Composition of form 6-NDFL

Quarterly form 6-NDFL was approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. It includes:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

The title page contains general information about the tax agent (company name, tax identification number, checkpoint, etc.). Totals are not reflected on the title page. However, sections 1 and 2 are expressly intended to reflect amounts.

Should totals be shown with or without kopecks?

Mandatory requirements

Rounding the amount in rubles

Rounding the tax amount is the procedure for bringing its value into the proper form, i.e. without indicating kopecks, in whole rubles. Just as in other income tax reporting, in Form 6-NDFL it is necessary to round off the numbers reflecting the amount of the total amount of tax and advance payments for it (Federal Tax Order No. ММВ-7-11 / [email protected] dated 10/14/2015) .

As an example, consider the following situation. The total personnel income for the reporting period amounted to 2,320,584.45 rubles. Income tax on it is 301,675.98 rubles. Question: is it necessary to round these amounts when preparing Form 6-NDFL?

The report form is strict. Its unified form and procedure for filling out are determined by the Federal Tax Service of Russia (order No. ММВ-7-11/ [email protected] ).

The 6-NDFL calculation contains lines consisting of two fields. They must reflect information in the form of a decimal fraction: rubles and kopecks.

These lines include:

| Page 020 | Transferred payments. |

| Page 025 | Funds paid out as dividends. |

| Page 030 | Tax deductions. |

| Page 130 | Funds actually received. |

From this it can be seen that the amounts accrued and paid to employees must be indicated exactly as they are - with kopecks. The ruble amount is entered in the first field, and then after the dot - expressed in kopecks.

The calculated and withheld income tax is recorded in 6-NDFL in lines 040 and 140. They provide only one field. Therefore, information reported here is rounded to the nearest whole number.

In addition to this obvious fact, personal income tax calculations in whole rubles are required by the provisions of clause 6 of Art. 52 of the Tax Code of the Russian Federation. According to the rules they established, amounts less than 50 kopecks must be discarded, and more must be brought up to a full ruble.

Disclaimers about leftovers

Starting in 2022, a new 2-NDFL certificate form came into effect. This document is prepared by tax agents paying employees salaries and other payments subject to income tax in several situations.

First of all, a document with sign “2” is drawn up and submitted when, in the reporting year, income tax was not withheld from payments made in favor of hired employees. The deadline for submitting the report is March 1 of the year following the year in which employee payments were made.

Secondly, with attribute “1”, the report is prepared by absolutely all enterprises that made payments to individuals in the previous tax period. It shows information about the income received by employees from the employer for the past year, as well as the amount of income tax calculated, withheld and paid to the state budget during this time.

2-NDFL certificates are submitted for each employee annually.

In addition, in accordance with Part 1 of Article 62 of the Labor Code of the Russian Federation, employers are required to provide their employees with copies of any documents related to the performance of their labor functions, including earnings certificates. To do this, employers have three days from the date of receipt of the written application.

At the same time, during the preparation of 2-NDFL certificates, tax agents are faced with the question of whether they need to round up the amounts of tax payments?

In relation to the previously valid form, this issue was regulated by the Recommendations for its preparation, approved by Order of the Federal Tax Service N ММВ-7-3 / [email protected] dated November 17, 2010 (today no longer valid).

The first section of the Recommendations states that in the certificate all total numbers are entered in rubles and kopecks, except for tax. Only tax payments are reflected in the form in whole rubles. Numbers less than 50 kopecks must be discarded, and numbers greater than 50 kopecks must be rounded.

The procedure for drawing up the current form of such rules does not provide for such rules. How to be? Is rounding necessary?

The deadline for submitting the 6-NDFL calculation for 2022 varies depending on the period, which is accepted in this case as the reporting period. Is it necessary to submit 6NDFL if wages are delayed? We will explain at the link.

The Tax Service clarified this situation in letter No. BS-3-11/ [email protected] dated December 28, 2015. It refers to paragraph 6 of Article 52 of the Tax Code of the Russian Federation, which determines that taxes, including personal income tax, must be calculated in whole rubles.

Thus, there have been no changes to the income tax rounding rules. Representatives of the Federal Tax Service simply did not duplicate the provisions of the Tax Code in the Procedure for filling out the new form.

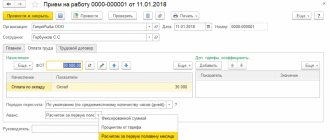

Sample sections 1 and 2 in 6-NDFL reporting:

Full numbers

In the new form 2-NDFL, tax amounts should be reflected in whole values, without kopecks.

On December 28, 2022, the Federal Tax Service clarified the rules for issuing certificates in 2020 in letter No. BS-3-11/4997. If the tax amount as a result of calculations is fractional, it must be rounded: more than 50 kopecks upward, less - downward to a whole ruble.

Where do the pennies come from?

When we multiply the amount of income by the tax rate, we can get an amount in rubles or kopecks. However, the tax should be calculated only in full rubles. In this regard, everything that is less than 50 kopecks is discarded, and 50 kopecks and more are rounded up to a full ruble (Clause 6 of Article 52 of the Tax Code of the Russian Federation). Moreover, you also need to pay personal income tax in rubles. Let's explain with an example.

