Taxation of travel expenses: general rules

For an employee sent on a business trip, the employer is obliged to:

1. Pay the average salary for the period of the trip.

You can find out how it is calculated in the article “How the average monthly salary is calculated.”

Personal income tax on an average travel salary is calculated in the same way as on a regular salary while a person is at work. In general, according to the same principles, travel and regular salaries are reflected in tax reporting (but there are nuances here - we will look at them later in the article).

2. Pay for travel and accommodation where the person is sent.

Such expenses are not subject to tax, since they are not the employee’s income (Clause 3, Article 217 of the Tax Code of the Russian Federation). Information about them after a business trip is not reflected in 6-NDFL.

3. Issue daily allowances.

These are amounts that an employee can use for personal purposes - usually associated with paying for food, public transport and taxis within the locality to which he left.

You can find out more about the amount of daily allowance that an employee is entitled to receive on a business trip in the article “What is the amount of daily allowance for business trips.”

In the manner prescribed by law, daily allowances are subject to personal income tax and are subject to reflection in tax reporting.

Let's take a closer look at the features of calculating and reflecting in form 6-NDFL those components of travel payments that are subject to personal income tax - the average salary and partially daily allowances.

Salary on a business trip: payment terms

Having information about the timing of transferring taxable payments to an individual is the most important condition for correctly filling out Form 6-NDFL.

The travel salary (which is calculated, as we noted above, on the basis of average earnings) is paid to the employee in the same time frame as the main salary, since it is one of the options for remuneration, part of the salary as such (Articles 167, 139 of the Labor Code of the Russian Federation) .

If the salary is transferred to the employee’s card, then, as a rule, there are no practical difficulties in meeting the deadlines for its payment (an exception is if, for example, in the locality where the business traveler went, there are no ATMs and acquiring services due to the fact that it is remote from communication networks).

If salaries are traditionally issued through the organization’s cash desk (or there are noted technical difficulties in using the card), then the employer should use available alternatives so that the employee on a business trip receives his salary on time. In this case, federal legislation proposes making a money transfer at the expense of the employer (clause 11 of the Regulations according to Decree of the Government of Russia dated October 13, 2008 No. 749).

In practice, the travel portion of the salary can be included in the calculation:

- advance payment (salaries for the first half month);

- basic salary (for the second half of the month).

Depending on which part of the salary includes its “travel” component, the procedure for reflecting this component in 6-NDFL is determined. Let's look at the options here.

How to reflect travel salary in 6-NDFL

Wages are recognized as income of an individual as of the last day of the month for which they are calculated. And the tax on it is withheld from the next nearest payment (usually until the 15th of the next month).

That is, personal income tax on the travel component of the salary will be:

- Calculated (based on the recognition of an individual’s income as received) - at the end of the month (regardless of whether travel allowances are included in the advance or the basic salary).

- Withheld - simultaneously with the payment of the main part of the salary.

- Transferred to the budget - the next day after deduction.

Thus, the 6-NDFL report shows (in terms of the amount of average earnings during the business trip and the personal income tax accrued on it):

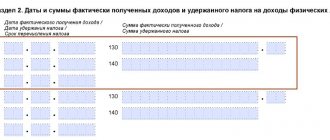

1. In section 2 of the report:

- on pages 110 and 112 - the amount of travel allowances;

- on pages 140 and 160 - the tax calculated and withheld from this amount.

2. In section 1 of the report:

- on page 021 - the next working day after the day of dismissal;

- on page 022 - the amount of personal income tax withheld.

Next, we will tell you how to reflect travel payments in terms of daily allowances in 6-NDFL.

6-NDFL: how to reflect the average earnings during a business trip?

For the purpose of personal income tax assessment, the date of actual receipt of income in the form of average earnings, retained when an employee is sent on a business trip, paid within the time limits established for the payment of wages, in accordance with paragraph 2 of Article 223 of the Tax Code of the Russian Federation, is recognized as the last day of the month for which the taxpayer was accrued the specified income .

Let's consider the situation.

On July 23, 2022, the average earnings were paid for the time spent on a business trip (from February 2, 2022 to February 10, 2022), calculated taking into account the bonus paid in July 2018 based on the results of work for 2016.

