According to Part 1 of Article 14 of Law 255, benefits for temporary disability, maternity, monthly child care payments are calculated based on the average earnings of the employee, calculated for two calendar years (KY) preceding the onset of temporary disability, maternity leave (BIR), baby care.

If in two CGs preceding the occurrence of the specified insured events, the employee was on maternity leave and (or) child care, the corresponding CGs, at the request of the employee, may be replaced for the purpose of calculating average earnings by previous dates, provided that this leads to to an increase in the amount of charges.

What are the benefits (730, 731 or 732 days)?

- For pregnancy and childbirth (maternity leave).

- For temporary disability (sick leave).

- Monthly benefits for child care up to 1.5 years (children).

According to Article 14 of Law 255-FZ, the calculation period (RP) for any benefits is two CG according to the income certificate. That is, in 2022, when calculating (maternity leave, sick leave and childcare benefits for children under 1.5 years old), it is necessary to take the employee’s income for 2022 and 2022 and divide the resulting value by the number of days. This is how the average daily earnings are calculated, which is used in the formulas when calculating the amount of benefits.

How many days are included in the RP - 365+365=730 or 365+366=731 days (if the recalculation falls on a leap year).

But in life everything is more complicated. Because the calculation of average daily earnings for benefits (maternity leave, sick leave, care for up to 1.5 years) is different. And there in some situations the number of days is strictly 730 days

.

When is it permissible to change years for maternity benefits?

Law 255-FZ regulates the procedure for replacing years for calculating maternity benefits. As a general rule, the two calendar years that precede the year of registration of leave under the BiR are recognized as calculated.

The right to choose for calculation is enshrined in paragraph 1 of Article 14 of Law 255-FZ.

According to this paragraph, you can select years for calculating maternity leave if the calculation period included either maternity leave or parental leave for a child under 1.5 years old.

There is also the right to a replacement if even one day of maternity leave falls within the two-year period.

You can change the year in which there are maternity days.

We recommend reading: how to go from maternity leave to maternity leave without going to work?

Rules for choosing a different billing period

When changing the billing period, you must comply with a number of conditions and rules:

- You can only change the year in which there was at least one day of maternity leave;

- can only be changed for the year preceding the billing period;

- you cannot skip years in which there was no maternity leave;

- as a result of the choice, the amount of maternity benefits should increase;

- the woman herself must declare her desire to choose other years for calculation.

When calculating maternity benefits, the total income received for each of the two calculation years is taken, then divided by the number of days of the period and multiplied by the number of maternity days.

The formula is:

BiR allowance = (Income for the 1st accounting year + Income for the 2nd accounting year) / (Number of days in the accounting period - Excluded days) * Days of maternity leave.

In this formula:

- The number of days in the period is 730 or 731 if it is a leap year.

- Excluded days are the time of maternity leave, care leave for up to 1.5 years, and sick leave.

- The days of maternity leave are 140, 156 or 194. In general, it is 140, for difficult births it is 156, for twins it is 194.

It is important that as a result of the choice made, the benefit amount increases. To do this, you need to calculate maternity benefits with and without replacement.

The peculiarity is that when maternity leave falls during the billing period, the woman’s income is less, but these days will be subtracted from the denominator of the formula. Accordingly, the benefit will be calculated based on the time actually worked and the earnings received. It is possible that this option will be more profitable than replacing years with earlier ones, when income may be lower.

When calculating maternity leave according to BiR, several calculations need to be made: without replacement and with replacement. At the same time, years can sometimes be replaced in different ways. Below are examples explaining how to choose the right period for calculation.

When calculating, it is important to take into account that the benefit cannot be less than the minimum value and more than the maximum.

Example 1

Initial data:

In 2022, a woman takes out a leave under the BiR with her second child for 140 days.

The first maternity leave ended on January 10, 2022.

Earnings: 2016 = 410,000, 2022 = 520,000, 2022 = 700,000.

Is there a right of substitution and is it necessary?

Calculation:

The billing period is 2022 and 2022. In 2022, a woman has 10 days of maternity leave (from 01.10 to 10.01), which means that it can be changed to the previous one - 2016. In 2022 there was no maternity leave, it cannot be changed.