Income of Ivanov A.P. amounted to 65,789 rubles, the applicable tax rate was 13%. We will calculate the tax as follows: 65,789 rubles. x 13% = 8552 rubles 57 kopecks. As you can see, it turned out to be more than 50 kopecks. Therefore, we will round the amount to the whole ruble. And it will turn out to be 8553 rubles. This is the amount that should be paid to the budget. Also see “Calculating Income Tax”.

The Ministry of Finance recalled the rules for rounding personal income tax by a tax agent

However, the rules and procedure for issuing a duplicate certificate of incapacity for work are prescribed and vary depending on the reason and degree of guilt of the applicant. The stages of constructing a wooden model of a folding ramp are similar to the manufacture of a metal product, but differ in complexity. The power of attorney must be certified by a notary and give authority to submit applications on behalf of the citizen.

Personal income tax is listed with kopecks

It is impossible to inherit property that has already been accepted as a gift. The legislation fully protects the interests of this category of citizens. The most correct way to reflect such a business transaction would be to use the debit of subaccount 50.

At the same time, in fact there should not be even a penny difference if the company has correctly calculated the contributions. Let's show it with an example. Maximum base per year - rub. A penny difference according to the Federal Tax Service formula can only arise if the company has overestimated the basis for the calculation. For example, I calculated contributions from payments of .05 rubles. Then the contributions will be .01 rub. Therefore, it is necessary to correct the calculation for last year. How to count. Consider the contributions for each employee as a cumulative total. Round the total contributions to the ERSV to the nearest kopeck - two decimal places.

Show income in rubles and kopecks

Always show the income received by individuals in 6-NDFL in rubles and kopecks. The fact is that the Tax Code of the Russian Federation does not provide that when calculating personal income tax, income can be rounded. Moreover, the possibility of reflecting kopecks is provided for in lines 6-NDFL, which show income. If you round the income on lines 020, 025, 030 and 130 to whole rubles, then the amount of calculated tax, in fact, will not be calculated correctly. And this already threatens a fine for the tax agent - 500 rubles for each settlement with false information (Article 126.1 of the Tax Code of the Russian Federation)

If you made a mistake and filled out the income of individuals in 6-NDFL without kopecks, then submit an updated calculation. If you submit the “clarification” before the tax authorities identify the error, you will not be fined. This is provided for in Article 126.1 of the Tax Code of the Russian Federation. You can fill out form 6-NDFL.

What's Happening Right Now: Interest Rates in 2022

Taxation is established by the legislation of our country. Of course, profit, which is different for everyone, is not without taxes, and the indicators also differ. In this table we show what amounts of income and in what categories personal income tax is withheld:

| Personal income tax percentage rate | Types of profit that are taxed |

| 13,00% | The first tax applies to people who work under an employment contract, these include citizens of the Russian Federation and other states (these are highly qualified workers who have a non-permanent place of residence in the Russian Federation). Types of categories from which personal income tax taxes are levied:

|

| 9,00% | This interest rate applies to:

|

| 15,00% | Receipt of income by citizens not residing in the Russian Federation from Russian enterprises that took part in their activities (shared construction) |

| 35,00% | This type is suitable for:

|

| 30,00% | Profit received by any citizen who does not reside in the Russian Federation (for example, a foreigner) |

Income tax is not deducted from other categories of citizens, for example, benefits, receipt of child support, reimbursement for payment for services in a medical institution, financial assistance from the state.

It is important to know! There are also other categories of contributions in Russia that are not taxable: pension insurance - 22 percent, social insurance - 2.9 percent, and also medicine - 5.1 percent. All employers are also required to make these transfers

Rebus Company

Tax authorities, when determining the amount of tax to be transferred to the budget and subsequently reflected in the reports 2-NDFL, 3-NDFL and 6-NDFL, proceed from the above administrative documents, as well as the norms of the Tax Code of the Russian Federation, in particular - clause 6 of Art. 52, which regulates the principle of rounding tax values.

Personal income tax to pay with or without kopecks 2022

In addition, changing the tax payment by rounding does not comply with the norms of paragraph 1 of Art. 3 codes that state that everyone is obliged to pay taxes established by law. However, rounding rules must be observed for individual taxes.

123, that is, penalties. This year there are no plans to make legislative changes to the procedure for calculating and transferring personal income tax. This means that in order to calculate the amount of budget payments, it is necessary to determine the tax base and apply the established calculated rates.

Deadline for paying personal income tax upon dismissal of an employee in 2022

This means that the algorithm and the result of accruals do not raise any complaints from regulatory authorities. Also, integer numbers are processed faster by specialized programs within which the Tax Service operates. In 2022 and subsequent years, everything remains at the same level, as well as the procedure for rounding the obtained values of the mandatory fee.

Personal income tax to pay with or without kopecks 2022

Tax agents may get confused about the timing of personal income tax transfers from various payments to individuals, forgetting about the prohibition on early tax transfers and the accrual of late fees. The solution in this situation is a table of deadlines for paying personal income tax in 2022 for legal entities.

The most common incomes for citizens are wages, pensions and stipends. To the list you need to add interest on deposits and dividends, fees for leasing any property not only real estate, royalties and much more. The law requires that a tax be transferred to the budget from the income of individuals - personal income tax (NDFL).