Legal side of the issue

An exhaustive list of costs that are taken into account in the tax base for a single simplified tax is set out in Article 346.16 of the Tax Code of the Russian Federation. Subclause 31 of clause 1 of this article of the Code states that the state duty under the simplified tax system with the object “income minus expenses” is taken into account when reducing the base for the single tax of the simplified tax system. However, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation states that costs must meet the requirements listed in paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Mainly, this paragraph requires the economic justification of the costs incurred in order to include them in the base for reducing the simplified tax system tax.

This means that by paying the state fee, the company must receive some significant result from this action, otherwise the fee cannot be classified as an expense.

Situations when the state duty cannot be included in expenses may be different. For example, a company submits an application to the tax authorities with a request to make changes to the Unified State Register of Legal Entities and is refused because the company itself made a mistake in the application form. The paid state duty will not be returned to the taxpayer, but the fee cannot be included in expenses, because no practical result is obtained from its payment.

Please note that if the state duty is reimbursed to a legal entity by court decision, the amount must be included in the company’s income. This opinion is shared by the Ministry of Finance of the Russian Federation in its letter dated May 17, 2013 No. 03-11-06/2/17357.

What expenses for the simplified tax system include state duty?

Acceptance of state duty as a cost under the simplified tax system depends on the purposes of paying this state fee. When paying the state fee for filing a claim with the judicial authorities, for making changes to the Unified State Register of Legal Entities, for issuing copies of documents and other similar procedures, the state fee is included in expenses for the purpose of reducing the single tax of the simplified tax system, regulated by the norms of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

If the fee is paid when registering a vehicle or during the registration procedure for real estate acquired by a company, then the state duty increases the amount of the cost of property subject to depreciation, and therefore reduces the tax base in accordance with the provisions of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation. It is important to note that this is legal for the state duty, which was paid before the depreciable object was put into operation. When paying a fee after putting this property into operation, the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation come into force, according to which the state duty should be included in one-time costs under the simplified tax system.

A convenient accounting program for the simplified tax system from Bukhsoft ensures competent maintenance and accounting of the warehouse, fixed assets, tangible and intangible inventories, as well as the company’s monetary assets in one place!

Is state duty included in expenses under the simplified tax system?

Are state duties included in the cost of simplification?

Are state duties included in expenses during simplification?

The list of costs taken into account when determining the single tax during simplification is indicated in Art. 346.16 Tax Code of the Russian Federation. This list is closed. This means that the taxpayer has the right to reduce the amount of income only for the costs named in the list.

According to sub. 31 clause 1 of the above-mentioned article, the state duty under the simplified tax system, income minus expenses, reduces the tax base. But according to paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, costs must meet the requirements of paragraph 1 of Art. 252 of the Code.

First of all, this paragraph mentions the economic feasibility of expenses. This means that as a result of paying the state duty, some significant result must be obtained. Otherwise, the fee paid cannot be considered an expense.

This applies, for example, to situations where, when submitting an application to make changes to the Unified State Register of Legal Entities, the registration action was refused due to an error made by an employee of the enterprise when filling out the form. In this situation, the paid state fee is not returned to the legal entity, but cannot be accepted as expenses.

IMPORTANT! In case of reimbursement of state duty to an enterprise by a court decision, the amount received must be included in income. This is how the Ministry of Finance of the Russian Federation interprets the norms of the code in letters dated 02/20/2012 No. 03-11-06/2/29, dated 05/17/2013 No. 03-11-06/2/17357. Read about what expenses are accepted for accounting under the simplified tax system.

As part of what costs during simplification is the state duty taken into account?

How the state duty is accepted as an expense under the simplified tax system depends on the action for which the duty was paid. If the state fee is paid for filing a lawsuit, registering changes in the Unified State Register of Legal Entities, issuing duplicate documents or other similar actions, then such a fee is included in the costs for determining the simplified tax according to the norms of subsection. 22 clause 1 art. 346.16 Tax Code of the Russian Federation.

But if the state duty is paid to register a vehicle or register real estate, then such a fee will increase the amount of depreciable property and will reduce the tax base in accordance with the procedure described in paragraph 3 of Art. Code 346.16. But this applies only to those fees that were paid before the depreciable property was put into operation. If the fee is paid after, then the state duty is included in the expenses under the simplified tax system at a time in accordance with clause 2 of Art. 346.17 Tax Code of the Russian Federation.

