Many have already heard that from July 1, the Federal Tax Service began issuing electronic signatures free of charge, and from 2022, digital signatures will only be issued by tax authorities and several accredited Certification Centers. We have successfully received a signature from the Federal Tax Service for an individual entrepreneur and are ready to share our experience.

In general, the procedure for obtaining a signature consists of four stages:

- Preparing to receive an electronic signature.

- Submitting an application for signature release.

- Obtaining a signature from the Federal Tax Service.

- Setting up a computer to work with digital signature.

We will try to talk about each stage within the framework of the article.

Stage 1. Preparation for obtaining digital signature

The electronic signature issued by the tax office cannot be called 100% free. The fact is that even though you won’t have to pay anything for the release itself, the signature needs to be recorded on a USB key, and that actually costs money. Get ready to pay around 1,500 rubles for it.

And no matter what key won’t work. This must be a token accompanied by an FSTEC certificate of authenticity.

Before purchasing, be sure to read the description of the “flash drive” and reviews. Many stores now write right in the description whether a specific token is suitable for the Federal Tax Service or not.

But there is another way to look at the situation with certificates. For example, in the Arkhangelsk region there is a rumor that tax authorities can write the key to a token without a certificate. Also here, on Clerk, the possibility of obtaining a signature without a token certificate was discussed. In our telegram chat they also wrote that some inspections can turn a blind eye to the lack of a certificate.

In general, to be sure of success, it is, of course, better to buy a token with a certificate. Perhaps the confusion with these certificates is due to the fact that the tax office has been issuing keys for only a few months. In this case, by the end of the year, everyone who “messed up” will receive a hat, and from January 1, the rules will become common to everyone. Wait and see.

In addition to the token for recording your digital signature, you need a passport and SNILS. Make sure you have them and you can move on.

Subscriber code - unique subscriber identifier - how to get it?

Often citizens are faced with the need to correctly fill out the necessary details in pay slips, tax returns, fine receipts, and payment slips paying for the services of budgetary organizations.

Difficulties are usually caused by the fields where it is necessary to enter the payer identifier (IP) and another identifier - UIN (aka UIP).

How do you know what it is? Citizens usually know what a payer identification number is: on the tax return form it is usually indicated as a Taxpayer Identification Number (TIN).

What is a UIN: assignment rules and instructions

UIN (UIP) stands for a unique identifier of charges (payments). To put it simply, this is a code that contains all the necessary information about the payment sent to the state budget and the correctness of its receipt.

What identifier is indicated in personal income tax and tax collections?

The income statement does not indicate the UIN, but the payer identifier (IP):

- for a legal entity - TIN;

- physical - SNILS or other, including alternative, identifier of an individual;

- for a foreign organization (IO) - FIO code (FIO).

In line No. 22 “unique identifier of charges (payment)” you must enter “0”.

Attention! There is no need to form a UIN when paying land, property, or transport taxes. In these cases, in payment documents of Form N PD sent from the Tax Service, the index of the tax document must be indicated as the UIN.

A payment order can be issued directly on the website of the Federal Tax Service using the electronic service. In this case, the UIN will be assigned automatically.

Clarification on these issues was provided by the Federal Tax Service, which specified cases when indicating the UIN is not necessary.

Is it necessary to indicate the UIN in other payments?

In all other payment orders not sent to the state, municipal or city budget, it is not necessary to indicate a unique payment identifier. You must enter zero in the “code” field.

If the bank unlawfully demands to indicate the UIN in the payroll, employees must be reminded of the letter of the Federal Tax Service of the Russian Federation No. ZN-4−1/ dated April 8, 2016.

Composition of the UIN code by category

- The first three categories contain the code of the chief administrator for state budget revenue (state body, local administration, local government self-government - Article 6 of the Budget Code of the Russian Federation).

- Digits 4 - 6: last three digits of the RPBS code (register of recipient of budget funds). (The register was created on the basis of Order of the Ministry of Finance No. 163n dated December 23, 2014).