Let's calculate the benefit with and without replacement:

Calculation for 2017-2018 = (520,000 + 700,000) / (730 - 10) * 140 = 237,222.22 rubles.

Calculation for 2016, 2022 = (410,000 + 700,000) / 731 * 140 = 212,585.50 rub.

As can be seen from the calculations made, it is not profitable for a woman to take another 2016. instead of 2022, so there is no need to write an application to change years.

Example 2

In 2022, a woman will apply for maternity leave under BiR for 140 days with her second child.

The first maternity leave lasted throughout 2022 until June 20, 2018.

Earnings: 2015 = 320,000, 2016 = 480,000, 2022 = 0, 2022 = 220,000.

There were no excluded days in 2015 and 2016, 365 excluded days in 2022, and 171 excluded days in 2022.

Do I need to select other years in this example?

Calculation:

In this example, the woman’s billing period is 2017-2018. Both years have maternity days, which means you can change either both, or one year, or not change them at all. You need to calculate in advance which option is more profitable.

The following options are possible:

- leave 2017-2018;

- change 2022 to 2016;

- change 2022 to 2016;

- change 2022 and 2022 to 2015 and 2016.

Calculation for 2017-2018 = (0 + 220,000) / (730 - (365 + 171)) * 140 = 158,762.89.

Calculation for 2016, 2022 = (480,000 + 220,000) / (731 - 171) * 140 = 175,000.00.

Calculation for 2016-2017 = (480,000 + 0) / (731 - 365) * 140 = 183,606.56.

Calculation for 2015-2016 = (320,000 + 480,000) / 731 * 140 = 153,214.77.

As a result of the calculation for four different options, it can be seen that the largest amount is obtained in the case of replacing only one year - 2018 with 2016, when the calculation period is recognized as from 01/01/2016 to 12/31/2017.

A woman is not obliged to change the year in which the maternity leave was to an earlier one; this is her right, not an obligation. Therefore, she can leave 2022 legally, although there was not a single day worked in it.

Example 3

During the period from January 1, 2016 to June 30, 2017, the woman received a child care benefit from social security in the minimum amount and was unemployed.

I got a job in December 2022.

Earnings for 2022 amounted to 40,000, for 2022 = 420,000.

In 2022, she takes out maternity leave with her second child. Does she have the right to replace?

Calculation:

The billing period in this example is 2022 - 2022. At this time, the woman receives a monthly benefit of up to 1.5 years in social security for the period until June 30, 2017.

Receiving benefits while unemployed does not provide grounds for replacing this year with an earlier one. When receiving money from social security, a woman is not on maternity leave, but only the presence of such leave in the billing period gives the right to choose.

Since maternity leave in 2022 and 2022 was not, then the period cannot be changed; the calculation must be made based on income for the period from 01/01/2017 to 12/31/2018. Days of receiving child benefit are not excluded.

Allowance = (40,000 + 420,000) / 730 * 140 = 88,219.18 rub.

How to apply?

The law states that years can be changed only upon the written request of a woman.

If there is no application, then the employer does not have to change anything, but is obliged to calculate the benefit based on the last two years.

If the request is submitted by the employee, then it is the employer’s responsibility to carry out at least two calculations and choose the most profitable option. Often, without a choice, the payout is greater than with replacement.

If the employer replaces the years based on the employee’s application without checking whether the benefit is increasing or not, then the employee subsequently has the right to demand a recalculation of maternity benefits.

An application to change the period for calculating benefits under the BiR is submitted by the woman along with other documents for registration of leave. It can also be submitted later - after the appointment of maternity leave without a choice of years. In this case, the employer will recalculate the amount.

applications can be found here.

How to make a replacement?

If a woman, while on maternity leave, finds out that she is pregnant again, it means that she will soon need to apply for maternity leave again. And for the purposes of calculating maternity leave, the question of choosing and replacing years will arise. After all, the B&R benefit is calculated based on the average earnings for 2 KGs preceding the occurrence of the insured event - pregnancy and birth, respectively.

