Before November 2016, paying taxes was much less convenient than in 2022. Previously, you could only transfer money to the inspectorate, with some exceptions, for yourself. However, Now you can transfer money for any person, even a legal entity: the procedure is possible on the State Services resource, Sberbank Online or on the official website of the Federal Tax Service. However, you need to take into account that when paying via Internet banking, you need to know the receipt number, and through the website www.nalog.ru - the inspection code, full name and tax identification number of the taxpayer.

Taxpayer's obligation

First, you need to remember that every taxpayer has certain obligations to the state. Namely, timely payment of taxes. Individuals most often face the following payments:

- property;

- transport;

- income;

- land.

Accordingly, you must pay to receive income on the territory of the Russian Federation, as well as for the ownership, disposal and use of this or that property. This obligation arises from the moment the citizen comes of age. Can taxes be paid for another individual in Russia? Or is it only the taxpayer himself who is able to deal with his debts?

Is it possible to pay taxes for someone else's legal entity?

No restrictions were introduced in this regard. You can transfer money to the account of someone else’s organization or your company, where another person is listed as the founder. Moreover, taxes of an individual can also be paid with money from the current accounts of legal entities.

It should also be taken into account that such material support, if it can be called that, is not legally considered income of the taxpayer. Therefore, he should not pay 13% as personal income tax on this money.

Legislation

Previously, the country's Tax Code prohibited third parties from making tax payments for taxpayers. But the latest changes, which came into force at the end of 2016, slightly adjusted the legislation.

From November 30, 2016, citizens can pay taxes for other persons and individual entrepreneurs. According to established legislation, now anyone can transfer insurance premiums to the Pension Fund for a company or entrepreneur (from January 1, 2017), as well as pay almost any fee or tax. The exception is premiums for accident insurance. Third parties cannot produce them.

It follows that taxes are paid for another individual. This right makes life easier for many taxpayers. Now loved ones and relatives will be able to pay taxes for them.

Long-awaited changes

Previously, tax legislation obligated taxpayers to pay taxes and fees independently (clause 1 of Article 45 of the Tax Code of the Russian Federation). However, due to the entry into force of Federal Law No. 401-FZ of November 30, 2016, the situation has changed. This law amended Article 45 of the Tax Code of the Russian Federation, thanks to which third parties will be able to pay taxes, fees and insurance premiums for organizations, individual entrepreneurs or individuals. However, the amendments will be introduced in stages, namely:

- from November 30, 2016, some persons have the right to pay taxes and fees for others;

- from January 1, 2022, third parties have the right to transfer insurance premiums for others.

Allowed payments

It is important to remember that not all tax obligations can be fulfilled by third parties. Paying tax for another person is an operation that has recently become available in Russia. It raises a lot of questions. For example, what kind of payments can be made for strangers?

Available for transfer:

- VAT;

- personal income tax;

- excise taxes;

- income taxes;

- for mining;

- water tax;

- state fees;

- Unified Agricultural Sciences;

- simplified tax system;

- UTII;

- patent tax;

- on the property of organizations;

- transport taxes;

- land taxes;

- property tax for individuals;

- trading fees;

- for the gambling business.

All listed taxes and fees may be paid by third parties. In addition, the following contributions are allowed:

- for pension insurance (compulsory);

- for health insurance;

- contributions in connection with temporary disability or in case of maternity leave.

In other words, almost any tax or fee can be paid by third parties. But what else should every citizen know about the process?

What are the restrictions?

It is worth noting that there are some restrictions associated with the transfer of taxes, fees and insurance premiums. They are as follows:

- after payment, a third party does not have the right to demand the return of the amount paid to an organization, individual entrepreneur or individual;

- It will be impossible to clarify the payment of insurance premiums for compulsory pension insurance if the Pension Fund of Russia division manages to record the received amounts in the personal accounts of the insured persons.

