Who must submit a VAT return?

Filing a VAT report is the responsibility of legal entities and individual entrepreneurs who:

- do not work under special regimes and made sales with value added tax over the past quarter;

- act as a tax agent;

- work under special regimes and are exempt from tax in accordance with Art. 145 of the Tax Code of the Russian Federation, but issued invoices to contractors with it.

If the company was not associated with tax for the quarter, then there should be no exemption from filing reports. A nil return must be filed.

Basic information about VAT returns

A VAT return must be submitted even if the company did not conduct commercial activities during the reporting period: if there are no objects of taxation, entrepreneurs submit “zero” reporting. However, there are a couple of exceptions:

- the company did not record trading transactions, and there was no movement of funds in its accounts and cash register, you can submit a single tax return;

- the company received an exemption from VAT in accordance with Art. 145 of the Tax Code of the Russian Federation (total revenue for the last three months did not exceed 2 million rubles).

Entrepreneurs using the simplified tax system and PSN are not VAT payers, so they do not need to submit a corresponding declaration.

In addition, the law provides for other cases when individual entrepreneurs or legal entities submit VAT reports:

- the enterprise leases real estate from the state - in this case the organization is recognized as a tax agent with an obligation to pay VAT;

- the entrepreneur issues an invoice with VAT to the buyer using the simplified tax system or PSN;

- the company purchases goods from a foreign partner who is not registered in the Russian Federation for further sale in Russia.

Regardless of the number of employees at the enterprise, the declaration must be submitted electronically through licensed TCS operators.

Where and when to submit the declaration

Reporting is submitted to the Federal Tax Service of the Russian Federation. In accordance with paragraph 3 of Art. 80 of the Tax Code of the Russian Federation, it can be submitted electronically or on paper. The obligation to submit electronically via TKS is assigned to the following categories of taxpayers:

- with an average number of employees over the past year of more than 100 people;

- only to established or reorganized companies with more than 100 employees.

Tax agents can submit reports in paper form.

The deadlines for submitting VAT reports imply submission no later than the 25th day of the month following the end of the quarter.

Registration

At the end of each quarter, you need to pay VAT to the budget and submit a tax return to the inspectorate. The VAT return is submitted to the tax office no later than the 25th day of the month following the end of the quarter. The declaration form is given in the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

Starting with reporting for the third quarter of 2022, an updated VAT return form will be used.

Changes to the declaration form, the filling procedure, as well as electronic submission formats were approved by order of the Federal Tax Service dated March 26, 2022 No. ED-7-3/ [email protected]

From July 8, 2022, the product traceability mechanism became fully operational. In this regard, the invoices were supplemented with new details:

- registration number of the product batch subject to traceability;

- quantitative unit of measurement of a product used for traceability purposes;

- quantity of goods subject to traceability.

New lines have been added to several sections:

- Section 8 “Information from the purchase book on transactions reflected for the expired tax period” and the appendix to it;

- Section 9 “Information from the sales book on transactions reflected for the expired tax period” and the appendix to it;

- Section 10 “Information from the log of issued invoices in relation to transactions carried out in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements reflected for the expired tax period”;

- Section 11 “Information from the log of received invoices in relation to operations carried out in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements reflected for the expired tax period.”

In each section, blocks of lines for traceable goods are assigned their own codes. In this regard, the order of filling them out has changed.

The barcode on each sheet of the declaration has changed.

The following may not submit a declaration:

- companies that have switched to a simplified taxation system (clause 2 of Article 346.11 of the Tax Code of the Russian Federation);

- companies that have received exemption from VAT payer obligations (Article 145 of the Tax Code of the Russian Federation);

- participants of an investment partnership who are not an authorized managing partner (for transactions related to the activities of the partnership (Article 24.1 of the Tax Code of the Russian Federation)).

There are cases in which firms must file a return even if they do not usually do so:

- the company pays VAT as a tax agent;

- the company issued an invoice with VAT allocated in it.

All companies and individual entrepreneurs must submit VAT returns only in electronic form, regardless of the number of employees. This rule applies to all taxpayers, including tax agents who pay VAT, as well as persons who are obliged to transfer VAT to the budget on the basis of paragraph 5 of Article 173 of the Tax Code (clause “a”, paragraph 6 of Article 10, paragraph 1, 2 paragraph “a”, paragraph 2, article 12, paragraph 3, article 24 of the Law of June 28, 2013 No. 134-FZ).

