Attention! From 2021, the UTII regime is no longer valid. All UTII payers must choose a different tax regime.

To calculate the most favorable tax regime, you can use a tax calculator.

Free tax consultation

To automatically calculate and generate a UTII declaration in 2019 in PDF and Excel formats, you can use the online service directly on our website. If you want to avoid annoying financial losses, we suggest trying the option of outsourcing accounting from 1C with a month of free service.

Individual entrepreneurs and organizations on UTII are required to submit a tax return to the Federal Tax Service at the end of each quarter. Since the UTII tax is paid regardless of whether the activity was carried out or not, the declaration must be submitted in any case.

Deadline for submitting the declaration

The tax period for UTII is a quarter

.

The UTII declaration is submitted based on the results of each quarter no later than the 20th day

first month of the next quarter.

Thus, in 2022 the declaration must be submitted:

- for the 1st quarter of 2022 – no later than April 22, 2022;

- for the 2nd quarter of 2022 – no later than July 22, 2022;

- for the 3rd quarter of 2022 – no later than October 21, 2022;

- for the 4th quarter of 2022 - no later than January 20, 2022.

If the 20th falls on a weekend or holiday, then the deadline for filing the declaration is postponed to the next working day, as is the case with the UTII declaration for the 1st, 2nd and 3rd quarter of 2022.

Postponement of tax payment deadlines

In accordance with the signed law, the Government of the Russian Federation is vested, for the period until December 31, 2022, with the authority to extend the deadlines established by the Tax Code of the Russian Federation for the payment of taxes (including under special regimes), insurance premiums and advance payments for taxes.

This doesn't just apply to federal taxes. The government has received the corresponding right in relation to advance payments for transport tax, corporate property tax and land tax, which are established by regional legislation and regulatory legal acts of municipalities (clause 6, clause 1, article 1 of Federal Law dated 01.04.2020 No. 102- Federal Law).

New deadlines for paying taxes are established by Decree of the Government of the Russian Federation dated April 2, 2020 No. 409.

Payment deadlines are postponed by 6 months:

- income tax for 2022;

- taxes and advances on them, with the exception of VAT, for the reporting periods falling on March and the first quarter of 2022;

- single tax paid in connection with the application of the simplified tax system, unified agricultural tax for 2022.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. The President of the Russian Federation signed Federal Law No. 102-FZ dated April 1, 2020, providing for the postponement of tax payment deadlines, reporting submissions and the suspension of tax control measures for the period of the spread of coronavirus infection.

2. The Government of the Russian Federation is vested, for the period until December 31, 2022, with the authority to extend the deadlines established by the Tax Code of the Russian Federation for paying taxes (including under special regimes), insurance premiums and advance payments for taxes.

3. New deadlines for paying taxes and submitting reports are established by Decree of the Government of the Russian Federation dated April 2, 2020 No. 409.

4. Tax control activities have been suspended until June 1, 2022.

5. Tax sanctions for committing tax offenses, liability for which is provided for in Article 126 of the Tax Code, committed during the period from March 1, 2022 to June 1, 2020, are not temporarily applied. Proceedings already initiated for such violations will not be carried out.

Payment deadlines are postponed by 4 months:

- taxes, except VAT, paid for reporting periods falling on the half-year (II quarter) of 2022

Payment deadlines are postponed by 3 months:

- Personal income tax on the income of individual entrepreneurs.

Payment deadlines are postponed to October 30, 2022:

- advance payments for transport tax, corporate property tax and land tax for the first quarter of 2022.

Payment deadlines are postponed to December 30, 2022:

- advance payments for transport tax, corporate property tax and land tax for the second quarter of 2022.

In addition, for micro-enterprises (and only for them!) of the affected sectors of the economy, the deadlines for payment of insurance premiums were also postponed

. Thus, the deadline for paying insurance premiums for March-May 2022 has been extended by 6 months. The deadline for payment of insurance premiums for the period June and July 2022 and fixed insurance premiums payable no later than July 1, 2022 has been extended by 4 months.

Where to submit the UTII declaration

Individual entrepreneurs and organizations must submit UTII declarations to the tax authority at the actual place of business

.

When providing services such as:

- delivery or peddling retail trade;

- advertising on vehicles;

- provision of motor transport services for the transportation of passengers and cargo;

It is impossible to unambiguously determine the place of business, therefore, in such cases, individual entrepreneurs submit declarations to the Federal Tax Service at their place of residence, and organizations at their location (legal address).

Several points on UTII with one type of activity

If you have several points on UTII with the same activity in one municipality

(with one OKTMO), then you need to submit one declaration, but at the same time summing up the physical indicators from each point in the 2nd section of the declaration.