Reimbursement of legal expenses for state fees in case of registration expenses minus income

USNO: how to take into account the payment of utilities by tenants, No. 14

- USNO: calculating the cost of goods sold, No. 12

- We return advances to the simplified tax system and reduce income, No. 12

- Answers to “special regime” riddles, No. 11

- An Uneasy Partnership of Simplists, No. 5

- Simplified accounting: simple recipes, No. 4

- Refund of last year's advance: reducing income under the simplified tax system, No. 4

- Simplified: about painful issues..., No. 3

- The simplifier transfers the building to the only participant - what is more profitable?, No. 3

- Simplification was wrongfully used: is it possible to avoid additional charges and fines?, No. 3

- From the new year - a new Book for simplifiers, No. 2

- “Simplified” tax for 2012, No. 2

- Is a simplifier entitled to deduct VAT on exports for the “general regime” period, No. 1

- 2012

Important: Simplified people have to deal with the provision of public services everywhere. Code, the state fee is attributed specifically to fees when applying to:

- Government structures.

- Local authorities.

- Other bodies and/or officials who are legally authorized to perform legally significant actions.

There should be no controversy as to whether state duty is taken into account in expenses under the simplified tax system when a document or a duplicate of it is issued to a simplifier for a fee. Yes, this is equated by law to legally significant actions. As follows from the meaning of subsection. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, state duty is accepted as expenses under the simplified tax system in any amount upon its transfer to the treasury to the appropriate account. Taxation in industries: The judges came to the conclusion that the HOA is an economic entity that does not act in its own interests, but exclusively in the interests of the members of the partnership, including when it defends the rights of the owners of premises in the courts.

Payment of state duty is accepted as expenses upon registration

Court fees By virtue of subparagraph 31 of paragraph 1 of Article 346.16 of the Tax Code, simplifiers with the object “income minus expenses” can take into account the costs of:

- Court expenses.

- Arbitration fees.

Thus, the costs of state fees to the court can always be taken into account on the simplified tax system. Moreover, simplifiers do this on the date of payment, and not on the date of entry into force of the court decision (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). To be more precise, the obligation to pay court fees arises due to the filing of a claim. Accordingly, such a state fee can be included in the expenses of the simplified tax system on the day the court issues a ruling to accept the application for proceedings. It also happens that at first the simplifier attributed the state duty to the expenses of the simplified tax system, which he paid under a civil law agreement. However, a court decision was subsequently issued, which, among other things, returned the paid state duty to him. What should I do? It must be included in income. N.G. Bugaeva, economist If a counterparty or the state returned some amounts to a company using the simplified tax system, then it is clear that the organization will not want to take them into account in its income and pay tax on them. Especially simplified with the object “income” p. 1 tbsp. 346.14 Tax Code of the Russian Federation. Let's try to figure out in what cases it is necessary to include returned amounts in income and in what cases not. What refundable amounts are not income Organizations and individual entrepreneurs using the simplified tax system when calculating tax take into account income from sales and non-operating income. 1 tbsp. 346.15, articles 249, 250 of the Tax Code of the Russian Federation. But they do not recognize in income:

- amounts that are directly named in Art. 251 Tax Code (for example, the amount of repaid loans and credits), as well as dividends received and interest on government securities. 1.1 art.

Moreover, simplifiers do this on the date of payment, and not on the date of entry into force of the court decision (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). To be more precise, the obligation to pay court fees arises due to the filing of a claim. Accordingly, such a state fee can be included in the expenses of the simplified tax system on the day the court issues a ruling to accept the application for proceedings.

Broker services

In accordance with paragraphs.

24 clause 1 art. 346.16 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system may take into account the costs of paying commissions, agency fees and fees under agency contracts when determining the tax base. At the same time, the activity of the customs representative (broker) in carrying out customs operations on behalf and on behalf of the declarant (another person who is entrusted with the duty or who is granted the right to carry out customs operations in accordance with the Customs Code of the Customs Union) is in the nature of intermediary activity (clause 34 p. 1 article 4, paragraph 2 article 12 of the Labor Code of the Customs Union, paragraph 1 article 971, paragraph 1 article 1005 of the Civil Code of the Russian Federation).

In this regard, the costs of paying remuneration to the customs representative (broker) can be taken into account by the taxpayer applying the simplified tax system when determining the tax base for the tax on the basis of paragraphs. 24 clause 1 art. 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated January 22, 2013 N 03-11-11/19).

By virtue of paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation, these expenses are accepted after their actual payment.

Classification of legal expenses

Legal expenses consist of state fees and legal costs associated with the consideration of the case by the arbitration court. This is stated in Article 101 of the Arbitration Procedure Code.

