Fixed asset or product - when the difference becomes clear

The status of accounting objects and the rules for working with them are determined primarily by the relevant provisions and accounting standards (PBU and FSBU).

According to PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance dated March 30, 2001 No. 26n, one of the criteria for classifying an object as a fixed asset (hereinafter referred to as fixed assets) is that the organization does not intend to use it in the future for resale (Clause 4 PBU 6/01). Important! PBU 6/01 is canceled from 01/01/2022. Instead, two new FSBUs are being introduced: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. ConsultantPlus experts explained in detail what the new standards will change compared to PBU 6/01 in their Review, which you can view for free after receiving trial access to K+.

Read more about accounting for fixed assets in the material “Fixed assets in accounting (nuances).”

The main characteristic of goods, on the contrary, is their intended purpose for sale (from 01/01/2021 - sub-clause “d” of clause 3 of FSBU 5/2019, until 01/01/2021 - clause 2 of PBU 5/01).

And the main distinguishing feature of a fixed asset is that this object can bring economic benefits to the organization for a long time (more than 12 months).

Thus, if we are talking about a newly acquired object of “long-term use,” then the question of which category it should be classified in comes down only to the presence or absence of the organization’s intention to resell it in the future.

But the intention can change. At the time of acquisition, the organization intended to use the facility for its activities, but then market conditions changed, the owners had other plans for business development, etc.

This means that this property needs to be sold. But the sale process may be delayed, and during the period of searching for buyers, the object will no longer be an asset that brings benefits to the organization. So why should it be considered a fixed asset and subject to property tax all this time?

Let's consider different views on this problem.

We remind you that movable property is not currently subject to tax. Therefore, all further explanations are relevant in relation to immovable fixed assets.

Transfer of fixed assets to low-value equipment in the 1C: Accounting 8 edition 3.0 program

We continue to consider changes in the accounting programs of the 1C company related to the emergence of new Federal Accounting Standards. And today we will again pay attention to the Federal Accounting Standard FSBU 6/2020 “Fixed Assets ” .

In the last article we looked at how the 1C:Accounting 8 edition 3.0 program automated the transition to the use of FAS 6/2020

.

This transition is quite complicated, since, in accordance with paragraph 48

of this Standard, the consequences of changes in accounting policies should be reflected retrospectively, that is, as if the Standard had been applied from the moment the facts of economic life affected by it arose. The new Standard can be applied to the program either from 2022 (mandatory), or earlier, from 2022 (at the request of the organization). To transition to the new standard, using a specific example, we examined the process of revising the elements of depreciation of fixed assets and the corresponding adjustment of their book value.

Now in the program 1C: Accounting 8 edition 3.0

in release 98, when switching to the use of

FAS 6/2020,

the ability to transfer fixed assets recognized by the organization as non-essential for accounting purposes to low-value equipment was added.

Transfer to low-value equipment is available only for those fixed assets that are not, in accordance with paragraph 1 of Art.

256 of the Tax Code of the Russian Federation (TC RF), depreciable property.

In accordance with clause 4 of FSBU 6/2020

For accounting purposes, an object of fixed assets is considered to be an asset that is simultaneously characterized by the following characteristics:

a) has a material form;

b) is intended for use by the organization in the normal course of business in the production and (or) sale of its products (goods), when performing work or providing services, for environmental protection, for provision for temporary use for a fee, for management needs, or for use in the activities of a non-profit organization aimed at achieving the goals for which it was created;

c) is intended for use by the organization for a period of more than 12 months or a normal operating cycle of more than 12 months;

d) is capable of bringing economic benefits (income) to the organization in the future (to ensure that the non-profit organization achieves the goals for which it was created).

In accordance with clause 5 of FSBU 6/2020

An organization may decide not to apply this Standard in relation to assets that are simultaneously characterized by the characteristics established by

paragraph 4

of this Standard, but have a value below the limit established by the organization, taking into account the materiality of information about such assets. In this case, the costs of acquiring and creating such assets are recognized as expenses of the period in which they are incurred. The organization must ensure adequate control over the presence and movement of such assets.