If you have several points on UTII with the same activity in different municipalities

(with different OKTMO), then you need to submit your own declaration to the tax office of each entity, while you do not need to summarize the physical indicators and fill out several sheets of the second section.

Several types of UTII activities

If you are engaged in several types of UTII activities in the territory under the jurisdiction of one Federal Tax Service, then you need to submit one declaration, but with several sheets of section 2 (filled out separately for each type of activity).

If you are engaged in several types of UTII activities in different municipalities, then you must submit your own declaration with the required number of sheets of section 2 to the tax office of each entity.

How to calculate tax

The tax payment on UTII is the product of the basic yield, the physical indicator, the coefficients K1, K2 and 15%. These indicators mean:

- Basic profitability is a figure determined by the state for each format of business activity.

- Physical indicator - number of employees, square meters, etc.

- K1 is a coefficient set annually by the Ministry of Economic Development taking into account inflation. In 2022 it is 1.915.

- K2 is the adjustment coefficient established by local authorities. Published on the official website of the Federal Tax Service.

- 15% - business tax on UTII.

Important! Local authorities are allowed to change the tax rate in this regime within the range of 7.5-15%.

The UTII tax period is one quarter. To calculate the payment, add up the tax amounts for three months. If during this period the physical indicator has not changed, you can simply multiply the payment amount for the month by 3. If there has been a change in the physical indicator, adjustments are made from the month when it changed.

To calculate tax for an incomplete month (for example, when closing a company), you should multiply the full monthly tax payment by the number of days of business, and then divide the resulting figure by the number of days in that month.

Entrepreneurs engaged in several types of activities on UTII need to calculate the tax for each of them separately, and then add up the amounts.

Methods for filing a UTII declaration

The UTII declaration can be submitted in three ways:

- In paper form (in 2 copies). One copy will remain with the tax office, and the second (with the necessary marking) will be returned. It will serve as confirmation that you have submitted the declaration.

- By mail as a registered item with a description of the contents. In this case, there should be a list of the attachment (indicating the declaration to be sent) and a receipt, the number in which will be considered the date of submission of the declaration.

- In electronic form via the Internet (under an agreement through an EDF operator or a service on the Federal Tax Service website).

Note

: to submit a declaration

through a representative

- individual entrepreneur, it is necessary to issue a notarized power of attorney, and for organizations to issue a power of attorney in simple written form (with the signature of the head and seal).

note

, when submitting a declaration in paper form, some tax inspectors may require:

- attach the declaration file in electronic form on a floppy disk or flash drive;

- print a special barcode on the declaration, which will duplicate the information contained in the declaration.

Such requirements are not based on the Tax Code of the Russian Federation, but in practice, failure to comply with them can lead to an unsuccessful attempt to submit a declaration.

UTII 3rd quarter 2022 for individual entrepreneurs: declaration

Let's look at the preparation of a declaration using an example.

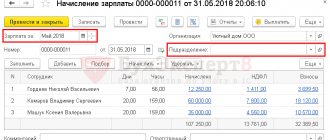

IP Minaev V.S. provides household services - performs shoe repair work in the Odintsovo district of the Moscow region. The number of hired employees is 4 people, activities are carried out in the city of Golitsyno.

On August 13, 2022, the entrepreneur began conducting similar activities in the city of Kubinka and hired three new employees. In fact, services were provided at this address for 18 days out of 31 days in August.

Considering that an individual entrepreneur provides personal services, the physical indicator for him is the number of employees (including himself), and the basic profitability is 7,500 rubles. for 1 person.

K1 for 2022 is set in the amount of 2.005 (Order of the Ministry of Economic Development dated October 21, 2019 No. 684), K2 is set by local authorities for the specified type of activity in the amount of 0.8 (Appendix No. 1 to the Decision of the Council of Deputies of the Odintsovo City District dated November 5, 2019 No. 5/ 10).

An individual entrepreneur with employees can reduce the amount of tax on insurance premiums paid during the tax period for themselves and for their employees, but no more than 50% (clause 1, clause 2, clause 2.1 of Article 346.32 of the Tax Code of the Russian Federation).

