Why save personnel documents, and what determines their retention period?

Storing personnel documents is the responsibility of all employers.

This is determined by Art. 17 of the Law of October 22, 2004 No. 125-FZ on archival affairs in the Russian Federation. Everyone is equal before this requirement of the law: companies, individual entrepreneurs, and government agencies. Personnel documentation occupies a significant place in the total volume of papers prepared by the employer. If he has several hundred or thousand employees, the number of personnel documents can reach several thousand units. But micro-employers who employ 2-3 people cannot do without these types of documents. And all of them are subject to storage for legally established periods.

The main feature associated with the storage period of personnel documents is the length of the period during which they cannot be destroyed. For example, information related to personnel is subject to long-term storage: for documents completed after 01/01/2003, it can be 50 years, before this date - 75 years, and individual documents generally for the entire period of the company’s existence. Such personnel documents include employment contracts and additional agreements thereto, personal cards of employees and other documents created by the employer related to the labor relationship between him and the employee.

The shelf life of cases generated in the personnel service is influenced by many factors. For example, due to the varying degrees of importance of the vacation schedule and staffing schedule, the storage periods for these documents differ (these are 3 years and 5 years, respectively).

How long should vacation orders be kept?

They are kept for the same amount of time as statements, depending on the category of the employee, inclusion in the personal file and the date of preparation. At the same time, there is no difference in how long an order for additional leave, for annual leave, etc. is kept. If the order is drawn up for a standard employee (not working in harmful or dangerous working conditions), the document is not included in the personal file and was drawn up after 01/01/2003, the storage period is five years.

The requirement for where employee leave orders are stored is contained in local regulations. The organization independently determines the place and method of storage. If there are few employees, it is not necessary to file folders annually - archive the filed folders for several years.

ConsultantPlus experts analyzed how long documents should be stored in an organization in 2022. Use these instructions for free.

Employment contract and list of employees engaged in hazardous work

At first glance, it is difficult to discern what is common in these two documents. An employment contract is a written agreement between an employee and an employer, which defines the main responsibilities and rights of the parties to the contract, indicates the work and rest schedule, specifies payment terms, as well as other necessary conditions. It is drawn up individually for each hired employee and contains the signatures of the employee and the director.

You can familiarize yourself with a sample employment contract and download its form in the article “Unified Form No. TD-1 - Employment Contract” .

The list of employees working in hazardous work is drawn up in the form of a list and does not contain employee signatures. But with each employee indicated in the list, his employment contract must agree, for example, on such an important feature of remuneration as compensation for hard work and work in harmful and (or) dangerous working conditions (with a description of the features of working conditions in the workplace).

IMPORTANT! If a company employee works in difficult, dangerous or harmful conditions (if he has relevant experience), a pension is assigned to him in accordance with sub-clause. 1–10, 12 p. 1 tbsp. 30 of Law No. 400-FZ.

However, these documents have an important unifying feature - their shelf life is 50/75 years (depending on the date of publication of the document).

IMPORTANT! The storage period for personnel documents in an organization is determined on the basis of the List of standard archival documents approved by Order of the Federal Archive of December 20, 2019 No. 236.

For information on the storage periods for other documents generated in the activities of a legal entity, read the material “What is the storage period for documents in the organization’s archive?”

How much and where to store applications

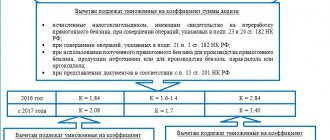

All companies and entrepreneurs must keep documents generated in the course of business activities. The law regulates the storage periods for orders for annual leave and its other types, depending on working conditions:

- five years for standard conditions;

- fifty for harmful or hazardous conditions.

Besides:

- statements are kept for fifty years when they are included in a personal file;

- seventy-five - all statements written before 01/01/2003 and if they are included in the employee’s personal file.

The period is calculated from January 1 of the year following the year in which the document was completed by office work (Part 1 of Article 17, Article 21.1, Part 1, 2 of Article 22.1 of Federal Law No. 125, Articles 434, 435 of Order No. 236) .

You have the right to determine for yourself whether to include them in your personal file or not in a local regulatory act, taking into account Parts 1, 4 of Art. 8, part 1 art. 22 Labor Code of the Russian Federation.

There are no differences in the storage periods for applications for leave without pay (unpaid), for annual and additional ones - all these documents are stored in accordance with the general rules indicated above.

Local regulations (charter, regulations on document storage, etc.) determine where employee leave applications are stored: in the organization’s archives, in a warehouse, in separate folders or in a personal file. The archive is created in a separate office or in the HR department office. Usually, documents are filed (if they are not part of a personal file), a folder of employee statements for the year is created and submitted to the organization’s archives. You can delimit folders and determine where to store applications for unpaid leave, maternity leave, additional leave, etc.

Storage periods for personnel documents using an example

We will tell you about the periods during which personnel documentation must be preserved using a specific example.

When she was hired, N.P. Savina, an accountant at Premiere LLC, was informed that in addition to her direct responsibilities related to accounting and reporting, she would have to keep personnel records. According to the management, the personnel document flow in the company is insignificant and little time will be required for this area of work, since the company has a staff of 18 people.

