Prerequisites for using UPD

Sales of goods from VAT payers are usually accompanied by the execution of two documents:

- primary accounting - by virtue of the legislation on accounting (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ);

- invoices - as required by tax legislation (clauses 1, 3 of Article 168, clause 1 of Article 169 of the Tax Code of the Russian Federation).

However, the content of the listed documents is basically identical. After all, invoices (TORG-12, waybill T-1) or acts and invoices duplicate the content of a business transaction. And this increases both time and financial costs for registration, accounting, storage, search and analysis of primary accounting documents.

The invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. And clause 9 of the Rules for filling out an invoice, contained in the same resolution, talks about the possibility of adding lines or columns for additional information. The Tax Code also does not contain any prohibitions on supplementing this document. Also, since 2013, any organization can develop its own primary documents for accounting purposes (Clause 4, Article 9 of Law No. 402-FZ). In this regard, the tax authorities decided to simplify the documentation procedure for sellers and proposed a single document based on the invoice.

IMPORTANT! The use of this document may be at the discretion of the organization. It is not mandatory, it is only designed to make the work of accountants easier and reduce the costs of organizations.

What document did the Federal Tax Service propose?

The Federal Tax Service formalized its proposal in the letter “On the absence of tax risks when taxpayers use a primary document drawn up on the basis of an invoice” dated October 21, 2013 No. ММВ-20-3/ [email protected] , where it recommended that taxpayers use the form of a universal transfer document ( Appendix No. 1).

This document includes all the necessary details required for both the primary accounting document and the invoice. The taxpayer has the right to use it both for accounting purposes and for taxation purposes for VAT, as well as for other taxes. The UPD prepared by the supplier is both the basis for the buyer to deduct VAT and to confirm income tax expenses.

If an organization decides to use UTD in its document flow, then it needs to take into account a number of organizational issues, and also bring the recommended form into line with the current form of the invoice.

How to switch to UPD? How to fill it out correctly? When is it necessary to use an invoice rather than an UTD? The answers to these and other questions were explained in detail by ConsultantPlus experts. Get trial access to the K+ system and go to the Guide for free.

Compliance between UPD and invoice

From 07/01/2021, the invoice form has changed and is valid as amended by the Russian Government Decree No. 534 dated 04/02/2021. The update of the form is due to the implementation of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We described in more detail the changes made to the invoice here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Guide. It's free.

The UPD form also needs to be adjusted, including adding:

- Lines 5a to indicate data about the document based on the shipment.

- Columns 11 to display the registration number of the batch of goods subject to traceability.

- Columns 12 and 12a to reflect the code and unit of goods that are subject to traceability.

- Columns 13 to indicate the quantity of goods subject to traceability.

Also in the form of the universal transfer document in column 11 you need to change the name to “Registration number of the customs declaration”.

You can adjust the invoice part of the UPD yourself. This is confirmed by the Federal Tax Service.

Official uniform

The form of the universal transfer document, or abbreviated as UTD, was developed by tax authorities in 2013 and introduced into circulation by Federal Tax Service letter No. ММВ-20-3/96 dated October 21, 2013 in order to simplify document flow in the accounting department. But, despite the fact that the universal transfer document is an officially approved form, organizations have the right to independently make changes and additions to the form.

IMPORTANT!

From July 1, 2022, the invoice form has changed. In this regard, the Federal Tax Service, in Letter No. ZG-3-3/4368 dated June 17, 2021, explains the procedure for taking this change into account when filling out the UPD. Line 5a must be added to the approved form. And if goods from the list of traceable products are sold, add columns 12–13.

The peculiarity of the universal transfer document is that it combines the details required for invoices and primary forms - for example, information about the shipper and consignee, details of the payment order, name and address of the buyer, name of the currency, government contract identifier, payer details, name the product and its characteristics, including quantitative, etc. Thus, instead of two transfer documents, one universal one is issued.

IMPORTANT!

Please note: if you know how to correctly draw up the UPD, the sample can be modified to suit the needs of a specific document flow in the accounting department. The rules for adding a column in a table to the UPD are as follows: after adding a column, you cannot change the existing numbering - assign an additional letter designation to the new column. For example, having entered a column between columns 5 and 6, enter the designation “5a” for it.

