Notify employees and employment services

People need time to get a new job, so notifying employees of the upcoming layoff should be the first step towards closing the individual entrepreneur.

The procedure for dismissing employees due to the closure of individual entrepreneurs is regulated by the Labor Code of the Russian Federation. Here's what it looks like:

- Employees must be notified two months prior to termination. There is no single form of notification; each company develops its own format. To save time, you can use a sample notice of dismissal form. Make sure every employee signs the notice. The employee’s signature is confirmation of the entrepreneur’s compliance with labor laws, which means he is protected from possible complaints from former employees.

- In accordance with Art. 25 of the Federal Law “On Employment in the Russian Federation”, no later than two weeks before upcoming layoffs, it is necessary to notify the employment service. If there is a mass layoff (more than 15 people), give them three months' notice. The employment service must be notified so that it is ready if it becomes necessary to find new jobs for dismissed employees. There is no uniform notification form for all employers, so you can compose it in any form. The main thing is to reflect in it information about the specialty, qualifications and conditions of remuneration of dismissed workers. Or use the sample notification form from the employment service, simply adding the necessary data there.

- For each employee, a dismissal order should be prepared in Form T-8. Make sure each employee reads and signs their order.

- On the last working day, the employee must be issued a work book and make a final payment. The final calculation should include salary and compensation for unused vacation. Don't forget about employees on parental leave. They are also entitled to a part of the child care allowance, in proportion to the part of the month until the last working day. The procedure for calculating benefits for less than a full month is described in detail in Part 5.2 of Article 14 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity.”

The employer is obliged to give two months' notice of dismissal and pay severance pay if such a condition was stipulated in the employment contract. However, often dismissed employees go to court due to the fact that the employer did not notify them of dismissal exactly two months in advance or did not pay benefits. And the courts sometimes satisfy such claims, regardless of the provisions of the employment contract. To protect yourself from litigation with former employees, it is better to notify them within two months and pay severance pay, even if this is not specified in the employment contract.

Remove the cash register from tax registration

There is no liability for the entrepreneur for failure to deregister the cash register. But in practice, an unlocked cash register will raise suspicions: what if the former entrepreneur continues to use it, bypassing the tax office? Therefore, when closing an individual entrepreneur, it is better to deregister the cash register yourself.

The procedure for deregistration of a cash register is defined in Art. 4.2 Federal Law No. 54 “On the use of cash register equipment when making payments in the Russian Federation.” This is what he looks like.

To close the cash register, it is necessary to prepare an application for deregistration of the cash register and a report on the closure of the fiscal drive.

The application must indicate the individual entrepreneur's details, as well as the name and serial number of the cash register.

In accordance with Federal Law No. 54, modern cash registers must be equipped with a fiscal storage device. It is a small chip inside the cash register that stores information about all transactions performed. The fiscal data operator transmits this information to the tax office. The report on the closure of the fiscal drive confirms that no monetary transactions of the individual entrepreneur for whom the cash register is registered are no longer carried out.

To generate a report on closing a fiscal drive, follow these steps:

- In the cash register menu, select > settings > fiscal drive.

- Make sure that the drive is ready to be closed: in the column “number of documents not sent to the OFD” there will be a zero, and in the column “shift status” it will be closed.

- Click on the “replace fiscal drive” button.

- The archive will automatically close and the closing report will begin printing soon.

The application and report can be submitted in paper form or online. In paper form - to any tax office.

If it is more convenient to submit online, use the taxpayer’s personal account on the Federal Tax Service website. To do this, go to the cash register section and select “deregistration”. Following the prompts for filling out the report, fill out several fields, select the reason for deregistration of the cash register and click “sign and send”.

The tax office will process the request within 10 business days. If you submitted documents through your personal account on the Federal Tax Service website, a record of deregistration of the cash register will appear on the “cash register accounting” page. There - in your personal account - the tax office will send an electronic card about deregistration of the cash register. If the entrepreneur submitted documents in paper form, he will receive a paper card about deregistration of the cash register by mail.

The card for deregistration of a cash terminal, like all cash documents, must be stored for five years, in accordance with clause 277 of the “List of documents, indicating their storage periods,” approved by order of the Federal Archive.

Entrepreneurs working with offline cash registers, i.e. cash desks that do not transmit information to the tax office, it is necessary to copy the data of all fiscal documents and provide it to the tax authorities along with the application. To do this, it is better to contact the tax office in person. Then the inspector on the spot reads the fiscal drive data from the cash register using a special USB adapter.

Pay your partners to receive money to your current account before the closure of the individual entrepreneur

All creditors, debtors, suppliers and any partners must be notified of the closure of the individual entrepreneur. If the individual entrepreneur ceases to exist, then the contracts concluded on his behalf will lose force. Partners have the right to know about this in advance.