Having agreed to such additional responsibilities, Savina N.P. began her duties. Since there was a lot of accounting work, direct accounting responsibilities took up all of her working time. The preparation of personnel documents was not required so often - new employees did not appear, the rest were successfully working in their places, no one was going on business trips yet, and internal transfers from one workplace to another were not practiced in the company. Therefore, almost no one looked into the cabinet with personnel documentation.

Nevertheless, accountant Savina N.P. did not forget about her personnel responsibilities, therefore, after submitting the next report, she began to study the personnel documents available at that time. The results of examining the contents of the “personnel” cabinet turned out to be disappointing - documents were arranged chaotically in folders, employees’ personal files were not fully completed, some of the documentation had become unusable due to long storage or contained difficult-to-read text. Some cases included documents with different storage periods (1 year, 3 years, 5 years and 50/75 years), including some of them that had lost their quality as information carriers.

Savina N.P. began work on sorting out personnel documentation by systematizing all available personnel documents. Before getting rid of damaged or unreadable documents, she decided to check the standard storage periods provided for in the List approved by Order No. 236. The results of her work will be discussed in the next section.

New storage periods for documents have been established

Rosarkhiv, in Order No. 236 dated December 20, 2019, published a list of standard management archival documents and their storage periods. The previous list, which was approved by order of the Ministry of Culture, has become invalid. Changes that affect the work of an accountant are collected in the table.

There is a more recent article on the topic:

Storage periods for accounting and tax documents

| Document | Shelf life | As it was | Article of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Treaties and agreements | |||

| Lease agreements, free use of: real estate; movable property | Upon expiration of the contract, after termination of obligations 10 years 5 years | Constantly | 94 |

| Agreement of gift (donation) of property | Before the liquidation of the organization | Constantly | 90 |

| Leasing agreement | 5 years after expiration of the contract or redemption of the property. If there is a disagreement, the agreement must be kept until a decision is made on the case. | Constantly | 96 |

| Real estate pledge documents | 10 years from the date of expiration of the contract. In case of a dispute, documents are kept until a decision is made on the case. | Constantly | 98 |

| Real estate exchange agreement; movable property | Before the liquidation of the organization; 5 years upon expiration of the contract or upon fulfillment of obligations | 5 years upon expiration of the contract or upon expiration of obligations under the agreement | 99 |

| Agency agreement: for real estate; on movable property | 15 years 10 years | 5 years | 101 |

| Credit or loan agreement with the condition of pledging property | 10 years | 5 years | 261 |

| Invoices | |||

| Invoices | 5 years | 4 years | 317 |

| Salaries and income of individuals | |||

| Cards for individual accounting of accrued payments, remunerations and insurance premiums | 6 years | 5 years | 309 |

| Registers of information on the income of individuals | 5 years | 75 years old | 313 |

| Personal accounts of employees: for documents for which paperwork was completed before the end of 2002; office work completed after January 1, 2003 | 75 years 50 years | 75 years old | 296 |

| Source documents | |||

| Primary accounting documents | 5 years. If there are disputes or disagreements, documents must be kept until a decision is made on the case. | 5 years | 277 |

| Calculation and payment of taxes and contributions | |||

| Certificates on the fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines, the status of settlements with the budget | 5 years | Not regulated | 305 |

| Calculations for insurance premiums (annual and quarterly): for documents for which paperwork was completed before the end of 2002; office work completed after January 1, 2003 | 75 years 50 years | Previously there were two articles. One of them stipulated that annual payroll statements for insurance contributions to the Social Insurance Fund must be kept permanently, and quarterly statements for five years. According to another, a five-year period was fixed for declarations and calculations of advance payments for pension contributions, if there are personal accounts | 308 |

| Fixed assets | |||

| Documents on revaluation of fixed assets and depreciation | 5 years after disposal of fixed assets or intangible assets | Constantly | 323 |

| Documents on write-off of fixed assets | 5 years after disposal of fixed assets or intangible assets. | Constantly | 323 |

| Acts of acceptance and transfer of real estate to the new copyright holder, i.e. when transferring from balance sheet to balance sheet | 5 years after disposal of property | Constantly | 325 |

| simplified tax system | |||

| Books of income and expenses | 5 years | Constantly | 318 |

| Expert and analytical activities | |||

| Reports and conclusions of expert and analytical activities of the Accounts Chamber, regional and local control and accounting bodies | 10 years | Not regulated There was an obligation to permanently store documents on comprehensive (thematic) audits of the organization | 142 |

| Financial and economic activity plan | |||

| The financial and economic activity plan must be kept for as long as the budget estimate: at the place of approval; at the place of development | 5 years continuously | Constantly | 243 |

| Reports on the implementation of FCD plans: annual; quarterly; period | permanently 5 years 1 year | Not regulated. General requirements for annual plans of the organization were extended - permanent storage | 272 |

| Grants and subsidies | |||

| Reports on the implementation of grant and subsidy agreements | 5 years | Constantly | 262 |

| Personnel documents | |||

| Vacation schedule | 3 years | 1 year | 453 |

| Documents on disciplinary sanctions | 3 years | 5 years | 383 |

| Applications regarding the need for foreigners | 1 year | 5 years | 377 |

| Documents on the status and measures to improve working conditions and safety | 5 years | Constantly | 409 |

| Books, registration logs, databases of industrial accidents, accident records | 45 years | Constantly | 424 |

| Employment contracts, documents on admission, transfer, dismissal, personal cards of employees | If the paperwork was completed before January 1, 2003, then they must be stored for 75 years, if after - 50 years | 75 years old | 435 |

| Notifications, warnings to employees | 3 years | Not regulated | 436 |

| Employee applications for the issuance of work-related documents and their copies | 1 year | Not regulated | 451 |

| Magazines, books of record of labor safety briefings (introductory and on-the-job) | 45 years | Not regulated | 423 |

