There are several options for transferring wages to bank cards:

- within the framework of a salary project - transfer of the total amount to the bank, which then transfers the salary to the personal accounts of employees opened in this bank;

- to personal cards of employees - the organization transfers salaries directly to the employee to his personal card.

Regardless of which option is chosen, the accountant’s actions in the program will be as follows: create a statement to the bank, transfer wages, pay personal income tax.

Let's look at each action with an example.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Step-by-step instruction

In the Organization, according to the local act, wages are paid twice a month: on the 25th and 10th. Payments are made under the salary project to the cards of employees, except for Gordeev N.V., who was hired on May 23, 2022 and indicated in the application a personal card for transferring salaries.

On June 8, 2022 (postponed from June 10), salaries for the second half of May were paid.

Tab. No. Last name I.O. employee To payoff Payment method 1 Komarov Vladimir Sergeevich 28 200 salary project 4 Mashuk Ksenia Valerievna 16 450 salary project 9 Gordeev Nikolay Vasilievich 10 839 to a personal card Total 55 489 On the same day, personal income tax for May 2022 was paid.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of wages according to the salary project | |||||||

| June 08 | — | — | 44 650 | Formation of payment statement | Statement to the bank - According to the salary project | ||

| 70 | 51 | 44 650 | 44 650 | Salary payment | Write-off from current account - Transfer of wages according to statements | ||

| Paying salaries to employees' personal cards | |||||||

| June 08 | — | — | 10 839 | Formation of payment statement | Statement to the bank - To employees' accounts | ||

| 70 | 51 | 10 839 | 10 839 | Salary payment | Debiting from a current account - Transferring wages to an employee | ||

| Payment of personal income tax to the budget | |||||||

| June 08 | 68.01 | 51 | 13 761 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

For the beginning of the example, see the publications:

- Advance payment

- Payroll

According to the salary project

A salary project is an agreement with a bank, according to which the bank opens its own personal account for each employee .

On payday, the organization transfers the wages of all employees to a special salary account in this bank in one amount .

In this case, a statement indicating the personal accounts of employees and the amounts to be paid . In accordance with this statement, the bank itself distributes funds to the personal accounts of employees.

At the same time, different banks have different capabilities and requirements for working with a salary project, if we are talking about electronic document management, that is, when we transfer money to a salary account through a client bank.

In this case (client bank), after sending the payment order to the bank, a letter is sent in any form with one of the following options attached (depending on the requirements and capabilities of the bank):

- printed and scanned statement of payments for personal accounts

- upload file directly from 1C

- upload file from a special program provided by the bank

If we send a statement to the bank in the form of a file (upload), then usually the bank responds by sending us a confirmation file, which we can also upload to 1C.

Creating a salary project

We go to the “Salary and Personnel” section and the “Salary Projects” item:

We create a salary project for Sberbank:

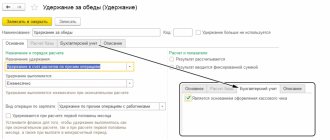

Here is his card:

We deliberately do not check the “Use electronic document exchange” checkbox in order to deal with the case when we send the bank statement in printed form.

We introduce personal accounts for employees

Let's assume that the bank has created a personal account for each of its employees. How to enter these accounts into the system? By the way, why do we want to do this? Then, so that in the statement that we will generate for the bank, opposite the employee’s full name, there will also be his personal account.

If we have a lot of employees, we can use the “Entering personal accounts” processing:

But in the example we have only 2 employees, so we will enter their personal accounts manually, directly into their cards (at the same time we will know where they are stored).