- Digits 7 - 9: index of the structural unit (if the organization does not have structural divisions, zeros are entered).

- Level 10 - case code: 1 - if a decision is made to punish for an accident in the form of a fine under the Code of Administrative Offenses; 2 - if the case is transferred to a magistrate.

- Digits 11 - 14: year and month of registration of the AP.

- Digits 15 - 19: serial number of AP registration.

- Bit 20 is a control key.

Note: In the absence of administrative cases of violations, zeros are entered in the identifier fields intended for digits 10 to 19.

From here it is clear that in a simple receipt for a kindergarten there will be a “0” in the ten penultimate fields of the code.

How to calculate the control key in the UIN code

The control key is a number from 0 to 9 and must occupy one digit (one field).

- To calculate the key, you need to assign a weight from one to ten to each digit (from the most significant digit, that is, the very first field, to the least significant one). After the 10th digit, they begin to assign weight again, starting from one.

- Each UIN digit is multiplied by the assigned weight and the sum of all products is added.

- The resulting amount is divided by 11. The remainder of the division is the control key.

- If during the calculation they receive a two-digit number, repeat the assignment of weight, but not from 1 to 10, but from 3 to 5 inclusive. Repeat the calculation. If this time the number is greater than 9, then in the 20th digit where the control key should be, put 0.

Payer ID - what is it?

There are individual entrepreneurs for legal entities, individuals and foreign organizations (IO). In this case, individual entrepreneurs are considered individuals.

For a legal entity, individual entrepreneur is the identification number of the payer (or taxpayer), that is, TIN. The TIN is usually indicated along with the reason code for registering the person with the tax authorities, i.e. KPP.

For an international organization, this is the KIO, that is, the code of the foreign organization, plus the checkpoint.

Stage 2. Submitting an application for signature release

The application is submitted through your personal account on the Federal Tax Service website. It doesn’t matter how you plan to get a signature - as an individual entrepreneur or as a director of an LLC, the application is submitted through your personal account as an individual. If you don’t remember the password for your personal account or are not at all sure that you ever registered it, use the login through government services. And if you haven’t registered for government services, then it’s time to do it.

In your personal account, click the “Life Situations” “Get a qualified electronic signature” button at the very bottom .

Next, you need to choose who you are receiving the signature as: as an individual entrepreneur or a representative of an organization.

There will also be a button “Taxpayer Data” . Click on it and carefully check all the information about yourself. If the tax office has incorrect information about any of your documents, they will refuse to issue you a signature. We are faced with this.

Arriving at the tax office, our individual entrepreneur discovered that the Federal Tax Service indicated his old SNILS number, which had been out of date for 13 years. Moreover, the information in State Services and the Pension Fund is correct. The inspector refused to issue the signature. Updating the data took approximately two weeks; a request for change can be sent from the same personal account. But it is possible that if you come to the tax office in person, everything will go faster.

If everything is fine, click Next . You will see a link with an application for issuing an electronic signature. You can download and read it. If nothing confuses you, click the Send .

Your personal account will display a message stating that the application has been sent and a response will be received within five days. In fact, this is a little different. The answer comes in literally a few minutes, so you can immediately press the Messages and watch for the answer.

The response will say that the application has been approved and now you can come to any tax office to record your digital signature on a flash drive. But it is not so.

Perhaps, from 2022, it will indeed be possible to obtain a signature from absolutely any inspection, but at the moment, only a few Federal Tax Service in each region are engaged in issuing digital signatures. For example, in St. Petersburg this is only the 15th tax office. On the tax website you can download an Excel sheet with a complete list of inspections to which you can apply for an electronic signature. After successfully registering through your personal account, you need to go to one of them.

About unclear identifiers in payrolls

Often citizens are faced with the need to correctly fill out the necessary details in pay slips, tax returns, fine receipts, and payment slips paying for the services of budgetary organizations.

Difficulties are usually caused by the fields where it is necessary to enter the payer identifier (IP) and another identifier - UIN (aka UIP).