In section 2 of the calculation in form 6-NDFL for 9 months of 2022, this payment must be reflected as follows:

- line 100 indicates 02/28/2017;

- on line 110 – 07/23/2018;

- on line 120 – 07/24/2018;

- on lines 130, 140 - the corresponding total indicators.

An updated calculation in Form 6-NDFL, in accordance with paragraph 6 of Article 81 of the Tax Code of the Russian Federation, is submitted by a tax agent to the tax authority if it is discovered in the calculation submitted by him to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an understatement or overestimation of the amount of tax, subject to transfer. Thus, when additionally calculating average earnings in 2018 for the time spent on a business trip in 2017, the tax agent should submit to the tax authority an updated calculation in Form 6-NDFL for 2022.

note

Only section 1 of the calculation in form 6-NDFL for 2017 is subject to clarification; the specified payment is not reflected in section 2.

Taxation of excess daily allowances: general points

Daily allowances are not taxed within the limits of amounts per employee (clause 3 of Article 217 of the Tax Code of the Russian Federation):

- 700 rubles per day - for business trips around Russia;

- 2500 rubles per day - for foreign business trips.

Amounts falling within the specified limit should not be reflected in any way in the 6-NDFL report.

This is the fundamental difference between daily allowances and tax deductions, which, in cases provided for by law, reducing personal income tax to zero, are nevertheless subject to reflection in reporting.

Taxable daily allowances, like wages, are subject to inclusion in tax reporting. In this case, daily allowances are recognized as income at the end of the month in which the accounting department approves the advance report of the employee returning from a business trip (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

The employee submits the report within 3 days after returning to work. The deadline for approval of the accepted report is determined by the employer himself (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). By analogy with salaries, tax on excess daily allowances, which are recognized as income at the end of the month, is withheld from the next next salary (in practice, from one of its parts, an advance or the principal amount). It doesn’t matter when the employee actually received the daily allowance; the moment they were received is not reflected in the reporting in any way and does not affect the procedure for its preparation.

Let's look at an example of how travel allowances are recorded in 6-NDFL if they are presented in excess of the limit.

Registration

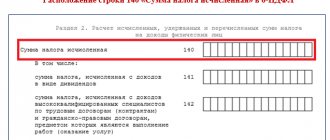

Section 1 indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate.

If the employer paid individuals during the tax period (presentation period) income taxed at different rates, section 1, with the exception of lines 060 - 090, is completed for each tax rate.

If the indicators of the corresponding lines of Section 1 cannot be placed on one page, then the required number of pages is filled in.

The totals for all rates on lines 060 - 090 are filled out on the first page of Section 1.

On line 010 you need to indicate the appropriate tax rate using which the tax amounts are calculated.

Line 020 is the cumulative amount of accrued income for all individuals from the beginning of the tax period. This line indicates all income the date of receipt of which falls within the period of submission of the calculation. For example, if this is the first quarter, then you should indicate the entire salary accrued for January - March, including part of the salary for March paid in April (clause 2 of article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated March 18, 2016 No. BS-4 -11/ [email protected] , dated February 25, 2016 No. BS-4-11/ [email protected] ).

If temporary disability benefits are accrued in one reporting period and paid in another, then both the amount of income (line 020) and the amount of personal income tax calculated from it (line 040) must be reflected in the report prepared for the period in which the period falls benefit payments. This clarification was given in the letter of the Federal Tax Service of Russia dated August 1, 2016 No. BS-4-11/13984. Let us recall that for personal income tax purposes, the date of receipt of cash income (including income in the form of temporary disability benefits) is considered the day of its payment.

On line 025 - the amount of accrued income in the form of dividends, cumulative for all individuals, on an accrual basis from the beginning of the tax period.

Line 030 is the sum of tax deductions generalized for all individuals that reduce income subject to taxation on an accrual basis from the beginning of the tax period. If the amount of personal income tax deductions provided to an employee exceeds his accrued salary, line 030 “Amount of tax deductions” indicates only the offset amount of the deduction, which is equal to the amount of accrued income indicated on line 020 (letter of the Federal Tax Service of Russia dated August 5, 2016 No. BS-4 -11/14373).

On line 040 - the amount of calculated tax generalized for all individuals on an accrual basis from the beginning of the tax period at the appropriate rate. This amount is calculated as follows: (total income (line 020) – total deduction (line 030) x personal income tax rate (line 010).

