Which financial statements are considered simplified?

Art. 6 of the Federal Law on Accounting dated December 6, 2011 No. 402-FZ obliges organizations to maintain accounting records. An idea of the financial condition of an enterprise is provided by reporting that reflects accounting indicators as of a specific date.

Some categories of entities have the right to conduct accounting in a simplified manner, these are:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

Law No. 402-FZ also provides restrictions prohibiting simplified accounting. Among them are the activities of cooperatives, microfinance organizations, companies subject to mandatory audit, etc. (Clause 5, Article 6 of Law No. 402-FZ).

Simplified accounting differs from conventional forms in volume and composition. Clause 6 of Order of the Ministry of Finance dated July 2, 2010 No. 66n allows for the generation of simplified reporting documents in the following composition:

- balance sheet;

- income statement;

- report on the targeted use of funds (if there was targeted financing).

Forms in a simplified version have fewer lines to fill out, and the indicators of such reporting are presented in aggregate, without their detailed breakdown by item.

Let us remind you that for 2022 you should report according to the accounting forms approved by Order of the Ministry of Finance dated 07/02/2010 No. 66n (Appendix No. 5), taking into account the changes made by Order No. 61n dated 04/19/2019.

What does Form 2 of the balance sheet look like?

Form 2 of the balance sheet is a table above which are given:

- reporting period and date;

- information about the organization (including codes OKPO, INN, OKVED, OKOPF, OKFS);

- unit of measurement (from 2022 - only thousand rubles).

The table with reporting indicators consists of 5 columns:

- number of the explanation to the report;

- name of the indicator;

- line code (it is taken from Appendix 4 to Order No. 66n);

- the value of the indicator for the reporting period and the same period of the previous year, which is transferred from the report for the previous year.

The indicators of the previous and reporting year must be comparable. This means that if the accounting rules change, last year’s ones should be transformed to the rules in force in the reporting year.

Read about how such a transformation is done in the material “Balance sheet of an enterprise for 3 years (nuances).”

What are accounting control ratios?

Any completed report requires verification—accounting is no exception. Control ratios (CRs) are formulas for interrelating indicators, comparing their amounts, confirming the correctness of the entered data.

The Federal Tax Service regularly informs in its letters how information from tax returns and calculations should be correlated, and now the department has developed a CS for financial statements as well. These recommendations are applied by tax inspectorates and business entities themselves.

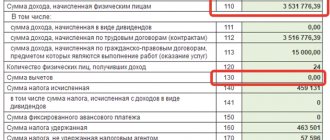

Income Statement: Breakdown of Lines

Statement of financial results - decoding of lines is carried out according to certain rules. Let's look at how to fill out individual lines of the report.

1. Revenue (line code - 2110).

Here they show income from ordinary activities, in particular from the sale of goods, performance of work, provision of services (clauses 4, 5 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

This is the credit turnover of account 90-1 “Revenue”, reduced by the debit turnover of subaccounts 90-3 “VAT”, 90-4 “Excise taxes”.

To find out whether it is possible to judge the amount of revenue from the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

2. Cost of sales (line code - 2120).

Here is the amount of expenses for ordinary activities, for example, expenses associated with the manufacture of products, the purchase of goods, the performance of work, the provision of services (clauses 9, 21 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

Control ratios of financial reporting forms (simplified) for 2022

For accounting purposes, the ratios are given by the Federal Tax Service in letter No. BA-4-1/ [email protected] (as amended on November 25, 2019). The agency has approved control formulas for checking the correctness of the preparation of accounting forms (including simplified ones), starting with reporting in 2022. We present the current ratios for simplified reporting forms.

KS balance sheet

| Complied with columns 3, 4, 5 | |||

| Line codes | 1600 (total asset) | = | 1150 + 1170 + 1210 + 1230 + 1250 (sum of asset indicators) |

| = | 1700 (total liabilities) | ||

| 1700 (total liabilities) | = | 1300 + 1410 + 1450 + 1510 + 1520 + 1550 (sum of liability indicators) | |

At the same time as equalities, it is necessary to take into account that all balance sheet indicators are non-negative.