Settlements with creditors and debtors must be made before the termination of the individual entrepreneur’s activities.

An entrepreneur can send or receive money to pay off a debt to his current account, and this will not arouse any suspicion. It is more difficult for an individual without individual entrepreneur status to collect a debt from a company. If an organization transfers money to pay off a debt from its current account to the bank card of an individual who is a former entrepreneur, this may cause increased interest from tax authorities. They may regard such a tranche as income and require the organization transferring the money to pay personal income tax.

Therefore, try to pay off creditors and collect from debtors before you close the business. This way, no misunderstandings will arise with the tax authorities.

What to consider when adjusting the “simplified” tax on insurance premiums when closing an individual entrepreneur

This usually applies to individual entrepreneurs who use OSNO with the object of taxation in the form of income. In this case, you have the right to reduce the total amount of fees. If there are employees, this reduction reaches a maximum of 50%. If they are not there, then the reduction occurs by the full amount.

The moment of transfer of money most often occurs after an entry has appeared in the Unified State Register of Entrepreneurs confirming the termination of activities.

That is, an individual already pays, not within the current tax system. This means that payments that were made after this point cannot be taken into account.

When closing, an organization may face debts not only to the pension fund, but also to other organizations, private and public. Tax debt is a situation that many people face. The organization can be closed only after all relevant payments have been transferred. In connection with this issue, additional expenses often arise.

Therefore, it remains a mandatory requirement to provide a tax return for the entire period while business activity was carried out. This is done even if the activity itself was actually absent.

In this case, in the column for income and expenses of the company, they simply put zeros. A report is needed only for the latest tax period, if previously documents were submitted on time. The issue can be resolved a maximum of 5 days after liquidation, if the issue was not resolved within another time frame for one reason or another.

The property of a former entrepreneur can be used as payment for debts if he currently lacks finances.

Submit final reports for employees so as not to receive a fine

If an individual entrepreneur has employees, before closing the enterprise it is necessary to submit reports to the tax office, the Pension Fund and the Social Insurance Fund. Entrepreneurs without employees can skip this step.

Individual entrepreneurs with hired employees most likely have already had to submit reports at least once, since they are submitted monthly and quarterly. If not, we will tell you where you can and see the order of filling them out.

You need to submit a calculation of insurance premiums (DAM), certificates 2-NDFL and 6-NDFL to the tax office. The form and procedure for filling out the RSV can be downloaded in the appendix to the order of the Federal Tax Service dated September 18, 2019, the form and procedure for filling out certificate 2-NDFL - in the appendix to the order of the Federal Tax Service dated 02.10.2018, the form and procedure for filling out certificate 6-NDFL - in the appendix to the order of the Federal Tax Service dated 10/14/2015.

Reports SZV-M and SZV-STAZH should be submitted to the Pension Fund. The SZV-STAZH form can be downloaded from the Resolution of the PFR Board dated December 06, 2018, and the SZV-M form can be downloaded from the PFR website in the “for policyholders” section.

And finally, submit a report to the FSS in form 4-FSS. You can download the form on the FSS website in the “financial reporting” section.

Important. Submit all reports for employees, except for 2-personal income tax, to the tax office and funds before the day of filing the application to close the individual entrepreneur. 2-NDFL can be submitted before April 1 of the year following the year of termination of the individual entrepreneur’s activities.

What is needed to close a sole proprietorship

Using the simplest example of an individual entrepreneur without employees, let’s look at what documents need to be submitted during the year and what to pay. Entrepreneurs in the Russian Federation are encouraged to use a general or special tax regime.

Entrepreneurs working under OSN:

- They declare income using Form 3-NDFL. (The sample for filling out the 3-NDFL declaration changed last year).

- Quarterly VAT declaration.

- Makes payments for pension and health insurance.

IP on the simplified tax system in 2022:

- Advance payments are made every three months.

- At the beginning of the new year, they submit a declaration to the simplified tax system.

- Make payments for compulsory medical insurance and compulsory health insurance.

Individual entrepreneurs using UTII in 2022:

- Makes payments to the Federal Compulsory Medical Insurance Fund and the Pension Fund.

- Provides UTII declarations quarterly.

IP on PSN:

- Makes payments to the Federal Compulsory Medical Insurance Fund and the Pension Fund.

- Reporting is submitted only if there are workers.

When using different taxation regimes, the deadlines for submission and the procedure for submitting reports differ.

Pay insurance premiums so that debts do not pass on to the individual

Debts on taxes and insurance premiums of an individual entrepreneur who has ceased operations are not canceled, but are transferred to the individual. Often, in relation to individuals - former entrepreneurs who did not pay their fees, the courts issued writs of execution with all the ensuing consequences, such as confiscation of property.