Go to the “Salaries and Personnel” section, “Employees” item:

Open the card of the first employee:

And go to the section “Payments and cost accounting”:

Here we select the salary project and enter the personal account number received from the bank:

We do the same with the second employee:

We calculate salaries

Go to the “Salaries and Personnel” section and select “All accruals”:

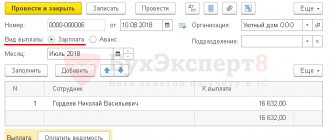

We calculate and process wages:

We pay salaries

Next, go to the “Salaries and Personnel” section, “Bank Statements” item:

We create a new document in which we indicate the salary project and select employees (note that their personal accounts are picked up):

We post the document and print out the statement for the bank:

Here's what it looks like:

Based on the statement, we generate a payment order:

In it, we transfer the total amount of the salary to the salary account of the bank in which we have an open salary project:

Along with this payment, do not forget to attach a statement (with a register of personal accounts and payments), printed above in the form required by the bank (usually this is an arbitrary letter through the client’s bank).

Uploading the register to the bank

Let's consider the possibility of uploading the statement (register) as a file to the bank. If your bank supports this option (or this is its requirement), then go to the “Salaries and Personnel” section, “Salary projects” item:

Open our salary project and check the box “Use electronic document exchange”:

We go again to the “Salaries and Personnel” section and see that two new items have appeared. We are interested in the item “Exchange with banks (salary)”:

There are three basic options for uploading to a bank:

- Payroll transfer

- Opening personal accounts

- Closing personal accounts

Let's focus on the first point. It allows us to upload our statement to a file, which is then sent by arbitrary letter through the client bank.

To do this, select the statement we need and click the “Upload file” button:

When a response comes from the bank, it will contain a confirmation file. You need to go into the same processing and upload this file through the “Download confirmation” button. Using this wonderful mechanism, we will be able to track which statements were paid by the bank and which were not.

Reflection in reporting 6-NDFL

Calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income in the form of wages is the last day of the month indicated in the Salary field for Payroll document (clause 2 of Article 223 of the Tax Code of the Russian Federation). It will be reflected on page 100 of Section 2 of form 6-NDFL.

Explore Payroll

In Form 6-NDFL, payment of wages is reflected in:

Section 1 “Generalized indicators”:

- pp. 070 - 13,761 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 05/31/2018 , date of actual receipt of income;

- page 110 - 06/08/2018 , tax withholding date.

- page 120 - 06/09/2018 , tax payment deadline.

- pp. 130 - 107,250 , the amount of income actually received.

- Page 140 - 13,761 , the amount of tax withheld.

How to choose a bank?

When choosing a bank, rely on the specifics of your business and the tasks that the salary project must solve. But usually the following points are important to entrepreneurs:

Bankiros recommends!

Tinkoff Bank, Lit. No. 2673

Tariff "Simple"

Service

for free

2 months, then for purchases from 50,000 ₽/month. or no operations for 2 months. Otherwise ‒ 490 ₽ / month.

Translations

from 1.5% + 99

up to 400,000 ₽ /month, 5% + 99 ₽ ‒ up to 1,000,000 ₽, 15% + 99 ₽ ‒ from 1,000,000 ₽

Cash withdrawal

from 1.5% + 99

up to 400,000 ₽ /month, 5% + 99 ₽ ‒ up to 1,000,000 ₽, 15% + 99 ₽ ‒ from 1,000,000 ₽

View tariff

Tinkoff Bank, Lit. No. 2673

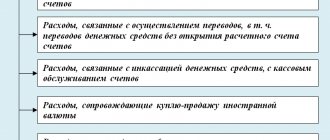

- Basic conditions for the RFP project. Who pays and how much for card servicing, how much do basic operations cost, incl. calculation of payments, subscription fee.

- The ability to conduct a salary project without connecting cash register services. Suitable for entrepreneurs who have already found a suitable bank to maintain an account, but specifically want to accrue salary through another organization.

- Servicing cards from third-party banks. It matters if employees want to receive salary for the plastics they already have.

- Conditions for employee cards. Including the cost of issue and monthly maintenance, commission on basic operations.

- Bonuses for employees. We are talking about cashback on cards, interest on the balance, overdraft, preferential lending conditions, etc.

- Bonuses for an entrepreneur. Typically this includes issuing a premium card with associated terms and conditions.

