Financial investments in an enterprise - what is it?

Financial investments are money or property invested in another legal entity or individual(s) with the intention of receiving income from these funds, accrued in the form of interest, dividends or differences in value.

These include deposits, loans issued, contributions to the authorized (share) capital, to the purchase of securities (CB) and receivables. According to the period during which they are repaid, financial investments are divided into long-term (more than a year) and short-term (less than a year). Accounting for financial investments, like any other property of an enterprise, is subject to the basic accounting rules contained in the Law “On Accounting” dated December 6, 2011 No. 402-FZ and Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (PBU on accounting and accounting). But for them there is also their own PBU 19/02 “Accounting for financial investments” (order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n). In this PBU, accounting for financial investments is described in more detail, disclosing the features of each type.

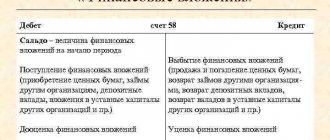

For accounting of financial investments, account 58 is used, distributing financial investments of various types among its subaccounts and organizing the analytics of accounting for financial investments so that it makes it possible to uniquely identify each of their units.

In accounting, financial investments fall into the asset balance sheet, dividing it into long-term (non-current assets) and short-term (current assets). The cost at which they are reflected in the statements depends on the specifics of the assessment of each type of financial investment and the presence of impairment reserves that reduce their value on the balance sheet.

How to reflect in the accounting and annual financial statements of an organization financial investments, as well as income and expenses recognized in connection with changes in their book value? The answer to this question is in ConsultantPlus. Get trial demo access to the K+ system and get the opinion of an expert for free.

Read about the role of financial investments in calculating liquidity ratios in the article “Calculation of the liquidity ratio (balance sheet formula)” .

I. General provisions

1. These Regulations establish the rules for the formation in accounting and financial reporting of information about the organization’s financial investments. An organization is further understood as a legal entity under the laws of the Russian Federation (with the exception of credit organizations and budgetary institutions). This Regulation is applied when establishing the specifics of accounting for financial investments for professional participants in the securities market, insurance organizations, and non-state pension funds.

2. For the purposes of these Regulations, in order to accept assets for accounting as financial investments, the following conditions must be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value and so on.).

3. Financial investments of an organization include: state and municipal securities, securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills); contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies); loans provided to other organizations, deposits in credit institutions, receivables acquired on the basis of assignment of the right of claim, etc. For the purposes of these Regulations, deposits of the partner organization under a simple partnership agreement are also taken into account as part of financial investments. The organization's financial investments do not include:

- own shares purchased by the joint-stock company from shareholders for subsequent resale or cancellation;

- bills issued by the organization-promissory note to the organization-seller when paying for goods sold, products, work performed, services rendered;

- investments of an organization in real estate and other property that has a tangible form, provided by the organization for a fee for temporary use (temporary possession and use) for the purpose of generating income;

- precious metals, jewelry, works of art and other similar valuables acquired for purposes other than normal activities.

4. Assets that have a tangible form, such as fixed assets, inventories, as well as intangible assets are not financial investments.

5. The accounting unit for financial investments is selected by the organization independently in such a way as to ensure the formation of complete and reliable information about these investments, as well as proper control over their availability and movement. Depending on the nature of the financial investments, the order of their acquisition and use, the unit of financial investments can be a series, batch, etc. homogeneous set of financial investments.

6. The organization maintains analytical accounting of financial investments in such a way as to provide information on the accounting units of financial investments and the organizations in which these investments are made (issuers of securities, other organizations in which the organization is a participant, borrowing organizations, etc.) . For government securities and securities of other organizations accepted for accounting, analytical accounting must contain at least the following information: name of the issuer and name of the security, number, series, etc., nominal price, purchase price, expenses associated with acquisition of securities, total quantity, date of purchase, date of sale or other disposal, place of storage. An organization can generate in analytical accounting additional information about the organization’s financial investments, including by their groups (types).