But in the case under consideration, one, or maybe both of these periods, for the woman consisted of children's leave. Then the employee has the right to replace one or both periods with earlier ones, if due to this the amount of due payments increases ( part 1 of article 14 of the Law of December 29, 2006 N 255-FZ, clause 11 of the Regulations on the specifics of calculating benefits, approved by Government Resolution dated 06/15/2007 No. 375

).

A similar situation arises for an employee who worked a short period between the first and second maternity leave.

What payments are due to maternity leavers?

A complete list of maternity payments is given in Art. 3 of Federal Law No. 81-FZ “On state benefits for citizens with children” dated May 19, 1995. This list includes:

- B&R manual;

- payment for early registration for pregnancy;

- payment at the birth of a child;

- monthly child care allowance;

- payment to a conscript's pregnant wife;

- child care allowance for a conscript's wife.

These are only those payments that are fixed at the federal level. Regional authorities often introduce additional methods of motivation in the form of additional payments to benefits or extension of payments for children under 3 years of age.

Changing the year when calculating maternity benefits in 2022

Not any days worked by the employee are subject to replacement, but those preceding the onset of the previous pregnancy.

Example

Artamonova S.M. has been working at Organization LLC since 09/03/2012. She was on vacation under BiR from 02/08/2017 to 06/20/2017, and on childcare leave from 06/21/2017. And on 10/08/2019 she brought a sick leave certificate issued in connection with a new pregnancy.

The billing period under such circumstances is 2017-2018. But since she was on children’s leave for almost all of these 2 years, she has the right to replace it for 2015-2016. The employee cannot transfer the RP to an earlier date, even if this will increase payments. That is, in the example it is impossible to replace 2017-2018, for example, with 2013 and 2014.

If the employer calculates the employee’s benefits, postponing the deadlines to more distant periods, then the Social Insurance Fund will not accept such payments for credit. And even if the organization decides to sue the Fund on this issue, the court will be on the side of the latter (Decision of the Supreme Court dated 02.12.2018 N 309-KG17-15902).

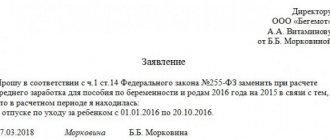

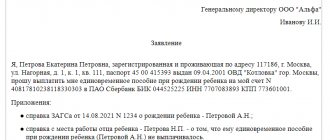

Application for replacing years when calculating maternity leave

The accountant calculates funds taking into account the replacement if he receives a request for replacement from the employee. That is, first the employee needs to be told about the possibility of choosing and replacing (she may not know this), and then write a statement. Because it is in her interests.

The application is drawn up in any form addressed to the head of the organization.

For example: “To calculate maternity benefits, as well as child care benefits, please replace 2022 and 2022. RP for 2015 and 2016, because from 02/08/2017 to 06/20/2017 I was on maternity leave, and from 06/21/2017 to 10/08/2018 - on child care leave.”

Let us remind you that it is impossible to provide an employee with both labor and parental leave at the same time. Therefore, she will be able to go on a new maternity leave only after the previous one is interrupted.

Important! If the dates included in the calculation at the request of the applicant were worked for another employer, you must bring a certificate in form 182n.

Social benefits are accrued within ten days from the date of receipt of the certificate of incapacity for work for pregnancy and childbirth

. If by this time the employee has not managed to bring a certificate from her previous job, maternity leave is calculated based on the available documents.

The accountant will divide the amount of salary for the two previous years by the total number of calendar days with the exception of:

- days spent on sick leave;

- days of prenatal and postnatal leave;

- days of rest to care for a child.

The resulting average daily earnings are compared with those calculated from the minimum wage. A larger amount of daily earnings is accepted for calculation. After receiving certificate 182n, the accountant is obliged to recalculate.

Conditions for selecting and replacing a billing period

To replace (select) RP, the following conditions must be met:

- the employee was on leave due to employment and labor regulations;

- written statement from the employee;

- replacing the RP should not worsen the employee’s position, that is, replacing the RP should help increase the amount of benefits.

When replacing, you should follow the established rules.