To prevent this, the entrepreneur closing the individual entrepreneur needs to pay insurance premiums for himself and for his employees (if there were any).

The entrepreneur must pay contributions for himself no later than 15 days from the date of closure of the individual entrepreneur. The date of closure of the enterprise will be considered the date indicated in the Unified State Register of Entrepreneurs record sheet. More on him later.

It is better to pay the tax office for contributions before submitting documents to terminate the activity. If any problems arise, there will be time to fix them.

According to Art. 430 of the Tax Code of the Russian Federation, for 2022 the entrepreneur is required to contribute 32,448 rubles. for compulsory pension insurance (+ 1% of income exceeding 300 thousand rubles) and 8,426 rubles. for compulsory health insurance. Total RUB 40,874. But this is the amount for a full calendar year. If the entrepreneur has not worked for the entire year, the amount of contributions is calculated in proportion to the months and days worked.

To calculate the amount of contributions due for payment, use the insurance premium calculator on the Federal Tax Service website. You just need to indicate the billing period, periods of work, income, and the calculator will calculate the amount of contributions.

Example

. Svetlana plans to close her individual entrepreneur at the end of July 2022. She decided to use an insurance premium calculator. The calculator helps you calculate your contributions quickly and avoid making mistakes. Svetlana indicated 2022 as the calculation period and work periods from 01/01/2020 to 07/31/2020. Her income for seven months of work did not exceed 300 thousand rubles, so Svetlana did not fill out the “amount” column.

The calculator instantly calculates the amount of contributions.

Amount to be paid RUB 23,843.17.

For the specified billing period, Svetlana must pay 18,928 rubles. for compulsory pension insurance and 4,915 rubles. for health insurance. Total RUB 23,843.

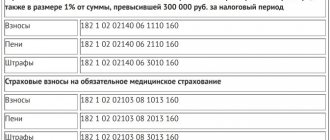

Insurance premiums for employees, on the basis of clause 15 of Article 431 of the Tax Code of the Russian Federation, must be paid within 15 days from the date of submission of the last calculation of insurance premiums. If the company does not provide for an increased or reduced amount of contributions, it is paid as standard: 5.1% for compulsory medical insurance, 22% for compulsory health insurance and 2.9% for compulsory social insurance, a total of 30%.

An entrepreneur can pay contributions both for himself and for third parties here on the Federal Tax Service website using a special service. Pay online or print a paper receipt and pay at the bank - whichever is convenient for you.

Important. On June 8, 2020, Federal Law No. 172 came into force, providing for SMEs from industries affected by the spread of coronavirus infection to write off employee contributions and taxes (except VAT) for April, May and June. This law also introduces a reduction in insurance premiums for individual entrepreneurs from affected industries by 1 minimum wage. But there is still little clarification on these issues. Therefore, if you are included in the register of SMEs from affected industries, it is better to seek clarification from the tax office before paying contributions.

Payment deadlines

According to Article 432 of the Tax Code of the Russian Federation, you need to pay contributions for individual entrepreneurs to the budget within 15 days after the date of making an entry in the Unified State Register of Entrepreneurs about the termination of activities. For example, if an individual entrepreneur is closed on April 1, then the payment deadline is April 15.

Contributions from employee salaries are paid no later than 15 calendar days from the date of submission of the last DAM to the inspection of the Federal Tax Service of the Russian Federation3. Let us remind you that this report is submitted before submitting application P26001.

If you pay contributions after these deadlines, you will have to pay an additional penalty for each day of delay.

Payment deadlines apply to the period when you have ceased to be an entrepreneur. The tax according to the simplified tax system (income) cannot be reduced by the amount of payment of insurance premiums after the closure of the individual entrepreneur.

“There is also an opposite opinion on this issue: they say that there is no official prohibition to take into account the amount of contributions when calculating income tax. But if you follow the instructions of the Ministry of Finance, you will sleep more peacefully. By analogy, they can be applied to the innovation of 2022: it is allowed to reduce the cost of a patent to 100% for the amount of contributions paid by individual entrepreneurs for themselves and up to 50% for employees.” Zolotova Yana, assistant to the arbitration manager

Since you do not know the exact date in advance, you can count 5 working days from the date of your application, pay the amount of contributions according to the preliminary calculation and accept it as a tax reduction according to the simplified tax system. And the “tail” is to pay extra on time.

Submit documents to the IRS for closing.

To terminate activities as an individual entrepreneur in 2022, you will need the following documents:

- Application on form P26001. Applications can be found on the Federal Tax Service website. It is necessary to indicate your full name, INN, OGRNIP, telephone number and email address. If an entrepreneur personally submits documents to the tax office or MFC along with a passport, the application will need to be signed on the spot. In all other cases, the signature on the application must be notarized. If you contact the tax office, prepare two copies of the application: hand in one, and on the second the inspector will mark receipt and return it.

