What are accounts receivable?

Accounts receivable are funds owed to a legal entity or entrepreneur by counterparties.

Below are the main cases of occurrence of receivables and accounts for their accounting according to the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2001 No. 94n):

| Situation | Accounting account |

| The supplier received an advance payment, but did not ship goods and materials or did not perform the agreed services | 76, 60 |

| The buyer did not pay for the valuables supplied or services received | 76, 62 |

| The borrower did not repay the loan received | 73, 76, 58 |

| The employee did not report on accountable amounts | 71 |

NOTE! We consider the nuances of accounting and writing off receivables from legal entities. Entrepreneurs are not required to keep accounting on the basis of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, but they can, at their own discretion, reflect receivables according to accounting rules.

The legislative framework for accounting for accounts receivable is represented by the following standards:

- Civil Code of the Russian Federation;

- Tax Code of the Russian Federation;

- regulations on accounting and accounting in the Russian Federation (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, hereinafter referred to as Regulation No. 34n);

Unfortunately, counterparties are not always in a hurry to pay off their debts. Therefore, in a number of situations, accounts receivable are considered uncollectible and are written off.

If you doubt the return of receivables, you must create a reserve for doubtful debts in your accounting. In tax accounting, such a reserve is not created in all cases.

ConsultantPlus experts explained how to properly form a reserve for doubtful debts. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Write-off of overdue accounts payable in a budget institution

Order of the Ministry of Finance of Russia dated December 16, 2021 N 174n (as amended on November 16, 2021) “On approval of the Chart of Accounts for accounting of budgetary institutions and Instructions for its application” (Registered with the Ministry of Justice of Russia on February 2, 2021 N 19669) writing off accounts receivable (creditor) from the balance sheet ) income debt recognized in accordance with the legislation of the Russian Federation as unrealistic for collection (unclaimed by income creditors)

Let's consider the procedure for accounting and writing off accounts payable in a budget institution. Accounts payable of a budgetary institution, as a rule, refers to debts under accepted obligations, amounts of cash or the value of other assets that are subject to transfer to the creditor in exchange for non-financial assets supplied, services rendered or work performed.

What accounts receivable can be written off?

In accounting, accounts receivable can be written off in the following cases:

- upon expiration of the limitation period;

- the debt has become impossible to collect (clause 77 of regulation No. 34n).

As a general rule, the statute of limitations is 3 years. If the deadline for fulfilling the obligation is determined, then the limitation period is counted from the end of the period for fulfilling the obligation. If such a period is not defined or is established as the “moment of demand”, then 3 years must be counted from the date of presentation of the requirement to fulfill the obligation (Articles 196, 200 of the Civil Code of the Russian Federation).

However, there are many nuances in determining the limitation period for liquidation of receivables.

Firstly, the statute of limitations may be interrupted if the counterparty acknowledges the debt (Article 203 of the Civil Code of the Russian Federation). Recognition of debt can be in the form of:

- partial transfer of receivables;

- payment of interest on arrears;

- requests to defer payment;

- submitting an application for offset;

- signing the reconciliation report;

- recognition of a claim with simultaneous recognition of a debt;

- amendments to the contract - indicating the recognition of the existence of a debt (clause 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43).

If the counterparty has acknowledged the debt, then the limitation period must be recalculated from the moment of recognition. The time elapsed before recognition cannot be included in the new period.

IMPORTANT! The limitation period is not interrupted due to the inaction of the debtor: if he has not challenged the direct debiting of money from his current account, this does not mean automatic recognition of the debt (clause 23 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43).

Secondly, if the statute of limitations has expired, and the debtor suddenly acknowledges the debt he owes, the countdown of the statute of limitations begins anew (Article 206 of the Civil Code of the Russian Federation).

IMPORTANT! Even if the limitation period has been interrupted several times, it cannot be more than 10 years from the date of direct failure to fulfill the obligation by the counterparty (Article 181 of the Civil Code of the Russian Federation).

Thirdly, if the contract states that the obligation is fulfilled in parts, and the debtor acknowledged one of these parts, then the limitation period for other parts is not interrupted (clause 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43).

