Mandatory list

Regardless of the reason for dismissal (at one’s own request, by agreement of the parties, due to circumstances beyond one’s control, due to a reduction in numbers or staff, at the initiative of the employer for certain misconduct, etc.), each dismissed employee must be given the following set of documents:

Draw up personnel documents for free according to ready-made templates

1. Pay slip.

This document is issued upon final settlement with the employee. It contains information about all accruals and deductions made in this case (Articles 136 and 140 of the Labor Code of the Russian Federation). Each employer independently develops and approves the form of the payslip.

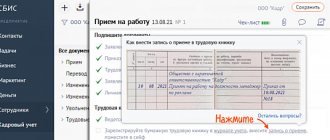

2. Work record book.

If the employer kept a paper work book for the dismissed employee, then it should be issued on the last day of work, even if the employee was granted leave before the dismissal (Part 4 of Article 84.1 of the Labor Code of the Russian Federation, ruling of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-O -Oh, letter from Rostrud dated December 24, 2007 No. 5277-6-1). For information about what entries to make in the work book when dismissing an employee, see the article “Filling out the work book in 2022: rules and sample.”

If the employee has switched to an electronic work book, then on the last day of work information is issued in the STD-R form (Article 84.1 of the Labor Code of the Russian Federation; see “How to fill out the STD-R form and issue it to the employee”). You can draw up a document either on paper or electronically, certifying the file with an enhanced qualified electronic signature. Please note that the choice of the method of receiving STD-R upon dismissal is the prerogative of the employee. And he must indicate his choice in the appropriate statement (Part 5 of Article 66.1 of the Labor Code of the Russian Federation).

Important

It is not necessary to issue STD-R upon dismissal to those who decided to keep the traditional paper work book (letter of the Ministry of Labor dated June 16, 2020 No. 14-2 / OOG-8465; see “An employee refused an electronic work record: is the employer obliged to give him information on form STD-R?”).

3. Extract from the SZV-M form.

This statement is issued for the month of dismissal. It contains information about the employer, as well as data about the dismissed employee. The extract must be certified. This is done as follows. The extract indicates the name and position of the person authorized to certify the document, followed by his signature and the date the extract was prepared. If the organization has a seal, then the extract must also be certified with a seal.

4. Extract from the DAM.

This statement is compiled for the period from the beginning of the quarter to the date of dismissal. Information about the employer from the title page is transferred to it, as well as data from section 3 “Personalized information about insured persons” concerning the dismissed employee. An extract from the DAM must be certified in the same manner as an extract from the SZV-M.

5. Extract from the SVZ-STAZH form.

Such an extract must be generated for the reporting year (up to the date of dismissal of the employee). Information about the employer and information about the dismissed employee are transferred to it (letter from the Pension Fund of Russia branch in Moscow and the Moscow region dated 04/03/18 No. B-4510-08/7361). The extract from the SZV-STAZH form must be certified according to the rules described above (i.e., the signature, full name and position of the authorized person, and the seal of the organization, if any, are required; the date the extract was compiled).

Fill out, check and submit SZV-M, SZV-STAZH and RSV via the Internet for free

6. Certificate of salary amount (certificate 182n).

This document is drawn up in the form approved by Order of the Ministry of Labor dated April 30, 2013 No. 182n (for information on how to fill out the certificate, see the article “Certificate 182n on the amount of wages”). We recommend giving the employee 2-3 copies of such a certificate - this will simplify his communication with subsequent employers.

Advice

Include in the set of documents that must be given upon dismissal of employees several copies of income certificates for the current and previous years (see below for more details).

In some cases, it is necessary to provide additional documents to the dismissed employee.

So, if the organization transferred insurance contributions to the funded part of the employee’s pension, then upon his dismissal he must draw up an extract from the DSV-3 form for the quarter of dismissal. And if during the time of work a medical record was issued for an employee (including at the expense of the employer), then it must also be included in the mandatory set of documents issued upon separation from employees (letter of Rospotrebnadzor dated November 10, 2015 No. 01/13734- 15-32).

Fill out and submit DSV-3 online for free

It is also necessary to return to the employee the originals of all documents that he brought during work. These can be diplomas, certificates, medical reports and other official papers.

Attention

The documents listed above (with the exception of income certificates) are issued at the initiative of the employer. No statements from the employee are required.

