Closing an individual entrepreneur is a fairly simple procedure. First, the entrepreneur must submit an application to the tax office on form P26001 and pay a fee of 160 rubles. After five working days, the Federal Tax Service will deregister it and make a corresponding entry in the Unified State Register of Individual Entrepreneurs.

But there is one more mandatory step - submit the last declaration according to your regime and finally pay off the budget. If you don’t do this, you will still have to communicate with the Federal Tax Service after the closure of the individual entrepreneur, but in a negative tone. After all, the former entrepreneur will be fined for failure to fulfill his duties.

For those who worked on a simplified taxation system, we have prepared a sample simplified taxation system declaration when closing an individual entrepreneur. Be sure to check it out because the simplified tax reporting form has changed as of March 20, 2021.

How to prepare for the closure of a sole proprietorship

The presence of an application to close an individual entrepreneur in form P26001 is a prerequisite for terminating activities. Only after this will it be possible to receive a notice of deregistration of an individual entrepreneur. At the end of the described procedure, it is allowed to close the individual entrepreneur and deregister from the Federal Tax Service.

Before proceeding to filling out the document, you must pay a fee for closing an individual entrepreneur in the amount of 160 rubles (as of 2021). If there are employees on staff, you need to ensure that they are notified of the fact of termination of the company’s activities at least 2 months in advance. It is recommended to do this in written format. Otherwise, the action is regarded as a violation of labor laws.

Submission of an application to the tax authority is carried out in paper or digital form. In the second case, you need to have your own digital signature. The application is considered within 5 working days from the date of submission. You will need to submit a tax return, even if the figures in it are zero.

Until 2013, it was also required to attach a certificate from the Pension Fund stating that the individual entrepreneur has no debts to the Pension Fund. However, this is no longer a mandatory requirement. The tax office independently sends a request to the Pension Fund.

Submitting reports is greatly simplified thanks to the Astral Report 5.0 web service.

Let's fill out the declaration

In our example, we will fill out the title page, sections 1.1 and the two-page section 2.1.1. The declaration will have 4 pages in total. At the top of each of them we will indicate the TIN.

On the title page we will indicate code 50. All other fields on the title page look standard.

Section 1.1 summarizes the results for the “income” object, so let’s start filling out the declaration from section 2.1.1.

We are looking at an example with a regular tax rate of 6%, the tax rate attribute code is 1.

Our individual entrepreneur has no employees, taxpayer indicator is 2.

Fill out the “Amount of income received” block. Anton completed his entrepreneurial activity in the 2nd quarter, so line 112 “income for 9 months” will remain empty. Income for the six months is transferred to line 113 “income for the tax period”.

- 110 - 185,000 rub.

- 111 - 210,000 rub.

- 112 –

- 113 - 210,000 rub.

After the next changes, line 124 appeared in the declaration. It is filled out by those who work at a reduced rate. You can read about this in the article “New in the declaration for business with a reduced rate.” We will put a dash in this line.

The “Amount of calculated tax” block looks like this:

- 130 - 11100 rub.

- 131 - 12600 rub.

- 132 –

- 133 - 12600 rub.

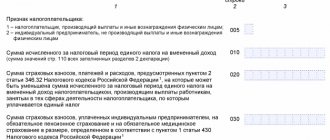

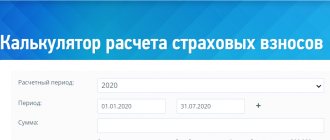

In the “amount of insurance premiums” block we will show everything that was transferred before closing:

- 140 - 10803 rub.

- 141 - 12253 rub.

- 142 –

- 143 - 12253 rub.

Now let's return to section 1.1. On this page, fill in the line “OKATO code” - the code of the administrative-territorial entity. Our individual entrepreneur paid a little less in insurance premiums than the single tax. In line 020 we will enter an advance payment based on the results of the 1st quarter - 297 rubles. And in line 100 we will show the additional payment for the year - 50 rubles.

Now all that remains is to sign the declaration and submit it to the inspectorate. You can take it to the tax office in person, send it by mail in a valuable letter with a list of the attachments, or send it electronically.

Submission of reports upon closure of individual entrepreneurs

Closing an individual entrepreneur involves submitting reports to various authorities. The following must be submitted to the tax office:

- application for termination of the company's activities, liquidation declaration for 2022 - depends on the chosen taxation system;

- submission of reports when closing an individual entrepreneur includes the calculated 6-NDFL, as well as certificates in the 2-NDFL form;

- calculated insurance premiums for employees.

It is important to take a responsible approach to meeting deadlines.

A declaration under the simplified tax system must be submitted by the 25th of the month in which the individual entrepreneur’s liquidation is recorded in the Unified State Register of Entrepreneurs.

The OSNO declaration must be submitted within the following deadlines: for personal income tax - within 5 days from the date of termination of activity, a VAT report - in the standard manner, that is, before the 25th day of the next month.

With the patent system, everything is simpler: there is simply no need to submit reports.

But the declaration under the Unified Agricultural Tax must be submitted before the 25th day of the month following the date of entry into the Unified State Register of Individual Entrepreneurs about the liquidation of the individual entrepreneur.