7. Features of the assessment and additional rules for disclosing information on financial investments in dependent business companies in financial statements are established by a separate regulatory act on accounting.

Accounting for financial investments in a management company or a simple partnership

Financial investments that are the primary contribution to the management company (simple partnership) are taken into account at the value agreed upon between the founders (partners). A contribution to the management company can be made in money, property or property rights.

With an initial deposit, at the time of registration of an established legal entity, the founder accrues a debt on his deposit in the accounting of financial investments (Dt 58 Kt 76), which is repaid depending on the method contained in the founders’ agreement:

- By transfer of money: Dt 76 Kt 50 (51).

- By contributing property (for depreciable property - at its residual value, if the contributor has depreciated it): Dt 76 Kt 01 (04, 10, 11, 21, 41, 58). At the same time, the VAT on it is restored (Dt 76 Kt 68), and the entire assessment is brought to the level determined by the founders (Dt 76 Kt 91 or Dt 91 Kt 76).

Subsequently, this contribution may be increased or decreased in accordance with legal requirements or by decision of the participants. In accounting for financial investments in accordance with a specific situation, this will be expressed as follows:

- Dt 50 (51) Kt 58 upon return of the deposit in cash.

- Dt 01 (04, 10, 11, 21, 41, 58) Kt 58 upon return of the deposit with property.

- Dt 91 Kt 58, if the return of money or property does not occur.

- Dt 58 Kt 50 (51) with additional payment up to the required deposit amount.

- Dt 58 Kt 76 and Dt 76 Kt 01 (04, 10, 11, 21, 41, 58) with additional VAT charge (Dt 76 Kt 68) and adjustment to the required estimate (Dt 76 Kt 91 or Dt 91 Kt 76), if additional carried out by property.

- Dt 58 Kt 91, if the increase occurs at the expense of the profit of the established legal entity.

Read more about how to increase the authorized capital at the expense of profits in the material “Increasing the authorized capital at the expense of retained earnings .

A contribution to the management company can be purchased. In accounting for financial investments, this will be reflected as the amount of all expenses for its purchase: Dt 58 Kt 60 (76). Such a deposit from the buyer is not adjusted to its nominal value.

The sale of a contribution to the capital company in the accounting of financial investments will be reflected by the entries: Dt 76 Kt 91 and Dt 91 Kt 58. The retiring contribution is assessed at its book value.

The income from such financial investments is periodically paid dividends (Dt 76 Kt 91). If there is a possibility that dividend receipts will stop, you can create a reserve to reduce the value of the contribution to the capital company, attributing it to the financial result: Dt 91 Kt 59.

ConsultantPlus experts explained in detail in what cases a reserve is created for the depreciation of financial investments. Get trial demo access to the K+ system and go to the Tax Guide for free.

Accounting for issued loans, deposits and purchased receivables

In accounting for financial investments, loans, deposits and purchased receivables will be displayed by the amounts actually invested in them in the following entries:

- Dt 58 Kt 50 (51, 52) – issuance of a loan.

- Dt 58 (55) Kt 50 (51, 52) – deposit. The use of account 58 or 55 to account for such a deposit must be specified in the accounting policy.

- Dt 58 Kt 76 – acquisition of debt.

Distinctive features of accounting for financial investments in the form of loans and deposits are:

- Regular accrual of interest income on them, expressed by the entry: Dt 76 Kt 91.

- Separate accounting (on financial results accounts) of expenses associated with their maintenance: Dt 91 Kt 51 (76).

If there is a threat of bankruptcy of the interest payer, then you can create a reserve to reduce the amount of the loan or deposit: Dt 91 Kt 59.

Thus, the amounts of financial investments available in accounting for deposits and loans throughout the entire period of their existence correspond to the actual amounts issued. They are closed at the time of return: Dt 50 (51, 52) Kt 58.

The financial result of investing in the purchase of receivables becomes clear after receiving it from the debtor (offset of debts is possible) or further sale: Dt 76 Kt 91 and Dt 91 Kt 58.