According to Article 106 of the Arbitration Procedure Code of the Russian Federation, these legal costs include:

- amounts of money to be paid to experts, witnesses, translators;

— costs associated with on-site inspection of evidence;

— payment for the services of lawyers and other persons providing legal assistance (representatives);

- other expenses incurred by the parties to the dispute in connection with the consideration of the case in the arbitration court.

Legal costs are not

:

— office and postal expenses;

— costs of organizing and conducting mobile court hearings;

— monetary payments to experts and translators for performing certain actions as part of their official assignment.

Let us consider in detail how to correctly take into account, for profit tax purposes, legal expenses that arise in various situations.

Costs of attorneys' and lawyers' fees

As a rule, a representative of an organization in court is required to have high legal qualifications. Small firms cannot always afford to have such specialists on staff and turn to law firms, legal or audit firms. The cost of services depends on the complexity of the dispute, the cost of the claim and the number of court hearings.

These legal costs are reflected in tax accounting by analogy with state duties, that is, as part of non-operating expenses. However, such expenses should be accepted for profit tax purposes, taking into account the requirements of Article 252 of the Tax Code. Namely: legal costs are taken into account as non-operating expenses in accordance with subparagraph 10 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, if they are documented, incurred at the time of consideration of the dispute and are economically justified.

The justification of expenses is determined based on a number of circumstances. For example, such as the outcome of the dispute, prevailing prices for lawyers’ services in a particular region, the number of documents, the terms of reference of the representative in the court.

note

: if an organization is represented in court by its full-time employee, then his salary is not accepted as legal expenses. In such a situation, judicial practice proceeds from the fact that the salary of a full-time lawyer is paid regardless of the presence or absence of a legal dispute. For profit tax purposes, such costs will be qualified as labor costs under Article 255 of the Tax Code.

In order for the amounts paid to the in-house lawyer to be taken into account as legal expenses, a civil law agreement must be concluded with him for representation in court. The contract should provide for payment for participation in a specific case. But this will only help if the lawyer’s job description does not include such a duty.

The following situation is also possible: if there is a full-time lawyer, the organization attracts a third-party specialist to participate in the court. In this case, it is necessary to strictly distinguish between the tasks of in-house and outsourced lawyers. Those issues that will be resolved by a third-party lawyer must be clearly stated in the contract. The fact is that it is possible to economically justify payment for the services of a third-party specialist (and, accordingly, accept these expenses for profit tax purposes) only if the services he provided do not duplicate the job responsibilities of an in-house lawyer.

At what point are legal costs for legal services reflected in the tax accounting of an organization?

Let's say a taxpayer accounts for income and expenses on an accrual basis. In this case, the date of inclusion of the specified legal costs in non-operating expenses is the day of presentation of the act on the services rendered by the lawyer in accordance with the terms of the contract concluded with him (regardless of when the court makes its decision). This is indicated by subparagraph 3 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation.

If the organization uses the cash method, then it writes off the corresponding expenses at the time of payment for the cost of services in accordance with the contract (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Expenses for witnesses, experts and translators

Amounts to be paid to witnesses and experts or necessary to pay the costs of an on-site examination shall be paid in advance by the party who made the corresponding request. If such a request was received from both parties, then they contribute the required amounts equally (Article 108 of the Arbitration Procedure Code of the Russian Federation).

When attracting experts and witnesses, the organization must transfer money to pay for their services to the deposit account of the arbitration court. Article 109 of the Arbitration Procedure Code of the Russian Federation determines that amounts of money due to experts and witnesses are paid after they have fulfilled their duties. This means that these amounts can be taken into account as non-operating expenses for tax purposes only after the expert presents an opinion and the witness gives testimony. That is, the moment of recognition of such expenses does not depend on what method the organization uses in tax accounting: accruals or cash.

The court must ensure the participation of an interpreter in cases established by law. Persons participating in the case have the right only to propose candidates for translator to the arbitration court (Clause 2 of Article 57 of the Arbitration Procedure Code of the Russian Federation). Payment for the services of an interpreter invited by the arbitration court to participate in the process, as well as payment of daily allowance and reimbursement of expenses in connection with his appearance in court, are made from the federal budget. This is stated in paragraph 3 of Article 109 of the Arbitration Procedure Code of the Russian Federation.

How to take into account the cost of state duty for income tax purposes and under the simplified tax system

Tax accounting of state duty depends on its type.

The state duty for registering rights to real estate and for registering cars both under the OSN and under the simplified tax system is taken into account depending on when it is paid:

- if before the facility is put into operation, it is included in the initial cost of the operating system;

- if after putting the facility into operation, it is taken into account in expenses at a time.