Documents on request

All other papers must be handed over to the dismissed employee only if he has submitted the appropriate application. We are talking about the following documents:

1. Certificate of income (clause 3 of Article 230 of the Tax Code of the Russian Federation).

Starting with income for the first quarter of 2022, this certificate is issued in the form given in Appendix No. 4 to the order of the Federal Tax Service of October 15, 2020 No. ED-7-11 / [email protected] And for income 2022 - 2022, a certificate in the form is used, given in Appendix No. 5 to the order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11 / [email protected] Both forms do not provide for indicating the position of the person who signed the certificate and affixing the organization’s seal. For more details, see “Certificate of income, which is issued to an individual upon his request: instructions for filling out.”

Calculate all payments taking into account personal income tax for the dismissed employee

2. Certificate for the employment service.

Officially, this document is called a Certificate of average earnings for the last three months at the last place of work (service) for registration at the employment center. The recommended form is given in the letter of the Ministry of Labor dated January 10, 2019 No. 16-5/B-5 (see “The recommended form of a certificate of average earnings at the last place of work has been updated”).

3. A copy of the dismissal order.

The issuance of this document is provided for in Part 2 of Article 84.1 of the Labor Code of the Russian Federation. It also states that the copy must be certified by the employer (when certifying this document, the same rules apply as when certifying extracts from SZV-M and other forms). A copy of the dismissal order is issued in the case when it is of an “individual” nature (for example, drawn up according to the unified form No. T-8, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1).

If several employees are dismissed by one order (for example, a unified form No. T-8a is used), then an extract from the order is drawn up in any form. The extract must indicate the date and number of the dismissal order, information about the dismissed employee (full name, position, department), the basis and date of dismissal, as well as information about who signed the dismissal order (full name and position).

4. Note-calculation.

The document is drawn up according to form No. T-61. It contains information about vacations used and unused during work, as well as the calculation of payments upon dismissal.

5. Other documents.

Also, upon application of the dismissed employee, copies of any other documents related to work (orders on admission, transfers, incentives and punishments, vacations, etc.) must be issued.

Attention

Let us repeat that the documents specified in this part of the article must be given to the employee only upon his request.

It is necessary to take into account that the application for obtaining “labor” documents is submitted in writing (Articles 62 and 80 of the Labor Code of the Russian Federation). But an employee can apply for a certificate of income orally (clause 3 of Article 230 of the Tax Code of the Russian Federation). That is why, in practice, this certificate is issued upon dismissal along with the mandatory set of documents discussed in the first part of the article. Maintain personnel records in the web service, fill out and submit SZV-TD via the Internet

Rules for preparing a certificate

There is no single, unified, mandatory sample of a certificate of employment. Enterprises and organizations have the right to write it in free form or use a template developed within the company (however, such templates must be registered in its accounting policies). Regardless of which option the company chooses, the certificate must contain a number of necessary data :

- Name of the organization,

- date of compilation,

- information that needs to be confirmed

- signature of the company director.

It is not necessary to put a stamp on the document, since since 2016 legal entities have been exempted from the obligation to certify their papers with seals and stamps (however, in this case it is advisable to include the organization’s details (address and telephone number) in the document, otherwise the certificate may simply not be issued accept where it is provided).

The certificate must contain only relevant and reliable information; entering into it knowingly false or unreliable information can lead to administrative punishment for organizations and officials in the form of a large fine.

If any documents or copies thereof are attached to the certificate, then information about this should also be recorded in the certificate itself in the form of a separate paragraph about the attached documentation.

Responsibility for non-issuance of documents

Failure to issue or untimely issue to a dismissed employee documents from the mandatory list threatens the organization with a fine in the amount of 30,000 to 50,000 rubles. Additionally, the head of the company can be punished - the fine will range from 1,000 to 5,000 rubles (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). And if such a violation is committed again within a year, the fines will increase (for an organization - up to 70,000 rubles, and for a manager - up to 20,000 rubles). In this case, the head of the company may be disqualified for up to 3 years (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Check the counterparty for signs of a shell company and the presence of disqualified persons

For a delay in issuing a work book, financial liability also arises under Article 234 of the Labor Code of the Russian Federation. The company will have to pay the former employee for the time during which he could not start a new job due to the lack of a work book (paragraph 2, paragraph 62 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2).

Important

For untimely issuance of STD-R, similar liability is established on the basis of Article 234 of the Labor Code of the Russian Federation.

However, most likely, this norm will be difficult to apply in practice, since an employee can obtain similar information about work activity (in the STD-PFR form) from the Pension Fund, MFC or through the State Services portal (Article 66.1 of the Labor Code of the Russian Federation). Fill out and print STD-R and other personnel documents for free

You need to send notification of receipt of a work book on time

The appeal ruling of the St. Petersburg City Court dated October 27, 2015 No. 33-18051/2015 is a vivid example of what the untimely issuance of a work book can result in for an employer.

