Own working capital in our lives

Own working capital - this term is not typical for everyday life. It is usually used by financiers of various enterprises, companies and organizations. However, any person who is in no way connected with commerce can also calculate this value and draw certain conclusions about their own working capital.

Example

Mechanical shop mechanic Nikolai Semenov has never been involved in commerce. From his early youth he worked at a factory, lived in a dormitory and, apart from his salary, had no other sources of income. The payment for his work was small, and from advance payment to payday, Semenov had to borrow money from his neighbor and childhood friend Sergei Ivanov.

To calculate Nikolai’s own working capital, you will need to know his current assets and current liabilities. For a simplified calculation, we will assume that Nikolai has no property or own reserves, and his salary is 10,000 rubles.

It should be noted that the indicator of own working capital is calculated on a certain date and at each moment can have different values. Let's calculate the working capital of a mechanic on the day he receives his salary.

On payday, Nikolai had no cash in his pocket, and the debt to his neighbor amounted to 5,000 rubles. In addition, in the mailbox there was a receipt for payment for accommodation in the hostel in the amount of 2,000 rubles. Thus, at the time of receiving his salary, his working capital amounted to 3,000 rubles. (10,000 – (5,000 + 2,000)).

Check whether you have correctly calculated the amount of your own working capital and the supply ratio using the balance sheet, with the help of advice from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

The example given is simplified and has no practical significance for Nikolai, since he has never done calculations and has not analyzed the efficiency of his working capital. However, it allows you to understand the formula for calculating your own working capital, which is the difference between current assets (salary) and current liabilities (debt for the hostel and to your neighbor).

Next, let’s look at the example of calculating the own working capital of a commercial company, learn about another algorithm for determining its value, and also talk about why it is necessary to calculate the company’s working capital.

Own working capital of a commercial company

At the initial stage of any commercial activity, an entrepreneur organizing a business, in addition to the desire to earn money, requires start-up capital. Such capital can be cash, equipment, real estate or other assets. They are the ones who allow a businessman to start his own business, because entrepreneurial abilities alone are not enough. However, not all assets can be used equally effectively for commercial activities, especially at the initial stage of development of the company.

For example, an entrepreneur has the skills and knowledge in the field of manufacturing disposable tableware; he has specialized equipment for its production at his disposal. However, the lack of money for the purchase of raw materials can reduce all his endeavors to zero - without consumables, the equipment will stand idle, and knowledge and skills will not be in demand. And in order to purchase this material, free funds are required. Where can I get them?

There are various ways to get the necessary amount: take a loan from a bank, ask for a loan from friends, sell your own property or invent other ways to get money. The resulting funds will allow us to purchase the necessary raw materials and materials, launch equipment and begin production.

The main purpose of working capital is to finance the current activities of the company, therefore, calculating the value of the working capital indicator will allow the businessman to understand whether the company has enough capabilities to uninterruptedly organize the production process without downtime and disruptions.

The formula for calculating working capital will be discussed in the next section.

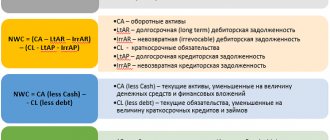

The first formula for calculating working capital: composition of indicators

Working capital is calculated based on the balance sheet indicators.

For more information about existing types of balance sheets and their structure, see the article “Balance sheet (assets and liabilities, sections, types)”

In the 1st section, we have already become acquainted with one of the formulas used in calculating our own working capital (WCC):

JUICE = TA – TO,

where TA and TO are current assets and current liabilities, respectively.

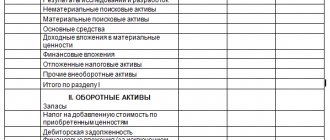

To calculate working capital using this formula, you need the indicators of sections II and V of the balance sheet. Let's look at them in more detail.

Section II “Current assets” of the balance sheet includes 6 main lines, which list the most liquid assets (property that is easily converted into money). The most effective in terms of availability as part of a company’s working capital are cash: they can be used at any time to pay for the resources necessary to maintain current activities. It is enough to issue a payment order and send it to the bank or pay suppliers in cash from the cash register.

Along with money, the calculation of working capital involves cash equivalents, which usually include assets that are quickly convertible into money. An example of cash equivalents is short-term bank deposits on demand (up to 3 months). In the absence of cash, this asset can most quickly be converted into money necessary to maintain the continuity of the technological chain of production.

The current assets involved in the calculation of working capital also include such balance sheet asset indicators as inventories and accounts receivable. These are less liquid assets compared to money, and converting them into money will require additional time and effort. However, all specified assets (including VAT and other current assets) constitute the total amount of current assets (TA) participating in the working capital calculation formula.