Only tax agents who are not VAT payers or are exempt from VAT can submit a return on paper. But only if they are not the largest taxpayers and the average number of their employees for the previous year (for newly created organizations - the number of employees) does not exceed 100 people (clause 3 of article 80 of the Tax Code of the Russian Federation, paragraph “a”, paragraph 6, Article 10, paragraph 3, paragraph “a”, paragraph 2, Article 12, paragraph 3, Article 24 of the Law of June 28, 2013 No. 134-FZ).

However, if these persons operate on the basis of intermediary agreements, then they are required to submit a declaration electronically (subsection “a”, paragraph 6, article 10, paragraph 4, subsection “a”, paragraph 2, article 12, paragraph 5 Article 24 of the Law of June 28, 2013 No. 134-FZ).

The VAT declaration is submitted in electronic form only via telecommunication channels through an electronic document management operator (clause 5 of Article 174 of the Tax Code of the Russian Federation).

The tax period for VAT for all companies is a quarter. This means that all VAT payers (including tax agents), regardless of the amount of revenue, report tax on a quarterly basis. The VAT return is submitted to the tax office no later than the 25th day of the month following the end of the quarter.

What liability follows for failure to submit a declaration?

If the deadlines are violated, the Federal Tax Service has the right to issue a fine to the company. The amount is calculated based on the amount of tax to be paid: 5% for each month. The fine has a set minimum (1 thousand rubles) and a maximum - it is 30% of the calculated VAT.

Tax authorities also apply additional sanctions. Thus, a delay in the VAT return for more than 10 days risks blocking transactions on the current account for a business. Tax officials also impose penalties in the amount of 1/300 of the Central Bank key rate, which are calculated every day.

The Astral Report 5.0 service will always remind you about the deadlines for submitting your VAT report. This is a convenient platform for maintaining records, exchanging documentation with counterparties and sending reports to regulatory agencies. You can fill out a VAT return in Astral Report 5.0 in a few minutes. The service will provide the current form of the form, and you can transfer the necessary information from the database loaded into the program.

Payment of tax to the budget

Home page – Objectives of the organization – Payment of VAT at 1/3 of the amount for the quarter

Algorithm for filling out a VAT return in 1C

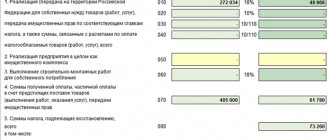

- generation and verification of VAT returns;

- checking the Purchase Book and Sales Book ;

- checking VAT accounting data and confirming the amount of tax payable to the budget;

- completeness of accrual (payment) of VAT sanctions.

See also:

- Algorithm for checking a VAT return

- VAT accounting in 1C 8.3: step-by-step instructions

- Algorithm for identifying discrepancies in the VAT return

- Composition of the VAT return

- Algorithm for VAT

- UA for analyzing VAT register data purchase book

- Errors in the VAT return

- Checking the relevance of VAT registration data

- Codes for types of VAT transactions

- [04/16/2021 entry] VAT return for the 1st quarter of 2022 in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The procedure for submitting a VAT return for the 2nd quarter of 2021 Let’s look at the procedure for submitting a VAT return for the 2nd quarter of 2021,…

- The procedure for submitting a VAT return for the 3rd quarter of 2021 Let’s look at the procedure for submitting a VAT return for the 3rd quarter of 2021,…

- The procedure for submitting a VAT return for the 4th quarter of 2022 in 1C Let’s look at the procedure for submitting a VAT return for the 4th quarter of 2021,…

- The procedure for submitting a VAT return for the 4th quarter of 2018...

Changes to the VAT return from 2022

From the 1st quarter of 2022, a new VAT tax return form will be used. Accordingly, taxpayers are required to use the new electronic format and the new established procedure for filling out the declaration. The changes are caused by the exemption from VAT for a number of transactions, the emergence of the right to use the declarative nature of the VAT refund procedure for a number of organizations and the emergence of duties as a tax agent when purchasing goods, works or services from foreign companies, in cases where the place of sale is the territory of the Russian Federation.

Autofill and verification

The VAT return can be completed from:

- Home Page – Organizational Objectives

- Accountant calendar in 1C: list of tasks

- ReportingByVAT

– VAT assistant - 1C-Reporting

- a single workplace

Organization on OSNO, VAT payer. In 1C, separate accounting of incoming VAT is maintained.