You also need to remember about submitting reports to the Pension Fund and the Social Insurance Fund. The following reports are required to be submitted to these funds:

- 4-FSS to the Social Insurance Fund, calculated for the period from the beginning of the year to the date of filing the document;

- reporting on personalized accounting to the Pension Fund.

Closing an individual entrepreneur becomes possible only after sending a number of papers. It is necessary to submit individual information for each employee in accordance with the ADV-1 form, not forgetting to add SNILS. The list of required documents also includes SZV-M, SZV-TD, DSV-3, SZV-STAZH.

Application of a simplified taxation system

The Tax Code of the Russian Federation provides for a deadline for submitting a declaration on the occasion of the abolition of an individual entrepreneur operating under a simplified taxation scheme. This must be done no later than the 25th day of the month following the month of cessation of activity. At the same time, the merchant must pay tax obligations. The taxpayer provides the tax authorities with a notice of termination of the individual entrepreneur’s work no later than 15 days from the date of closure. The Federal Tax Service of the Russian Federation issued an order dated July 4, 2014, in which it approved the Procedure for entering specific data into the declaration under the simplified system.

Appendix No. 1 of this document contains the following codes for the liquidation of individual entrepreneurs:

- 50 – indicates the last tax period of the individual entrepreneur;

- 34 - indicates the calendar year;

- 96 – denotes the last calendar year when the individual entrepreneur is stopped according to the simplified system;

- 0 – IP liquidation code.

When an enterprise is liquidated, the merchant must submit a zero declaration under the simplified system (profitability). Tax laws oblige entrepreneurs to file a declaration at their place of registration, no later than April 30 after the last calendar year. In this case, the tax code does not provide any alternative deadline for filing such documentation (even if the company is liquidated). Declaratory business paper when stopping the work of an individual entrepreneur must be submitted by the entrepreneur no later than May 3 after the last calendar year. This means that an individual, no longer acting as a businessman, can present a tax return to the tax authority.

At the same time, the Ministry of Finance states that an individual is obliged to submit a declaration to the tax authority and pay the tax established for the period of entrepreneurial activity. In this scenario, in accordance with the decree of the tax service mentioned above, the tax period code will be 50.

Closing an individual entrepreneur without employees

Filing reports when closing an individual entrepreneur becomes much easier if there are no employees on staff. In this case, you can get by by submitting an application in form P26001 and paying a state fee in the amount of 160 rubles. However, the second condition is not necessary to fulfill when sending documentation in digital format. This also applies to the MFC and the notary. It is advisable to submit a document indicating that information has been submitted to the Pension Fund.

In this case, you are allowed to send an application before repaying debts on individual entrepreneurship. Having received an official notice of termination of activity, you will need to take care of repaying debts within 15 days.

Application form according to form P26001

Penalties for late submission of tax returns

The Tax Code, in Article 119, stipulates that the state imposes a fine on an entrepreneur in case of violation of the deadline for submitting a declaration. The penalty is 5 percent of the unpaid taxes, in addition to the taxes themselves. To calculate this amount, information from declarations is taken as a basis, monthly from the date of filing. The maximum fine is 30 percent of the total tax, the minimum is 1 thousand rubles.

The Code of Administrative Offenses, in turn, collects a fine from the entrepreneur in the amount of 300-500 rubles for violating the filing deadlines.

Closing an individual entrepreneur with employees

If the individual entrepreneur worked with hired employees on staff, the closure procedure becomes somewhat more complicated. You need to proceed according to the following scheme.

First you need to resolve the issue with the employees. This applies to calculations, as well as filing reports and paying fees for each of them. A package of papers must be prepared for each employee. It is required to issue an order to terminate the employment contract, then an entry is made in the work books by analogy with what was made in the order. The next step is to add an entry to the employee’s personal card. It is required to present it to the employee himself for review, followed by signature. On the day of dismissal, each employee must receive a set of documentation: SZV-STAZH, certificate 2-NDFL, STD-R, work book. It is also important to promptly accrue wages to employees and compensation for unused vacation days.

Then you need to deregister the cash register. Then the issue with counterparties and other matters are resolved.

What else needs to be done when closing an individual entrepreneur

Filing reports is not the entire list of mandatory actions when closing an individual entrepreneur. To complete the liquidation procedure, you will need to complete the following steps:

- Notify the employment service about the reduction of employees. Notice must be sent at least 2 months before the date of dismissal.

- Pay off existing debt on tax deductions and contributions. Otherwise, you will have to pay debts like an ordinary individual.

- Deregister the cash register if it exists. It is required to submit a corresponding application to the territorial tax authority. This can be done online, through the Federal Tax Service website.

- Notify counterparties about the closure of the individual entrepreneur. It is also worth requesting reconciliation reports to identify debts, if any.

- Close your bank account.

All the necessary functionality for working with reports during the termination of an individual entrepreneur’s activities is contained in 1C-Reporting. With its help, you can perform the necessary actions as simply and quickly as possible.