The state fee paid by an organization when filing an application, statement of claim, complaint (appeal, cassation or supervisory) in court (arbitration or general jurisdiction), both under the OSN and under the simplified tax system, is taken into account in expenses.

The state fee, which the court decides to reimburse the defendant, is taken into account:

1) the defendant has expenses:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of payment;

2) the plaintiff’s income:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of receipt of money.

In other cases, both under the OSN and under the simplified tax system, the state duty is taken into account in expenses on the payment date, which always coincides with the accrual date.

This also applies to state fees for state registration:

- changes made to the organization's charter (Unified State Register of Legal Entities);

- real estate lease agreement concluded for a period of at least one year;

- rights to land plots.

Government duty

In accordance with the Tax Code of the Russian Federation, a state duty is a fee levied on organizations and individuals when they apply to state bodies, local governments, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation , legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local governments, for the performance of legally significant actions in relation to these persons provided for by the Tax Code, with the exception of actions performed by consular offices of the Russian Federation, namely:

when applying to courts of general jurisdiction, to magistrates;

when applying to arbitration courts;

when applying to the Constitutional Court of the Russian Federation and constitutional (statutory) courts of the constituent entities of the Russian Federation;

for notarial acts;

for actions related to civil registration;

for actions related to the acquisition of citizenship of the Russian Federation or renunciation of citizenship of the Russian Federation, as well as entry into the Russian Federation or departure from the Russian Federation;

for actions related to the official registration of a program for electronic computers, a database and an integrated circuit topology;

for the actions of authorized government agencies in the implementation of federal assay supervision;

for the actions of the authorized executive body during the state registration of medicinal products;

for the actions of the authorized executive body during the state registration of medical devices;

for state registration of legal entities, political parties, mass media, issues of securities, property rights, vehicles, etc.

Among other things, the Tax Code of the Russian Federation provides for state duties for:

the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

the right to export cultural values, collectibles

paleontology and mineralogy;

issuing permits for transboundary movement of hazardous waste;

issuing permits for the export from the territory of the Russian Federation, as well as for the import into the territory of the Russian Federation, of species of animals and plants, their parts or derivatives, subject to the Convention on International Trade in Endangered Species of Wild Fauna and Flora.

How to take into account state duty in accounting

In accounting, the state duty is reflected in the following entries:

Wiring

Operation

The state duty is included in the initial cost of the fixed assets (real estate, car)

D 20 (26, 44) - K 68

[1]

State duty on transactions related to the normal activities of the organization is taken into account (for example, when registering a lease agreement)

The state duty paid when applying to court, reimbursed by court decision, for other transactions not related to the ordinary activities of the organization (for example, when selling a share in the authorized capital) is taken into account.

How to take into account the cost of state duty for income tax purposes and under the simplified tax system

Tax accounting of state duty depends on its type.

The state duty for registering rights to real estate and for registering cars both under the OSN and under the simplified tax system is taken into account depending on when it is paid:

if before the facility is put into operation, it is included in the initial cost of the operating system;

if after putting the facility into operation, it is taken into account in expenses at a time.

The state fee paid by an organization when filing an application, statement of claim, complaint (appeal, cassation or supervisory) in court (arbitration or general jurisdiction), both under the OSN and under the simplified tax system, is taken into account in expenses.

The state fee, which the court decides to reimburse the defendant, is taken into account:

1) the defendant has expenses:

in case of OSN - on the date of entry into force of the court decision;

2) the plaintiff’s income:

in case of OSN - on the date of entry into force of the court decision;

In other cases, both under the OSN and under the simplified tax system, the state duty is taken into account in expenses on the payment date, which always coincides with the accrual date.

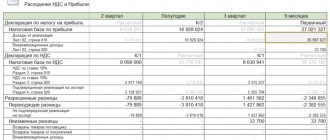

How to reflect the state duty in income tax returns and the simplified tax system

In the income tax return, the state duty paid by the organization (except for that included in the initial cost of fixed assets) is reflected on line 041 of Appendix No. 2 to Sheet 02 on an accrual basis in the total amount of taxes and fees accrued in the reporting (tax) period.

In the tax return under the simplified tax system in Section 2.2, in the total amount of expenses incurred, the amounts of state duty (except for those included in the initial cost of fixed assets) paid during:

I quarter - on line 220;

half a year - on line 221;

9 months - on line 222;

year - on line 223.

