (if it purchases the specified goods from the mentioned foreign person) (Letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03 07 08/6170).

If VAT is not paid when importing goods into the territory of a CU member state and, accordingly, an application for the import of goods and payment of indirect taxes is not drawn up, the VAT rate is zero on the sale to a foreign person who is not a taxpayer of a CU member state of goods exported from the territory of the Russian Federation to the territory of such a state is not applied by the Russian taxpayer.

Import of goods from the EAEU

Content:

1. Setting up functionality and directories for importing EAEU goods

2. Registration of receipt of goods from EAEU member states

3. VAT calculation on imported goods

4. Payment of the accrued VAT amount to the budget when importing goods into 1C

5. Application for a tax deduction when importing EAEU goods

Let's look at how to reflect the import of goods to Russia from EAEU member states in 1C.

| Example: The organization TF-Mega LLC, which applies a general taxation system, imported the following goods into the territory of the Russian Federation from the territory of the EAEU member states in February 2022 and accepted for accounting: · under contract with Belarusian: February 3, 2022 - women's suits in the amount of 20 pieces. worth RUB 120,000.00, February 14, 2022 - children's costumes in the amount of 30 pieces. worth RUB 60,000.00; · under a contract with the Kazakh organization Astana LLP: February 21, 2022 - a batch of pumping stations in the amount of 5 pieces. worth RUB 45,500.00. |

What actions do we need to take in order to correctly, quickly and clearly reflect the import of goods from the EAEU? Just a couple of consecutive steps to process all documents without errors.

Setting up functionality and directories for importing EAEU goods

v Settings - “Functionality”

v “Trade” tab - you need to check the presence of a checkbox for the 1C value “Import of goods, including from the EAEU”. If there is no checkmark, it must be checked (Fig. 1).

Rice. 1

v Section “Directories”, subsection “Purchases and sales” - we check the completion of information about partners who are payers of the EAEU member states. When entering information about a supplier who is a taxpayer of the Republic of Belarus (hereinafter - RB) or the Republic of Kazakhstan (hereinafter - RK) into the "Counterparties" directory, you need to replace the default value "RUSSIA" in the "Country of Registration" field with the value "BELARUS" or "KAZAKHSTAN" » accordingly (Fig. 2).

Rice. 2

Section “Directories”, subsection “Goods and services (Nomenclature)” - indicate the corresponding HS code (Fig. 3) in accordance with the Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54

Rice. 3

Registration of receipt of goods from EAEU member states

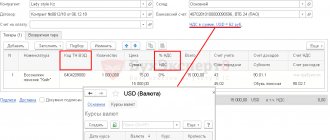

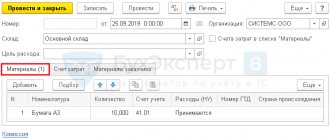

We register the receipt of goods from the EAEU member states in the program using the document “Receipt (act, invoice)” with the type of operation “Goods (invoice)” (Fig. 4).

In the header we indicate:

· in the “Invoice No.” field - the document number of the Belarusian seller;

· in the “from” field - the date of the seller’s document;

· in the “Counterparties” field - the name of the seller from the “Counterparties” directory;

· in the “Agreement” field - an agreement with the seller from the “Agreements” directory;

· in the “Settlements” line - settlement accounts and the procedure for crediting the advance. These details are usually filled in automatically.

The tabular part of the document includes:

· in the “Nomenclature” field - the name of the purchased imported goods (from the “Nomenclature” directory);

· data on the quantity and price of goods in the contract currency (in this example - in rubles);

· in the “Account account” field – account for the purchased goods;

· in field 1C “Country of origin” - the country of origin of the imported goods;

Since in accordance with paragraph 1 of Art. 72 of the Treaty on the EAEU and clause 3 of the Protocol on Indirect Taxes, the exporter of goods applies a zero VAT rate, and the tax when importing goods into the territory of the Russian Federation is calculated and paid by the buyer; the value “0” is automatically indicated in the “% VAT” field.

If an organization carries out operations that are subject to and not subject to VAT, and on the “VAT” tab in the “Accounting Policy” (section “Main - subsection Settings - Taxes and Reports”), a check mark is placed in the field “Incoming VAT is separately accounted for by accounting methods”, then in the document “Receipt (act, invoice)” there will be a column “Method of accounting for VAT”. This column may not be filled in, since information on the amounts and method of accounting for VAT accrued on the cost of goods imported from the EAEU and subject to payment to the budget will be entered further using the document “Application for the import of goods” 1C (Fig. 14).