We will talk about the composition of current liabilities (CL), deducted from the amount of current assets when calculating working capital, in the next section.

Second method of determination: formula

Another calculation option involves data on current assets and short-term liabilities (financial). It takes the following form:

SOK = OA – KFO, where

- ОА – amount of current assets (line code 1200)

- KFO – short-term financial liabilities (take line code 1500)

Important! In a situation where the company's equity is financed not only by its short-term but also long-term borrowings, their size must also be subtracted. The formula will be like this:

SOK = OA – KFO – DO

OA constitute Section 2 of the balance sheet and include the following items: inventories, accounts receivable, financial investments (short-term) and the most liquid component - cash. CFOs form Section 5 of the balance sheet.

How do short-term liabilities affect the amount of working capital?

The company's working capital indicator directly depends on the amount of current (short-term) liabilities. The greater the amount of current debts, the lower the working capital (with current assets remaining unchanged).

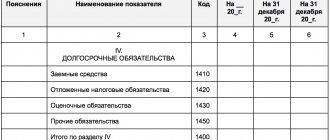

Presented in Section V, Current liabilities on the balance sheet are current liabilities (CL). The Current Liabilities section in the balance sheet is line 1510-1550. Current liabilities include: loans, debt to creditors, reserves for future expenses, expected future income, as well as other obligations. The other short-term liabilities indicated on page 1550 in the balance sheet are data on liabilities that are very significant for the enterprise, which were not taken into account on pages 1510-1540. For example, funds received from investors of a development company in the form of targeted financing.

The most important from the point of view of urgency of repayment are borrowed funds (1510): such debts must be repaid regularly, and late payment is fraught with additional costs in the form of fines provided for in loan agreements.

Accounts payable (1520) not repaid on time also entails negative consequences. For example, having a salary not paid on time (short-term obligations) will require additional material expenses, because you will have to find funds to pay compensation. Its size is calculated based on 1/300 of the refinancing rate for each day of delay, unless otherwise established by the collective agreement (Article 236 of the Labor Code of the Russian Federation). This money will have to be withdrawn from circulation, and there may not be enough funds to support current economic activities.

If a company has overdue tax obligations, it may also entail additional expenses for the payment of penalties and fines.

For information about what punishment a company will face if it transfers personal income tax to the budget late, see the article “What is the liability for non-payment of personal income tax?”

Long-term and short-term liabilities (Sections IV and V of the balance sheet) are sources of funds for the enterprise, with the exception of capital and reserves (Section III). Current liabilities include all debts that are due within a year, while long-term liabilities have a maturity of one year or more.

The more money is required to pay off short-term obligations, the greater the need for working capital to ensure current activities and, as a result, the lower the amount of working capital.

In the next section, you will learn how to calculate your own working capital using completely different balance sheet indicators.

The absolute value of each component of working capital

The company's working capital consists of the following components:

- Inventories (materials, goods, work in progress)

- Accounts receivable

- Short-term financial investments

- Money in accounts and in the cash register

- Accounts payable

- Advances received from buyers

- Advances paid to suppliers

- Tax advances.

The most liquid are money and securities that can be quickly converted into money. It is important to take into account the influence of each component separately when analyzing. To do this, calculate the absolute value for each position and the total amount of working capital. At the same time, too slow turnover of receivables and payables ultimately leads to the appearance of zero working capital of the enterprise. A constant increase in accounts receivable and payable, in turn, may indicate an increase in the outflow of funds to pay interest for deferred payments to suppliers and the emergence of unwanted, doubtful debts from buyers.

The second formula for own working capital

Own working capital, the formula of which was discussed in the previous section, can be calculated using a different algorithm. In this case, the indicators of sections I, III and IV of the balance sheet will be used.

In this case, the calculation of own working capital (WCC) will be made using the following formula:

JUICE = SC + DO – VNA,

where: SK - equity capital reflected in section III of the balance sheet;

DO - long-term liabilities (section IV);

VNA - non-current assets of the company from section I of the balance sheet.

Let's talk about them in more detail.

The influence of equity capital on the amount of own working capital can be seen in the following example.

Example

The minimum amount of authorized capital (AC) for a limited liability company is 10,000 rubles. (Clause 1, Article 14 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ). If a merchant deposited the specified amount into a current account and began to develop a business, he will have to additionally find working capital in order to pay the expenses necessary for current activities (for example, renting an office, purchasing materials and components, etc.). If the size of the management company were several orders of magnitude larger, he would not have had to think at the initial stage of his activity about where to find the required working capital.