The employee filed a lawsuit against her former employer for untimely issuance of a work book, the obligation to change the date of dismissal and issue a work book, to recover unpaid wages, penalties for delayed wages, as well as to recover compensation for forced absence and moral damages.

On the day of dismissal, the woman was present at the workplace, but did not receive the book. The employer did not come to his senses immediately, but almost three months after the dismissal and sent the former employee a notice about the need to receive the book or agree to have it sent by mail. The notice was sent on 02/20/2015 and received by the plaintiff on 02/26/2015. The lady received her work book only during the consideration of the case on 07/01/2015.

The woman’s last day of work was November 27, 2014. The court ordered the company to pay wages from November 28, 2014 to February 20, 2015, that is, from the next day when the employee should have been issued a work book. As a result, for the specified period of forced absence, the organization paid the former employee 36,237 rubles, while changing the date of dismissal to 02/20/2015, that is, the date the notice was sent.

Appeal ruling of the St. Petersburg City Court dated October 27, 2015 No. 33-18051/2015

On the day of dismissal, the employee is not at work

What to do if an employee did not work on the day of dismissal or did not show up to receive the relevant documents? The algorithm of actions in such a situation is regulated by law only in terms of issuing a work book and information about work activity.

Article 84.1 of the Labor Code of the Russian Federation states that if it is impossible to issue an STD-R to an employee on the last day of work, then the information is compiled on paper and sent by registered mail with acknowledgment of delivery. From this moment on, the employer is released from liability for failure to issue STD-R. We believe that the same should be done if the employee did not submit an application to choose the method of issuing STD-R upon dismissal (paper or electronic).

The procedure for dealing with an employee who cannot be given a work book on the day of dismissal is somewhat more complicated. He needs to be notified. It should indicate that the person must come for the work book, or agree to have it sent by mail.

STD-R or notification must be sent no later than the next business day after the employee’s dismissal. But it is better to do this at the end of the day on which the dismissal took place. Since it is the fact of sending the specified form or notification that exempts you from the fine, it is important to have a document confirming the sending. Therefore, you should use registered mail with a description of the contents and a return receipt. It is necessary to keep the inventory and postal receipt. If the delivery receipt is not returned, you need to print out the delivery information from the Russian Post website.

The letter should be sent to the employee’s official place of residence (“registration”). If the personal card contains information about other addresses of the employee, we recommend that you additionally send a notification to these addresses. In a situation where all sent envelopes have been returned, they must be stored unopened along with the shipping documents.

If written consent is received from the dismissed person to send the work book by mail, it must be sent to the address specified by the employee. To do this, you should also use a registered mail item with a description of the contents and a receipt. If there is no consent for forwarding, then the work book must remain with the employer. Also, you cannot send a work book outside the Russian Federation, even if the employee requests this in writing. In this case, the document also remains with the employer (letter of the Ministry of Labor dated September 17, 2019 No. 19-1/OOG-210; see “The Ministry of Labor informed whether it is necessary to send a work book abroad at the request of an employee”).

A similar procedure can be applied to all other documents that the employer is obliged to issue to the dismissed employee.

Advice

If the employee is not available on the day of dismissal, send him two letters. The first - with STD-R information or with a notification of the need to obtain a work book, the second - with a notification of the need to obtain other documents required to be issued upon dismissal. This will confirm that the employer has fulfilled the duties assigned to him in strict accordance with the requirements of the Labor Code of the Russian Federation. And also clearly define which documents the dismissed person agreed to forward. If an employer sends a work book by mail without the employee’s express written consent, this will be recognized as a violation, which will entail liability under Part 1 of Article 5.27 of the Code of Administrative Offenses and under Article 234 of the Labor Code of the Russian Federation. Please note that sending other documents (except STD-R) by mail without the employee’s consent will not relieve the employer from the need to re-issue them in person.

Certificate of salary amount

The certificate has a wonderful short name: “Certificate of the amount of wages, other payments and remunerations for the two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate of the amount of wages, other payments and remunerations, and the current calendar year for which insurance premiums were calculated, and the number of calendar days falling in the specified period for periods of temporary disability, maternity leave, child care leave, the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period.”

Thank you for reading!

So, the certificate is issued on the day of termination of work. If this is not possible, the employee must be notified of the need to appear for it or agree to have it sent by mail. The same as with a work book.

The need to issue a certificate is determined by clause 3 of part 2 of article 4.1 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

From February 2022, the certificate form has been changed. The Clerk wrote in the article what specific changes had occurred.