Deadlines for issuing a universal transfer document

The UPD must comply with the requirements of both Chapter 21 of the Tax Code of the Russian Federation and Law No. 402-FZ. Only if these conditions are met can it be used for accounting and taxation purposes (letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/ [email protected] ). So, in accordance with paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, an invoice for the sale of goods, work, services (transfer of property rights) is issued no later than 5 calendar days from the date of shipment of goods, performance of work, provision of services (transfer of property rights). Primary accounting document, based on clause 3 of Art. 9 of Law No. 402-FZ, must be formalized upon completion of the fact of economic life or immediately after its completion.

Due to these requirements, the UPD should be drawn up when the fact of economic life occurs or immediately after it. In this case, both the conditions of Law No. 402-FZ and the requirements of the Tax Code of the Russian Federation will be met. The date of preparation of the document is reflected in line 1 of the UPD “Invoice No. ____ dated __________”. It must correspond to the date reflected in line 11 of the UTD “Date of shipment, transfer (handover) “__” __________ 20__.”

At the same time, the Federal Tax Service of Russia allows a slight difference between the date of preparation of the document and the date of shipment (Appendix No. 3 to the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ) in the following cases:

- if the shipment took place the next day after the document was issued;

- if the document is executed after the date of actual shipment, when this cannot be done during the transaction.

In any case, the UPD must be drawn up no later than the next business day after shipment.

Procedure and sample for filling out the UPD

Filling out the universal transfer document begins by indicating its status. The status determines in what capacity the UPD will be used: as an invoice and a primary document (status 1) or only as a primary document (status 2), the obligation to fill out a number of its lines.

In the UPD with status 1, all details for both the invoice and the transfer document must be filled in. As an invoice, the UPD must contain all the details required for invoices, provided for in Art. 169 of the Tax Code of the Russian Federation and Government Decree No. 1137 dated December 26, 2011. As a primary document, the UPD must contain all mandatory details in accordance with the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

In UPD with status 2, filling in the details for the invoice is not required. In this case, this document is used only as a transfer document and confirms only the fact of a business transaction.

After indicating the status, the registration number of the UTD and the date of its compilation are filled in (line 1). In the UPD, which has status 1, a serial number is given in accordance with the chronology of the numbering of invoices, and the UPD with status 2 is numbered in accordance with the chronology of the numbering of primary documents.

In case of correction of errors in the previously issued UTD, line 1a reflects the number and date when the corrections were made. Corrections are made in a manner similar to correcting invoices.

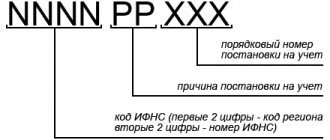

Mandatory information about the seller (lines 2, 2a, 2b) and buyer (lines 6, 6a, 6b) is provided.

Information about the shipper (line 3) and consignee (line 4) is filled in only when goods are shipped. When performing work or providing services, a dash is placed in these lines.

Line 5 “To the payment and settlement document” may not be filled in if the UTD is used only as a transfer document.

Line 7 contains an indication of the currency and its code, and line 8 contains the identifier of the government contract, if any.

Filling out the tabular part is carried out in accordance with the procedure for filling out invoices, taking into account the following features:

- Column A “Item No.” provides the entry number in the table, and column B “Code of goods/works, services” indicates the article number for goods or the OKVED code for services. Filling out these fields is optional.

- The fields intended exclusively for the invoice are optional (if the UPD has status 2):

- column 6 “Including the amount of excise tax”;

- column 7 “Tax rate”;

- column 10 “Digital code of the country of origin of the goods”;

- column 10a “Short name of the country of origin of the goods”;

- column 11 registration number of the batch of goods subject to traceability;

- columns 12 and 12a the unit of measurement of the product, which is used for traceability. It is determined according to the All-Russian Classifier of Units of Measurement;

- column 13 quantity of goods in the specified units.

Then the number of sheets on which it is compiled is entered in the UPD, and under the tabular part the document is signed by the responsible persons: the manager and the chief accountant / individual entrepreneur. The authority to sign the UPD may be delegated to authorized persons. If the UPD does not serve as an invoice, but only as a transfer deed, then the signatures of the manager, chief accountant/individual entrepreneur are not required.

