The expansion of a business always pleases its owner, but it also brings new reports into the life of an accountant. Such a report could be a notification of controlled transactions, the need to submit which is not always related to the amount of annual revenue. We will tell you who should submit this application and the procedure for filling it out in the 1C: Accounting 8 program, version CORP.

- Who submits notification of controlled transactions

- Filling out the notification preparation assistant in “1C: Accounting 8”

What applies to controlled transactions?

The list of controlled transactions is determined by law. In particular these include:

- various transactions with securities;

- transactions made and connections with the execution of loan agreements;

- construction transactions;

- rent;

- receiving property as a gift, etc.

It should be noted that not all income received by an organization is recognized as the result of controlled transactions and needs to be included in the document. For example, the following do not require notification:

- transactions related to precious metals, currencies, securities;

- dividends;

- profit from equity participation, etc.

Notification form in 2022

The 2022 Controlled Transaction Notification Form includes:

- title page;

- Section 1A “Information on a controlled transaction (group of similar transactions)”;

- section 1B “Information about the subject of the transaction (group of homogeneous transactions)”; section 2 “Information about the organization - a participant in a controlled transaction (group of homogeneous transactions)”;

- Section 3 “Information about an individual participant in a controlled transaction (group of similar transactions).”

The form for notification of controlled transactions and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated 05/07/2018 N ММВ-7-13/ This form is new! However, there are few amendments. For example, cell 140 was added to section 1A. In it you will need to indicate information about payers of the tax on additional income from the extraction of hydrocarbons. Clause 7.23 was excluded from the filling procedure. Previously, it indicated in which cases it was possible not to fill out section 1B for individual transactions.

How to submit a completed form

Notification can be sent in several ways:

- The simplest and fastest: personally from hand to hand to a specialist from the local tax service.

- Send through a representative, provided that he has a current notarized power of attorney.

- It is acceptable to send the notification via Russian Post by registered mail with return receipt requested.

- If an organization has an officially registered digital signature, it can send a notification via electronic means, a method of providing notifications that has become increasingly common in recent years.

Rules for filling out the document

The notification form has a strictly unified form, the use of which is mandatory. It is compiled once a year, at the end of the reporting period.

When generating a notification, you should remember a few simple but important rules:

- Data must be entered in capital letters, left, right;

- dashes are placed in empty cells;

- If units of measurement are entered, their data must correspond to official codes.

You can fill out the form either by hand (using pens of any dark color) or on the computer.

Errors, blots and corrections in the form are unacceptable.

Therefore, all data entered into the notification must be current and verified; if it so happens that an inaccuracy is revealed after the notification has been sent to the tax service, an updated report should be generated and sent there.

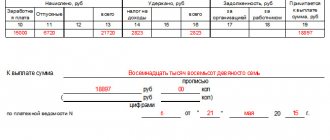

In those lines where we are talking about amounts, the values must be indicated in rubles (numbers up to 50 kopecks are not taken into account, after 50 they are rounded to the nearest ruble).

You must enter information in rubles even about transactions that were carried out using foreign currency.

Each page of the document must be numbered and signed (and the signature must only be “live”).

The form should be stamped only if the use of seals or stamps is specified in the company’s internal regulatory documents. There is no need to fasten the notice sheets together.

What transactions are considered controlled?

The Federal Tax Service has significantly reduced the number of controlled transactions that now need to be reported (letter of the Federal Tax Service No. ED-3-13 / [email protected] dated 10.25.18). Now only those that are completed on Russian territory and whose value exceeds one billion rubles will be considered a controlled transaction. Until 2022, a different threshold was set for the transaction amount - 60 million rubles (for participants in special tax regimes there was a different criterion - 100 million rubles). Therefore, inspectors were literally overwhelmed with work on checking such transactions. At present, some transactions carried out on the territory of our country will not be recognized as controlled, although last year the Federal Tax Service was checking them.

Also for transactions with foreign counterparties, there is now a monetary threshold of 60 million rubles.

Let's take a closer look at what criteria for controlled transactions apply from January 1, 2022.

Transactions between related parties

Who are interdependent persons and what does it depend on? These are not only individuals who can influence each other. But also various organizations, regardless of the form of organization or tax regime, which have the opportunity to influence the financial condition or operating conditions of each other, and significantly. These could be companies that are subsidiaries or parents of others with more than 25% ownership, have the same CEO, or have more than half of the same founders on the management board of both organizations. Such companies and persons must be registered in our country or pay taxes here. Their transactions can be considered controlled if the following criteria are met:

- the amount of profit from transactions of such persons must be more than 1 billion rubles (

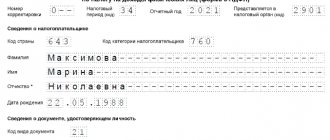

Title page

At the beginning of the document is the title page. This includes information about the taxpayer:

- his details (TIN, KPP, OKATO);

- branch number of the territorial tax inspectorate;

- last name, first name and patronymic name of the company representative submitting the document;

- Contact Information;

- the year for which the reporting is prepared.