How do you know what it is? Citizens usually know what a payer identification number is: on the tax return form it is usually indicated as a Taxpayer Identification Number (TIN).

What is a UIN: assignment rules and instructions

UIN (UIP) stands for a unique identifier of charges (payments). To put it simply, this is a code that contains all the necessary information about the payment sent to the state budget and the correctness of its receipt.

When is it necessary to indicate the UIN

The decision on the need to indicate this detail in a number of cases was made in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013. Thus, the following payment orders for transfers to the state budget must necessarily contain the UIN and payer identifier:

- sent from tax authorities, demanding payment of arrears, fines, penalties;

- fines for administrative violations;

- transfers to the budget (for example, fees for kindergarten or education);

- transfers under an agreement, when the recipient of the money assigns a UIN to the payment order in advance and notifies the counterparty about this (used in mutual commercial settlements of legal entities).

The form of the receipt, in which you must indicate the UIN - 0504510.

What identifier is indicated in personal income tax and tax collections?

The income statement does not indicate the UIN, but the payer identifier (IP):

- for a legal entity - TIN;

- physical - SNILS or other, including alternative, identifier of an individual;

- for a foreign organization (IO) - FIO code (FIO).

In line No. 22 “unique identifier of charges (payment)” you must enter “0”.

Attention! There is no need to form a UIN when paying land, property, or transport taxes. In these cases, in payment documents of Form N PD sent from the Tax Service, the index of the tax document must be indicated as the UIN.

A payment order can be issued directly on the website of the Federal Tax Service using the electronic service. In this case, the UIN will be assigned automatically.

Clarification on these issues was provided by the Federal Tax Service, which specified cases when indicating the UIN is not necessary.

Is it necessary to indicate the UIN in other payments?

In all other payment orders not sent to the state, municipal or city budget, it is not necessary to indicate a unique payment identifier. You must enter zero in the “code” field.

If the bank unlawfully demands to indicate the UIN on the payroll, employees must be reminded of the letter of the Federal Tax Service of the Russian Federation No. ZN‑4–1/ dated April 8, 2016.

How is UIN assigned?

According to the order of the FS FBN No. 48 dated February 28, 2014, it is necessary to assign not only UIP, but also individual entrepreneurs:

- for payments for state or municipal services, and other payments to the state budget;

- imposition of sanctions from the tax authorities and fines, according to the Code of Administrative Offenses (in this case, the UIN is usually indicated in the payment document itself;

- drawing up protocols on administrative violations (AP) sent to the magistrate.

The rules for assigning an identifier are contained in Appendix 1 of the order of the FS FBN.

The UIN (UIP) code contains 20 digits, the individual payer identifier contains 25.

Composition of the UIN code by category

- The first three categories contain the code of the chief administrator for state budget revenue (state body, local administration, local government self-government - Article 6 of the Budget Code of the Russian Federation).

- Digits 4 - 6: last three digits of the RPBS code (register of recipient of budget funds). (The register was created on the basis of Order of the Ministry of Finance No. 163n dated December 23, 2014).

- Digits 7 - 9: index of the structural unit (if the organization does not have structural divisions, zeros are entered).

- Level 10 - case code: 1 - if a decision is made to punish for an accident in the form of a fine under the Code of Administrative Offenses; 2 - if the case is transferred to a magistrate.

- Digits 11 - 14: year and month of registration of the AP.

- Digits 15 - 19: serial number of AP registration.

- Bit 20 is a control key.

Note: In the absence of administrative cases of violations, zeros are entered in the identifier fields intended for digits 10 to 19.

From here it is clear that in a simple receipt for a kindergarten there will be a “0” in the ten penultimate fields of the code.

Where can I get the Chief Revenue Administrator code?

The code of the chief administrator of state revenues is taken from the list established by Federal Law No. 359 - Federal Law of November 22, 2016.

The list of codes can be seen here.

How to calculate the control key in the UIN code

The control key is a number from 0 to 9 and must occupy one digit (one field).

- To calculate the key, you need to assign a weight from one to ten to each digit (from the most significant digit, that is, the very first field, to the least significant one). After the 10th digit, they begin to assign weight again, starting from one.