Signatures in the UPD are affixed as follows:

| Line | Meaning | Filling Features |

| 10 | Full name, position and signature of the person who shipped the goods/transferred services, results of work, property rights | Always filled in, regardless of the status of the document. If full name and the position of the person who shipped the goods (transfer of services, work, property rights) coincides with the full name. and the position of the person who signed the invoice, then the signature can not be duplicated, but only the position and full name can be indicated. |

| 13 | Full name, position and signature of the person responsible for registration of the facts of economic life on the part of the seller | Always filled in, regardless of the status of the document. If full name and the position of the person responsible for registration coincides with the full name. and the position of the person: · who put his signature in line 15, then the signature may not be duplicated, but only the position and full name may be indicated; · who signed the invoice, then the signature can not be duplicated, but only the position and full name can be indicated. |

| 15 | Full name, position and signature of the person who received the goods/services, results of work, property rights | Always filled in, regardless of document status |

| 18 | Full name, position and signature of the person responsible for registration of the facts of economic life on the part of the buyer | Always filled in, regardless of the status of the document. If full name and the position of the person responsible for registration coincides with the full name. and the position of the person who signed in line 15, then the signature can not be duplicated, but only the position and full name can be indicated. |

The UPD contains three lines to indicate the date:

- line 1 - date of document preparation;

- line 11 - date of shipment, transfer (handover);

- line 16 - date of receipt.

Regardless of whether these dates coincide or not, in column 3 “Date and number of the seller’s invoice” in the sales book, the date of shipment will be indicated as the date given in line 11 of the UPD, unless the moment of determining the tax base is date of acceptance of work (line 16 of the UPD).

Column 8 “Date of registration of goods (work, services, property rights) in the purchase book will indicate the date given in line 16 of the UPD.

Lines 14 and 19 indicate the names of business entities that take part in the preparation of documents on the part of the seller and the buyer. Here you can find information about the company that maintains accounting records for the seller/buyer under an agreement for the provision of accounting services. Line 14 may also indicate information about the commission agent (agent) transferring to the principal the goods (works, services) purchased from the seller on his own behalf. If the UPD is affixed with a seal (an optional detail) of the document originator, then lines 14 and 19 may not be filled in.

UPD with status 2

If you do not need to issue an invoice, use this universal transfer option optimally.

An example of how to fill out the UPD if its status section contains 2

The rules for filling out the UTD with prefix 2 for VAT non-payers are basically the same as the procedure established for status 1 and are given above. But there are also differences. We have presented them in a table.

| Information about the rate and amount of VAT is not filled in if the seller is not its payer (uses the simplified tax system, the patent system). | 7–8 columns of the table |

| The country and the gas customs declaration do not fit in. | Columns 10, 10a and 11 |

| Signatures are not placed under the tabular part. This block relates to signing an invoice. | Head of the organization or other authorized person Chief accountant or other authorized person Individual entrepreneur or other authorized person |

| The seller will enter information about the buyer's power of attorney if he has this information. If such data is not available, the buyer will enter it upon acceptance. | Line 9 |

| The lines in both copies will be filled in by the buyer upon acceptance of the goods. One copy will be returned to the supplier. | Lines 16–20 |

Results

The universal transfer document was developed to facilitate the execution of transactions for the sale of goods, works and services: one document instead of two. UTD is the basis for the calculation or deduction of VAT, to confirm income for the seller or expenses for the buyer. The tax authorities check the UPD according to the same criteria as the check of the usual primary documents and invoices. There are no tax risks when using the UTD provided that it is filled out correctly.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to work with UPD

The universal transfer act is filled out by suppliers.

If the parties work according to the old scheme, then the order of their interaction is as follows: the contractor ships goods or performs work or services, after which the customer accepts them. If there are no complaints, sign the delivery note or act. Only after signing the documentation confirming the fact of delivery, payment registers are issued - an invoice and an invoice for tax purposes.

You can also work according to a simplified version. A universal deed of transfer combines the functionality of several primary documents. Some suppliers combine the details of the invoice and the delivery note or certificate of work performed in the form. If the customer has no claims to the goods shipped, work performed and services provided by the supplier, then he signs the UPD and pays immediately, without waiting for a separate settlement register to be issued.

ConsultantPlus experts discussed how to correct the UPD if there is a technical error in it. Use these instructions for free.