If the notification is written on behalf of an individual who is not registered as an individual entrepreneur, then there is no need to put a TIN; it is enough to enter personal data on the title page, including information from a passport or other identity document.

Section 1A

This section of the notification must be completed, first, if necessary, dividing transactions into groups based on homogeneity and identity. At the same time, when dividing transactions, you do not need to rely on intuition; you should be guided by specific norms of the Tax Code of the Russian Federation (clause 5 of Article 105.7, 105.5).

For each group of transactions, aggregate information about them is recorded, as well as about the amount of income received as a result of their implementation (taken from the financial statements). If there is no division into groups, then the number of filled blocks in this section should be equal to the number of executed controlled transactions.

Section 1A. Information about a controlled transaction (group of similar transactions)

Section 1A is completed separately for each controlled transaction or group of similar transactions, incl. if such a transaction (a group of similar transactions) was carried out by the commission agent on his own behalf, but on behalf of and at the expense of the principal under the commission agreement.

If various heterogeneous transactions are made within the framework of one agreement, then a separate section 1A is completed for each such transaction.

To create section 1A, in the “List of deals” of the main menu, you need to click on the “Add deal” .

In the “Sequence number of the transaction by notification” , the order number of the transaction is automatically indicated.

If the transaction was completed by a commission agent, then a mark is placed in the appropriate field.

Further in the subsection “Grounds for control of a transaction...” :

- in the “Interdependence” , select the corresponding code of interdependence of the parties to the transaction;

- in fields 121-124 , the grounds for classifying a transaction as controlled according to Article 105.14 of the Tax Code of the Russian Federation are noted (for example, if the operation is a transaction between related parties, then a mark is placed in field 121 , etc.);

- fields 131-138 indicate the grounds for classifying a transaction as controlled, taking into account the specifics provided for transactions made between related parties, the place of registration (residence, tax residence) of all parties and beneficiaries of which is the Russian Federation (for example, if the amount of income from such transactions exceeds 1 billion rubles, then a mark is placed in field 131 , etc.).

Simultaneous marking in fields 122-123 and 131-138 is not allowed.

In the subsection “Information about a controlled transaction (group of similar transactions)” :

- in the “Group of homogeneous transactions” if the information is prepared for a group of transactions. the “Group of homogeneous transactions” field is not marked;

- the following are selected from the relevant directories: code of the name of the transaction and code of the party to the transaction, which is the taxpayer;

- in the field “Indicator of determining the price...” a mark is made if the taxpayer has made transactions in respect of which price regulation is provided, taking into account the features established by Article 105.4 of the Tax Code of the Russian Federation;

- “Comments” field reflects comments about the number and date of the document on the basis of which price regulation is carried out (the field is not required to be filled out);

- in the “Code for determining the transaction price” , the appropriate code is selected if the transaction price is recognized as market price in accordance with clauses 8-11 of Article 105.3 of the Tax Code of the Russian Federation;

- if a code is selected in the “Transaction price determination code” , then comments are indicated (the field is not required);

- in the “Code of pricing methods” , select the code of the pricing method used by the taxpayer (the field is not required to be filled in);

- if the taxpayer used a combination of 2 or more pricing methods (code “06” is indicated in the “Pricing methods code” ), then comments are reflected (the field is not required to be filled out);

- in fields 251-259 , a mark is placed for the corresponding code of the source of information used by the taxpayer when comparing the terms of transactions between related parties with the terms of transactions between persons who are not related (the field is not required to be filled out);

- the “Number of transaction participants” field reflects the total number of participants in the controlled transaction;

- “Comments” field displays comments about the participants in the transaction (group of similar transactions) (the field is not required to be filled out).

In the subsection “Amount of income received and amount of expenses incurred...” the following information is indicated:

- the amount of income of a taxpayer from a controlled transaction (group of similar transactions), determined for a calendar year according to accounting rules. The amount of income is indicated only if the taxpayer sells goods (work, services or other objects of civil rights) in a controlled transaction;

- the amount of income from a controlled transaction, the price of which is subject to regulation;

- the cost of goods (work, services, other objects of civil rights) purchased by a taxpayer in a controlled transaction (group of similar transactions) for a calendar year. The amount of expenses is indicated only if the taxpayer in a controlled transaction acquires goods (work, services or other objects of civil rights);

- the cost of goods (work, services, other objects of civil rights) purchased by a taxpayer under a controlled transaction, the price of which is subject to regulation.

When filling out this subsection, it should be taken into account that it is not allowed to simultaneously fill in the fields “Amount of income...” and “Amount of expenses (losses)...” values, and the value of the indicators must be equal to the sum of the indicators of the fields “Total cost excluding VAT and excise taxes” in sections 1B , complying with this section 1A.

Section 1B

Here the number of filled blocks is directly dependent on the previous section. This is due to the fact that it is additional, and information is entered here about work performed or services provided, supplies of inventory, shipments, loadings, etc.