Third parties are not required to obtain any authorization to pay taxes, fees or insurance premiums for others.

Filling out an order

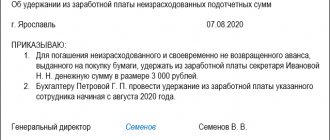

For example, the nuances of filling out a payment order. Without this feature, it will not be possible to correctly transfer funds for another taxpayer.

Are you planning to pay taxes? The payment order, according to the recommendations of experts, should be filled out as follows:

- You must follow all generally accepted rules for filling out payment orders.

- Information about the payer is the data of the person who directly contributes funds to the state treasury. TIN, KPP and the “Payer” section are the fields in which a citizen indicates information about himself.

- The purpose of the payment specifies for whose benefit the money is being contributed.

Perhaps these are all the features of filling out a payment order. The purpose of the payment must contain information about to whom the money is being transferred. Namely:

- Full name of the citizen for whom the tax is paid;

- Taxpayer INN;

- Checkpoint (for organizations).

So far, payment orders do not have any separate fields in which it would be possible to indicate that the tax is paid not for oneself, but for a third party. It is possible that payment slips will soon be redesigned to make filling out more convenient in the situation under study.

How to transfer payments to third parties

If someone wants to pay taxes, fees or insurance premiums for others, then most likely the question will arise about how to fill out payment orders for such payment. Let me explain.

The tax, fee or insurance premiums will be considered paid on the day when the third party presents to the bank a payment order to transfer money from his current account to the account of the Treasury of Russia. In this case, there must be enough money in the current account for such a payment.

Of course, the payment order must be filled out correctly. Third parties must fill it out in accordance with the Rules approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. This follows from the first paragraph of paragraph 7 of Article 45 of the Tax Code of the Russian Federation. In our opinion, in the payment order the third party must indicate information about himself as the payer. Information about the payer is indicated in fields 8 “Payer”, 60 “TIN” and 102 “KPP”. However, in the purpose of the payment you will need to indicate which organization, individual entrepreneur or individual the payment is being made to. Here is a sample filling.

However, it is worth noting that, perhaps, the payment rules will be adjusted in 2017 and will provide for a special procedure for filling out payment orders by third parties. It is also possible that additional clarification will appear on the procedure for filling out payment orders when making payments to third parties.

Restrictions

Paying taxes for another individual is an operation that has several features. Every citizen should know about them.

Do I need permission to pay tax for another person? No. No additional documents will be required to bring your idea to life. Experts recommend agreeing with the taxpayer to transfer money in advance to avoid overpaying taxes.

Third parties who did not make the payment for themselves cannot demand the transferred amount from the taxpayer. Thus, paying taxes and fees, as well as insurance premiums for a stranger, is a voluntary and free action.

Only those for whom deductions were made by a third party can clarify payments received from a citizen to the Tax Services and the Pension Fund.

Who, for whom and what tax can pay

The Tax Code of the Russian Federation does not contain any restrictions regarding the definition of the circle of persons who have the right to pay taxes, fees and contributions for taxpayers. As well as for those whose duties to contribute money to the budget are fulfilled, there are no restrictions. That is, both third parties (those who do not pay for themselves) and taxpayers (those for whom payments are made to the state) can be individuals, individual entrepreneurs, as well as enterprises, organizations and other legal entities, as they say, "in any combination." At the same time, you can entrust another person to make a payment through Sberbank Online, even if the taxpayer has a different region of registration. The most common situations are paying property taxes for relatives or making current payments for your company when there is not enough money in the account.

Any taxes and fees (including state duties), as well as penalties and fines for them, are accepted for payment. Insurance contributions for compulsory pension and health insurance, in case of temporary disability and in connection with maternity are also allowed to be made by third parties. An exception is made for contributions from industrial accidents and occupational diseases (abbreviated as “for injuries”), since the tax authority is not the recipient of these amounts (they are administered by the extra-budgetary social insurance fund). You can deposit funds both in terms of current tax obligations and in the account of repayment of debt from previous periods.