- Special requirements. Integration with accounting services, remote maintenance, issuing cards in packages, etc.

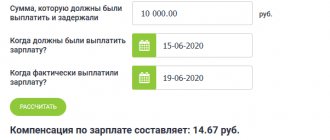

Payment of personal income tax to the budget

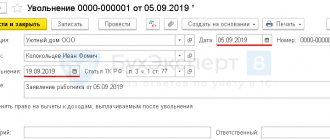

Payment of personal income tax to the budget is carried out no later than the day following the day of payment of wages to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

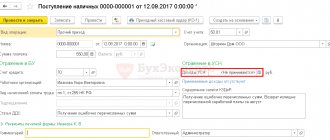

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - May 2018 , the month of accrual of income (salaries).

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt - payment of personal income tax to the budget for May.

What is it needed for?

Both the entrepreneurs themselves and the workers they hire have a stake in the salary project. By being served by the bank, both parties receive benefits:

- The burden on accounting is reduced. With a salary project, you no longer need to fuss with cash: now the issuance of all payments to employees is simplified and automated.

- Costs are reduced. Participants in the salary project save on cash collection and the accountant's salary.

- Saves time. Employees receive a salary without reference to the place where they are currently located. This is convenient for those who work remotely or have to leave the office frequently.

- There are nice bonuses. Banks return interest on purchases, allow you to increase your balance, and offer other cards and products on preferential terms.

Bankiros recommends!

VTB Bank, Lit. No. 1000

Tariff “At the start”

Service

for free

3 months. From the 4th month - free with a turnover of 10,000 ₽ or more. Otherwise – 199 ₽/month.

Translations

from 1%

Cash withdrawal

from 2.5%

View tariff

VTB Bank, Lit. No. 1000

All the advantages of non-cash payments also relate to the salary project. This means speed and security of payments, convenience, and the ability to manage money remotely - through an online account and mobile application.

Checking mutual settlements

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

In this case, the end date of the report must be the day of payment of wages.

The absence of a final balance in the “Settlements with personnel for wages” account means that there is no wage arrears for each employee.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, wages were paid on June 8, so the end date of the report should be June 09, i.e. the next day after the day the wages were paid.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

See also:

- Salary settings: 1C

- Accounting policy for NU: Insurance premiums

- Registration of salary project

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of an advance through a bank on bank cards Let's consider the features of reflecting in 1C the payment of an employee's advance through a bank....

- Features of paying wages to a foreign worker through a bank...

- Payment of wages through the cash register: in cash according to a statement. There are several options for paying wages. The main ones: on…

- Indication from June 1, 2022 of income codes and withheld amounts on writs of execution for payments through a bank in ZUP 3.1 In ZUP 3.1.14, the automatic ability to record income codes and...

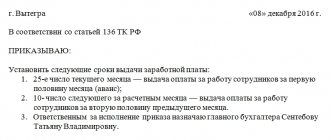

Is it necessary to pay wages on a card?

According to Art. 136 of the Labor Code of the Russian Federation, the employer is offered two ways to pay wages to employees - in cash from the cash register or by transfer to the employee’s bank account. The procedure for paying wages must be fixed in a collective agreement or in an employment contract, which the employer must adhere to in the future.

For example, if the parties have chosen only one method - by card, then when the employee asks to give him money from the cash register, the employer has the right to refuse. This position is also supported by the courts (decision of the Moscow City Court dated November 12, 2018 in case No. 33-48833/2018).

However, it must be taken into account that the process of receiving a salary for an employee should be as convenient as possible. Therefore, if he cannot always withdraw money from the card, then he will have to add the possibility of issuing “cash” from the cash register. To do this, you will have to make changes to the employment contract - by agreement of both parties, approve the new procedure and record it in a written additional agreement to the current employment contract.

Most employers still try to transfer salaries to employees’ bank cards. There is no need to bother with large amounts of “cash” and pay for collection services. In addition, this method is also convenient for employees, because many pay for purchases with a card, receiving cashback and various bonuses from banks.