On line 045 - the amount of calculated tax on income in the form of dividends, aggregated for all individuals, on an accrual basis from the beginning of the tax period.

On line 050 - the amount of fixed advance payments generalized for all foreign employees working under patents, accepted to reduce the amount of calculated tax from the beginning of the tax period.

Below are the summary figures for all tax rates.

On line 060, indicate the total number of individuals who received taxable income during the tax period. In case of dismissal and hiring of the same individual during the same tax period, the number of individuals is not adjusted.

How one person is counted:

- a person who received income under different contracts during one period;

- a person who has received income subject to personal income tax at different rates.

On line 070 - the total amount of tax withheld on an accrual basis from the beginning of the tax period.

On line 080 - the total amount of tax not withheld by the tax agent, cumulatively from the beginning of the tax period (for example, in the case when an individual receives income in kind or in the form of material benefits). The total amount of personal income tax not withheld by the tax agent from this income is reflected in line 080 if there is no other income in cash (letter of the Federal Tax Service of the Russian Federation dated July 19, 2016 No. BS-4-11 / [email protected] ).

How to reflect above-limit daily allowances in 6-NDFL: example

Ivanov A.A. On July 8, 2022, he went on a business trip for 15 days, receiving a daily allowance in the amount of 15,000 rubles. Upon his return, he prepared an advance report and submitted it to the accounting department on July 23. For July, Ivanov received his salary on August 6.

Accountants will need:

1. Calculate the taxable amount of excess daily allowance.

It's simple: divide 15,000 by 15 days of business trip - it turns out 1,000 rubles per day. Of these, 300 rubles. (1,000 – 700) is the employee’s taxable income. Total taxable income for a business trip is 4,500 rubles (300 × 15 days).

2. Reflect in the 6-NDFL report for 9 months (in terms of taxable amounts for excess daily allowance):

1. In section 2:

- in columns 110 and 112 - 4,500 rubles of income;

- in columns 140 and 160 - 585 rubles each (calculated and withheld tax).

2. In section 1:

- in column 021 - 08/09/2021 (personal income tax is transferred to the budget);

- in column 022 - 585 rubles (personal income tax on daily allowance).

The terms we considered for calculating and reflecting travel payments in the 6-NDFL report are determined in relation to the status of an individual as an employee of an organization. But what about these procedures if, at the time the daily allowance is recognized as received and taxable income, the employee is fired? This scenario can be classified as a special one - let’s get acquainted with the accounting procedure in this case.

General algorithm for filling out all sections of 6-NDFL

The algorithm for filling out different sections of the report will vary:

- In Section 1 , personal income tax from wages and vacation pay will be divided into 2 lines depending on the deadline for transferring the tax: 12/30/2021 for wages and 01/10/2022 for vacation pay.

- In Section 2, wages and vacation pay will be included in lines 110 and 112 , and calculated and withheld tax will be included in lines 140 and 160 .

- In Appendix 1 6-NDFL, salary and vacation pay will be included in the income information for December, but with different income codes: 2000 for salary and 2012 for vacation pay. Personal income tax on vacation pay and wages will be taken into account in the total amount of calculated, withheld and transferred tax.

Let's look at filling out 6-personal income tax while simultaneously paying wages and vacation pay using an example.

Employee Volkov M.S. On December 29, 2021 the following were paid:

- salary for December. The amount of income is 65,000 rubles, personal income tax is 8,450 rubles.

- vacation pay for the period 01/10/2022 – 01/14/2022 Amount of income 15,400 rubles, personal income tax 2,002 rubles.

Let's check how this operation will be reflected in the 6-personal income tax for 2022.

Special scenarios: reporting per diem upon dismissal of an employee

For clarity, let's consider another example.

Ivanov A.A. submitted a report on the business trip on July 5, 2022, then, after working in the company until the 16th, he wrote a letter of resignation. The parties agreed to terminate labor relations on July 19 and make all payments.

The question arises - how to withhold personal income tax (and reflect it in reporting) if the day on which the excess daily allowance is recognized as income - July 31, 2022 - comes later than the day the employee is dismissed?

In this case, personal income tax is subject to withholding simultaneously with calculations upon dismissal. In form 6-NDFL the following are recorded (in section 1):

- in column 022 - 07/20/2021 (date of transfer of tax to the budget).