Accounting for financial investments in the form of securities

The complexity of accounting for financial investments made in the Central Bank depends on whether they are traded on their market or not:

- In both situations, financial investments are taken into account according to the total amount of investments in their purchase: Dt 58 Kt 60 (76). At the same time, securities traded on the market must be revalued in accounting monthly or quarterly in order to bring their accounting valuation to the current market price (Dt 58 Kt 91 or Dt 91 Kt 58). SMEs that have established such a procedure in their accounting policies may not overestimate financial investments listed on the market.

- Expenses incurred in connection with the purchase of securities, if they are insignificant in comparison with the contractual purchase price, can not be added to the formed price of financial investments in accounting, but included in the financial result as they arise: Dt 91 Kt 60 (76). Similarly, for debt securities not traded on the market, the difference between the purchase price and the par value during their circulation period can be attributed to the financial result: Dt 58 Kt 91 and Dt 91 Kt 58.

- If there is a systematic decrease in their prices for the Central Bank (which is more often found for circulating securities), then a reserve can be created that takes into account the amount of impairment (Dt 91 Kt 59), which will be equal to the difference between the estimated and book value.

- When disposing of (redemption, sale, entry into the management capital, donation) securities that are not traded on the market, they are written off from the accounting of financial investments at one cost of their three possible values: each unit, average or FIFO. The method of determination is established in the accounting policy. Market-traded financial investments that are deregistered from accounting are written off at their last market price. In a similar assessment (at the latest market price), the accounting for financial investments shows circulating securities for which the determination of their market price has been discontinued. You cannot change the assessment method during the year. The disposal will be reflected by the entry: Dt 76 Kt 91 and Dt 91 Kt 58.

Taxes and Law

In accordance with the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, financial investments are accepted for accounting at their original cost, which may subsequently change.

For the purposes of subsequent assessment, financial investments are divided into two groups:

— financial investments by which the current market value can be determined;

— financial investments for which the current market value is not determined.

Accordingly, we can distinguish two main types of adjustments that can change the initial cost of financial investments:

1) for financial investments with a determinable current market value;

2) for financial investments with an undeterminable current market value.

Currently, accounting does not provide for separate accounting of the initial cost of financial investments and the accumulated adjustments on them. However, the value of this information has increased, especially given the new requirements for the format of reporting information.

According to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On Forms of Accounting Reports of Organizations,” organizations have the right to independently develop forms of explanations for the balance sheet and profit and loss statement. At the same time, the financial department in Appendix No. 3 to Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n “On the forms of financial statements of organizations” offers examples of the preparation of such explanations. In particular, in example 3.1 “Availability and movement of financial investments”, special columns are provided for disclosing information on accumulated adjustments to financial investments at the beginning and end of the period, as well as changes in these adjustments for the period.

Consequently, the need to provide information of this kind and the degree of detail are established at the legislative level. In this regard, the question arises: how to organize accounting of financial investments so that the generation of information about accumulated adjustments to financial investments is carried out with minimal labor costs? This issue is not only technical, but also methodological in nature.

By Order No. 160n dated November 25, 2011 “On the entry into force of International Financial Reporting Standards and Explanations of International Financial Reporting Standards on the territory of the Russian Federation,” the Russian Ministry of Finance officially notified the entry into force of International Financial Reporting Standards (IFRS) on the territory of the Russian Federation. The following standards are devoted to accounting and disclosure of information about financial investments, which impose new requirements for the disclosure of information about an organization’s financial instruments:

— IAS 32 “Financial instruments: presentation of information”;

— IAS 39 “Financial instruments: recognition and measurement”;

— IFRS 7 “Financial Instruments: Disclosures”.

In particular, according to PBU 19/02, the procedure for writing off the difference between the initial and par value of debt securities during their circulation period is voluntary, while IAS 39 indicates the direct obligation of the organization to reflect investments held to maturity at amortized cost, the determination of which is based on a methodology similar to Russian accounting.