- Each UIN digit is multiplied by the assigned weight and the sum of all products is added.

- The resulting amount is divided by 11. The remainder of the division is the control key.

- If during the calculation they receive a two-digit number, repeat the assignment of weight, but not from 1 to 10, but from 3 to 5 inclusive. Repeat the calculation. If this time the number is greater than 9, then in the 20th digit where the control key should be, put 0.

Payer ID - what is it?

There are individual entrepreneurs for legal entities, individuals and foreign organizations (IO). In this case, individual entrepreneurs are considered individuals.

For a legal entity, individual entrepreneur is the identification number of the payer (or taxpayer), that is, TIN. The TIN is usually indicated along with the reason code for registering the person with the tax authorities, i.e. KPP.

For an international organization, this is the KIO, that is, the code of the foreign organization, plus the checkpoint.

Payer ID of an individual

For individuals, the following can be used as identifiers:

- insurance number of a person insured by the Pension Fund of the Russian Federation (SNILS);

- series and number of passport or driver's license;

- series and number of the vehicle registration certificate received upon registration;

- other information permitted for use as personal identifiers, in accordance with the law (for example, military ID, sailor’s passport, etc.).

The individual ID code is a two-digit number. Allowed ID codes for individuals:

Assigning an alternative identifier to an individual

An alternative payer identifier provides information about an identity document (or other document permitted by law for personal identification) and citizenship of an individual.

- The first two digits of the IP are occupied by the document code.

- The next 20 digits (from 3 to 22) are the series and document number in one line without a space between them).

- The last three digits are the code of the country whose citizenship the payer has.

The rules for specifying identifiers are determined by Appendix 2 of Order No. 48 of the Federal Service of the Russian Federation (the information differs little from that presented in the chapter When it is necessary to indicate the UIN of this article).

Brief final review

The taxpayer identifier of an individual entrepreneur and the unique accrual identifier UIN are two different things:

- An individual entrepreneur is indicated in tax documents when paying standard duty taxes (on personal income, property, transport, etc.).

- In the role of an individual entrepreneur for a legal entity, there may be a taxpayer identifier and a tax registration reason code (TIN + KPP).

- For an individual, this may be identification information consisting of the series number of the provided document (any of the list of permitted ones) and the code of the country of citizenship.

- The UIN is not indicated in self-completed tax returns.

- When paying all property taxes in the field, the role of the accrual identifier UIN is performed by the document index (the topmost field on the left on the payment document sent from the tax service.

- The UIN on fine receipts and payments is usually also indicated in the payment document itself.

- Payment documents independently created by users of the electronic service of the Federal Tax Service have an automatically assigned code.

If the payment order contains a field with a UIN, it cannot be left blank, since the payment may not go through due to such a “little thing.” Even if the payment identifier cannot be assigned and it is not found in the document, you must enter “0” in the field for it.

It is necessary to clearly distinguish cases when it is necessary to indicate a unique payment identifier:

- when imposing penalties on the part of the tax service (for concealment, arrears, late tax payment);

- in payment orders sent from state or local municipal authorities;

- in fines for traffic violations and other administrative violations;

- in the payrolls of commercial organizations (if a UIN is assigned by the recipient).

Individuals are faced with the need to use UIN mainly when paying fines and paying for kindergarten. In other cases, for individuals, the payer identifier is used.

Checking fines by UIN

By the way, the UIN can be useful - for example, you can use it to check traffic police fines. Just go here, enter the UIN in the field and click “Check fines.” A nice bonus from the inspection is a 50% discount within 20 days after the fine is assessed.

Loading…

Stage 3. Obtaining a signature from the Federal Tax Service

Probably, it was not worth highlighting this point in a separate section of the article, since it is difficult to say anything smarter than “go to the tax office of your choice and do what the inspector says.” But it’s worth at least talking about what to take with you.

- Passport. Where would we be without him?

- USB token. No wonder we bought it.