Thus, the FSB

allows you to write off costs for the acquisition (creation) of fixed assets that are “insignificant” for accounting purposes, costing below the cost limit established by the organization, immediately upon their acquisition (creation). Assets of this type do not have a book value, are accounted for off the balance sheet and are called Low-Value Equipment in the program (we wrote about accounting for low-value equipment in one of the previous articles).

In accordance with clause 49 of FSBU 6/2020

the carrying amount of items that, in accordance with previously applied accounting policies, were accounted for as part of property, plant and equipment, but in accordance with this Standard are not such, is written off as a one-time adjustment to retained earnings, except in cases of reclassification of such items into another type of asset.

As we have already noted, low-value equipment has no book value (written off upon acquisition) and is accounted for in off-balance sheet accounts. Therefore, writing off the book value of fixed assets, which, in accordance with the new Standard, are not fixed assets, can be represented in accounting as their transfer to low-value equipment.

Organizations that have the right to apply simplified accounting methods may not make any adjustments and begin to apply this Standard prospectively, namely only in relation to facts of economic life that occurred after the start of its application ( p

.

51 FSBU 6/2020

).

Let's look at a small example.

The organization "Rassvet" applies the general taxation regime - the accrual method and PBU 18/02 "Accounting for calculations of corporate income tax"

. Moreover, accounting for deferred tax assets and liabilities in the program is carried out using the balance sheet method, reflecting permanent and temporary differences. The organization is a VAT payer.

The Rassvet organization decided to apply the norms of the Federal Accounting Standard FSBU 6/2020 “Fixed Assets”

starting in 2022.

The year from which the organization applies the standards of FAS 6/2020

, is indicated in the form for setting up the organization’s accounting policy.

The accounting policy settings are shown in Fig. 1.

Rice. 1

At the beginning of 2022, the organization’s balance sheet includes a fixed asset item Laptop

. The initial cost of the object in accounting is 70,000 rubles, the useful life is 25 months. Depreciation is calculated using the straight-line method. By the beginning of 2022, the amount of accrued depreciation is 33,600 rubles.

For profit tax purposes, the object does not belong to depreciable property, since in accordance with paragraph 1 of Art. 256 Tax Code of the Russian Federation

, the initial cost of the depreciable property must be more than 100,000 rubles.

Therefore, the value of the object in tax accounting is zero and, since the organization applies PBU 18/02

, the corresponding temporary differences are registered in its value.

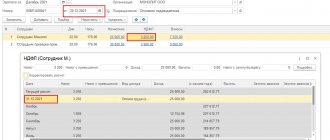

Balance sheets for 2022 by account 01.01

and account

02.01

are presented in Fig. 2.

Rice. 2

The object was accepted for accounting as a fixed asset in December 2022. For profit tax purposes, since the object is not depreciable property, its cost was fully included in material expenses. Taxable temporary differences (TDT) arose and the corresponding deferred tax liability (DTL) was accrued.

IT = NVR * STnp = 70,000 rub. * 20% = 14,000 rub.

Starting from 2022, depreciation began to be calculated for the object in accounting. The amount of monthly depreciation charges is 2,800 rubles (70,000 rubles / 25 months). Depreciation was accrued only in accounting. Therefore, when calculating depreciation, deductible temporary differences (DTD) were recorded. Deductible temporary differences result in the settlement of the deferred tax liability.

pog ONO = VVR * STnp = 2,800 rub. * 20% = 560 rub.

Monthly postings of routine operations Depreciation and depreciation of fixed assets

and

Calculation of deferred tax according to PBU 18

are shown in Fig. 3.

Rice. 3

Thus, for 2022, the deferred tax liability was repaid by 6,720 rubles (560 rubles * 12 months).

The balance sheet for 2022 for account 77 is presented in Fig. 4.

Rice. 4

When switching to accounting standards FSBU 6/2020

, the organization decided to set a cost limit for non-essential fixed assets for accounting purposes in the amount of 100,000 rubles. Accordingly, all fixed assets with a value below the established limit, which are not depreciated property for profit tax purposes, are subject to transfer to low-value equipment.