What do you need to pay?

Now a little about what may be required to transfer taxes and fees for other people. In general, this operation is not much different from the usual fulfillment of tax obligations to the state.

However, in order to make a payment without any problems, you need to collect the following information:

- details for paying taxes (they are indicated in the payment slip);

- payer's TIN;

- Full name of the citizen who decided to pay the tax for another person;

- TIN of the person for whom the payment is made;

- amount of payment;

- Full name of the taxpayer whose tax will be paid.

As a rule, this process does not bring any difficulties. The tax is considered paid after the citizen brings a payment slip to transfer money to the state treasury to the bank. In other words, from the moment funds are received into the account and after presentation of the paid receipt.

Payment Methods

How can I make a payment? Paying taxes for other citizens is generally no different from transferring funds “for yourself.” Therefore, the population is offered quite a few ways to make payments.

Namely:

- in person at the bank;

- at the tax office using a payment terminal;

- by bank card;

- using electronic wallets;

- through the Internet.

Let's consider one of the most common scenarios - payment using a bank card. What will you need to do to transfer money to the tax office for another person in this way?

Can I pay taxes for another person using my card?

Paying taxes for someone else using your card will not be difficult. According to some Russians, paying with your card means that the money can only be used to pay for their personal expenses. An example would be paying by credit card in a supermarket. It doesn’t matter whether you are its owner - knowing the PIN code, anyone can pay for purchases. When paying taxes for another person, you will need to know his full name, details of the organization where the funds will be sent and the purpose of the payment. According to the law, the payment is gratuitous, therefore the person for whom the money was paid does not have the right to demand its return from you or the organization. It will be possible to return it if the person goes to court together with the owner of the card or account from which the money was written off.

Via ATM or terminal

The first way to transfer money is to pay taxes through an ATM or payment terminal. Let's look at the process using the example of working with ATM from Sberbank. This is the most common scenario.

So, to pay tax for another person, you need to:

- Find any ATM or payment terminal of Sberbank. Prepare all previously specified information in advance.

- Go to the machine and insert your bank card into it. Enter your PIN code to get started.

- Go to the menu “Payments and transfers” - “Search for recipient”. Select the appropriate search option. For example, “By TIN”.

- In the window that appears, enter information about the recipient organ. They will be written on the payment order. Click on the “Search” button.

- Select the tax service to which the funds will be transferred. Next, click on the “Taxes” line. To continue, click on “Next”.

- After this, you will have to indicate the purpose of the payment. Or rather, information about the taxpayer. Here, as experts say, you need to indicate information about who makes the payment. Namely, about a third party paying the tax.

- Enter payment information, if necessary. As a rule, the operation involves indicating the amount due for payment.

- Confirm the operation. Attach the receipt to the payment slip and save it. It will serve as confirmation of the transfer of funds.

That's all. This is how taxes are paid with a bank card. But you can use several more methods that allow you to transfer money from plastic to the tax authorities.

Internet banking

For example, by using online banking. Most banks have special services for making payments online. For example, Sberbank Online.

To pay tax for another citizen, you need to:

- Log in to the service. In our case, on the Sberbank Online page.

- Go to the section “Payments and transfers” - “Federal Tax Service”.

- Select the item “Payment of taxes” - “Search for recipient by TIN.”

- Enter data about the recipient tax authority. Click on “Next”.

- Confirm the information and fill out the payment form. The purpose of payment indicates information about whose benefit the funds are transferred to. The remaining information must contain information about the direct payer.

- Click on “Next”. Confirm actions. You must indicate the amount due for payment, as well as the card from which to write off the money.

After processing the request, the citizen will be able to save the payment receipt or print it immediately. This is a mandatory operation, without which it is impossible to confirm the fact of tax payment.