- Certificate for the token. We remember that not all tax authorities require it, but it’s better to be safe than sorry.

- SNILS. Without it the key will not be issued

There is no need to take registration documents.

Well, so that this paragraph is not completely ridiculously small, a few words about key renewal. It is valid for 15 months. 2 weeks before the end it can be extended in your personal account. Moreover, you won’t need to go to the Federal Tax Service again for this; everything can be done from your computer (at least that’s what the inspector who issued the signature assured us).

Information systems of the Federal Tax Service

Information services allow you to obtain reference materials. Let's look at the most popular of them:

- Details of the current tax office. Using this service, you can check the registration address of the tax payer, the details of the current Federal Tax Service, and its number. This information is needed to pay taxes.

- Information about rates. At this address you can find out about the current rates and benefits for the following taxes: on transport, on land, on property of legal entities and individuals.

- Letters from the Federal Tax Service. Here are collected letters from the Federal Tax Service that were ever sent to tax departments, explanations from the Federal Tax Service that should be used by government agencies. The letters contain the position of the tax service regarding various issues. How is this service used? The Federal Tax Service must act in full accordance with the law. However, actions in some situations are not regulated by law. They may be regulated by letters from the Federal Tax Service. You can find these letters in the service by their number or keyword.

- Common questions. Payers, when interacting with the tax service, often have the same questions. The most common of these questions are collected on the service. How to use it? It is enough to select the topic of interest. If the question is related to regional tax, then you can select a region.

- Checking counterparties. Here you can verify the state registration of legal entities and individual entrepreneurs.

Information services allow you to quickly obtain all the necessary information.

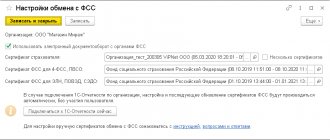

Stage 4. Setting up a computer to work with digital signature

If you have not worked with electronic signatures before, you need to set up your computer.

Let’s make a reservation right away: if you have specially trained people on your staff, then it is better to entrust the setup to them. This doesn’t mean that you won’t succeed, you’ll just save yourself some nerves, because the procedure for setting up a workplace to work with digital signatures is stressful for an unprepared person.

As an example, we will consider connecting via digital signature to the personal account of an individual entrepreneur. Connecting to your LLC personal account is approximately the same.

A few words about the crypto provider

For those who have already worked with signatures and have a computer set up, it will be useful to know that the tax office is currently issuing signatures for Crypto Pro. There is information on the Internet that they plan to establish work with VipNet, but so far the work is going on exclusively with Crypto Pro . This means that if your computer is configured to work with VipNet, you will not be able to use the key from the Federal Tax Service so easily, since these two crypto providers are not friends with each other.

Browser selection

The personal account is quite picky about browsers. We managed to configure everything through the Yandex browser. You can use it.

Installing a crypto provider

In order for you to be able to work with your signature on Internet resources, you need to install a crypto provider and a browser plugin. This can be done using the link.

Installing a personal certificate

Insert the key into the computer. Open the Crypto Pro CSP program. Go to the Service section. Click the View certificates in container . Select your key. In the window that opens, click the Install certificate .

Browser settings

Go to the Yandex browser settings, go to the System section and check the box next to Connect to sites that use GOST encryption .

Adding Federal Tax Service services to the list of trusted sites

Open Control Panel . Select Internet Options . In the window that opens, go to the Security . Click the Safe Sites the Sites button . Add two sites to the list:

- https://lkul.nalog.ru

- https://lkul.nalog.ru

Connecting to your personal account

Go to your personal account, find the button Verify compliance with the conditions for access to your personal account and complete the verification. If all is well, the service will ask you for permission to access the key, we agree.

If something went wrong

If it was not possible to connect to the service, the verification wizard will tell you at what stage the error occurred and what you can try to do. Very often errors occur due to the operation of the antivirus; you can try disabling it temporarily.

If all else fails, it’s better to turn to the experts.