To perform this operation, the program uses a new document Transfer of OS to low-value equipment

. In our example, we need to create such a document at the end of 2020.

The “header” of the document indicates the division - the location of fixed assets, and the Transfer to low-value equipment event has already been set.

In the tabular part of the document, fixed asset objects are selected to be converted into low-value equipment. It is convenient to fill out the table part using the “Selection”

.

Using the “Customize List”

, you can select fixed assets according to their original cost. In our example, we select all fixed assets with an initial cost below the established limit, corresponding to 100,000 rubles (Fig. 5).

Rice. 5

In the column Low-value equipment

Nomenclature

directory can be selected .

If a directory item is not selected, it is created automatically and has the same name as the main item. Type of catalog item nomenclature - Low-value equipment and supplies

.

In the Employee

The financially responsible person is automatically entered in the tabular part of the document. If necessary, this detail can be changed manually.

When posted, the document will write off in accounting the initial cost of the fixed asset item in the debit of account 01.09 “Retirement of fixed assets”

.

The accrued depreciation will be written off against the credit of the account. Thus, the residual value will be calculated on account 01.09

, which, in accordance with

clause 49 of FSBU 6/2020

, will be written off as a debit to account

84.01

“Profit subject to distribution.” Taxable temporary differences recorded in its value will also be written off along with the asset.

Since, in accordance with clause 5 of FSBU 6/2020

, the organization must ensure proper control of the availability and movement of low-value equipment; it will be recorded in the off-balance sheet

account MTs.04 “Inventory and household supplies in operation”

for the specified financially responsible person.

Example document Translation of OS

into low-value equipment and the result of its implementation are shown in Fig. 6.

Rice. 6

In addition to accounting entries, when conducting the document, it will make entries in the necessary registers of information on accounting for fixed assets.

First, an entry will be generated in the OS Events information register with the type Transfer of OS to low-value equipment.

Secondly, an entry will be generated in the information register of Asset Depreciation Accruals (accounting) with the value No.

And finally, thirdly, an entry will be generated in the information register OS Status

organizations with the status

Deregistered

.

Document movements Transfer of OS to low-value equipment

information registers are shown in Fig. 7.

Rice. 7

The transfer of fixed assets, which in accordance with the new Standard are not such, into low-value equipment is carried out in conjunction with an adjustment to the book value of the remaining fixed assets (this event is described in detail in our previous article). At the beginning of the period of application of FSBU 6/2020

it is necessary to perform the routine operation

Transition to FSBU 6

.

For those organizations that are switching to the new Standard from 2022, this regulatory operation will be automatically added to the Closing month

.

For those organizations that switch to the new Standard ahead of schedule, from 2022, this regulatory operation must be performed manually in December 2022. After completing the measures for the transition to the new Standard, it is necessary to re-perform the regulatory operations Calculation of deferred tax

according to

PBU 18

and

Reformation of the balance sheet

.

Processing Month Closing with Regulatory Operation Transition to FSBU 6

shown in Fig. 8.

Rice. 8

When converting the Laptop property, plant and equipment item into low-value equipment, we wrote off its carrying amount to retained earnings. Together with the asset, we wrote off the taxable temporary differences recorded in its value. The write-off of taxable temporary differences (TDT) should lead to the settlement of the deferred tax liability (DTL).

linear IT = smart. NVR * STnp

In December 2022, even before the transition to the new Standard, as a result of depreciation on the fixed asset Laptop, 2,800 rubles of temporary differences were written off, which led to the repayment of a deferred tax liability of 560 rubles (see Fig. 3). When writing off the book value of the object, another 36,400 rubles of temporary differences were written off, which will lead to the repayment of the deferred tax liability by another 7,280 rubles (36,400 rubles * 20%). Thus, the total amount of repayment of the deferred tax liability will be 7,840 rubles (560 rubles + 7,280 rubles).