Rice. 4

After posting the document, an accounting entry will be generated (Figure 5):

on the debit of account 41.01 and the credit of account 60.01 - for the cost of imported goods of the EAEU accepted for accounting.

Rice. 5

If an organization maintains separate accounting, then a corresponding entry with the type of movement “Incoming” will be entered into the “Separate VAT accounting” register (Fig. 6).

Rice. 6

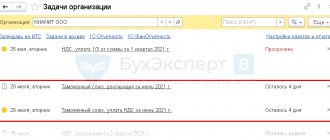

An entry will also be made in a special register of information in 1C: “Import of goods from the states of the customs union.” The information in this register is used to create tasks for the accountant (Fig. 7).

Rice. 7

To fill out statistical reporting forms in the document “Receipt (act, invoice)”, using the hyperlink “Consignor and consignee”, you can fill in information about the type of transport that imported goods into the territory of the Russian Federation (Fig. 8).

Rice. 8

Similarly, the program reflects the receipt of goods from the payer of the Republic of Belarus on February 14, 2020 (operation 2.2 “Receipt of goods from the Republic of Belarus”) (Fig. 9).

Fig.9

And receipt of goods from the payer of the Republic of Kazakhstan on 02/21/2020 (operation 2.3 “Receipt of goods from the Republic of Kazakhstan”) (Fig. 10).

Rice. 10

VAT accrual on imported goods

When importing goods from the territory of the EAEU member states, the buyer is obliged to transfer VAT on the imported goods to the budget (clause 1, clause 4 of Article 72 of the Treaty on the EAEU, Article 13 of the Protocol on Indirect Taxes).

Payment of import VAT is made no later than the 20th day of the month following the month in which imported goods were registered (clause 19 of the Protocol on Indirect Taxes).

Along with the completed tax return for the import of goods to Russia from the Republic of Belarus and the Republic of Kazakhstan, it is also necessary to submit to the tax office an application for the import of goods and payment of indirect taxes (hereinafter referred to as the application for the import of goods) on paper (in four copies) and in electronic form , or an application for the import of goods in electronic form with an electronic (electronic digital) signature of the taxpayer (clause 1, clause 20 of the Protocol on Indirect Taxes).

The calculation of VAT on imported goods and the generation of an application for the import of goods (operation 3.1 “Accrual of VAT on goods imported from the Republic of Belarus”) is carried out in the program using the 1C accounting system document “Application for the import of goods” (section “Purchases - subsection Purchases”) .

You can create a 1C accounting system document “Application for the import of goods” from the document “Receipt (act, invoice)” by executing the command of the same name from the list of commands opened by clicking the “Create based on” button (Fig. 11).

Rice. eleven

If the 1C document “Application for the Import of Goods” is generated on the basis of a specific receipt document, then information only from this receipt document is automatically transferred to its tabular part (Fig. 12).

Fig.12

At the same time, an application for the import of goods can be generated both for each receipt document, i.e. for each batch of purchased goods, and for several receipts of goods from one supplier during the reporting month.

To reflect in one document information about all goods accepted for accounting in a particular month and received from a given supplier, you must use the “Fill” button to execute the “Add from receipt” command, selecting from the proposed list of receipts those that will be included in the generated application ( Fig. 13).

Fig.13

As a result, the document “Application for the import of goods” will indicate commodity items from all selected documents “Receipt (act, invoice)” (Fig. 14).

If the importer maintains separate accounting, then before posting the document, it is necessary to fill in the column “Method of VAT accounting” in the tabular part of the document, indicating one of four possible values: “Accepted for deduction”, “Taking into account in the cost”, “Blocked until confirmed 0%”, "Distributed."

Fig.14

As a result of document 1C “Statement on the carriage of goods”, an accounting entry will be generated (Fig. 15): on the debit of account 19.10 and the credit of account 68.42 - for the amount of VAT payable to the budget as a result of the import of Belarusian goods in February 2022 and the component RUB 30,000.00 (RUB 120,000.00 x 20% + RUB 60,000.00 x 10%).

Fig.15

In the “VAT presented” register, entries with the type of movement “Receipt” and the event “Presented by VAT by the Supplier” are entered for each batch of received goods reflected in this application for the import of goods (Fig. 16).

Fig.16

When the buyer maintains separate accounting, records with the type of movement “Incoming” are also entered into the “Separate VAT accounting” register for each batch of goods received (Fig. 17).