In 1st quarter:

- goods and services were purchased with VAT 20%;

- the sale of services subject to 20% VAT, non-taxable (exempt from taxation), not recognized as an object of taxation was carried out...

Instructions for filling out a VAT return

| Declaration section | What you need to indicate | Notes |

| Title page | Basic information about the organization. Clarification of the period for which the report is submitted. | All organizations and individual entrepreneurs must fill out this form. If an adjustment is sent, its number should be indicated in the appropriate field (002, 003) |

| Section 1 | The amount of tax that the taxpayer estimates should be transferred to the state treasury. | Please indicate the correct OKTMO and KBK codes. It is recommended that you fill in the numbers in the other sections before completing this section as it is summary in nature. |

| Section 2 | The amount of tax calculated for transfer to the state budget according to the tax agent. | This part is provided by tax agents for each organization for which they perform similar functions. |

| Section 3 | Calculation of tax deductions for transactions taxed at the rates from paragraphs. 1-4 articles 164 of the Tax Code of the Russian Federation. | These sections, as well as annexes, should be completed if the organization carried out the operations specified in them. If there were no such sheets during the reporting period, then these sheets should simply be excluded from the document. |

| Sections 4-6 | Calculation of tax on the sale of goods or the sale of services or work for which a zero rate has been established, which has already been confirmed by documents or not yet. | |

| Section 7 | Information about transactions that are exempt from this type of taxation. | |

| Section 8-9 | Data from the books of purchases and sales for transactions for the reporting quarter is recorded here. | Data must be entered from the relevant journals. This section is intended to be completed by intermediaries, including those who are not VAT payers. |

| Section 10 | Transfer information from the invoice journal | |

| Section 11 | Display information from the log of received invoices | |

| Section 12 | Include data from invoices issued by persons from the list of clause 5 of Article 173 of the Tax Code of the Russian Federation. | Fill in those non-payers of VAT who, when preparing invoices, allocate the tax on a separate line. |

In a zero VAT return, only the title and the first section are filled out.

Features of filling out the declaration

The VAT declaration consists of a title page and 12 sections, but representatives of SMEs most often need to fill out only a few of them:

- title page and 1 section are mandatory for everyone;

- Section 2 is completed only by tax agents;

- Section 3 is intended for calculating the tax base and VAT at non-zero rates;

- sections 4-6 are completed only by exporters;

- Section 7 is intended for those who in the previous quarter carried out transactions not subject to VAT;

- Section 8 is information about received invoices, and section 9, respectively, about issued ones;

- Sections 10 and 11 are intended for intermediaries - here they indicate information about issued and received invoices, respectively;

- the last, section 12, is filled out by companies if they are exempt from VAT or carry out non-taxable transactions. For example, individual entrepreneurs and legal entities using the simplified tax system or PSN, issuing invoices with VAT.

Sanctions for violators

For violation of the procedure for submitting a VAT return, including failure to comply with the electronic form, an organization or individual entrepreneur is held liable for taxation:

- For failure to submit a declaration within the prescribed period, liability is provided for in Article 119 of the Tax Code of the Russian Federation. Its provisions introduce a fine of 5% of the amount of tax not paid within the period established by law, which was indicated for payment in this declaration. The fine is charged for each full or partial month from the day on which the legally established deadline for submitting the declaration falls. The maximum fine in this case is not more than 30% of the specified amount, and the minimum is not less than 1,000 rubles.

- For violation of the rule on submitting a VAT return in electronic form, sanctions are applied under Article 119 of the Tax Code of the Russian Federation, since such a report is considered not submitted.

In addition, for violation of the established deadlines for submitting VAT reports, officials of the organization may be brought to administrative liability under Article 15.5 of the Code of Administrative Offenses of the Russian Federation. In this case, they will be given a warning or a fine of 300 to 500 rubles. For a delay in filing a VAT return (including if it is sent in paper form) for more than 10 working days, tax authorities have the right to suspend transactions on the taxpayer’s bank accounts and electronic money transfers. This possibility is provided for in Article 76 of the Tax Code of the Russian Federation. Consequently, submitting a report on paper, violating the requirements of the law, is not at all profitable. We recommend that you carefully study how to submit VAT electronically via the Internet.

VAT. Monthly or quarterly

Please describe the procedure for submitting VAT reports and the deadlines for paying VAT, if during the quarter there are months when the amount of revenue excluding tax exceeds and does not exceed 1 million rubles.