IAS 39 requires adjustments to the fair value of an available-for-sale financial asset to be recognized in other comprehensive income until the financial asset is derecognized. On disposal of the asset, these accumulated adjustments must be eliminated from equity and recognized in profit or loss. In this regard, there is a need to generate and accumulate information about such adjustments for the purpose of their subsequent restoration at the time of disposal of the asset.

International Financial Reporting Standard (IFRS) 7 imposes specific disclosure requirements on changes in the fair value of financial instruments and the nature and extent of the risks to which an entity is exposed during the period and at the end of the reporting period by holding the financial instruments.

Thus, separate accounting of accumulated adjustments caused by changes in the current market value of financial investments will make it possible to assess the degree of market risk of owning these assets. Taking into account accumulated adjustments for financial investments for which it is impossible to determine the current market value will allow us to characterize the degree of credit risk. Information about accumulated adjustments caused by changes in exchange rates will be relevant in assessing the degree of exchange rate risk inherent in financial investments denominated in foreign currencies.

Consequently, the need to develop new methods of accounting for financial investments is obvious and is determined both by new requirements to meet the increased information needs of users of financial statements, and by the active introduction of IFRS into Russian accounting practice.

Let's consider the option of separate accounting of the initial cost of financial investments and their accumulated adjustments, as well as disclosure of information in the notes to the balance sheet.

Adjustments to the value of financial investments that can be used to determine the current market value. Information on financial investments is accumulated in account 58 “Financial investments”. To decipher financial investments by groups and types, subaccounts are opened for this account:

— 58-1 “Units and shares”;

— 58-2 “Debt securities”;

— 58-3 “Loans provided”;

— 58-4 “Deposits under a simple partnership agreement”, etc.

In the organization's balance sheet, financial investments are reflected in two asset sections: non-current and current assets, based on the expected tenure. Based on this, we propose to introduce additional analytics for separate accounting of long-term and short-term financial investments. In the future, information on these analytical accounts will allow the formation of appropriate explanations for the balance sheet.

In deciphering long-term financial investments by groups and types, account 58 “Financial investments” is taken in the context of analytical subaccounts:

— 58-010 “Long-term shares and shares”;

— 58-020 “Long-term debt securities”;

— 58-030 “Long-term loans provided”;

— 58-040 “Deposits under a simple partnership agreement”, etc.

Decoding of short-term financial investments by groups and types is carried out in the context of the following analytical sub-accounts:

— 58-011 “Short-term shares and shares”;

— 58-021 “Short-term debt securities”;

— 58-031 “Short-term loans provided”, etc.

Financial investments for which the current market value can be determined usually include financial investments listed on the securities market, as well as other financial investments whose current value can be documented. They are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date.

Consequently, the adjustment to the value of financial investments, by which the current market value can be determined, is the difference between the valuation of financial investments at the current market value as of the reporting date and their previous valuation.

This adjustment is made monthly or quarterly based on the organization’s accounting policies and is included in the financial results as other income or expenses.

Accounting for financial investments, by which the current market value can be determined, is kept in accounts 58-010 “Long-term shares and shares” and 58-011 “Short-term shares and shares.”

For these accounts, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information about accumulated adjustments due to changes in the current market value of such financial investments. Since the market value of financial investments can fluctuate both up and down, the balance in the adjustment account can be either a debit or a credit.

Data from these analytical accounts will be used to fill out explanations for reporting and subsequent analysis of the effectiveness of investing funds in financial investments.

Adjustments to the value of financial investments for which the current market value is not determined. Financial investments for which the current market value cannot be determined primarily include debt securities. This group also includes other financial investments that are not traded on the stock market and have no market value.

For financial investments for which the current market value is not determined, adjustments of two types are possible:

— adjustments in connection with the accrual of part of the difference between the original and nominal value of debt securities;

— adjustments in connection with the creation of a reserve for depreciation of financial investments.