Since, for the purpose of separate accounting for quantitative accounting of goods received, a receipt entry has already been made in the “Separate VAT Accounting” register based on the document “Receipt (act, invoice)” (Fig. 6), then based on the document “Application for the import of goods” 1C produces only a reflection of the total indicators for the receipt documents taken into account when creating the “Application for the import of goods” in 1C (Fig. 14).

Fig.17

By clicking the “Application for the import of goods” button (Fig. 14), you can view the generated Application for the import of goods (Fig. 18).

Fig.18

Using the “Print” button from the viewing mode of the generated application for the import of goods (Fig. 18), it is printed on paper.

Click the “Upload” button to upload the document in electronic form for sending to the tax authority. Let us recall that in accordance with paragraphs. 1 clause 20 of the Protocol on Indirect Taxes, an application for the import of goods is submitted on paper (in four copies) and in electronic form or in electronic form with an electronic signature of the taxpayer.

By clicking the “Create based on” button, you can generate a statistical form for recording the movement of goods in mutual trade of the Russian Federation with the member states of the EAEU, approved. Decree of the Government of the Russian Federation dated December 7, 2015 No. 1329 (Fig. 19).

Fig.19

In a similar way, an application for the import of goods into the Russian Federation is drawn up and VAT is charged on the cost of goods imported in February 2022 from the territory of the Republic of Kazakhstan (operation 3.2 “Calculation of VAT on goods imported from the Republic of Kazakhstan”) (Fig. 20).

Fig.20

The accrued amount of import VAT on goods imported in February 2022 from the Republic of Belarus and the Republic of Kazakhstan in the amount of RUB 39,100. (24,000 rubles + 6,000 rubles + 9,100 rubles) is automatically reflected in section 1 of the declaration on indirect taxes when importing goods into the Russian Federation from EAEU member states for February 2022 (section “Reports - subsection 1C-Reporting - Regulated reports") (Fig. 21).

Fig.21

Along with the declaration and application for the import of goods, it is also necessary to submit to the tax authority the documents named in paragraph 20 of the Protocol on Indirect Taxes. For the example under consideration, such documents will be:

· bank statement confirming the actual payment of indirect taxes on imported goods;

· transport (shipping) and (or) other documents;

· invoices issued in accordance with the legislation of the Member State upon shipment of goods;

· agreements (contracts) on the basis of which goods imported into the territory of a Member State from the territory of another Member State were purchased.

Payment of accrued VAT to the budget when importing goods in 1C

In order to perform operation 4.1 “Transfer to the budget of VAT accrued on goods from the Republic of Belarus”, it is necessary to create a document “Payment order” (Fig. 22).

A payment order is drawn up for each completed application for the import of goods.

To fill out a payment order for tax payment, you must set the “Type of transaction” field to “Payment of tax” and fill in the relevant document details.

Fig.22

The document “Write-off from the current account” (Fig. 23) can be created manually or based on downloading from other external programs (for example, “Client-Bank”).

However, if payment orders are not created in the 1C: Accounting 8 program, then creating a payment order in the basic version of 1C: Accounting 8 may not be necessary. In this case, only the document “Write-off from the current account” is entered, which generates the necessary transactions.

When filling out the document “Write-off from the current account”, you must indicate the type of transaction: payment of the accrued VAT amount.

Fig.23

If the document is posted, an accounting entry will be generated:

on the debit of account 68.42 and the credit of account 51 - for the amount of VAT payable to the budget as a result of the import of Belarusian goods in February 2022, and amounting to RUB 30,000.00. (RUB 120,000.00 x 20% + 60,000.00 x 10%) (Fig. 24).

Fig.24

In a similar manner, the payment of import VAT accrued when goods are imported from the territory of the Republic of Kazakhstan in February and reflected in the corresponding application for the import of goods (Fig. 25).

Fig.25

Application for a tax deduction when importing EAEU goods

In accordance with clause 26 of the Protocol on Indirect Taxes, the importing organization has the right to deduct the amount of VAT actually paid when importing goods, in the manner prescribed by the legislation of the EAEU member state into whose territory the goods were imported.

To tax deduct the amount of VAT accrued when importing goods into the territory of the Russian Federation from the territory of a member state of the EAEU, an application for the import of goods with a mark from the tax authority and payment documents confirming the actual payment of VAT are required (paragraph 3, paragraph “e”, paragraph 3 clause “k” clause 6 of the Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137); letter of the Ministry of Finance of Russia dated March 13, 2012 No. 03-07-08/69).

Confirmation of VAT payment is made using the routine operation “Confirmation of VAT payment to the budget”, which is called from the “Routine VAT operations” list using the “Create” button (section “Operations - subsection Closing the month - Routine VAT operations”) (Fig. 26).