In accordance with paragraph 1 of Art. 163 Tax Code of the Russian Federation

As a general rule, the tax period for VAT is a calendar month.

At the same time, for taxpayers with monthly amounts of revenue from the sale of goods (work, services) excluding VAT during the quarter, not exceeding two million rubles

, the tax period is established as a quarter (

clause 2 of article 163 of the Tax Code of the Russian Federation

).

Note!

Since January 1, 2006

The maximum amount of sales revenue, which allows you to pay VAT quarterly, has been increased by 2 times (from 1 to 2 million rubles).

In 2005, the specified revenue limit was equal to 1 million rubles.

Clause 6 art. 174 Tax Code of the Russian Federation

It has been established that taxpayers with

monthly

amounts of revenue from the sale of goods (work, services) excluding VAT during the quarter, not exceeding two million rubles, have the right to pay tax based on the actual sale (transfer) of goods (performance of work, provision of services)

for the past quarter

no later than the 20th day of the month following the expired quarter.

That is, for example

, for the first quarter (January, February, March), taxpayers who pay VAT quarterly must pay VAT no later than April 20.

Taxpayers whose revenue exceeds 2 million rubles

per month (excluding VAT), pay VAT monthly, no later than the 20th day of the month following the expired tax period (

clause 1 of Article 174 of the Tax Code of the Russian Federation

).

For example

, VAT for January such taxpayers must pay no later than February 20.

The timing of submitting VAT returns depends on whether VAT is paid monthly or quarterly.

Taxpayers paying tax quarterly

, submit a tax return no later than the 20th day of the month following the expired quarter (for example, for the first quarter - no later than April 20).

Taxpayers paying tax monthly

, submit a tax return no later than the 20th day of the month following the expired month (for example, for January - no later than February 20).

Since only those taxpayers who for each month

during a quarter, the amount of revenue from the sale of goods (work, services) does not exceed 2 million rubles, then if your amount of revenue in any month exceeds 2 million rubles, you will lose the right to quarterly payment of VAT and quarterly submission of a VAT return .

That is, you will submit a declaration and pay tax in the general manner (monthly).

As the Ministry of Taxes of the Russian Federation explained in letter No. 14-1-04/627-M233 dated March 28, 2002, in this case taxpayers are required to submit a declaration on a monthly basis, starting from the month in which the above excess amount of revenue occurred

.

For example

In the first quarter, the amount of sales revenue excluding VAT in one month (

February

) exceeded 2 million rubles.

Submit your tax return for January

it is necessary no later than the 20th day of the month following the expired month (

February

) in which the excess amount of revenue occurred, that is,

no later than March 20th

.

At the same time, you need to pay VAT and submit a tax return for February

.

Let us note that, according to the tax authorities, in this situation the taxpayer must pay a penalty for late payment of VAT for January.

According to paragraph 1 of Art.

75 of the Tax Code of the Russian Federation, penalties are recognized as

an amount of money that a taxpayer must pay in the event of payment of due amounts of taxes or fees later than the deadlines established by the legislation on taxes and fees.

In accordance with paragraph 1 of Art. 174 Tax Code of the Russian Federation

VAT is paid at the end of each tax period based on the actual sale (transfer) of goods (work, services) for the expired tax period no later than the 20th day of the month following the expired tax period.

Therefore, tax authorities believe that if the amount of revenue exceeded 2 million rubles, for example, in February

, then penalties for late payment of value added tax

for January

are accrued

from February 21

.

The position of the tax authorities is not indisputable.

Indeed, until the maximum amount of revenue was exceeded, the taxpayer was obliged to pay VAT no later than the 20th day of the month following the expired quarter

.

That is, until the maximum amount of revenue was exceeded, the taxpayer had no obligation to pay VAT for each month.

On the other hand, the right to pay VAT quarterly

arises for the taxpayer only if

in each month of the quarter

the amount of revenue from sales (excluding VAT) does not exceed 2 million rubles.

Otherwise, the taxpayer does not have

.

That is, in this quarter he must pay VAT monthly

.

Since there is no clear arbitration practice on this issue, it is impossible to predict which side the court will take in the event of litigation.

Please note that if the maximum amount of revenue (2 million rubles) is exceeded in the 3rd month of the quarter (for example, in March), then it is necessary to submit to the tax authorities not one tax return (for the quarter), but three tax returns

(for each month).

Indeed, in this case, the taxpayer does not have the right to pay tax and submit a tax return quarterly.