Financial investments for which the current market value is not determined are reflected in the financial statements as of the reporting date at their historical cost less the amount of the reserve created for their depreciation.

At the same time, for debt securities, if their initial value differs from their par value, organizations can evenly write off part of the difference between the indicated values according to the income due on the securities.

To account for adjustments on debt securities to accounts 58-020 “Long-term debt securities” and 58-021 “Short-term debt securities”, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information on accumulated adjustments in connection with with the write-off of part of the difference between the original cost of a debt security and its par value.

In addition to this type of adjustments for financial investments for which the current market value cannot be determined, adjustments may occur due to exchange rate differences.

In particular, the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006) indicates that the recalculation of securities, with the exception of shares denominated in foreign currency, should be carried out not only on the date of the transaction, but also at the reporting date.

Consequently, the account “Adjustments to the value of financial investments” must also reflect exchange rate differences associated with the recalculation of the value of securities, other than shares, at the rate as of the reporting date.

In accordance with the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, financial investments are accepted for accounting at their original cost, which may subsequently change. For the purposes of subsequent assessment, financial investments are divided into two groups: - financial investments for which the current market value can be determined; - financial investments for which the current market value is not determined. Accordingly, two main types of adjustments can be distinguished that can change the initial value of financial investments: 1) for financial investments with a determinable current market value; 2) for financial investments with an indeterminable current market value. Currently, accounting does not provide for separate accounting of the initial cost of financial investments and the accumulated adjustments on them. However, the value of this information has increased, especially taking into account the new requirements for the format for presenting reporting information. According to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On forms of financial statements of organizations,” organizations have the right to independently develop forms of explanations for the balance sheet and profit and loss statement. At the same time, the financial department in Appendix No. 3 to Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n “On the forms of financial statements of organizations” offers examples of the preparation of such explanations. In particular, in example 3.1 “Availability and movement of financial investments”, special columns are provided for disclosing information on accumulated adjustments to financial investments at the beginning and end of the period, as well as changes in these adjustments for the period. Consequently, the need to provide information of this kind and the degree of detail are established at the legislative level. In this regard, the question arises: how to organize accounting of financial investments so that the generation of information about accumulated adjustments to financial investments is carried out with minimal labor costs? This issue is not only technical, but also methodological in nature. By Order No. 160n dated November 25, 2011 “On the implementation of International Financial Reporting Standards and Explanations of International Financial Reporting Standards on the territory of the Russian Federation,” the Ministry of Finance of Russia officially notified the implementation of International Financial Reporting Standards reporting (IFRS) on the territory of the Russian Federation. The following standards are devoted to accounting and disclosure of information about financial investments, which impose new requirements for the disclosure of information about an organization’s financial instruments: - IAS 32 “Financial Instruments: Presentation of Information”; - IAS 39 “Financial Instruments: Recognition and Measurement” "; - IFRS 7 “Financial Instruments: Disclosure of Information”. In particular, according to PBU 19/02, the procedure for writing off the difference between the initial and par value of debt securities during their circulation period is voluntary, while IFRS ( IAS 39 indicates an entity's express obligation to record held-to-maturity investments at amortized cost, which is based on a methodology similar to Russian accounting. In accordance with IAS 39, adjustments to the fair value of an