Together with the authorized capital, the calculation of own working capital includes indicators of additional and reserve capital, as well as retained earnings (uncovered loss) and the amount of revaluation of non-current assets.

From section IV of the balance sheet, to determine the amount of own working capital, indicators such as long-term borrowed funds, estimated liabilities, deferred tax liabilities and other long-term liabilities are taken.

The amount of equity capital and long-term liabilities of the company is reduced by the amount of assets reflected in section I of the balance sheet (non-current assets). As a result of these calculations, the company's own working capital is determined.

In the next section, a practical example will show the algorithm for calculating your own working capital using the 2 formulas discussed.

Calculation formula

Own working capital is found in several ways. This is always an absolute value and is expressed only in monetary terms, in contrast to the various coefficients derived from it.

1 formula:

SOS = AO - OK, where:

- JSC – current assets;

- OK – short-term liabilities.

Current assets are circulating funds and circulation funds. These include raw materials, supplies, fuel, finished products, and accounts receivable. The indicator is expressed in money.

According to the balance, the SOS value is found as follows:

SOS = page 1200 – page 1500, where:

- Page 1200 – line value 1200 (total for section II);

- Page 1500 – line value 1500 (total for section IV).

2 formula:

SOS = (KS + OD) - AB, where:

- KS – equity capital;

- OD – long-term liabilities;

- AB – non-current assets.

The balance sheet looks like this:

SOS = page 1300 + page 1400– page 1100, where:

- Page 1300 – line value 1300 (total capital);

- Page 1530 – line value 1400 (long-term liabilities);

- Page 1100 – value of line 1100 (cost of non-current assets).

For all formulas, data for calculations should be taken for a certain period. If you have figures for the beginning and end of the period, you can find the average value in this way (using the example of Ks - equity capital):

Δ KS = (KS LF + KS CP) / 2, where:

- KS NC – the amount of equity capital at the beginning of the period;

- KS KP – the amount of equity capital at the end of the period.

Example of RNS calculation

The formulas for own working capital (WCC), discussed in the previous sections, are based on completely different balance sheet indicators, but lead to the same result. Let's consider both options for calculating the SOC using the example of the following balance sheet indicators:

| Indicator name | Code | As of December 31, 2020, thousand rubles. |

| Assets | ||

| I. Non-current assets | ||

| Fixed assets | 1150 | 430 |

| II. Current assets | ||

| Reserves | 1210 | 100 |

| Accounts receivable | 1230 | 20 |

| Financial investments (excluding cash equivalents) | 1240 | 34 |

| Cash and cash equivalents | 1250 | 90 |

| BALANCE | 1600 | 674 |

| Passive | ||

| IV. Capital and reserves | ||

| Authorized capital | 1310 | 10 |

| retained earnings | 1370 | 104 |

| V. Long-term liabilities | ||

| Borrowed funds | 1410 | 350 |

| VI. Short-term liabilities | ||

| Accounts payable | 1520 | 210 |

| BALANCE | 1700 | 674 |

1st calculation option:

SOC = (100,000 + 20,000 + 34,000 + 90,000) – 210,000 = 34,000 rub.

2nd calculation option:

SOC = (10,000 + 104,000) + 350,000 – 430,000 = 34,000 rub.

In various sources, own working capital is called net working capital (NWC) or working capital (WK), since it shows the amount of funds remaining with the company after paying off current debts and is in constant circulation (work). In any case, own working capital is the most important characteristic of the capital involved in the current activities of the company.

A good example

Let's look at an example of calculation using specific numbers. To do this, we provide conditional data for reporting that does not exist as of December 31, 2016 (thousand rubles):

- 97 415 – VNA

- 103 480 – OA

- 61,500 – UK

- 65 103 – BEFORE

- 74 292 – KFO

Calculation examples

We check that the amount of assets and liabilities in the company’s balance sheet is equal:

97 415 + 103 480 = 61 500 +65 103 + 74 292 = 200 895

Let's calculate the value of SOC as of the reporting date in two versions.

Option 1. Let's assume that long-term loans and credits are aimed at financing the company's BNA, which corresponds to the norm. In this case:

- first method 61,500 – (97,415 – 65,103)

- second method 103,480 – 74,292 = 29,188

It can be seen that according to both formulas the result was the same: 29,188 thousand rubles. If this does not happen, there was an error in the calculations.

The result is a positive number. This means that according to this indicator the company will be considered financially stable. Current assets in the amount of 29,188 thousand rubles. financed from the company's internal sources. VNA in the amount of 65,103 thousand rubles. are formed with the help of attracted external long-term sources, the rest (32,312 thousand rubles) - from their own money.