- Receipt for payment of state duty in the amount of 160 rubles. You can pay the fee online on the Federal Tax Service website using the service or generate a paper receipt and pay at the bank. If you pay online, be sure to save your proof of payment. It is better to make a copy of the paid paper receipt: give the original, and keep a copy just in case.

It is necessary to submit documents for termination of activities as an individual entrepreneur to the registering tax office - the one to which the documents for opening an individual entrepreneur were submitted. To avoid mistakes, you can use the service for determining the details of the Federal Tax Service.

There are several ways to submit documents - choose the most suitable one:

- Personally. If you apply in person, you will not need to have your documents notarized. In addition, an on-site inspector will check that the application is filled out correctly.

- Through a representative. A representative can submit documents if he has a notarized power of attorney confirming the right to act on behalf of the entrepreneur.

- Online. Documents can be submitted on the Federal Tax Service website using the service for registering legal entities and individual entrepreneurs. If you submit documents electronically, you will not need to pay a fee. But you will need an electronic digital signature. It can be purchased at certification centers in any city.

- Through MFC. If you plan to apply to the MFC and pay the state fee online on the Federal Tax Service website, in the “type of payment” section, select “state fee for registering the termination of a sole proprietor’s activity as an individual entrepreneur (when applying through the MFC).” And before submitting documents through the MFC, it is better to call and make an appointment. This way you can make sure that this MFC provides the required service. In addition, appointments have been introduced to prevent the spread of the virus.

This type of payment must be selected when applying through the MFC.

Important. Until now, some tax inspectorates have not resumed personal reception of citizens. If you plan to leave documents for closing an individual entrepreneur in the box for receiving correspondence, do not forget to notarize the signature on the application.

On the sixth working day, a notice of deregistration of an individual with the tax authority and an entry sheet from the Unified State Register of Individual Entrepreneurs will be sent to the email address specified in the application. The former entrepreneur can receive the paper sheet from the inspectorate in person or through a representative by proxy. From the date indicated in the Unified State Register of Individual Entrepreneurs, the individual entrepreneur is considered closed.

IP closed on February 5, 2022.

Close your bank account. A closed individual entrepreneur does not need it

The law does not oblige an entrepreneur to close a current account when closing an individual entrepreneur. But we advise you to do this, so as not to arouse increased interest from the tax authorities. After all, the account was opened in the name of the entrepreneur, and after the closure of the individual entrepreneur, the entrepreneurial status is lost.

So, after paying final settlements to employees, returning and collecting debts, paying fees and taxes, it is better to close the account. Before doing this, do not forget to withdraw the remaining money from him and return the debt to the bank, if any.

You can request an account closure application form from your bank. Confirmation of closing the current account will be a certificate issued by the bank.

In 2014, the obligation of an entrepreneur to report the closure of a current account to the tax office and funds was abolished. The bank will do this on its own.

Calculation of contributions if a full calendar year has been worked

When closing an individual entrepreneur, the main point is how much time the entrepreneur worked during the year. If a full calendar year has been worked, then no difficulties arise.

Currently, the amount of contributions to the budget is regulated by law and is determined by Article 430 of the Tax Code of the Russian Federation.

The Code establishes that for 2022 the amount of contributions will be:

- For pension insurance 29354 rubles

- For medical insurance 6884 rubles

If an entrepreneur worked for a full year and closed on the last day of the year, then these are the amounts that need to be transferred to the budget.

But this is ideal; usually it doesn’t work out that way and the closure occurs within a year.

Checklist on how to close an individual entrepreneur

When closing an individual entrepreneur yourself, follow the sequence of actions:

- Two months before the closure, notify employees of the layoff, and two weeks before the closure, send a notice to the employment office. Prepare a dismissal order for each employee. On the last working day, give employees wages, compensation for unused vacations and other outstanding debts. Give me your work books.

- Prepare an application for deregistration of the cash register and a report on the closure of the fiscal drive. Submit documents to the tax office no later than one business day from the date of closing the cash register and wait for the card deregistering the cash register.

- Terminate existing contracts. Pay off creditors and collect debts.

- Submit reports for employees, if any. Pay insurance premiums for yourself and your employees.

- Fill out an application for termination of activity as an individual entrepreneur and pay the state fee. Submit documents to the tax office in any convenient way.

- Receive a record sheet from the Unified State Register of Individual Entrepreneurs confirming the closure of the individual entrepreneur.

- Submit a declaration for the chosen tax regime and pay taxes.

- Close your current account by submitting an application to the servicing bank. If there are several banks - to all.

- Be prepared to provide clarifications to questions from tax officials as part of a desk audit.

- Keep all tax and accounting documents remaining after the closure of the individual entrepreneur for at least six years, and documents regarding employees for 75 years.