Long-term and short-term financial investments

The placement of an organization's free funds for the purpose of subsequent profit in the form of dividends or interest is called financial investments. The investment periods differ between short-term and long-term investments. The latter include objects with a maturity of more than 1 year. What exactly can the company's funds be invested in? The main forms of long-term financial investments include (clause 3 of PBU 19/02):

- State and/or municipal securities.

- Securities of other companies, including bills and bonds with a precisely defined value and maturity date.

- Deposits in banking institutions.

- Contributions to shareholders or share capital of companies; under simple partnership agreements.

- Interest-bearing loans issued to other organizations.

- Accounts receivable under contracts for the assignment of claims.

- Other long-term investments of a similar nature.

Note! Own securities purchased for the purpose of further cancellation or resale are not recognized as financial investments; investments in precious metals; bills of exchange for mutual settlements with counterparties; investments of the organization in property objects used in rental activities (clauses 3, 4 of PBU 19/02).

Classification and evaluation of financial investments

Financial investments are classified into:

- short-term;

- long-term (with a period of more than a year).

- non-current;

- negotiable;

- assets purchased for the purpose of receiving interest income, dividends, or other forms of income as a result of their ownership;

- assets purchased for resale;

- participating in the formation of the authorized capital;

- participating in the formation of debt obligations.

The above classification is not complete, but reflects the most common modern approach to the classification of financial investments that exists in the Russian Federation today.

When accepted for accounting, financial investments are assessed at their original cost.

IMPORTANT! Organizations that have the right to use simplified accounting methods can carry out subsequent assessment of financial investments traded on the organized securities market at their original cost, regardless of changes in their current market value (paragraph 2, paragraph 19, paragraph 21 of PBU 19/02 , clause 10 of Information of the Ministry of Finance of Russia N PZ-3/2015).

Accounting for long-term investments and financial investments

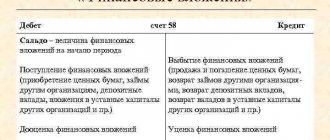

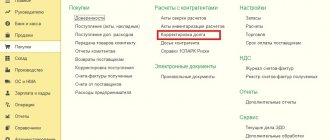

Accounting for long-term and short-term financial investments is carried out on the account. 58 in the manner prescribed by Order of the Ministry of Finance No. 94n dated October 31, 2000. Information on invested funds with the opening of the corresponding sub-accounts is summarized here. Analytical accounting of long-term financial investments is carried out by type of investment, counterparties, and terms.

Subaccounts to the account 58:

- 58.1 – records of shares and shares are kept here.

- 58.2 - to display transactions on investments in securities - both public and private.

- 58.3 – loans provided to other enterprises (individual entrepreneurs, individuals) – cash and others – are taken into account here.

- 58.4 – intended to display contributions based on simple partnership agreements.

Note! Currently, for the correct accounting of long-term financial investments, account 06 of the same name is no longer used. According to Order No. 94n, this account was excluded from the current Chart of Accounts of enterprises and was replaced by an account. 58.

Kinds

In particular, an organization’s financial investments can be:

| Type of investment | Explanation |

| Investments in securities with fixed maturities and maturity values | There are many types of securities on the market. Each of them performs a specific task. According to the procedure established by law, the following occurs:

|

| Investments in the capital of other companies | Each company has the right to invest its funds in the authorized capitals of others - newly created or already existing companies. Such investments:

|

| Issued loans (except interest-free) and deposits | The issuance of loans can be considered financial investments only if interest is charged on the loan amount. Otherwise, such assets are not related to financial investments. Typically, loans are not the main type of financial investment for organizations that do not engage in lending. |

| Acquired receivables, etc. | Under an assignment agreement, an organization (assignee) can acquire the right to claim a debt from the assignor to a third party. Under such a transaction, all documents relating to this right must go to the assignee. According to the law, the assignment agreement must be drawn up in accordance with the law stipulated for the transaction under which the right of claim arose. |

The financial investments made in the specified assets are worthwhile if they meet certain criteria. They are as follows:

- fully documented;

- the presence of economic risk from the relevant investments;

- the opportunity to bring economic effect, profit (dividends, increase in the value of an asset, etc.).

Cash equivalent is also a financial investment. By virtue of clause 5 of PBU 23/2011, this indicator includes assets that meet certain criteria. It should be:

- short-term;

- easy to implement;

- equivalent to a certain amount of money;

- their value should not be subject to significant fluctuations.

Examples of such assets are demand deposits and bills of exchange of the Central Bank of the Russian Federation. Under certain circumstances, loans issued may also be included here, provided that they meet the cash equivalent criteria set out in the company’s accounting policies.

Also see “When a company can count on subsidies/investments from the budget: 11 reasons.”

Long-term financial investments - an asset or a liability?

Account 58 is active. The debit reflects the actual investments of the enterprise in correspondence with the accounts of valuables. For example, this is an account. 51, 50, 52, 01, 10, 91, 75, 80, 76, 98. Accordingly, the disposal of investments when the debtor repays obligations is reflected in the loan account. 58 in correspondence with property or other accounts. These are accounts such as - 52, 50, 51, 76, 90, 80, 91, 99, 04, 01.

Note! The procedure for accepting financial investments for accounting is given in clauses 8-17, 18-24 PBU 19/02; upon disposal, you must follow the requirements of clauses 25-33 of the PBU.

What is Long-Term Investment?