Option 2. Due to long-term obligations, the enterprise forms an OA, which initially does not correspond to the norm. The calculations are as follows:

- the first way 61,500 – 97,415

- the second way 103,480 – 74,292 – 65,103

As you can see, the indicator is negative and amounts to -35,915 thousand rubles. The company is in a difficult financial situation. The company's own funds are not enough to form an OA; the company is not able to pay off its current debts using only funds in circulation.

The two calculation options considered show that the same balance sheet data can be interpreted differently and lead to opposite results. It is important to correctly evaluate and classify long-term loans and borrowings. Without knowing the purposes and directions of their use, it is impossible to correctly determine the SOC. In reality, the entire volume of long-term borrowings of an enterprise does not have one purpose of use. Therefore, it is necessary to carefully analyze all available loans.

In general, to maintain a normal level of the indicator under consideration, and therefore ensure the financial stability of the company, the following should be done:

- strive to obtain and increase profits

- optimize non-current assets of the enterprise

- monitor the size and quality of accounts receivable

- do not allow the use of long-term liabilities to form current assets

- maintain an optimal balance structure

These measures will help the normal functioning of the enterprise. Using the indicator, you can assess whether a company is able to pay off its short-term debts with liquid funds.

Top

Write your question in the form below

Why do you calculate your own working capital?

Calculation of own working capital helps to estimate the amount of own and equivalent funds aimed at financing current assets. RNS can be either positive (> 0), negative (< 0) or take a zero value.

Lack (shortage) of COC can lead a company to bankruptcy, since a negative value of its own working capital indicates the company’s inability to repay short-term obligations in a timely manner. This situation can be caused by various factors:

- low efficiency of use of company assets;

- the presence and increase in the remains of unfinished construction;

- growth of accounts receivable;

- unprofitability of the company;

- other factors.

But not only the lack of SOC, but also its excess has a negative impact on the company’s work. If the indicator of own working capital significantly exceeds the optimal need for it, we can talk about low efficiency in the use of the company's resources. An example of such irrational use of SOC may be obtaining loans in excess of required needs or irrational use of profits from business activities.

Zero own working capital is typical for newly created companies, as well as companies whose working capital is financed entirely from borrowed funds.

Analysis of the RNS helps to take timely measures to optimize it. Such measures include reducing working capital in inventories, which is achieved by reducing the excessive number of inventories in the company’s warehouses, organizing work to collect accounts receivable and other measures.

Calculation of the indicator “own working capital”

Data on own working capital is formed on the basis of information contained in the balance sheet, which is the main source of information for analyzing the activities of the enterprise.

How the lines of the balance sheet are deciphered can be found in the article “Deciphering the lines of the balance sheet (1230, etc.).”

Various methods for analyzing the balance sheet of an enterprise are shown in the material “Methodology for analyzing the balance sheet of an enterprise.”

First of all, from the balance sheet you can obtain data on the assets and liabilities of the enterprise.

Enterprise assets are economic assets, control over which is obtained by the organization as a result of accomplished facts of economic activity and which should bring it economic benefits in the future.

Assets are divided into non-current and current, while own working capital is understood as that part of current assets that is financed from own sources.

Here is the formula for calculating our own working capital:

SOS = OA – KO,

Where:

SOS - own working capital;

OA - current assets;

KO - short-term liabilities.

Often the concept of “own working capital” is confused or considered synonymous with the concept of “own working capital”. Own working capital and own working capital have the same numerical value, but different economic meaning. If own working capital is part of the assets and resources aimed at making a profit, then equity capital is part of the long-term sources of financing through which own working capital is formed.

The formula for calculating your own working capital looks like this:

SOK = (SC + DO) – VA,

Where:

SOK - own working capital;

SK - equity capital;

DO - long-term liabilities;

VA - non-current assets.

The method for calculating your own working capital is quite simple, but at the same time you need to be able to interpret the obtained value and establish its relationship with other analytical indicators.

In the most general case, a positive value of own working capital is considered normal.

How the coefficient of provision with own working capital is calculated is shown in the article “Ratio of provision with own working capital”.

In practice, both an increase and a decrease in the value of this indicator can have different effects on the liquidity, financial stability and business activity of the enterprise. The composition of own working capital includes various assets: cash, accounts receivable, inventories. Changes in these components in dynamics and relative to each other can significantly change the structure of its own working capital and have a different impact on the financial position of the enterprise.

Results

Own working capital can be calculated in different ways using balance sheet figures. It characterizes the volume of the company’s own and equivalent funds aimed at financing current assets.

Analysis of the calculated amount of own working capital helps to take timely measures to optimize it and increase the efficiency of the company.

Sources: Federal Law of 02/08/1998 No. 14-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.