The main tasks of inventorying financial investments

An inventory of financial investments (FI) means a comparison of what is actually available with accounting data. The objects of the inventory are:

- securities;

- investments that the company makes into the authorized capital of other companies;

- loans and credits provided to other organizations.

Carrying out an inventory of PV allows you to establish:

- how correctly and correctly the execution and registration of securities (CB) was carried out;

- Is the value of the securities at which they are recorded on the balance sheet real?

- level of security of the Central Bank;

- reflection of the amount of income received from the Central Bank, interest on loans granted;

- How complete and timely the relevant records are made.

The inventory should be carried out on the same days as the inventory of money in the company's cash desk.

Wiring example

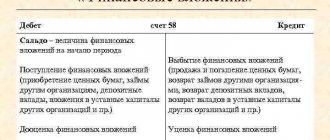

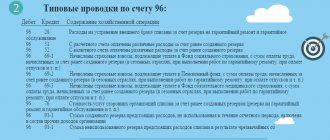

Account 58 records and analyzes all of the company's investments. When an inventory of financial investments is carried out, account entries must correspond to actual transactions with securities or loans.

Let's look at an example of a standard design.

- Debit 58.2, Credit 75.1: receipt of shares as an investment by the founder in the authorized capital of the organization. The fundamental document is the protocol of the founders’ decision.

- Debit 58.1, Credit 98.2: reflection of the value of gratuitously received securities in deferred income. The act to reflect the transaction is a document confirming the fact of the transfer.

- Debit 76.1, Credit 58.1: write-off of insured securities due to compensation from the insurer. The document reflecting the operation is an insurance contract.

- Debit 90.2, Credit 58.1: reflection of expenses from sold securities. The fundamental agreement is a document according to which one party transfers the goods, and the second accepts and pays money for it.

Inventory of financial investments: stages and procedure

Inventory consists of several stages (stages):

| Stages | Content |

| Preparatory | Development of an order to carry out work on the inventory of company assets |

| The inventory commission, created earlier by a separate order, needs to start working. Removal of the latest documents on the inventory date: receipts and expenses, reports | |

| Direct work | Documentary verification: comparison of the actual availability of confirmed financial investments with accounting data. |

| Entering the monetary value of financial investments into the inventory list | |

| Analytical | Analysis of the results obtained for discrepancies between inventory data and accounting records, comparison |

| Final | Signing the inventory list. Members of the commission prepare proposals for: – assessment of identified unaccounted financial investments; – write-off of undocumented investments; – bringing the guilty parties to financial responsibility |

Management considers the proposals of the commission that conducted the inventory and makes specific decisions. The results of the inventory are necessarily reflected in accounting. Read also the article: → “Inventory of cash in the cash register, how often in 2022”

Drawing up an inventory order

The order is generated immediately before the inventory work is carried out. It states:

- start and end dates of the inventory;

- the reason for the conduct;

- deadlines for submitting final documents to the accounting department.

The commission is usually created at the beginning of each year. The order additionally indicates its composition (chairman and members). The position of each employee and his full name are indicated.

We recommend that you familiarize yourself with an example of a completed order for inventory 2022.

Important! When developing an order, standard form No. INV-22 is taken as a basis.

Formation of an act of inventory of financial investments

In order to record the results of the inventory, an inventory is provided according to the INV-16 form. It contains columns for reflection:

- actual financial investments;

- included in the Federal Law for accounting information;

- results. There may be surpluses, shortages, or neither.

The inventory is signed by the chairman of the commission and its members.

If, as a result of comparisons, a discrepancy between the actual availability and the accounting data is discovered, the company employee financially responsible writes down the reasons for the identified shortcomings on the form and puts his signature. When the discrepancies are significant, he will need to issue an additional extended explanatory note.

In the last lines of the inventory, the manager writes down his decision regarding the identified deviations. In particular, he can issue a warning, reprimand to the guilty person, or oblige him to compensate for the losses incurred. Such decisions are additionally formalized by order.

Documents for inventory of financial investments

Before starting to check financial investments, it is necessary to determine whether certain assets are legally assigned to the account. 58. The simultaneous implementation of the following conditions is taken into account:

- Correct execution of documentation giving the right to dispose of the asset and the income received from it.

- Confirmation that all risks for a specific financial investment have been transferred to the company.

- Realizable probability of obtaining benefit from the financial investment.

It is advisable to record all the features of the inventory process in the company’s accounting policy.

Representatives of the inventory commission note the objective existence of documents on the basis of which financial investments are recognized as such:

- contracts and agreements;

- bills and invoices for goods and materials;

- investment certificates;

- acts of acceptance and transfer of services performed.

To ensure the correctness of the assessment of financial investments, the commission examines:

- actual expenses on the Central Bank and investments made in the authorized capitals of other companies;

- loans provided to other organizations, correct calculation of interest.

The commission analyzes data for each PV. The name of the document, its series, number, price (both actual and nominal) are entered into the act of inventory of financial investments. If securities are stored in a special storage facility, the balances in the accounting accounts are compared with statements provided by the specified organizations.

Important! Before you start inventorying financial assets, you need to make sure that all the necessary primary documents and accounting registers are available.

Checking act

The inventory of financial investments must be recorded, and its results entered into a special form INV-16 for the inventory list. This form must contain all the necessary information and comply with Part 2 of Article 9 of Federal Law No. 402. This includes the following details:

- Title of the act.

- When was it compiled?

- The name of the company that drew up the act.

- Type of transaction.

- Unit of measurement.

- The position of the person responsible for conducting the inspection.

- Signature of inventory participants.

The financial investment inventory report, a sample of which must be provided to the manager for review, must be approved in advance and its form included in the company’s accounting policy.