KS of the financial results report

| Complied with columns 3, 4 | |||

| Line codes | 2400 (financial result: profit/loss) | = | 2110 – 2120 – 2330 + 2340 – 2350 + 2410 (the value of page 2410 can be either positive or negative) |

| 0 | 2110 and 2340 (income) | ||

| 0 | 2120, 2330 and 2350 (consumables) | ||

KS report on the intended use of funds

The Federal Tax Service proposes to apply the following ratios:

| Complied with columns 3, 4 | |||

| Line codes | 6200 (total funds received) | = | 6220 + 6240 + 6250 |

| 6300 (total funds used) | = | 6310 + 6320 + 6330 + 6350 | |

| 6400 (fund balance at the end of the year) | = | 6100 + 6200 – 6300 (balance at the beginning of the period + receipt – use) | |

| 0 | From 6200 to 6250 (received funds) | ||

| 0 | From 6300 to 6350 (funds used) | ||

The simplified report form does not contain the total values for codes 6200 and 6300. Therefore, we consider it fair to perform the check as follows:

Row 6400 = Rows 6100 + 6220 + 6240 + 6250 – 6310 – 6320 – 6330 – 6350.

As in the Income Statement, expense amounts are included in parentheses and subtracted when calculating totals.

Please note: the balance at the end of the previous period must match the balance at the beginning of the reporting period, i.e. line 6400 columns 4 = line 6100 columns 3.

Explanation of the balance sheet according to the lines of section 2

In the 2nd section of the balance sheet there are lines reflecting the value of the most liquid assets available in the company at the reporting date - working capital:

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| Reserves | 1210 | Explanation of line 1210 “Inventories” in the balance sheet includes:

| D/t 10 + D/t 15 + D/t 16 (or – K/t 16) + D/t 20 + D/t 21 + D/t 23 + D/t 28 + D/t 29 + D/ t 41+ D/t 43 – K/t 42– K/t 14 + D/t 44 + D/t 45 |

| VAT on purchased assets | 1220 | Debit balance of the account. 19 “VAT on purchased MC” | D/t 19 |

| Accounts receivable | 1230 | Combine debit balances on settlement accounts with suppliers, customers, employees - 60, 62, 70, 71, 73 (excluding long-term interest-bearing loans on account 73/1), 75, 68, 69.76 (VAT on advances reflected on these are not taken into account). The credit balance of the account is subtracted from the resulting value. 63 “Reserves for doubtful debts”, if a reserve was created | D/t 60 + D/t 62 – D/t 63 + D/t 68 + D/t 69 + D/t 70 + D/t 71 + D/t 73 (except for loans on account 73-1) + D/t 75 + D/t 76 (minus VAT on advances issued and received) |

| Financial investments (except cash equivalents) | 1240 | Investments in short-term periods (less than a year) to make a profit. Sum up the debit balances on accounts 55/3 and 58 (minus the credit balance of the reserve for impairment of short-term investments on account 59), 73 | D/t 58 – K/t 59 + D/t 55/3 + D/t 73-1 (for short-term transactions) |

| Cash and cash equivalents | 1250 | They generate information about the balances of funds in bank accounts and the cash desk of the company, for which they sum up the debit balances on accounts 50 (except for the subaccount for monetary documents 50/3), 51, 52, 55, 57, 58 (in terms of cash equivalents - securities , shares, etc.) | D/t 50 (except 50/3) + D/t 51 + D/t 52 + D/t 55 (except 55/3) + D/t 57 + D/t 58 (for investments in securities) |

| Other current assets | 1260 | The value of assets not included in the listed lines, for example, the debit balance of an account. 50/3 (when taking into account monetary documents), the amount of shortages and losses in the account. 94 | D/t 50/3 + D/t 94 |

| Total for Section II | 1200 | Total line by section | Sum of filled section lines |

| BALANCE | 1600 | Total for balance sheet assets | Sum of lines 1100 and 1200 |

Balance Sheet (Financial Indicators)

The study and subsequent analysis of the financial indicators of the future counterparty is necessary in order to see the dynamics of the company’s development and determine the prospects for cooperation with the future partner.