When settled, deferred tax liabilities increase current income taxes. Therefore, they are canceled in correspondence with the credit of account 68.04.2 “Calculation of income tax”

.

But when transferred to low-value equipment, the book value of the fixed asset item is written off not as expenses, but as retained earnings, and does not have any impact on the amount of the current income tax. Therefore, the regulatory operation compared the amount of income tax calculated according to tax accounting data with the current income tax calculated according to accounting data. I discovered a discrepancy and wrote off the difference to account 99.09 “Other profits and losses”

.

When the balance sheet is reformed, account 99.09

will be closed and will ultimately be reflected in the amount of retained earnings.

Regular transaction postings Calculation of deferred tax

according to

PBU 18

for December 2022 are shown in Fig. 9.

Rice. 9

Now let's check the results of our actions.

As a result of the transfer of a fixed asset item to low-value equipment, we wrote off the fixed asset item from the organization’s balance sheet in accounting and fully repaid the deferred tax liability accrued when the item was accepted for accounting.

Balance sheets for 2022 for account 01.01, account 02.01 and account 77

are presented in Fig. 10.

Rice. 10

Now the former fixed asset item is accounted for as low-value equipment in the off-balance sheet account MTs.04

for the financially responsible person.

Balance sheet for account MTs.04

is presented in Fig. eleven.

Rice. eleven

The transfer of fixed assets, which in accordance with the new Standard are not such, into low-value equipment is carried out not only during the transition to FAS 6

. This transfer can be carried out after the transition to the new Standard when revising the cost limit used by the organization in accounting to recognize fixed assets as immaterial.

Our clients can consult with our specialists on any issue in the program. By concluding a 1C support agreement with us today, you will receive free

hours of consultations

from our leading specialists.

Take advantage of the promotion right now! Order a free consultation

Transfer for sale to another type of asset: possible or not

From 2022

With the reporting for 2022, the updated provisions of PBU 16/02 came into force, by virtue of which fixed assets scheduled for sale can be transferred to another asset class: long-term assets for sale (LTAs).

Assets are accepted for accounting as DAP at the moment when (simultaneously):

- Their use has been discontinued due to the decision to sell.

Important! Temporarily unused non-current assets are not transferred to DAP (clause 10.1 of PBU 16/02).

- It has been confirmed that the resumption of use of these facilities is not expected.

Confirmation can be:

- the corresponding decision made by the management of the organization;

- commencement of actions to prepare the asset for sale;

- conclusion of a sales agreement, etc.

With the transfer to DAP, fixed assets cease to be subject to property tax. An exception is real estate registered as a DAP, taxed at cadastral value (see letter of the Ministry of Finance dated January 22, 2020 No. 03-05-05-01/3316).

ConsultantPlus warns Please note: reclassification of fixed assets into DAP does not mean their transfer to the category of goods. Unlike goods, the financial result from the sale of DAP forms profit (loss) from other operations, and not profit (loss) from ordinary activities (Information message of the Ministry of Finance of Russia dated 07/09/2019 N IS-accounting-19). The transfer of fixed assets into goods, in our opinion, is still possible in rare cases, although this is not directly provided for by PBU 16/02... Read more about the requalification of fixed assets into DAP or into goods in K+. Trial access is available for free.

Until 2022

Previously, government financial authorities took an unambiguous position on the issue of transferring fixed assets into goods for sale - it is impossible. This opinion was based on the fact that PBU 6/01 does not provide for the transfer of fixed assets into goods, and writing off fixed assets from accounting is possible only upon their disposal.

Therefore, from the point of view of the regulatory authorities, an object that was initially acquired as a fixed asset should have remained in this status until the moment of sale (or disposal for other reasons). And from this it followed that property tax must be paid on this object until the moment of its sale (disposal). This opinion was reflected, in particular, in the letter of the Ministry of Finance dated March 2, 2010 No. 03-05-05-01/04.

But despite the principled position of tax authorities on this issue, organizations still tried to optimize property taxes in this way. Taxpayers tried to convert fixed assets into goods and tried to defend their position in court. They succeeded in this with varying degrees of success. A selection of judicial practice can be found in K+ by getting free trial access to the system.