The second criterion for recognizing a receivable as uncollectible is the proven impossibility of the debtor to fulfill the obligation in the event of:

- liquidation of the debtor (Article 417 of the Civil Code of the Russian Federation);

- exclusion of the debtor from the Unified State Register of Legal Entities after 09/01/2014, which is equivalent to the liquidation of the company;

- force majeure, emergency (Article 416 of the Civil Code of the Russian Federation);

- a court ruling on the impossibility of collecting a debt or in the event that the debtor does not have property to collect (Article 266 of the Tax Code of the Russian Federation).

IMPORTANT! If another individual entrepreneur owes money to a legal entity or individual entrepreneur, then it is impossible to consider the receivable as uncollectible just because the debtor-individual entrepreneur is excluded from the register - businessmen are liable for debts with all their property even after the end of business activity (letter of the Ministry of Finance of the Russian Federation dated September 16, 2015 No. 03-03 -06/53157). An entrepreneur’s debt can be written off on a general basis either in the event of his death or upon completion of bankruptcy proceedings.

A closed list of criteria for recognizing a debt as bad is established by Art. 266 of the Tax Code of the Russian Federation and is not subject to expansion for tax accounting purposes.

But in accounting, debt can be written off for one more reason - the impossibility of collection in the opinion of the creditor himself. This method should be used only if the company has exhausted all ways to obtain money from the debtor without the help of the court, and the expected costs of the trial will exceed the amount of the receivable.

Is untimely write-off of accounts receivable considered a gross violation of accounting requirements? The answer to this question is in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

The procedure for recording overdue accounts receivable

Writing off a debt due to the debtor's insolvency is not a cancellation of the debt. This debt must be reflected on the balance sheet in account 04 “Debt of insolvent debtors” for a certain period. Such rules are provided for in paragraph 339 of the Instructions to the Unified Chart of Accounts No. 157n.

Write off the amount of debt that is unrealistic for collection to the financial result of the current year (clause 120 of Instruction No. 162n, clauses 152–153 of Instruction No. 174n, clauses 180–181 of Instruction No. 183n). Debt must be written off from all accounts on which the debt is recorded. And even if the institution at one time did not reflect the transfer of debt from accounts 206.00, 208.00 to account 209.30, then write off the debt from them too (after all, the instructions contain such correspondence). But be prepared, when checking, to justify the reasons for writing off the debt from these accounts, without first reflecting it on account 209.30. And in order to avoid explanations, we once again advise you to transfer this debt to account 209 on time.

We recommend reading: Swallow suburban St. Petersburg pension

How to document the write-off of accounts receivable?

Before writing off an overdue receivable, you need to make sure that there are documents confirming the fact of the debt. Otherwise, writing off the debt as expenses is risky (letter of the Federal Tax Service of the Russian Federation dated December 6, 2010 No. ШС-37-3/16955).

The company or individual entrepreneur must have:

- contracts;

- reconciliation reports;

- primary document confirming the fact of shipment of goods and materials or provision of services, or documents confirming that an advance was transferred to the counterparty.

We also recommend storing the claims submitted to the counterparty and the responses to them - to confirm that measures were taken to collect the debt, and the debtor himself knew about his debt to the company.

If an employee owes money to the company, then check the documents confirming the issuance of accountable amounts using our material “Tax audit of settlements with accountable persons (nuances).”

In addition, it is necessary to conduct an inventory of receivables and reflect the results in the act in the INV-17 form.

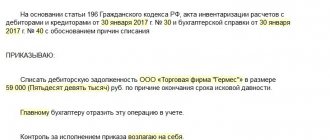

The accountant draws up an accounting certificate in which he indicates information about the size of the receivable, the reasons for its occurrence and write-off, and provides a link to INV-17. Then the manager issues an order to write off receivables.

Write-off of accounts receivable for balance

Debts in accounting should be written off using the reserve for doubtful debts. All enterprises are required to create it, with the exception of entrepreneurs (Clause 2, Article 6 of Law No. 402-FZ, Article 2 of Regulation No. 34n). If the reserve amounts are not enough to cover receivables, then the excess amount is included among other expenses (clause 11 of PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n).