So, you can replace the CG only entirely. One changes to another. You can’t split it up by selecting several months from each month.

When replacing the billing period, the entire period of time changes and the RP will still have two calendar years, although it is not necessary that it be two consecutive years.

This may be the first one preceding the occurrence of the insured event and the third, or the second and third, third and fourth - if there are grounds for replacing two years.

If the employee was on maternity leave during the two years included in the calculation, one or both years of the RP can be replaced with the previous ones. Provided that this will lead to an increase in the benefit amount. And it doesn’t matter that the billing period accounts for only part of the specified time off.

What is maternity leave?

Maternity leave is not an official name; in documents it is referred to as maternity leave (Maternity leave). Employed women receive sick leave at the 30th week of pregnancy. That is, from this day on they are officially on maternity leave, which lasts:

- 140 days - if there are no complications;

- 156 days - if there are complications;

- 194 days - in case of expecting the birth of twins, triplets, etc.

Adoptive parents also have the right to go on maternity leave if they adopted a child under 3 months old. But in this case, the vacation lasts only 70 days, counting from the date of birth of the child. Or 110 - if there are several children.

Legislation

The FSS in a letter dated November 30, 2015 No. 02−09−11/15−23247 explained:

An exception is the case when in the years preceding the billing period the employee was also on maternity leave. In this case, replacement can be made for the time preceding the occurrence of the first insured event.

From the general rule for determining RP, legislators made an exception for women who were on maternity leave during the specified period and lost wages because of this. In the described case, you can move one year or both to an earlier time.

From Part 1 of Article 14 of Law No. 255-FZ, it follows that a replacement can be made if three conditions are met.

- In two CGs immediately preceding the occurrence of the insured event (illness, maternity leave), or in one of the indicated years, the employee was on maternity leave.

- An employee requested a replacement.

- The replacement will result in an increase in benefit amount.

Let's sum it up

- The procedure for calculating benefits for BiR is almost identical to the procedure for calculating benefits for temporary disability, with the exception of certain nuances.

- When calculating the SDZ for the B&R benefit, the actual number of days in the years that are included in the calculation is taken into account. And when calculating sick leave, the duration of the calculation period is always fixed - 730 days.

- When replacing years in the calculation period, the maximum base for contributions to the Social Insurance Fund (for calculating the SDZ limit) is taken for those years that are included in the calculation.

Excluded period when calculating benefits

From the calculation period in accordance with parts 1 and 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ, exclude:

- temporary disability (“sick leave”), maternity leave (“maternity leave”);

- releasing an employee from work with full or partial retention of wages, if insurance premiums were not calculated from wages.

Note: These rules do not apply to situations where the average daily earnings must be calculated based on the minimum wage.

When determining the amount of maternity benefits, is the time when the employee worked part-time while maintaining the right to child care benefits excluded from the calculation period?

While working part-time, the employee continues to be on maternity leave, this follows from the provisions of Article 256 of the Labor Code of the Russian Federation. Therefore, this time should be excluded from the number of calendar days of the RP.

The salary accrued to an employee for working part-time is included in earnings when calculating maternity benefits. Child care benefits and compensation payments until the child reaches three years of age, respectively, are not included in the earnings of the calculation period.

. Such rules are established in parts 1, 2 and 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ.

In practice, a situation is possible when the number of calendar days of the RP will be equal to zero. This will happen if the entire billing period consists of excluded time. For example, if during the two years preceding the maternity leave, the employee was on another maternity leave.

If, while on maternity leave, the employee worked part-time, then she will have earnings in the billing period. In such a situation, it is impossible to calculate the average daily earnings in the general manner, based on the earnings of the billing period. Since the denominator of the calculation formula (the number of calendar days of the RP) is equal to zero.

In this situation, two options are possible:

- calculate maternity benefits based on earnings equal to the minimum wage;

- at the request of the employee, replace the RP at an earlier date (part 1 of article 14 of the Law of December 29, 2006 No. 255-FZ).

Examples of calculating maternity benefits

When calculating maternity benefits, you need to carry out calculations with and without replacement of years in the billing period. Below are examples of situations on how to choose the most profitable option.