"Payment for government services"

The next trick is to use specialized services. For example, the “Payment for government services” website is perfect for paying taxes. With its help, you can make a payment without registration by debiting money from a bank card.

To do this you will need:

- Open the website oplatagosuslug.ru. Click on the item “Tax debts”.

- Select a taxpayer search method in the window that appears. For example, “By document index”. In this case, you need to enter the payment order index and click on “Next”. If a citizen clicks on “Search by TIN,” he must write the TIN of the taxpayer for whom the money is being transferred.

- Select the required tax. Click on “Next”.

- Indicate the method of transferring funds to the state treasury. In our case - “Bank card”. Next, you have to choose the bank whose plastic is used for the operation.

- Enter your bank card information in the appropriate fields. This is necessary in order for the money to be debited from a specific account.

- Check the details and confirm the payment. The receipt can either be saved on your PC or printed immediately.

The payer's signature is not required in all of the above cases. It needs to be set only if the citizen personally pays the tax at the bank. When exactly can you pay? The periods for paying taxes for someone are similar to the established periods for paying payments for yourself.

Instructions for paying tax for another taxpayer

This can be done in several ways: through the State Services website, through Sberbank Online, and also through the mediation of the Federal Tax Service website (www.nalog.ru ). The least convenient of the listed platforms is the State Services website, so the question of how to pay tax for another person through this platform is often associated with it. For the same reason, we will consider this method first.

Payment through State Services

It has one undeniable advantage: you will not need a receipt when making such a payment. Therefore, in some cases, payment through a government platform is preferable.

The taxpayer needs to create his own account on the website https://www.gosuslugi.ru , by taxpayer we mean the person who directly owes the Federal Tax Service. To register, you need to enter reliable information about yourself, passport, personal, and contact information. Then an SMS message with a verification code will be sent to the phone number you specified - enter it in the appropriate field to confirm the procedure.

Next, the taxpayer must click on the “Taxes” link . Among the available functions, you need to find a window with the tax for which you must pay - for example, it could be a transport tax. Here you can not only pay tax, but also track your current debt.

Click on the "Pay" button. The site will offer you several ways to transfer money: select “Payment by bank card.” Finally, the main thing is that it doesn’t matter who owns the bank card . It could belong to your friend, relative or spouse - you just need to confirm the transaction correctly.

As a rule, this requires the personal presence of the card holder or at least his phone number - this is where SMS messages with a verification code are sent from the bank. Done, within 24 hours the debt will disappear from the database.

Through Sberbank Online

To make the transfer, you will need not only an account in Sberbank Internet banking, but also a receipt from the tax office. Unfortunately, without this document it is impossible to transfer money to the Federal Tax Service for a stranger from your current account.

- Log in to Sberbank Online by entering your username and password. The platform does not matter - you can use both the Sberbank website and its mobile application;

- Find the “Payments and Transfers” tab;

- Click on the “Taxes, traffic police fines” window;

- Find the line “Federal Tax Service” in the list that opens. To simplify your search, you can use the search bar;

- Select “Payment by document index” from the menu. In the appropriate field, enter the number that is always indicated on the tax receipt;

- Specify the debit account and confirm the transaction by entering the verification code from the SMS in the special field. Ready.

Via the Federal Tax Service website

To make a transfer in this way, you will not need a receipt number, but you will need the taxpayer’s full name and TIN.

- Go to the website https://www.nalog.ru ;

- Find the “Payment of taxes and insurance premiums” window in the “Services” menu;

- The resource will prompt you to enter the UIN (receipt number). If available, enter it - this will speed up the operation. If not, click at the very bottom on the “Skip step and start generating a payment document” button. If you choose this method, be prepared to indicate the exact amount of the transfer against tax, the recipient’s details, full name and INN of the taxpayer, etc.;

- After filling out the form, indicate that you want to pay the tax by card. Confirm the transaction from your account to the taxpayer. Ready.