Also, the document “Confirmation of payment of VAT to the budget” can be generated from the document “Application for the import of goods” by clicking the “Create based on” button (Fig. 14).

In the document “VAT Payment Confirmation”, information about generated applications for the transportation of goods with VAT amounts reflected for payment is filled in automatically by clicking the “Fill” button.

In order to register an application for the import of goods in the purchase book in accordance with the requirements of the tax authorities, you must manually fill out the “Registration mark” column of the tabular part of the document “Confirmation of payment of VAT to the budget” (Fig. 26).

The registration number entered is a sixteen-digit digital code consisting of a sequence of numbers from left to right (letter of the Federal Tax Service of Russia dated March 21, 2016 No. ED-4-15 / [email protected] ):

· 4 digits - code of the tax authority that assigned this registration number (NNNN);

· 8 digits — date of registration of the application (DDMMYYYY);

· 4 digits - serial number of registration during the day (ХХХХ).

Fig.26

After posting the document “Confirmation of payment of VAT to the budget”, entries are made in the “Invoice Log” register to store the necessary information for registering an application for the import of goods in the purchase book, in particular, to store the registration number and the date of marking by the tax authority (Fig. 27).

Fig.27

Also, in the “VAT Purchases” register, for each application for the import of goods, a corresponding entry is made without indicating the event (columns “Event” and “Date of event”) and cost values (columns “Amount without VAT” and “VAT”) (Fig. 28) .

Fig.28

Direct submission for deduction of the amount of VAT paid on the import of goods (operation 5.3 “Submitting for deduction of the amount of VAT paid on the import of goods”) is carried out by the document “Creating purchase ledger entries”, which is called up from the list of “Routine VAT operations” by clicking the “Create” button (section “Operations - subsection Closing of the month”).

Data for the purchase book on the amounts of tax to be deducted in the current tax period are reflected on the “Purchased Assets” tab (Fig. 28).

To fill out a document according to the accounting system data, it is advisable to use the “Fill” command (Fig. 29).

ATTENTION! Under the tabular part of the document “Creating purchase ledger entries,” information is provided on the calculated share of tax deductions from the amount of tax accrued from the tax base:

· for the corresponding tax period - for the purpose of applying clause 8 of Art. 88 Tax Code of the Russian Federation;

· for 12 months - in order to comply with the safe share of deductions in accordance with clause 3 of the Publicly Available Criteria for Self-Assessment of Risks, approved. by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected]

Fig.29

After posting the document “Creating Purchase Ledger Entries”, accounting entries will be generated (Fig. 30):

on the debit of account 68.02 and the credit of account 19.10 - for the amount of VAT accepted for tax deduction for each batch of imported goods.

Fig.30

Information about the amounts of VAT to be deducted will be entered into the “VAT Purchases” register to fill out the purchase book (Fig. 31).

Fig.31

An entry will be made in the “VAT submitted” register for each batch of goods with the type of movement “Expense” and the event “VAT submitted for deduction” (Fig. 32).

Fig.32

Based on the information in the “VAT Purchases” register, appropriate entries will be made in the purchase book for the 1st quarter of 2022 (Fig. 33) (section “Reports - VAT subsection”).

Fig.33

When registering applications for the import of goods in the purchase book in accordance with Resolution No. 1137, the following will be indicated:

· in column 2 - transaction type code “19”, which corresponds to the value “Import of goods into the territory of the Russian Federation and other territories under its jurisdiction from the territory of the states of the Eurasian Economic Union” (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV -7-3/ [email protected] );

· in column 3 - the number and date of the tax authority’s mark on the Import Application (clause “e”, clause 6 of the Rules for maintaining the purchase book);

· in column 7 - details of documents confirming the payment of VAT to the budget (clause “k”, clause 6 of the Rules for maintaining a purchase ledger).

VAT amounts accrued upon import of goods and paid to the budget will be reflected in section 3 of the VAT tax return for the 1st quarter of 2020, approved. by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (section “Reports - subsection 1C-Reporting - Regulated reports”) (Fig. 34).

Fig.34

Information from the purchase book will be reflected in section 8 of the VAT return for the 1st quarter of 2022 (Fig. 35).

Fig.35

So you and I have analyzed in detail each action that we need to perform in order to correctly reflect the import of goods from the EAEU in 1C. I believe that in this example we have clearly shown that clear actions lead to the right result!

However, I would like to note the fact that there are a lot of truly difficult moments, so if you suddenly have questions, you can safely call or write to us. We are always in touch and happy to help!

Specialist

Natalia Mitnitskaya