How to reflect the state duty in income tax returns and the simplified tax system

In the income tax return, the state duty paid by the organization (except for that included in the initial cost of fixed assets) is reflected on line 041 of Appendix No. 2 to Sheet 02 on an accrual basis in the total amount of taxes and fees accrued in the reporting (tax) period.

In the tax return under the simplified tax system in Section 2.2, in the total amount of expenses incurred, the amounts of state duty (except for those included in the initial cost of fixed assets) paid during:

- I quarter - on line 220;

- half a year - on line 221;

- 9 months - on line 222;

- year - on line 223.

State duty: accounting entries

A state duty is a fee that is collected when applying to government agencies, local governments, other bodies or officials authorized by law to perform legally significant actions (clause 1 of Article 333.16 of the Tax Code of the Russian Federation).

State duty: accounting account

Accounting for state duties is kept on active-passive account 68 “Calculations for taxes and fees” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). When calculating state duty, accounting in accounting means crediting account 68, and payment of the duty is reflected in the debit of account 68. We will describe below which accounts correspond with account 68.

State duty on property value

The procedure for reflecting state duty in accounting depends on what the payment of state duty is associated with and at what stage such payment is made.

If the state duty is paid in connection with the acquisition of property, then it is included in its original cost. However, if the duty is paid after the object has been accepted for accounting (put into operation), and the accounting rules do not provide for a change in the initial cost in such cases, the duty will be applied to expenses for ordinary activities or other expenses, depending on the to what type of activity the payment of this duty applies.

For example, the state duty paid for registering rights to real estate before the commissioning of the object is included in its initial cost (clauses 7, 8 PBU 6/01, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 08 “Investments in non-current assets” - Credit of account 68.

Refund of state duty from the budget

If the proceedings in the case were terminated, or the application was left by the court without consideration, or the state duty was paid (collected) in excess, then the amount of the state duty (partially or fully) is returned to the taxpayer. The basis is the corresponding indication in the court decision.

So, according to paragraph 2 of Art. 129 of the Arbitration Procedure Code of the Russian Federation, when the court makes a ruling on the return of the statement of claim, the arbitration court decides the issue of returning from the federal budget the state duty paid by the plaintiff.

The refund of the state duty to the taxpayer is carried out in accordance with Art. 78 of the Tax Code, taking into account the features established by Ch. 25.3 of the Code.

The procedure for a taxpayer’s actions when returning state duty is determined by clause 3 of Art. 333.40 Tax Code of the Russian Federation. An application for the return of the overpaid (collected) amount of state duty is submitted to the tax authority at the location of the court in which the case was heard. The application is accompanied by decisions, rulings and certificates from the courts regarding the circumstances that are the basis for a full or partial refund of the overpaid (collected) amount of state duty.

If the state duty is refundable in full, then along with the above documents, original payment documents (orders and receipts confirming payment of the state duty) are also submitted. If the state duty is partially refundable, copies of payment documents.

This procedure has been in effect since January 31, 2006 in connection with the provisions of Federal Law dated December 31, 2005 N 201-FZ.

The taxpayer has the right to a refund of the state duty within three years from the date of payment. In other words, the corresponding application must be submitted before this period expires.

The tax authority is obliged to return the amount of state duty within a month from the date the taxpayer submits the application. Otherwise, the tax authority may be charged interest on the amount of state duty not returned within the prescribed period, calculated based on the refinancing rate of the Bank of Russia (clause 9 of Article 78 of the Tax Code of the Russian Federation).

In tax accounting, the organization includes the amount of returned state duty as part of non-operating income. This is stated in paragraph 3 of Art. 250 Tax Code of the Russian Federation.

An organization using the accrual method recognizes non-operating income based on the procedure established by Art. 271 Tax Code of the Russian Federation. According to this procedure, the amount of state duty returned to the organization is reflected in non-operating income on the date of entry into force of the court decision on such return.

A similar position regarding the procedure for recording and recognizing returned state duty is set out in Letters of the Ministry of Finance of Russia dated January 18, 2005 N 03-03-01-04/2/8 and dated July 1, 2005 N 03-03-04/1/37.

Under the cash method, the amount of the refunded state duty is recognized in the manner provided for in Art. 273 of the Tax Code of the Russian Federation, - as funds arrive in the taxpayer’s account or cash desk.

In the corporate income tax return for the reporting (tax) period, the amount of non-operating income in the form of returned state duty is reflected in line 100 “Non-operating income - total” of Appendix No. 1 to sheet 02 and, accordingly, is included in the total line 020 “Non-operating income” of sheet 02.