Long-term investing is a popular strategy for those who are willing to wait three, five, or even ten years. The basic principle is “buy and hold.” At first glance, it seems that this is an ideal financial safety net, but this is not so: as sources of long-term investments, you need to choose funds that you definitely will not need in the coming years (we have already written about this here).

The strategy is suitable for those who do not want to delve into the intricacies of the stock market and constantly monitor changes. This is a kind of lazy investing, when the investor takes a minimum of actions and most of the time just passively observes. What is meant by long-term investments often justifies itself - in the horizon of several years, most markets grow.

Long-term financial investments on the balance sheet

Regardless of the type of investment, long-term financial investments in the balance sheet are line 1170. Information about the balances at the end of the reporting period for issued interest-bearing loans, purchased securities, deposits, contributions to share capital, charter capital and other investment objects with a validity period of more than 12 months Financial investments of a short-term nature, that is, with a repayment (circulation) period of less than a year, must be reflected on line 1240, excluding cash equivalents.

Note! If an enterprise creates a reserve for the depreciation of the value of investments, the value indicator minus the amount of deductions to the reserve is entered on line 1170.

Other types of investments

Long-term financial investments also include deposits in companies that issue loans. The investor provides funds issued to citizens as a loan. This investment involves receiving a certain percentage of the payment. This type of investment is mainly carried out for several years.

Investments can also be made in the authorized capital of partnerships. They represent an organizational and legal form. The latter allows you to obtain capital sufficient to start a business activity by summing up the funds contributed by the co-founder. Accordingly, the investor will receive a percentage of the partnership's profits.

Income is distributed among the co-founders in accordance with the amount of capital contributed by each of them. Long-term investments in communities enable productive business management. You will have to wait more than one year for profit. However, this depends on the specific case.

Analysis of long-term financial investments

In order to improve the efficiency of managing an enterprise's available funds, it is necessary to analyze financial investments. The procedure may include a multifactor analysis of the composition and horizontal structure of investments; long-term calculation of investment results; choosing the most profitable direction, etc. At the same time, an increase in long-term financial investments indicates that the company has a significant amount of available funds that can be used for long-term investment.

On the one hand, this indicates the success of the business.

But on the other hand, it is fraught with a decrease in business activity in the main work activity, which in the future may cause a decrease in profits for the reporting period. Therefore, it is optimal to analyze indicators over time, and not just over a short period of time. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

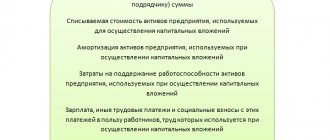

How to recognize assets as a financial investment of an organization

The following evidence is required for assets presented as financial investments:

documents confirming the organization’s ability to make a financial investment. This could be an agreement on a loan or deposit, a bill issued by another organization, shares and bonds or certificates for them;

the ability of this investment to produce income in the future. Income is considered interest, the difference between purchase and sale, dividends;

the ability to take responsibility for the risks that are transferred along with investments.

Shares and other securities are considered investments if they are acquired in the following ways:

payment of cost;

capital contribution;

by barter;

free of charge.

Accounting includes not only the costs of the actual amount of the asset, but also those associated with it:

payment for consulting services (if after the consultation you took advantage of the offer);

remuneration to the intermediary (for example, a lawyer or notary);

other costs that have to be paid additionally, but they are directly related to the acquisition of the asset.

Differences between short-term and long-term investments

The main differences between the two types of financial investments in a company are reflected in the table below.

| Comparison criterion | Long-term | Short term |

| Balance lines | Page 1170 | Page 1240 |

| Term | More than 12 months | Up to 12 months |

| Examples | · participation in the form of a share in the authorized capital of another company; · interest-bearing loans for other companies; · purchase of securities (shares, bonds) that have a long maturity period | · securities of other companies; · funds of time deposits and deposits; · |

| Liquidity | Low | High |

| Feasibility | Low | Lightweight |

The differentiation of investments into short-term and long-term is associated with the following points:

- with the company's plans for this investment;

- Analytical accounting is created for account 59 in the company. The value of investments for which a reserve has been created corresponds to the balance sheet value of the investment minus the reserve.

Example No. 1. Suppose that company A acquired a share in another company B. Various options for using this share of the share of company A are assumed:

- it is possible to influence company B through the size of the share;

- it is possible to carry out control measures over company B;

- You can make a profit from the purchased share as dividends.

If the purpose of using the asset by company A is in the cases described above, then such an asset can be considered long-term and reflected on line 1170.

The situations for classifying this asset as short-term on line 1240 are as follows:

- if the share is resold in less than one year;

- When reselling a share, a profit is made in the form of the difference between the purchase price and the sale price.

FAQ

Question No. 1. In what forms is information on line 1240 recorded?

Answer. Main options:

- Dt 58 accounts. It collects information about the accounting of financial investments;

- D55 or D73 is added to Dt 58 of the account. This includes: deposits and loans for employees;

- then they subtract Kt59 of the account on which data on the formation of reserves for financial investments is collected;

- other financial investments are reflected on line 1170 as long-term options.

Question No. 2. Can financial investments be transferred from long-term to short-term?

Answer. Yes, they can be translated. This procedure must be enshrined in the company's Charter

Question #3: What is the purpose of line 1240?

Answer. Collection and synthesis of data on the placement of free funds of the company for the purpose of investing in the short-term (up to 1 year) period in order to make a profit.