We will carry out preliminary calculations to fill out the document and calculate the amount of UTII payable for the 3rd quarter of 2022:

| Place of business | Golitsyno | Cuban | |

| Number of employees, including individual entrepreneurs, people. | 5 | 3 | |

| Basic profitability, rub. | 7 500,00 | ||

| K1 | 2,005 | ||

| K2 | 0,8 | ||

| Taxable base, rub. | for July | 60 150 (5 x 7500 x 2.005 x 0.8) | 0 |

| for August | 60 150 (5 x 7500 x 2.005 x 0.8) | 20 955 (3 x 7,500 x 2.005 x 0.8 x 18/31) | |

| for September | 60 150 (5 x 7500 x 2.005 x 0.8) | 36,090 (3 x 7500 x 2.005 x 0.8) | |

| Total | 180 450 | 57 045 | |

| Tax rate | 15% | ||

| Tax amount, rub. | at the place of business | 27 068 | 8 557 |

| Total | 35 625 | ||

| Insurance premiums paid in the 3rd quarter of 2022, rub. | 57 000 | ||

| Amount of tax payable including contributions (at least 50% of the calculated tax amount before deduction of contributions), rub. | 13 534 | 4 279 | |

| 17 813 | |||

Let's move on to completing the declaration.

Basic rules for filling out the declaration

- All indicators are recorded starting from the first (left) cell, and if any cells are left blank, dashes must be placed in them.

- If there is no data to fill out a field, a dash is placed in each cell.

- Physical indicators and values of cost indicators are indicated in whole units according to rounding rules (with the exception of the K2 coefficient, the value of which is rounded to the third decimal place).

- Text fields are filled in in capital block letters.

- When filling out the declaration, you must use black, purple or blue ink.

- When filling out a declaration on a computer, characters must be printed in Courier New font with a height of 16-18 points.

- All pages, starting from the title page, must be numbered (for example, the 1st page is “001”; the second is “020”, etc.).

- On the title page and pages of the first section, you must sign and date the declaration. At the same time, if there is a seal, then it should be placed only on the title page, where the M.P. is indicated. (place of printing).

- There is no need to stitch or staple the pages of the declaration.

- Double-sided printing of the declaration and correction of errors in it are not allowed.

- Fines and penalties are not reflected in the declaration.

- It is more convenient to fill out the second section first, then the third, and lastly the first section of the declaration.

Instructions for filling out the UTII declaration

You can download the official instructions for filling out the UTII declaration from this link.

Title page

Field " TIN

" Individual entrepreneurs and organizations indicate the TIN in accordance with the received certificate of registration with the tax authority. For organizations, the TIN consists of 10 digits, so when filling it out, you must put dashes in the last 2 cells (for example, “5004002010—”).

Field " Checkpoint"

" The IP field of the checkpoint is not filled in. Organizations indicate the checkpoint that was received from the Federal Tax Service at the place of registration as a UTII taxpayer. The reason for registration (5-6 checkpoint mark) must have code “35”.

Field " Adjustment number"

"

It is entered: “ 0—

” (if the declaration is submitted for the first time for the tax period (quarter), “

1—

” (if this is the first correction), “

2—

” (if the second), etc.

Field “ Tax period (code)

"

The code of the tax period for which the declaration is submitted is indicated ( see Appendix 1

).

Field " Reporting year"

" This field indicates the year for which the declaration is being submitted.

Field “ Submitted to the tax authority (code)

" The code of the tax authority to which the declaration is submitted is indicated. You can find out your Federal Tax Service code using this service.

Field “ at place of registration (code)

"

The code for the place where the declaration is submitted to the tax authority is indicated ( see Appendix 3

).

Field " Taxpayer"

" Individual entrepreneurs need to fill out their last name, first name and patronymic, line by line. Organizations write their full name in accordance with their constituent documents.

Field “ Code of the type of economic activity according to the OKVED classifier

" This field indicates the UTII activity code in accordance with the latest OKVED classifier. Individual entrepreneurs and LLCs can find their activity codes in an extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

note

, when filing a UTII declaration in 2022, this code must be indicated in accordance with the new edition of OKVED. You can transfer the code from the old to the new edition using our OKVED code compliance service.

If you carry out several types of UTII activities or the activity includes several OKVED codes, then you must indicate the code of the activity with the maximum income

.

Field “ Form of reorganization, liquidation (code)

" and the field "

INN/KPP of the reorganized organization

".

These fields are filled in only by organizations in the event of their reorganization or liquidation ( see Appendix 4

).

Field " Contact phone number"

" Specified in any format (for example, “+74950001122”).

Field " On pages

" This field indicates the number of pages that make up the declaration (for example, “004”).

Field “ with attached supporting documents or copies thereof

" Here is the number of sheets of documents that are attached to the declaration (for example, a power of attorney from a representative). If there are no such documents, then put dashes.

Block “ Power of attorney and completeness of information specified in this declaration

"

In the first field you must indicate: “ 1

” (if the authenticity of the declaration is confirmed by an individual entrepreneur or the head of an organization), “

2

” (if a representative of the taxpayer).