Tax period - quarter

A quarter is a tax period for the following taxes:

- VAT (Article 163 of the Tax Code of the Russian Federation);

- water tax (Article 333.11 of the Tax Code of the Russian Federation);

- UTII (Article 346.30 of the Tax Code of the Russian Federation).

If the tax period for the relevant tax is a quarter, the end date of the tax period is determined taking into account the provisions established by clause 3.2 of Art. 55 Tax Code of the Russian Federation:

| Period of termination of an organization through liquidation or reorganization | Last tax period |

| Until the end of the quarter | The period from the beginning of the quarter in which the organization was terminated until the day of state registration of termination |

| The organization was created and terminated in one quarter | The period from the date of creation of the organization to the day of state registration of termination as a result of liquidation or reorganization |

| The organization was created less than 10 days before the end of the quarter and terminated before the end of the quarter following the quarter in which the organization was created |

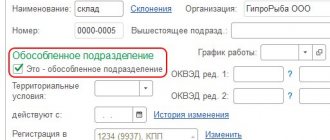

How to reflect the closure of an individual entrepreneur in 1C

When working in the 1C program, the closure of an individual entrepreneur can be reflected as follows. You need to go to the “Main” section to the “Taxes and reports” item, here select “Insurance premiums (IP)”. This is where you will need to uncheck the item called “PFR and FFOMS”. You should also indicate the date following the day of publication in the Unified State Register of Entrepreneurs of data on the termination of activities as an individual entrepreneur, and click OK.

If an individual entrepreneur plans to change his status to self-employed, he must select “Taxation system” in the same paragraph and check the box next to “Tax on professional income.” It is necessary to enter the date of submission to the Federal Tax Service of the application for registration as a payer of NAP.

Zero reporting

When liquidating an individual entrepreneur, you must submit a declaration, even if there was no income during the reporting period. In this case, a “zero” individual entrepreneur declaration is submitted. The difference between filling out such a declaration and a regular one is that income, advance payments and insurance premiums of the individual entrepreneur are not indicated. Let's consider filling out the zero declaration of individual entrepreneurs on the simplified tax system with the object of taxation “income”.

The declaration will be presented on three pages.

- The first page is filled out according to the general rules for filling out the title page.

- The second page is section 1.1. Advance payments and taxes are not specified, only the OKTMO code is indicated.

- Third page – section 2.1.1. We leave the fields with income and taxes empty, fill in the rest.

If the object of taxation is “income minus expenses,” then on the second page (section 1.2) only the OKTMO code is entered, and on the third (section 2.2) all fields with income, expenses and taxes are skipped.

Obligations after closure of the individual entrepreneur

Termination of activities as an individual entrepreneur does not relieve one from liability to creditors. Article 24 of the Civil Code of the Russian Federation states that a citizen will have to answer for obligations with existing property. This means that all debts will be collected as from an individual - through the courts or through bankruptcy proceedings. The second option is also chosen in a situation where the debtor does not pay for 3 months. However, in this case, it will be prohibited to conduct business for 5 years, and in some cases, traveling abroad will also be prohibited. As a result of the trial, a decision may be made: a settlement agreement, restructuring of the existing debt, or sale of property.

It is important to fulfill obligations to the Pension Fund. An individual entrepreneur is his own employer, so you need to pay insurance premiums on time during your stay as an individual entrepreneur. You will need to pay the debt to the Pension Fund even after the closure of the individual entrepreneur.

Basic mistakes when closing an individual entrepreneur

The procedure for closing an individual entrepreneur involves performing an impressive list of actions. It is necessary to pay off employees, submit reports to the Federal Tax Service, etc. In this case, there is a risk of making mistakes. The most common are the following:

- Late submission of reports to the tax office. Liquidation of an individual entrepreneur implies the need to pay tax contributions within 15 days.

- Failure to deregister a cash register. The cash register equipment used must be deregistered before sending the application to close the individual entrepreneur.

- Destruction of documents. Storage of papers is mandatory for the next 4 years from the date of liquidation of the company. In the case of personnel documents, this period increases to tens of years. This includes orders for the hiring and dismissal of employees, their personal files and cards, bills, etc. It is enough to keep receipts and payment documents for 6 years.

Individual entrepreneurs who decide to cease operations must act correctly. This also applies to the correct termination of employment relationships with employees. In the absence of debts, timely payment of contributions and tax deductions, the procedure for closing an individual entrepreneur takes anywhere from several days to a calendar month.

Tax period - month

The month is the tax period for the following taxes:

- excise taxes (Article 192 of the Tax Code of the Russian Federation);

- mineral extraction tax (Article 341 of the Tax Code of the Russian Federation);

- tax on gambling business (Article 368 of the Tax Code of the Russian Federation).

If the tax period for the relevant tax is a month, the end date of the tax period is determined taking into account the provisions established by clause 3.4 of Art. 55 Tax Code of the Russian Federation:

| Period of termination of an organization through liquidation or reorganization | Last tax period |

| Until the end of the month | The period from the beginning of the calendar month in which the organization was terminated until the day of state registration of termination |

| The organization was created and terminated in one calendar month | The period from the date of creation of the organization to the day of state registration of termination as a result of liquidation or reorganization |