available-for-sale financial asset must be recognized in other comprehensive income until the financial asset is derecognised. On disposal of the asset, these accumulated adjustments must be eliminated from equity and recognized in profit or loss. In this regard, there is a need to generate and accumulate information about such adjustments for the purpose of their subsequent restoration at the time of disposal of the asset. International Financial Reporting Standard (IFRS) 7 puts forward special requirements for the disclosure of information about changes in the fair value of financial instruments, as well as the nature and amount risks to which the organization is exposed during the period and at the end of the reporting period in connection with the ownership of financial instruments. Thus, separate accounting of accumulated adjustments due to changes in the current market value of financial investments will allow assessing the degree of market risk of owning these assets. Taking into account accumulated adjustments for financial investments for which it is impossible to determine the current market value will allow us to characterize the degree of credit risk. Information about accumulated adjustments caused by changes in the exchange rate will be relevant when assessing the degree of currency risk inherent in financial investments denominated in foreign currencies. Consequently, the need to develop new methods of accounting for financial investments is obvious and is due to both new requirements to meet the increased information needs of users financial statements, and the active introduction of IFRS into Russian accounting practice. Let's consider the option of separate accounting of the initial cost of financial investments and their accumulated adjustments, as well as disclosure of information in the notes to the balance sheet. Adjustments to the value of financial investments, by which the current market value can be determined. Information on financial investments is accumulated in account 58 “Financial investments”. To decipher financial investments by groups, types, subaccounts are opened for this account: - 58-1 “Units and shares”; - 58-2 “Debt securities”; - 58-3 “Loans provided”; - 58-4 “Deposits for simple partnership agreement”, etc. In the organization’s balance sheet, financial investments are reflected in two sections of the asset: as part of non-current and current assets, based on the expected tenure. Based on this, we propose to introduce additional analytics for separate accounting of long-term and short-term financial investments. In the future, information on these analytical accounts will allow the formation of appropriate explanations for the balance sheet. In deciphering long-term financial investments by groups and types, account 58 “Financial investments” is taken in the context of analytical subaccounts: - 58-010 “Long-term shares and shares”; - 58- 020 “Long-term debt securities”; - 58-030 “Long-term loans provided”; - 58-040 “Deposits under a simple partnership agreement”, etc. Breakdown of short-term financial investments by groups and types is carried out in the context of the following analytical subaccounts: - 58- 011 “Short-term shares and shares”; - 58-021 “Short-term debt securities”; - 58-031 “Short-term loans provided”, etc. Financial investments for which the current market value can be determined, as a rule, include financial investments quoted on the securities market, as well as other financial investments, the current value of which can be documented. They are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date. Consequently, the adjustment to the value of financial investments, by which the current market value can be determined, is the difference between the valuation of financial investments at the current market value to the reporting date and their previous assessment. The specified adjustment is made monthly or quarterly based on the accounting policy of the organization and is included in the financial results as part of other income or expenses. Accounting for financial investments, by which the current market value can be determined, is kept in accounts 58-010 “Long-term shares and shares" and 58-011 "Short-term shares and shares". For these accounts it is advisable to open an analytical account "Adjustments to the value of financial investments", which will accumulate all information about accumulated adjustments in connection with changes in the current market value of such financial investments. Since the market value of financial investments can fluctuate both up and down, the balance in the adjustment account can be either a debit or a credit. Data from these analytical accounts will be used to fill out explanations for the statements and subsequent analysis of the effectiveness of investing funds in financial investments. Example 1. In December 2009, the open joint-stock company (JSC) ANK