How to reflect the reclassification of fixed assets into long-term assets for sale in accounting and what entries to make is explained in detail in the Ready-made solution from ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

About OS according to PBU

Buildings, premises, equipment, cars, other assets intended for use in production, performing work, providing services, leasing, for the management needs of the organization for a long period of time (more than 12 months), are reflected in accounting as main funds ( clause 4 of PBU 6/01 “Accounting for fixed assets” ).

Machinery, equipment and other similar items listed as goods in the warehouses of organizations engaged in trading activities are not recognized as fixed assets. Assets intended for sale are part of the inventory ( clause 2 of PBU 5/01 “Accounting for inventories” ).

Reflecting an asset as part of fixed assets means that its cost is written off as expenses during its useful life by calculating depreciation. The rules are like this. Calculation of depreciation charges:

- begins on the first day of the month following the month the asset was accepted for accounting, and continues until its cost is fully repaid or the object is written off from accounting;

- terminates on the first day of the month following the month of full repayment of the cost of an asset or write-off of this asset from accounting;

- is not suspended during the useful life of the OS object, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months, as well as during the restoration period of the object, the duration of which exceeds 12 months.

As a rule, fixed assets that are located in a certain technological complex or have a completed cycle of the technological process are transferred to conservation ( clause 63 of the Methodological Guidelines for Accounting of Fixed Assets [1]);

is carried out regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period to which it relates.

Based on clause 29 of PBU 6/01, an asset is subject to write-off from accounting under the following circumstances:

1) disposal in such cases as:

- sale;

– termination of use due to moral or physical wear and tear;

– liquidation in case of an accident, natural disaster and other emergency situation;

– transfer in the form of a contribution to the authorized (share) capital of another organization, a mutual fund;

– transfer under an agreement of exchange, gift;

– making a contribution under a joint activity agreement;

– identification of shortages or damage to assets during their inventory;

– partial liquidation during reconstruction work;

2) inability to generate economic benefits (income) in the future (when the facility is not constantly used for the production of products, performance of work and provision of services, or management needs of the organization).

Issues

In our case, at the time of making the decision to sell the fixed assets, the disposal of the asset does not occur, and in the future it should bring economic benefits (income) as a result of a sale transaction, and not as a result of use for the production of products, performance of work, provision of services or management needs of the organization. Thus, the asset ceases to meet the conditions for its recognition in accounting as an asset and essentially becomes a commodity. The difficulty lies in the fact that accounting regulations do not provide for the procedure for requalifying fixed assets due to a change in the model for obtaining future economic benefits.

Conditions for OS requalification

How to proceed in such cases (when federal accounting standards do not establish accounting methods for a specific issue of accounting) is prescribed in clause 7.1 of PBU 1/2008 “Accounting Policy of an Organization” , introduced by Order of the Ministry of Finance of the Russian Federation dated April 28, 2017 No. 69n .

So, the organization independently develops an appropriate method of accounting, based on the requirements established by the legislation of the Russian Federation on accounting, federal and industry standards. For these purposes, the following documents should be used sequentially:

- international financial reporting standards;

- provisions of federal and (or) industry accounting standards on similar and (or) related issues;

- recommendations in the field of accounting.

According to international standards, assets classified as non-current assets are reclassified as current assets when they meet the criteria for classification as assets held for sale in accordance with IFRS 5 Non-current assets held for sale and discontinued operations [2 ].

The basic rule is:

An entity shall classify a non-current asset (or disposal group) as held for sale if its carrying amount will be recovered principally through sale rather than through continuing use.