Example 2 . CJSC Aton filed a claim with the arbitration court to recover a penalty in the amount of 100,000 rubles from its supplier. for violation of the terms of a business contract. On the same day, before submitting the application, Aton CJSC paid the state fee.

The amount of state duty was calculated according to paragraphs. 1 clause 1 art. 333.21 Tax Code of the Russian Federation. It states that in property cases considered in arbitration courts, if the value of the claim is from 50,001 to 100,000 rubles. The fee is 2000 rubles. plus 3% of the amount exceeding RUB 50,000.

Thus, the amount of state duty paid by Aton CJSC amounted to 3,500 rubles. [2000 rub. + (RUB 100,000 - RUB 50,000) x 3% : 100%].

However, when considering the case in the court of first instance before the court decision was made, the plaintiff (Aton CJSC) reduced the amount of claims to 60,000 rubles. The arbitration court recognized this as not contrary to the law and not violating the rights of other persons.

If the plaintiff reduces the amount of the claim, the amount of the overpaid state duty shall be refunded. In accordance with paragraphs. 1 clause 1 art. 333.40 of the Tax Code of the Russian Federation, the state duty is subject to partial or full refund if it is paid in a larger amount than provided for in Chapter. 25.3 of the Code.

The amount of state duty, calculated based on the new price of the claim, amounted to 2,300 rubles. [2000 rub. + (60,000 rub. - 50,000 rub.) x 3% : 100%].

Thus, on the date of filing the statement of claim to reduce the size of the claim, the plaintiff must be returned 1,200 rubles. (3500 rub. - 2300 rub.).

As already noted, the refund of the overpaid amount of state duty is made upon the application of the taxpayer (plaintiff) to the tax authority. The application is accompanied by the relevant court rulings (decisions) and payment documents referred to in clause 3 of Art. 333.40 of the Tax Code of the Russian Federation, which confirm the fact of payment of the state duty.

Let's assume that Aton CJSC lost the case and its legal costs were not reimbursed. In this case, the organization’s accountant must make the following entries in accounting:

Debit 68 subaccount “Calculations for payment of state duties” Credit 51

- 3500 rub. — the state fee for consideration of the case in the arbitration court is transferred;

Debit 91-2 Credit 68 subaccount “Calculations for payment of state duties”

- 3500 rub. — the amount of the state duty paid is reflected in non-operating expenses;

Debit 68 subaccount “Calculations for payment of state duties” Credit 91-1

- 1200 rub. — the debt of the tax authority for the refund of state duty is reflected (as of the date of filing the relevant application);

Debit 51 credit 68 subaccount “Calculations for payment of state duties”

- 1200 rub. — the amount of overpaid state duty was returned to the bank account of Aton CJSC.

In tax accounting, the accountant of Aton CJSC reflects:

- as part of non-operating expenses - 3,500 rubles;

- as part of non-operating income - 1200 rubles.

State duty on expenses

In addition to the duties paid after the property is registered (put into operation), duties not related to the acquisition of property will be directly included in the organization’s expenses. We are talking, for example, about the state fee when filing a statement of claim in court, the state fee for performing notarial acts, the fee for making changes to the constituent documents of the organization, etc. In these cases, when accounting for state duties in accounting, the entries (from the point of view of the debited account) may be different.

Court fees are usually reflected as part of the organization's other expenses:

Debit account 91 “Other income and expenses”, subaccount “Other expenses” - Credit account 68.

The procedure for accounting for other duties depends on what type of activity the payment of the duty relates to.

So, for example, the state duty paid for amending the charter will be reflected as follows (clauses 5, 7 PBU 10/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit account 26 “General business expenses”, 44, etc. – Credit account 68.

[1]

For example, the state duty paid for issuing a certificate for a released license plate unit when disposing of an organization’s vehicle will be reflected as follows (clause 11 of PBU 10/99):

Debit account 91, subaccount “Other expenses” - Credit account 68.

Is it possible to take into account the state fee in expenses in case of refusal to issue a license?