Create your own business

Few accounting programs can help you decide for free how best to run your business so as not to lose money on taxes. There is such an opportunity on the Federal Tax Service website. It will help you intelligently approach the choice of the future tax regime. In addition, he will tell you how to register a new business, about online cash registers, tax audits and other general but important issues.

Also see “Online cash registers from 2022: the law has been adopted.”

Choose the legal structure of your business (LLC, JSC, etc.) and tax regime. The proposed option will be the most optimal financially.

You can find your way around many tax issues in advance here: https://www.nalog.ru/create_business/

Where can I use a signature from the Federal Tax Service?

In addition to access to your personal account, the signature can be used to work in third-party services, for example, in the VLSI program. We were confirmed by technical support that it is possible to work in VLSI with a signature from the Federal Tax Service.

The tax authorities themselves write about the signature like this:

The signature can be used:

On all electronic platforms and services.

When submitting tax returns (calculations):

- Through electronic document management operators;

- Through the service “Presentation of tax and accounting reports in electronic form”.

By the way, many people think that a personal account for individual entrepreneurs and LLCs is a useless thing in which you can only look at tax debts. This is a little different. Through your personal account, you can send requests to the Federal Tax Service, submit a Notice of transition/change of the simplified tax system, and even make changes to the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

True, in order to make changes you will have to master a special program, but it is worth it.

You can also submit reports for free using an electronic signature. For this purpose there is a service “Presentation of tax and accounting reports in electronic form”. But if you are used to working with some kind of VLSI or Contour, this service may shock you culturally. It is intended solely for sending reports; it is impossible to create a declaration in it. And in order to send a declaration through it, you need to create it in a special format, for which you will need the Taxpayer Legal Entity program.

In general, with the help of an electronic digital signature from the tax office, you can submit reports using free services of the Federal Tax Service and make changes to the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. But for this you need to master additional programs that are not always intuitive. But if you have the time and the attitude, anyone can do it.

What needs to be done to work in the Taxpayer’s personal account on the Federal Tax Service website?

The total volume of tax accruals for them amounted to 299.2 billion rubles, which is 2% more than last year. The Tax Service draws attention to the changes that occurred in 2022, for which taxes were assessed to citizens.

In the windows that open, click “Next” - “Next” - “Finish”, without changing the default settings.

After generating a declaration or loading an existing one, it is necessary to unload it to form a transport container. To upload a document, you need to right-click on the report. In this case, if a document or group of documents is marked, the marked documents will be uploaded. If there are no marked documents, the document on which the cursor is positioned will be unloaded.

Electronic primary" Service Diadok, with which you can transmit electronic invoices, as well as acts, invoices and contracts via the Internet.

We tell you how to use this service to submit reports through the taxpayer’s personal account. Suitable media: Rutoken EDS 2.0, Rutoken S, Rutoken Lite, JaCarta GOST, JaCarta-2 GOST and others that meet the requirements of the FSB or FSTEC.

Online magazine for accountants

Based on Law 210-FZ “On the organization of the provision of state and municipal services” on the transfer of information to the GIS GMP, thanks to which the UIN column was introduced into the payment order, banks offered clients to indicate a unique accrual code for the following balance accounts in the “Recipient’s account number” detail:

Interesting: How to Pay for Utilities Via the Internet

From March 31, 2014, the Ministry of Finance of the Russian Federation introduces a new payment order requisite - UIN. UIN stands for unique accrual identifier. It is entered in field No. 22 - “Code”. This code will be assigned to each transfer to the state budget.

Services for individuals and beginning businessmen

There are also the following Federal Tax Service services:

- Find out the TIN. Here you can check the TIN that is assigned to the payer. To do this, you need to enter information about yourself: full name, passport data, date of birth.

- Acceptance of an application for registration. The application must be sent if the individual does not have a TIN. However, the certificate of registration is not issued online. You will have to go to the government agency to get it.

- Creating your own business. Here you can study all the information regarding the creation and registration of an individual entrepreneur. The page contains information about taxation systems. There is everything a person starting his own business needs here. Step-by-step guides are available for various procedures.

All information is presented in a simple and understandable form.