To do this, the asset (or disposal group) must be available for immediate sale in its current condition solely on the terms customary and customary for the sale of such assets, and its sale must be highly probable. A sale is considered highly probable under the following circumstances:

- management at the appropriate level has undertaken the implementation of the plan to sell the asset;

- active measures are being taken to find a buyer and implement the plan;

- there are active efforts to sell the asset at a price that is reasonable in relation to its current fair value;

- The sale is expected to be completed within one year from the date of reclassification of the fixed asset as a current asset. Due to events or circumstances beyond the entity's control, the period for completing a sale may exceed one year, provided that the plan to sell the asset remains in effect;

- actions to implement the plan to sell indicate that significant changes to the plan or its cancellation are unlikely;

- the likelihood of shareholder approval of the transaction (if required in the relevant jurisdiction) is high.

Thus, an asset that has been decided to be sold is reclassified as a current asset if it is available for immediate sale in its current condition, the sale is scheduled on normal and customary terms, and the sale is highly probable. As a result, there is no need to depreciate such a non-current asset while it is classified as held for sale ( clause 25 of IFRS 5 ). Depreciation accrual stops on the first day of the month following the month of requalification of the fixed assets item.

note

The FSBU project “Fixed Assets” stipulates that this standard is not applicable to objects whose use has been discontinued and whose resumption of use is not expected in connection with a decision to sell them. If the way in which the economic benefits from a previously recognized property, plant and equipment are received changes so that it no longer has the characteristics necessary to account for it as a fixed asset, the entity must reclassify it as another appropriate asset.

According to the FSBU project “Inventories”, it is this standard that will need to be applied to account for non-current assets (with the exception of financial assets), the use of which has been discontinued and the resumption of use of which is not expected in connection with a decision to sell them (long-term assets for sale).

Transfer of individual fixed assets to low value

But some of the objects, namely inventory, household supplies, tools, equipment and devices, fit the definitions of both Instructions No. 26 and Instructions No. 133, and in order to separate them, the organization could resort to additional criteria, including cost. But objects classified as equipment, which include telephones, faxes, office equipment, etc., in the author’s opinion, should be classified only as operating systems, regardless of their cost. By the way, the Ministry of Finance gave the same explanations last year. In 2013, certain property, regardless of its value, had to be counted only as part of fixed assets (for example, equipment). However, since 2014, according to clarifications from the Ministry of Finance, some objects classified as equipment (telephones, printers, faxes, etc.), under certain conditions, can be accounted for as separate items as part of working capital. How can such objects, recorded in 2013 as part of fixed assets, be transferred to inventories?

24 Dec 2022 marketur 1653

Share this post

- Related Posts

- Inn is a required document when applying for a job 2019

- When will benefits be paid to medical workers working in rural areas?

- For what violation can a car be seized in Italy?

- How long does it take for a fine to arrive from the camera?

How to convert OS into budget wiring materials

The “Place on one account” switch is intended to assign all material assets from the invoice to one source of financing (current, personal account) after creating the document. When this switch is turned on, a drop-down list of current accounts becomes available, in which you must select the one on which all material assets of the document will be taken into account. If the switch is turned off, the source of funding for material assets will remain unchanged after the document is created. By clicking the “Add. » a directory of material balances opens. For material assets added from the directory, in the “New Account” column, by clicking on the button in the cell, set the chart of accounts account in which the material asset will be accounted for after the document is created. The new account will be set in the marked lines.

Please note => Why incentives are not paid to teachers in the proletarian district of the Rostov region

Budgetary accounting of fixed assets in 2019-2019 (nuances)

- Since 2016, film and photographic equipment, due to a reduction in useful life, has been classified in group 3 of fixed assets accounting, and in 2016–2019 its useful life is 3–5 years.

- In 2016, objects with a new value limit (100,000 rubles) began to be accepted for tax accounting of fixed assets. This limit is valid for OSes put into operation after 2015.

- In 2022, the provisions reflected in the main documents on the rules for accounting for fixed assets were clarified in relation to objects leased, free use, trust management, and also those that are the subject of concession agreements.

Below we consider the scheme for generating an accounting account number in a budgetary organization, and also decipher the category codes using an example. A detailed explanation of the categories can also be found in clause 21 of the instructions to the chart of accounts (order No. 157n), in the table of the budget accounting chart of accounts and in clause 2 of the instructions to it (order No. 162n).