Dividend payment

After paying all taxes at the end of the period (six months, year or quarter), the enterprise has the right to distribute net profit among the LLC participants. If a company has only one founder, then he receives all profits individually.

This method of withdrawing money is absolutely legal, but not very profitable - you will need to pay 13% personal income tax on the transferred dividends, despite the fact that the company has already paid income tax in accordance with its taxation system. In addition, if the LLC was unprofitable in the past period, then distribution of profits becomes impossible.

Example

The OSNO company made a profit of 500,000 rubles. Of this amount, 20% income tax was paid, after which 400,000 rubles remained. After transferring these funds to the founder, 13% personal income tax was withheld; as a result, out of 500,000 rubles, the business owner received only 348,000 rubles, and 152,000 rubles went to the budget.

Capital income

Individuals who invest money in a business are entitled to receive income if their company makes a profit. The profit of the company, which remains after taxation, can be distributed among the participants (shareholders).

LLC and JSC

Indeed, the possibility of paying dividends in cash depends on the legal form of the organization planning to make payments to the founders. Let's start with LLC. The legislation does not provide for any restrictions on the payment of dividends from the cash register of a limited liability company. Is it possible to issue dividends to the founder of an LLC through a cash register? It is possible if we are talking about an LLC.

Let's say that you received good income during the quarter and paid dividends from the net profit. Then, at the end of the year, the profit turned out to be less. Payment of dividends will be reclassified as remuneration to an individual, and you will have to pay all insurance premiums and resubmit related reporting to the Funds.

In an ideal world, where the price of growth stocks grows steadily year after year without drawdowns, and the price of dividend stocks is static for all 20 years, the result would be the same. The $10,000 invested would have turned into $61,159 in both cases.

Payment of dividends to LLC founders in 2022

Quarterly and semi-annual distributions will be considered interim. The payment of such dividends is assessed accordingly. If at the end of the tax period (year) it turns out that dividends on it can be distributed in a smaller amount than has already been done, this will entail the attribution of excess payments to ordinary income and the need to additionally charge insurance contributions to funds that do not pay dividends. accrue.

Cash payments between legal entities in 2022 are limited by a limit. This is the maximum amount of money in which cash payments can be made between legal entities and individual entrepreneurs. What you cannot spend cash proceeds on, see the article >>>

The frequency of dividend payments is chosen by the owners of the enterprise . Payments can be made quarterly, semi-annually or annually. Specific dates are determined at a meeting of all shareholders.

Payment from the organization's cash desk

- the company provides employees with wages, temporary disability benefits and other similar payments;

- the company carries out settlements with citizens;

- the company issues cash to its employee going on a business trip or based on an advance report.

Do we understand correctly that it is now impossible to issue benefits for temporary disability, maternity, or child care from cash proceeds? Previously, they fell under other payments to employees, on which proceeds from cash registers could be spent. 2 Instructions of the Central Bank dated June 20, 2007 No. 1843-U (hereinafter referred to as Instruction No. 1843-U). And now there are no other payments on the list of allowed expenses. 2 Directions. Is it really possible that if there is money in the cash register, the amounts needed to issue benefits will have to be withdrawn from the current account?

But that's not true. Please note that the limit is for cash payment participants. These include legal entities and individual entrepreneurs. An ordinary individual does not qualify as a participant in cash payments. Settlements with individuals do not have an entrepreneurial orientation.

What are the consequences of paying dividends from the organization's cash desk?

The charter of Torgovaya LLC stipulates that the organization pays dividends quarterly. For the second quarter, the organization’s net profit amounted to 50,000 rubles. At the general meeting of participants, which took place in July, it was decided to use this entire amount to pay dividends. The decision was made unanimously. The minutes of the general meeting of participants were drawn up.

If day X falls on a weekend, then the salary is issued on the previous day. In addition, the duration of payment of wages is strictly limited by the same Central Bank: wages can be kept in the cash register for 5 days, then the remainder is handed over to the bank.

You may like => How to find out housing and communal services debt in Sberbank if you don’t have a personal account

The peculiarity of the proposal part is that after each listing with any proposal, the number of participants who spoke “for”, “against” and abstained from voting is indicated. The final decision of the meeting (which is recorded in the resolution) can only be made if the proposals are unanimously accepted.

Is it possible to pay dividends through the cash register to the founders 2020

This is the distribution of net profit. You can distribute not only the profit of the current year, but also of previous years, if it was not previously allocated for dividends or other purposes. To distribute profits, a corresponding decision of the general meeting of shareholders or participants is required.

Then, if the founders decide to pay dividends, it will be necessary to take into account the amounts received by them interim during the year. The following payments made by the owners are not considered dividends:

Payment for IP services for company management

Another way to withdraw money to the founder’s personal account is to receive it as payment for services for managing your own company. By law, an LLC can hire an individual, individual entrepreneur or other company for management functions. The most profitable option is to enter into a contract for the provision of services, then you can not only avoid overpayments of taxes (6% of income instead of 13% personal income tax), but also save a lot of money. It is very important that the individual entrepreneur is not affiliated with the owners of the business (editor's note).

Example

An organization on OSNO paid the individual manager on the simplified tax system “Income” 200,000 rubles for his services in accordance with the contract. From this amount, the manager paid tax 200,000 rubles x 6% = 12,000 rubles. 188,000 rubles remained “clean”.

Next, the organization included these 200,000 in expenses and thus reduced the tax base by 200,000 rubles x 20% = 40,000 rubles. With other combinations of tax systems of the entrepreneur-manager and the company, this method is also very profitable.

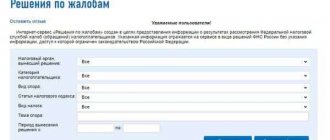

The law does not prohibit the use of this withdrawal of funds, but due to the often fictitious services of the founder, the Federal Tax Service closely monitors such contractual relations. To ensure that the cooperation of an LLC with an individual entrepreneur is not recognized by tax authorities as an ordinary labor relationship, and the company does not fall under penalties, the following should be done:

- indicate in the contract with the individual entrepreneur the specific functions of the manager - the number of meetings held, participation in negotiations, defending the interests of the LLC in government agencies, personnel management responsibilities, etc. You also need to check that other management employees do not have duplicate functions in the employment contract;

- stipulate in the agreement the purpose of attracting an individual entrepreneur, indicate his qualifications and experience - why this particular candidate is suitable for the organization.

- describe in detail the remuneration and methods for calculating it. Each payment for the manager’s services must be accompanied by a report on the work performed with the amounts for each item.

- Do not withdraw all of the organization’s profits to pay for the services of the individual entrepreneur.

An agreement with an individual entrepreneur can be concluded not only for management functions, but also for the transfer of intellectual rights, rental of property, etc. It is important that any withdrawal of funds is documented, and that the organization experiences an increase in financial indicators. Then the Federal Tax Service will not suspect the management of the LLC of tax evasion.

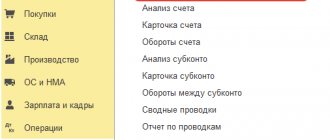

What to do before receiving dividends

- Prepare financial statements Based on them, you calculate profit. For dividends at the end of the year, the accounting records that you have prepared for the tax office are suitable. At the end of the quarter or year, reporting will have to be prepared specifically for the payment of dividends - it is called interim accounting.

- Determine the amount of dividends Find the amount in the balance sheet line “Capital and reserves” and subtract the authorized capital from it. You can distribute all or part of the profit.

- Make a decision on paying dividends. If you are the sole founder of the LLC, print and sign the resolution. For companies with several founders, the procedure is more complicated.

Profit distribution decision template