Bashneft acquired 47.18% of the shares of JSC Ufaneftekhim from the joint-stock financial corporation (JSFC) Sistema for the amount of 13,047,106 thousand rubles. Shares of OJSC Ufaneftekhim are quoted on the stock exchange of the Russian Trading System and are reflected in the balance sheet at market value as of the reporting date. In June 2010, OJSC ANK Bashneft purchased another 7.75% of shares of OJSC Ufaneftekhim worth 2,950,773 thousand roubles. From the moment of the first purchase until June 2010, the market value of shares of OJSC Ufaneftekhim did not change significantly, however, in the second half of 2010, the current market value of shares of OJSC Ufaneftekhim increased and as of December 31, 2010 amounted to 25,639,606 thousand. rub., and on March 31, 2011, the current market value of the shares increased to 27,984,355 thousand rubles. The following entries must be made in the accounting records (Table 1). Table 1 Accounting records of JSC ANK Bashneft ————T——————-T———-T—————T—————¬¦ ¦ Contents ¦ Amount, ¦ ¦ ¦¦ Date ¦ business ¦ thousand rubles¦ Account debit ¦ Account credit ¦¦ ¦ transactions ¦ ¦ ¦ ¦+———-+——————-+———-+—————+——— ——+¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦+———-+——————-+———-+—————+—————+¦12/31/2009¦ Shares purchased ¦13 047 106¦ 58-010/ps ¦ 76 “Settlements ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ “Long-term ¦ with different ¦¦ ¦ ¦ ¦ shares and shares” ¦ debtors ¦¦ ¦ ¦ ¦ ¦ and creditors" ¦+———-+——————-+———-+—————+—————+¦12/31/2009¦Paid for shares ¦13 047 106¦ 76 “Calculations ¦ 51 “ Settlement ¦¦ ¦OJSC "Ufaneftekhim" ¦ ¦ with different ¦ accounts" ¦¦ ¦ ¦ ¦ debtors ¦ ¦¦ ¦ ¦ ¦ and creditors"¦ ¦+———-+——————-+———- +—————+—————+¦01.06.2010¦Purchased ¦ 2,950,773¦ 58-010/ps ¦ 76 “Calculations ¦¦ ¦additional shares¦ ¦ “Long-term ¦ with different ¦¦ ¦OJSC “ Ufaneftekhim" ¦ ¦ shares and shares" ¦ debtors ¦¦ ¦ ¦ ¦ ¦ and creditors"¦+———-+——————-+———-+—————+————— +¦01.06.2010¦Paid shares ¦ 2,950,773¦ 76 “Settlements ¦ 51 “Settlements ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ with different ¦ accounts” ¦¦ ¦ ¦ ¦ debtors ¦ ¦¦ ¦ ¦ ¦ and creditors" ¦ ¦+———-+——————-+———-+—————+—————+¦12/31/2010¦Produced ¦ 9 641 727¦ 58-010/corr ¦ 91 “Other ¦¦ ¦ overvaluation of shares ¦ ¦ “Long-term ¦ income ¦¦ ¦ JSC “Ufaneftekhim” ¦ ¦ shares and shares” ¦ and expenses" ¦+———-+——————-+———-+ —————+—————+¦31.03.2011¦Produced ¦ 2,344,749¦ 58-010/corr ¦ 91 “Other ¦¦ ¦overvaluation of shares ¦ ¦ “Long-term ¦ income ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ shares and shares" ¦ and expenses" ¦L———-+——————-+———-+—————+—————- Adjustments to the value of financial investments for which the current market value is determined. Financial investments for which the current market value cannot be determined primarily include debt securities. This group also includes other financial investments that are not traded on the stock market and do not have a market value. For financial investments for which the current market value is not determined, two types of adjustments are possible: - adjustments due to the accrual of part of the difference between the original and nominal value for debt securities; - adjustments in connection with the creation of a reserve for depreciation of financial investments. Financial investments for which the current market value is not determined are reflected in the financial statements as of the reporting date at their original cost minus the amount of the created reserve for their depreciation. At the same time, debt securities, if their original value differs from their face value, organizations can write off evenly part of the difference between the indicated values according to the income due on the securities. To account for adjustments on debt securities to accounts 58-020 “Long-term debt securities” and 58- 021 “Short-term debt securities”, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information on accumulated adjustments in connection with the write-off of part of the difference between the initial cost of a debt security and its par value. In addition to this type of adjustments on financial investments , for which it is impossible to determine the current market value, adjustments may occur due to exchange rate differences. In particular, the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006) indicates that the recalculation of valuable securities, with the exception of shares denominated in foreign currency, must be made not only on the date of the transaction, but also on the reporting date. Consequently, the account “Adjustments to the value of financial investments” must also reflect exchange differences associated with the recalculation of the value of securities, except shares, at the exchange rate as of the reporting date.

Kulikova L.I., Goshunova A.V. Accounting for adjustments to the value of financial investments // International accounting. 2012. N 38. P. 2 - 12.