IA GARANT LLC applies the simplified tax system (“income minus expenses”), paid the state fee in June 2014 for a retail alcohol license in the amount of 200,000 rubles. In the same month, a license was refused because the premises did not meet licensing standards. As a result, the LLC refused to lease this premises. Can the paid state fee be considered an expense? If so, what entries should it be reflected in accounting? If the state duty is not recognized as an expense, then how should it be taken into account? Having considered the issue, we came to the following conclusion: In our expert opinion, your organization has the right to take into account the expense in the form of paid state duty for the purposes of calculating the tax base for the tax paid when applying the simplified tax system. This expense is recognized in the period of payment of the state duty. In accounting, the paid state duty is taken into account as part of other expenses. Rationale for the conclusion:

Tax accounting

Organizations that apply the simplified taxation system (hereinafter referred to as the simplified taxation system) and have chosen income reduced by the amount of expenses as an object of taxation can take into account the expenses that are listed in the closed list of clause 1 of Art. 346.16 Tax Code of the Russian Federation. In accordance with paragraphs. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, taxpayers applying the simplified tax system, when determining the object of taxation, reduce the income received by the amounts of taxes and fees paid in accordance with the legislation on taxes and fees, with the exception of the amount of tax paid in accordance with Chapter 26.2 of the Tax Code of the Russian Federation. According to paragraph 1 of Art. 333.16 of the Tax Code of the Russian Federation, state duty is a fee levied on organizations and individuals when they apply to state bodies, local governments, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of constituent entities of the Russian Federation and regulatory legal acts of local government bodies, for the commission of legally significant actions in relation to these persons, provided for in Chapter 25.3 of the Tax Code of the Russian Federation, with the exception of actions performed by consular offices of the Russian Federation. Moreover, in accordance with paragraph 10 of Art. 13 of the Tax Code of the Russian Federation, state duty refers to federal fees. Thus, the state duty for the provision by authorized bodies of a license for the retail sale of alcoholic beverages can be taken into account when determining the tax base for the tax paid in connection with the application of the simplified tax system (letter of the Federal Tax Service of Russia for Moscow dated February 10, 2010 N 16-15/ [email protected] , see also letters of the Ministry of Finance of Russia dated May 10, 2012 N 03-11-06/2/63, dated April 16, 2012 N 03-11-06/2/57, resolution of the Federal Antimonopoly Service of the Ural District dated March 20, 2012 N F09-1186 /12 in case No. A07-9208/2011). According to paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation, expenses of a taxpayer are recognized as expenses after their actual payment. In this case, the costs of paying taxes and fees are taken into account in the amount actually paid by the taxpayer. Please note that the cash method used under the simplified tax system does not imply an even write-off of expenses during certain reporting (tax) periods (with the exception of fixed assets and intangible assets acquired during the period of application of the simplified tax system, the cost of which is written off evenly during the reporting (tax) period) . Therefore, the costs of paying the state fee for the provision of a license by authorized bodies are taken into account as part of the costs when determining the object of taxation for the tax paid in connection with the application of the simplified tax system, in the period of its payment in the amount of actual costs (letter of the Ministry of Finance of Russia dated March 30, 2012 N 03-11- 06/2/49, dated 02/09/2011 N 03-11-06/2/16, dated 01/23/2009 N 03-11-06/2/5). In accordance with paragraph 18 of Art. 19 of the Federal Law of November 22, 1995 N 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products” (hereinafter referred to as Law N 171-FZ) for the provision of licenses for the retail sale of alcoholic products, extension of the validity of such licenses and their re-registration, a state duty is paid in the amounts and in the manner established by the legislation of the Russian Federation on taxes and fees. A license for the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products is issued for a period specified by the organization, but not more than five years (Clause 17, Article 19 of Law No. 171-FZ).

In accordance with paragraph 19 paragraphs. 94 clause 1 art. 333.33 of the Tax Code of the Russian Federation (as amended in 2014), a state fee of 40,000 rubles is paid for granting a license for the retail sale of alcoholic beverages. for each year of the license validity period (from 01/01/2015 this amount is 65,000 rubles - a change was made to this norm by Federal Law dated 07/21/2014 N 221-FZ). Thus, payment of the state fee is one of the conditions for the provision of public services. As follows from paragraph 7 of Art. 19 of Law N 171-FZ, the provision of a public service may result in a refusal to issue a license. Moreover, neither Law No. 171-FZ, nor Art. 333.40 of the Tax Code of the Russian Federation (providing, in particular, the grounds and procedure for the return of state fees), refusal to grant a license as a basis for the return of state fees is not provided (letter of the Ministry of Finance of Russia dated September 27, 2013 N 03-05-05-03/40158, dated September 23 .2013 N 03-05-04-03/39358). The Ministry of Finance of Russia in these letters drew attention to the position of the Constitutional Court of the Russian Federation, according to which paragraph 1 of Art. 333.40 of the Tax Code of the Russian Federation, both in its literal meaning and in connection with paragraph 19 paragraphs. 94 clause 1 art. 333.33 of the Tax Code of the Russian Federation does not provide for the return of paid state duty in the event of an authorized body’s refusal to grant a license (Resolution of the Constitutional Court of the Russian Federation dated May 23, 2013 N 11-P). The question arises: can an organization applying the simplified tax system take into account for tax purposes the state duty paid, which is not subject to refund due to the fact that the authorized body refused to issue a license. By virtue of paragraph 2 of Art. 346.16, paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer. In this case, any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income. Consequently, in order to recognize an expense in the form of a paid state duty, it is also necessary that this expense be economically justified and documented. However, tax legislation does not use the concept of economic feasibility and does not regulate the procedure and conditions for conducting financial and economic activities. According to the judges of the Constitutional Court of the Russian Federation, the validity of expenses that reduce income received for profit tax purposes cannot be assessed from the point of view of their expediency, rationality, efficiency or the result obtained. Due to the principle of freedom of economic activity, the taxpayer carries out it independently at his own risk and has the right to independently and solely assess its effectiveness and expediency. Expenses are justified and economically justified if they are incurred to carry out activities aimed at generating income. Moreover, only the purpose and direction of such activity matters, and not its result. In this case, the burden of proving the unfoundedness of the taxpayer’s expenses rests with the tax authorities (decrees of the Constitutional Court of the Russian Federation dated 04.06.2007 N 320-O-P, N 366-O-P, letter of the Ministry of Finance of Russia dated 04.10.2013 N 03-03-06/1/41201 ).