Features of accounting and registration of inventory results

When the inventory reveals unaccounted for financial assets, they are capitalized at prices prevailing in the market. The latter are determined:

- Based on stock quotes for those securities that are admitted to trading on the stock exchange.

- By expert means. This method is acceptable for securities located outside the exchange turnover, and for other financial assets.

An accounting error discovered through inventory can be corrected as follows:

Dt 58 Kt 50 (or 51) purchase of securities reflected

Acceptance of financial assets for accounting in the absence of errors is formalized by the entry:

Dt 58 Kt 91 (1)

When the inventory reveals the absence of documents confirming the company’s rights to a specific financial asset, it is necessary to try to restore them. An official request for a duplicate or copy should be made from the company to which the financial statements were sent. You can also contact the organization that registered the transaction.

If attempts do not bring a positive result, undocumented financial investments are written off:

| Debit | Credit | A comment |

| 94 | 58 | Reflection of losses arising from a lack of financial investments |

| 73 (2) | 94 | Collection of material losses from those responsible |

| 50 | 73 (2) | The amount of loss was reimbursed by the culprit through the cash register |

| Or: | ||

| 70 | 73 | The amount of damage is withheld from the salary of the guilty person |

| If the perpetrators are not identified, or the court, by its decision, refuses to collect: | ||

| 91 (2) | 94 | Write off the loss as a financial result |

In what cases is INV-16 compiled?

An inventory list of securities and BSO in the INV-16 form is formed as a result of the inventory. The main requirement for the document is to reflect real discrepancies between actual and accounting data.

Based on the inventory, accounting data is adjusted if necessary. When unaccounted for securities are identified, a posting is generated: Dt 58 - Kt 91. In the opposite situation, if a shortage or damage to financial instruments is detected, an entry should be made: Dt 94 - Kt 58, which reduces the actual availability of securities.

If discrepancies affecting the BSO documents are identified, the data is adjusted in the off-balance sheet accounting account 006. The identified surpluses appear on the debit side of the account, while the shortage is formed on the credit side.

Errors when taking inventory of financial investments

An inventory of the physical inventory results is compiled in two copies. The check most often reveals the following errors:

- FVs are formatted incorrectly;

- documents confirming them are missing or not compiled in accordance with established requirements;

- Financial assets are classified as financial assets, although there is no reason for this;

- inaccurate determination of the initial value of the securities;

- income generated by the financial fund is not fully reflected;

- legal norms have been violated.

Inaccuracies are recorded in the act. It is signed by all members of the commission, and approved by the director. Errors are also possible on the part of the inventory commission. Often they consist of incorrect execution of final documents, which can lead to repeated work or its continuation:

| The essence of the error | Description |

| The inventory procedure is violated | 1. The manager did not approve the inventory procedure. 2. The persons forming the composition of the commission have not been identified. 3. Inventory deadlines have not been established. 4. Financially responsible employees did not provide receipts indicating that they submitted documents to the accounting department. 5. Some of the commission members are on vacation, business trip or sick |

| Incorrect registration of inventory results | 1. The deadlines for reflecting inventory results have been violated. 2. Only one copy of the inventory has been prepared (instead of two). 3. The inventory contains corrections and errors that were not certified by the commission members. 4. The totals in the last line of the page are not included. There are empty lines. 5. The financially responsible person did not sign confirming the absence of claims on his part to the conclusions of the commission. |

Important! When the inventory is transferred to the next day, the room or place (safe) where the securities and other financial assets are stored is sealed.

Inventory stages

At the beginning of the inventory, a special commission of several people is organized by order of the head of the organization. Checking financial investments requires first obtaining an inventory list for certain types of financial documents. This inventory is compiled in two copies. Next, specialists check the accuracy and legality of the presence of the described securities and other financial documents as part of the assets. There are criteria that allow us to classify financial instruments as assets:

- the correctness and reliability of the execution of documents that confirm the company’s rights to own them;

- assessment of the impact of investments on the future activities of the company;

- information about economic indicators and types of income possible in the future from investments.

Picture 1.

Finished works on a similar topic

Course work Inventory of financial investments 490 ₽ Abstract Inventory of financial investments 230 ₽ Test work Inventory of financial investments 190 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Taking an inventory of financial investments is a rather lengthy process. This is due to the fact that each security is subject to verification and is grouped by category. During the inventory, the actual availability of securities is compared with their number indicated in the documentation. The real value of these assets is also checked and their current price is determined. Securities that are not owned by the organization, but managed by it under an agreement, are also subject to verification during the inventory. Here, accounting for financial investments is carried out on the basis of the price approved by a joint agreement. During the audit process, the specialist checks the accuracy and reliability of the information entered into the securities ledger.

The final part of the inventory is recording the results of the inspection in the inventory. Based on the accounting data and those obtained as a result of the inventory, the actual availability of assets is verified and reflected in the documents. In practice, the audit reveals a large number of errors made in the process of turnover of financial instruments. Therefore, an inventory of financial investments is a necessary procedure, and the quality of asset accounting in an organization depends on its regularity. The most common mistakes are:

- incorrect documentation of the investment of financial resources;

- unreasonably classifying an investment as a financial asset;

- inaccuracies in calculating the initial cost of a security;

- incomplete reflection of income generated by financial investments;

- violation of legal norms.

Inventory of financial investments under the simplified tax system - features

The inventory process in companies with the simplified tax system is no different from companies with the basic tax system. But the order in which shortages are reflected is somewhat different. For “simplified people” with the object of taxation “income”, there is no way to reduce expenses by lost amounts, since this is not allowed. Therefore, they immediately impact the financial result.

For those companies whose object of taxation is “income minus costs,” the latter includes shortages within the limits of natural loss rates. But this applies only to inventories, and not to financial investments.