Our service provides the most complete information on the financial indicators of all organizations; all legal entities are required to regularly send reports to the Federal Tax Service and Rosstat. Rosstat data is updated once a year, and for comparison it is possible to look at figures for the last few years.

Our service has several undeniable advantages over competitors, namely:

·up-to-date information (we update data as soon as it appears in the original sources;

· detailed RAS analytics including current status, growth prospects and chances of bankruptcy.

We correctly assess the financial performance of the counterparty

For a deeper understanding, it makes sense to analyze the counterparty’s direct competitors, which will give a deeper understanding of what is happening in this industry.

One of the main indicators is the company’s net profit; it shows the final income after deducting all expenses, debt payments and taxes.

When taking a quick look, you usually pay attention to the following indicators:

· accounts receivable (the figure shows how much the organization owes to other legal entities - counterparties, borrowers, etc.);

· accounts payable (this is how much the company owes to others, the ratio of these two parameters is called the balance sheet);

· assets (for one-time cooperation with a counterparty, the principle of liquidity is important - the counterparty’s ability to quickly turn resources into money);

· liability (if the attracted capital is significantly greater than its own, this means that the company mostly “lives” in debt).

Analyzing financial indicators is a complex matter

Analyzing financial indicators and drawing the right conclusions is a non-trivial task; you need to have vast experience and look not only at the numbers. Let's give a few examples.

A high value of long-term accounts receivable may indicate that the company’s clients may have problems with solvency, or that work with debtors is not properly organized.

If the numbers in the “inventory” column are quite high, this means that there are a lot of finished products in the warehouses; a possible reason is that the company’s products are not in great demand right now. Another option is that the turnover is very large, the company considers it necessary to work ahead.

If there are strong declines in financial indicators, it makes sense to look for their cause. Maybe the organization recently changed management, or there were problems with procurement?

Conclusion - getting a complete picture only based on financial indicators is not very easy; it is necessary to take into account a huge amount of other data and evaluate changes in dynamics.

If necessary, you can receive an extract with an electronic signature - an extended electronic signature; this document has the same legal force as the paper version received in hand from the Federal Tax Service.

Software analysis of the RAS certificate - professional verification of counterparties

If you want to conduct a more detailed assessment of the counterparty’s activities, you can refer to our professional analysis of RAS (a certificate that complies with Russian accounting standards).

This document presents more than 40 indicators; you can view the graphs and read detailed comments.

Not every professional can handle high-quality financial analysis. If you use our service, the program will do everything for you!

How to check a potential counterparty

The Federal Tax Service in its Letter dated October 11, 2019 No. ED-4-1/ [email protected] indicates the need for companies to exercise due diligence. Tax authorities give recommendations on what needs to be done before starting cooperation and concluding an agreement so that the principle of due diligence is observed.

First, you need to find information on the Federal Tax Service website about the average number of employees of the counterparty, taxes and fees paid by it, violations of tax legislation on its part, incl. the presence of debt on mandatory payments, penalties, fines.

Secondly, you can request information from tax returns from the Federal Tax Service if the counterparty agrees to recognize this information as publicly available.

Thirdly, it is required to assess risks according to 12 criteria regulated by the Letter of the Federal Tax Service dated May 30, 2007 No. MM-3-06 / [email protected]

In addition, we should not forget that any user can find the necessary information on the GIRBO Internet resource. This service makes it possible to obtain free information about the accounting (financial) statements of any company. In addition, you can request and receive a copy of the accounting records, which will contain the electronic signature of the Federal Tax Service.