In the letter of the Ministry of Finance of Russia dated July 6, 2007 N 01-02-03/03-311, specialists from the financial department also noted that the issue of assessing the effectiveness and feasibility of costs is the responsibility of the taxpayer as a business entity. Then, based on the above, we can come to the conclusion that the justification of the expense, including in the form of a state duty, occurs if it is aimed at generating income. In this case, the result (issuance of a license or refusal to issue it) does not matter. This license is required for your organization to carry out retail trade in alcoholic beverages. In our opinion, these circumstances directly indicate that the expenditure in the form of paid state duty is aimed at generating income from business activities. In this regard, we believe that the organization has the right to recognize the state duty indicated by you at the time of actual payment, regardless of the fact that the authorized body subsequently refused to grant a license. Please note that the position we have expressed is our expert opinion. Unfortunately, we were unable to find clarifications from the Russian Ministry of Finance and tax authorities, as well as court decisions regarding the recognition of expenses in the form of state duties in situations where the relevant government authorities refused to issue a license. In order to avoid claims from the tax authorities, we recommend that the organization exercise the right of the taxpayer and contact the Ministry of Finance of Russia or the tax authority at the place of registration of the organization for the appropriate written explanations (subparagraphs 1, 2, paragraph 1 of Article 21 of the Tax Code of the Russian Federation). If a dispute arises, the presence of personal written explanations from the financial department or tax authorities excludes the person’s guilt in committing a tax offense on the basis of paragraphs. 3 p. 1 art. 111 of the Tax Code of the Russian Federation.

Accounting

Paragraph 4 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99) provides that the expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into expenses for ordinary activities and other expenses. In this case, expenses other than expenses for ordinary activities are considered other expenses. In turn, clause 5 of PBU 10/99 determines that expenses associated with the manufacture and sale of products, the acquisition and sale of goods, the performance of work, and the provision of services are recognized as expenses for ordinary activities. Obtaining a license is a necessary condition for the organization to carry out its activities. This means that the costs of paying the state duty for issuing a license are directly related to the main activities of the organization and are subject to accounting as part of the expenses for ordinary activities during the period of their implementation on the basis of clause 18 of PBU 10/99. However, in the analyzed situation, the authorized body refused to issue a license. Therefore, the criterion given in paragraph 5 of PBU 10/99, in our opinion, is not met. Considering this circumstance, in our opinion, it is permissible to take into account the state duty paid by your organization as part of other expenses in account 91 “Other income and expenses.”

We also believe that calculations for the payment of state duties are reflected in the accounting accounts in correspondence with account 68, since these payments are transferred to the budget system of the Russian Federation. As a result, in the accounting of the organization in the case under consideration, the following entries should have been made: Debit 68, subaccount “State duty” Credit 51 - state duty paid; Debit 91, subaccount “Other expenses” Credit 68, subaccount “State duty” - expenses for payment of state duty are recognized. We also recommend that you familiarize yourself with the material: - Encyclopedia of Solutions. Correction of errors in accounting and reporting. The answer was prepared by: Expert of the Legal Consulting Service GARANT Zara Tsorieva Quality control of the answer: Reviewer of the Legal Consulting Service GARANT professional accountant Myagkova Svetlana