This part of the document states:

- reference to the agreement during the execution of which this or that transaction was completed (number and date of conclusion);

- place of transaction;

- number of goods;

- price per unit;

- the full cost of the controlled transaction.

At the same time, goods passing through one controlled transaction cannot be added to each other; they must be indicated separately.

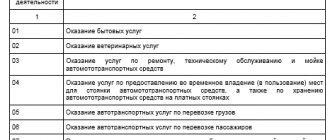

Table. Criteria for controlled transactions 2017 and 2022

| Nature of the controlled transaction | Signs indicating a controlled transaction | Transaction amount to recognize it as controlled |

| Participants in the transaction are interdependent persons and residents of the Russian Federation (Clause 2 of Article 105.14 of the Tax Code of the Russian Federation) | Sum of transaction prices for the year | The total income from transactions is at least 1 billion rubles. |

| One of the parties to the transaction is on UTII or Unified Agricultural Tax, while the other party applies a tax regime different from those indicated | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction applies a 0% income tax rate or is completely exempt from paying it | The total income from transactions is at least 100 million rubles. | |

| One of the parties to the transaction is a resident of a SEZ or a participant in a SEZ that has income tax benefits. In this case, the second party to the transaction should not be a participant in the specified zones | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction has a license to use a subsoil plot on the territory of which there is a new offshore hydrocarbon deposit, or this party to the transaction is the operator of such a deposit and calculates the income tax in accordance with Art. 275.2 Tax Code of the Russian Federation. It is important that the second party to the transaction is not involved in these circumstances or, being the operator of the field described above, does not take into account income (expenses) from this activity when calculating income tax | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction is a participant in a regional investment project, whose income tax rates are distributed as follows: 0% to the federal budget and a reduced rate to the budget of the constituent entity of the Russian Federation. In this case, the second participant in the transaction can also be a participant in the investment project under the same conditions | The total income from transactions is at least 60 million rubles. | |

| One or both parties to the transaction are research corporate companies that are exempt from VAT | The total income from transactions is at least 60 million rubles. | |

| One or both parties to the transaction apply an investment deduction for income tax (Article 286.1 of the Tax Code of the Russian Federation) | The total income from transactions is at least 60 million rubles. | |

| Transaction involving intermediaries - non-related parties | The intermediary is engaged only in the resale of goods | The income from the transaction does not matter |

| The intermediary resells goods and does not bear any risks and does not use its own assets | ||

| Contract in the field of foreign trade in goods of global exchange trade | As a result of the transaction, they sell: oil and oil products, mineral fertilizers, non-ferrous or ferrous metals, precious stones and metals | |

| Foreign economic transaction between related parties | All transactions that meet the characteristics | The income from the transaction does not matter |

Sections 2, 3

This part of the notice gives an overview of transactions in relation to the enterprise (the information in section 1B is not taken into account). In cases where the taxpayer did not have transactions with counterparties that were subject to accounting, these sheets can be left blank.

Similar transactions: what are their criteria?

Ideally, the Federal Tax Service is required to provide notifications of controlled transactions, reflecting all business transactions in as much detail as possible (letter of the Federal Tax Service of the Russian Federation dated August 30, 2012 No. OA-4-13/14433). But in practice, this wish of the tax authorities is obviously difficult to implement: the number of unique business transactions per legal entity, especially if it is a large business, can amount to tens of thousands.

Therefore, it makes sense for firms to take advantage of the opportunity to combine transactions of the same type into groups based on their similarity in type of goods, as well as comparability in financial conditions (clause 5 of Article 105.7 of the Tax Code of the Russian Federation). But the criteria for classifying transactions as similar, given in the Tax Code of the Russian Federation, are quite superficial, and their interpretation in the taxpayer’s version may not coincide with the approach of the Federal Tax Service (formed at the level of official instructions and understanding of the essence of transactions by a specific inspector).

What criteria should be considered objective?

The Ministry of Finance of the Russian Federation, in letter No. 03-01-18/33520 dated August 16, 2013, recommends merging transactions if they are similar in terms of profitability indicators, determined in accordance with the provisions of Art. 105.8 Tax Code of the Russian Federation. For example, the sale of vegetables and fruits has approximately the same profitability, regardless of the specific type of product sold.

The Office allows the following not to be indicated in the notification about a group of transactions:

- prices per unit of goods or services,

- number of goods and services supplied,

- the place where the transaction was concluded or the goods were sent.

But the form, as the Ministry of Finance notes, must record the names of groups of similar transactions, the amount of income received from them, as well as the pricing method.

Please note that the structure of the notification form does not allow grouping transactions for the supply of similar or even identical goods secured by different contracts with the same supplier. The fact is that in columns 060 and 065 of section 1B, in any case, the date and number of the specific agreement are indicated.

Thus, taking into account the position of the Ministry of Finance, similar transactions can be grouped if they:

- reflect supplies of goods with the same profitability;

- delivered under one contract.