Accounting entries for the formation of a reserve for doubtful debts and write-off of receivables:

| Debit | Credit | Contents of operation |

| 91 | 63 | A reserve for doubtful debts has been created |

| 63 | 62, 76 | Bad receivables written off against reserve |

| 91 | 62, 76 | Accounts receivable written off in excess of reserve for doubtful debts |

| 91 | 60, 62, 76, 73, 58 | The entire amount of bad receivables is written off as other expenses - if the company did not create a reserve for this debt. IMPORTANT! For accounting purposes only. To calculate taxes, only amounts calculated according to the rules of Art. 266 Tax Code of the Russian Federation. |

| 94 | 71 | Accountable amounts not returned by the employee on time are reflected |

| 91 | 94 | Uncollectible amounts are written off |

But that’s not all: written-off bad receivables must be taken into account on the balance sheet for another 5 years from the date of write-off. This is what the account is designed for. 007 “Debt of insolvent debtors written off at a loss.” The organization is obliged to monitor the possibility of still receiving the debt from the debtor for 5 years (clause 77 of regulation No. 34n). The write-off of receivables for the balance is reflected in the debit of the account. 007. If 5 years have passed and the money has not been received, the receivable is finally written off by posting a credit account. 007.

If within 5 years it became possible to collect the debt and the counterparty transferred the money, then the following entries should be made in the accounting:

| Debit | Credit | Contents of operation |

| 51, 50 | 91 | Money has been received to repay previously written off bad receivables. Other income is recognized in the amount of repaid bad receivables that were previously written off |

| 007 | The written-off receivables have been repaid |

IMPORTANT! If you have written off a bad debt of a counterparty (individual or employee), then the written off amount becomes the citizen’s income, and your company or individual entrepreneur becomes a tax agent for personal income tax (letter of the Federal Tax Service of the Russian Federation dated December 31, 2014 No. PA-4-11/27362). There is no need to charge insurance premiums on the amount of the employee’s debt written off - such amounts are not subject to insurance premiums (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009). However, officials insist on payment of contributions (letter of the FSS of the Russian Federation dated November 17, 2011 No. 14-03-11/08-13985), arbitration practice is ambiguous, disputes with inspectors are possible (resolution of the FAS Volga District dated December 17, 2013 No. F06-24/13 on case No. A65-4684/2013).

Another aspect that we recommend paying attention to is the write-off of VAT when eliminating bad debts. Whether it is necessary to adjust or restore the tax amount - find out from the article “How to take into account VAT amounts when writing off accounts receivable?”

Analytical accounting by account. 007 should be kept:

- for each debtor whose debt was written off at a loss;

- for each debt written off.

Information about accounts receivable on the balance sheet can be indicated in the explanations to the accounting records (Appendix 3 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

The procedure for writing off overdue accounts receivable from previous years

Bad accounts receivable are written off in accounting by decision of the institution’s commission on receipt and disposal of assets. Moreover, the debt is written off from the balance sheet only if there are documents that confirm the liquidation or death of the debtor, or in cases that are prescribed in the legislation of the Russian Federation, including the deadline for resuming the collection procedure.

A budgetary institution in 2022 (now became a state-owned institution in 2022) provided a service. The customer did not sign the work completion certificate and, accordingly, no payment was received for 3 years. They don't answer calls. During all this time we were able to talk to the accountant once, she said that the manager said not to pay for our services without motivating the refusal. We cannot go to court due to personal reasons (the founder obligated us to provide the service, with all the documents presented) How to write off overdue accounts receivable if there is no court decision, the institution exists, but will not pay?

We recommend reading: What exams do you need to pass for category D for a tractor?

Results

Off the balance sheet, accounts receivable are recorded in the account. 007 within 5 years after the debt is recognized as bad and written off at the expense of the reserve or at a loss.

We looked at the algorithm for writing off receivables in accounting, and for the nuances of tax accounting and writing off bad debts, see the article “Procedure for writing off receivables.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Write-off of overdue accounts payable in a budget institution

Accounts payable of a budgetary institution, as a rule, refers to debts under accepted obligations, amounts of cash or the value of other assets that are subject to transfer to the creditor in exchange for non-financial assets supplied, services rendered or work performed.

Write-off of receivables is carried out in accordance with the provisions and requirements of the Instructions on Budget Accounting, approved by Order of the Ministry of Finance of Russia dated December 30, 2022 N 148n (hereinafter referred to as Instruction N 148n).