In the remaining fields of this block:

- If the declaration is submitted by an individual entrepreneur, then the field “last name, first name, patronymic in full” is not filled in. The entrepreneur only needs to sign and date the declaration.

- If the declaration is submitted by an organization, then it is necessary to indicate the name of the manager line by line in the field “last name, first name, patronymic in full.” After which the manager must sign, the seal of the organization and the date of signing the declaration.

- If the declaration is submitted by a representative (individual), then it is necessary to indicate the full name of the representative line by line in the field “last name, first name, patronymic in full.” After this, the representative must sign, date the declaration and indicate the name of the document confirming his authority.

- If the declaration is submitted by a representative (legal entity), then in the field “Last name, first name, patronymic in full” the full name of the authorized individual of this organization is written. After this, this individual must sign, date the declaration and indicate a document confirming his authority. The organization, in turn, fills in its name in the “organization name” field and puts a stamp.

Section 2. Calculation of the amount of single tax on imputed income for certain types of activities

If you are engaged in several types of UTII activities on the territory of one municipality (with one OKTMO), then you need to submit one declaration, but with several sheets of section 2

(filled out separately for each type of activity).

You will also have to fill out several sheets of Section 2 in cases where the activities are carried out in different municipalities (with different OKTMO), but they are geographically related to the same Federal Tax Service

.

Field "TIN"

and

the “Checkpoint” field

(how to fill it out, see the “Title Page” section).

Line "010"

.

It is necessary to indicate the business activity code ( see Appendix 1

).

Line "020"

.

It is necessary to fill in the full address of the place of business activity (if line “010” indicates the type of activity with code 05

,

06

,

10 or 16

, then organizations in line “020” need to write the legal address, and individual entrepreneurs – the address of the place of residence).

Line "030"

. You can find out the OKTMO code using this service.

Line "040"

.

The basic profitability of your activity is indicated here ( see Appendix 1

).

Line "050"

.

In 2022, the deflator coefficient K1 = 1.915

.

Line "060"

.

The correction coefficient K2

is set by municipal authorities in order to reduce the amount of UTII tax. You can find out its meaning on the official website of the Federal Tax Service (select your region at the top of the site, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section).

Lines "070", "080"

And

«090»

:

In column 2

it is necessary to indicate the values of physical indicators for the corresponding type of activity in each month of the quarter (which is a physical indicator

, see Appendix 1

). When filling out the declaration, the values of physical indicators are rounded to whole units according to the rounding rules.

If a physical indicator changed during the quarter (for example, another employee was hired), then this change is reflected in the declaration starting from the same month in which it occurred.

If you carry out one type of activity, but in different places of the same city (with one OKTMO), then you do not need to fill out another sheet of Section 2, just add up the values of physical indicators from each such place.

In column 3

the number of days of activity is indicated. This column is filled out only in cases where the declaration is submitted for a quarter in which you either just registered as a UTII payer (not from the beginning of the month), or completed your activities without waiting for the end of the quarter.

Example

.

You submit your return for the 4th quarter. Let’s say that on October 25 you registered, and on November 5 you wrote an application for deregistration. In this case, in column 3 of line 070

you need to write “

7-

”, and in line

080

indicate “

5-

” (since in October you were active for 7 days, and in November for 5 days).

In line 090

you will need to put

dashes

.

Note

: if during the quarter you did not register (were not deregistered), then dashes must be placed in all cells of column 3.

In column 4,

the tax base (the amount of imputed income) is calculated for each calendar month of the quarter.

To obtain the values of the fields of column 4, it is necessary to perform the product of lines 040

,

050

,

060

, and then multiply the resulting result by the corresponding value of each line of column 2.

Moreover, if you have values in column 3, then the resulting values for column 4 must additionally be multiplied by the corresponding value of each completed line in column 3 and the resulting result divided by the number of calendar days in the month for which the tax base is calculated.

String "100"

. The total tax base for 3 months of the quarter is indicated here (sum of lines 070-090, column 4).

Line "110"

. The tax amount for the quarter is indicated here, which is calculated using the formula:

Row 100 x 15 / 100

Section 3. Calculation of the amount of single tax on imputed income for the tax period

Line "005"

.

It is set to “ 1

” - if an individual entrepreneur or organization makes payments to employees engaged in those areas of activity for which UTII tax is paid, or is set to “

0

” - if an individual entrepreneur does not make payments to individuals.

Line "010"

. You must record the total tax amount for the quarter. This value is calculated as the sum of the values of lines 110 of all completed sheets of the 2nd section of the declaration.