Example 1:

Maternity leave begins in 2022, and the sick leave list indicates 140 days.

The woman is already expecting her second child, and maternity leave with the first ended in 2022.

Income by year: 2022 - 405,000, 2022 - 606,000, 2022 - 690,000 rubles.

There were 2022 and 2022 excluded days, and in 2022 there were 10.

Let's check whether a woman can change her years, and whether it is beneficial.

Calculation period: 2022 and 2022. In 2022, there are days of maternity leave with the first child, but in 2022 there are no such days. Accordingly, a woman has the right to replace only 2022. There were no maternity days in 2021, so it cannot be changed.

Amount of maternity leave for 2022 and 2022: (606,000 + 690,000) / (366 + 365 - 10) x 140 = 251,650.49 rubles Amount of maternity leave for 2022 and 2021: (405,000 + 690,000) / (365 + 365) x 140 = 210,000 rubles

From the calculation it is clear that changing the years is not profitable, and there is no need to write an application to change the years.

Example 2:

Maternity leave begins in 2022, and the sick leave list indicates 140 days.

The woman is expecting her second child; maternity leave with the first began in 2020 and ended in 2022.

Income by year: 2022 - 350,000, 2022 - 490,000, 2022 - 0, 2022 - 200,000 rubles

Excluded days: 2022 - 0, 2022 - 0, 2022 - 365, 2022 - 200 days

The billing period is 2022 and 2022, but both years contain maternity days, which means they can be replaced by law.

Let's calculate maternity benefits for different years in the billing period:

2020 and 2022: (0 + 200,000) / (366 + 365 - 200) x 140 = 52,730.70 rubles 2022 and 2022: (490,000 + 200,000) / (365 + 365 - 200) x 140 = 182,264 .15 rubles 2022 and 2022: (490,000 + 0) / (365 + 366 - 365) x 140 = 187,431.69 rubles 2022 and 2022: (350,000 + 490,000) / (365 + 365) x 140 = 161 095.89 rubles

From the calculation it is clear that the option of greatest interest is when the calculation period is taken for the years 2022 and 2022.

Example 3:

In the period from January 2022 to June 2022, the woman was unemployed and received child care benefits from the OSZN. In December 2022, she got a job.

Income by year: 2022 - 70,000, 2022 - 400,000

Calculation period: 2022 and 2022. During this period, until June 2022, the woman received child benefits in the OSZN. Being unemployed and receiving benefits does not give a woman the right to change the pay period, since she is not on maternity leave. Therefore, in this example, the calculation period does not change, and income is calculated based on the child benefits received.

The benefit amount will be: (70,000 + 400,000) / (366 + 365) x 140 = 90,013.68 rubles

Maternity leave replacement table

| What period was the previous “children’s” leave for? | What to replace with | Examples |

| For both years of the billing period, completely | Two years - entire RP | On the second maternity leave, immediately after the first, the employee will go on maternity leave from November 20, 2022. From December 2013 to March 2022 she was on maternity leave. The billing period was 2015–2016, I was on “children’s” leave. All of 2014 and part of 2013 also fell on vacation. Therefore, they immediately precede the decree of 2011 and 2012, and the RP can be replaced with them upon application. |

| For one year from the RP in full and partially for the second | Two years – the entire billing period | One year from the RP, the employee was on maternity leave. The employee has been working in the organization since 2010. From January 12, 2017, she goes on maternity leave. From December 2011 to March 2015 she was on maternity leave. Calculation period – 2015–2016. Since she was on maternity leave in 2015, this year can be replaced. Directly precedes the first decree of 2010, so 2015 is changed to 2010. |

| Only for one year from the RP, and the other employee worked completely | The year in which the “children’s” vacation fell | An employee goes on maternity leave while on maternity leave. The employee has been working in the organization since 2012. Since October 2022, she has gone on maternity leave while on maternity leave. She went on maternity leave with her first child in April 2015. Estimated period: 2015–2016. Since in 2015 and 2016. she was on maternity leave, these years can be replaced. Directly preceding the first decree are 2013 and 2014. The RP changes to them. |