Line "020"

. Organizations and individual entrepreneurs indicate in this line the amount of insurance premiums paid this quarter for employees employed in those areas of activity for which UTII tax is paid. Also, payments and expenses provided for in paragraph 2 of Art. 346.32 Tax Code of the Russian Federation.

Line "030"

. Individual entrepreneurs indicate in this line the amount of insurance premiums paid this quarter for themselves in a fixed amount.

Line "040"

. The total amount of UTII tax payable to the budget is indicated here.

Depending on the value of line 005, it is calculated using one of the following formulas:

If line 005 = 1

, Then:

Line 040 = Line 010 – Line 020

, and the resulting value must be ≥ 50% of line 010.

If line 005 = 0

, Then:

Line 040 = Line 010 – Line 030

, and the resulting value must be ≥ 0.

Section 1. The amount of single tax on imputed income subject to payment to the budget

Field "TIN"

and

the “Checkpoint” field

(how to fill it out, see the “Title Page” section).

Line "010"

. Here you indicate the OKTMO code of the municipality in which the activity is carried out (where you are registered as a UTII taxpayer). If the code contains 8 characters, then the three free cells on the right are filled with dashes (for example, “12345678—”). You can find out the OKTMO code using this service.

Line "020"

.

The total amount of UTII tax payable to the budget is indicated here ( Line 040 section 3

).

If you carry out UTII activities in several municipalities (with different OKTMO), but which belong to the same Federal Tax Service

, then the total amount of tax (Line 040 of the 3rd section) must be broken down separately for each OKTMO (see formula below) and the required number of Lines 010 and 020 must be filled in.

Calculation formula:

Line 040 of section 3 x (Sum of lines 110 of all sheets of section 2 for this OKTMO / Line 010 of section 3)

.

Appendix 1. Types of UTII activities (codes, physical indicators, basic profitability)

| Activity code | Kind of activity | Physical indicators | Basic income per month |

| 01 | Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| 02 | Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| 03 | Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| 04 | Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| 05 | Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| 06 | Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

| 07 | Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| 08 | Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| 09 | Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| 10 | Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| 11 | Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| 12 | Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| 13 | Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| 14 | Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| 15 | Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| 16 | Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| 17 | Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1000 |

| 18 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6000 |

| 19 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| 20 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| 21 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

| 22 | Sales of goods using vending machines | Number of vending machines | 4500 |

Appendix 2. Tax period codes

| Period code | Name of period |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

Appendix 3. Codes of the place of submission of the declaration to the Federal Tax Service

| Location code | Name of place |

| 120 | At the place of residence of the individual entrepreneur |

| 214 | At the location of the Russian organization that is not the largest taxpayer |

| 215 | At the location of the legal successor who is not the largest taxpayer |

| 245 | At the place of activity of the foreign organization through a permanent representative office |

| 310 | At the place of activity of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 331 | At the place of activity of the foreign organization through a branch of the foreign organization |

Codes "120

and “

214

” are indicated only if you carry out the following types of activities:

- delivery or peddling retail trade (10);

- advertising on vehicles (16);

- provision of motor transport services for the transportation of passengers (06) and cargo (05);

Note

: the activity code in accordance with

Appendix 1

.

Appendix 4. Codes of reorganization and liquidation forms

| Form code | Form name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

What is UTII

UTII is one of the special taxation regimes, which is classified as simplified. Its main feature is that the amount of tax payments does not depend in any way on the actual profit received. That is why this format is chosen by businessmen who have fairly high incomes.

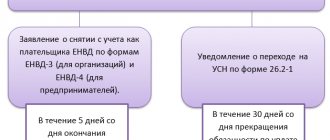

You can choose the UTII mode from the very beginning of work or switch to it later by submitting a tax application using the appropriate form. In the first case, the application is submitted 5 days before the start of activity, in the second - within the same period from the start of work under the new regime.

The UTII regime is not available to all entrepreneurs. It can only be used by merchants engaged in:

- provision of household services to the population;

- passenger or freight transportation;

- veterinary treatment;

- auto repair work, vehicle washing;

- retail trade in goods;

- placement of outdoor advertising;

- hotel business.

Permitted activities for this regime also include catering services, leasing of parking lots and retail outlets. But regional authorities have the right to independently decide which types of activities to allow the transition to UTII.

Important! If a catering facility has a hall area for serving customers of more than 150 square meters, the UTII regime is not available for it.

UTII can be used by both individual entrepreneurs and legal entities. The main thing is that the number of employees does not exceed hundreds, and the share of participation of other organizations does not exceed 25%. The second paragraph makes an exception for structures with authorized capital consisting of contributions from public organizations of people with disabilities.