Shelf life table

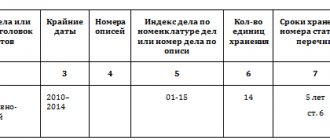

The cabinet with personnel documentation consisted of several compartments. Accountant Savina N.P. began sorting through papers from the first compartment. The results of her work are presented in the table.

| Name | Information from the List approved by Order No. 236 | Document status | ||

| Article | Shelf life | Note | ||

| Time sheets for the period from 2008 to 2022 | 402 | 5 years (1) | (1) Under difficult, harmful and dangerous working conditions - 50/75 years | Partial loss of text information |

| Lists of bonused employees of Premiere LLC for 2010–2013 | 405 | 5 years | — | Hard to read |

| Personal files of employees | 445 | 50/75 years EPK | — | Existing personal files are not fully staffed, 3 employees are missing |

| Questionnaires of persons not hired at Premiere LLC for 2015–2019 | 438 | 1 year | — | — |

| Lists of Premier LLC employees who retired in 2009–2019 | 465 | 5 years | — | — |

| Vacation schedules | 453 | 3 years | — | The text is partially faded from exposure to sunlight |

| Orders on administrative and economic issues for 2009–2019 | 19 | 5 years | — | — |

| Orders on the main activities of Premiere LLC for 2009–2019 | 19 | The entire period of the company's activity | — | — |

From the contents of the last column of the table it follows that part of the personnel documentation needs to be restored, since its storage period has not yet expired. And other papers simply take up space because their standard storage period has expired. We will talk about the consequences of analyzing personnel documentation in the next section.

The storage period has not expired, but the document is damaged - what to do?

From the table presented in the previous section, it can be seen that the time sheets, the shelf life of which according to the List is 5 years, have been partially damaged. Since this data was compiled by the employer himself and information about the time worked by the employees of Premiere LLC was saved in the accounting computer, the question of restoring damaged copies does not present any difficulty.

It is impossible to simply throw away time sheets that have become unusable (without replacing them with similar ones) - then there will be an unauthorized reduction in the normatively established storage periods for this type of personnel documents. And this threatens punishment for the company’s management (Article 27 of the Law “On Archiving in the Russian Federation” No. 125-FZ).

But you can get rid of some of the vacation schedules - they need to be saved for only 3 years, and by the time the personnel documentation is sorted, it has already expired (except for the schedules for 2017-2019). There is no need to restore faded copies from 2009–2016.

Difficult-to-read lists of bonus employees for 2010–2013 can be destroyed in full - their 5-year storage period has also expired.

But the perfectly preserved profiles of applicants for jobs at Prestige LLC for 2015–2019, as well as lists of company employees who retired in 2009–2019, need to be sorted, putting aside for storage those for which the storage period continues.

Missing personal files of employees are subject to registration (or restoration), the rest - to be completed with the subsequent organization of their storage for the 50/75 years established by the List.

It should be noted that you cannot simply throw away documents with an expired shelf life. In this case, a special procedure is provided, which involves the examination of documents with the execution of a special act. Only then are the papers disposed of in a manner suitable for the company.

You can familiarize yourself with the procedure for destroying documentation in the article “Destruction of documents with expired storage periods (act)” .

Results

The storage period for personnel documents may vary. For example, 3 years for vacation schedules or 5 years for orders for administrative and economic activities. Most personnel records are stored for much longer; for example, a 50/75-year retention period is provided for employee personal files.

If a personnel document, the storage period of which has not yet expired, is lost or damaged, it must be restored. It is prohibited to arbitrarily shorten the legally established storage periods. You can get rid of papers with an expired shelf life, but only after a special examination and execution of a report.

Sources: Order of Rosarkhiv dated December 20, 2019 No. 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

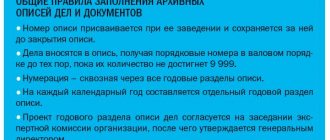

Rationale

The storage periods for archival documents are determined, in particular, by the List of standard administrative archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating their storage periods (approved by Order of the Federal Archive of December 20, 2019 N 236) (hereinafter referred to as the List of standard management archival documents).

It is necessary to comply with the deadlines specified in the List due to Part 1 of Art. 17 of the Federal Law of October 22, 2004 N 125-FZ “On Archiving in the Russian Federation” (hereinafter referred to as Law N 125-FZ).

Please note: Rosarkhiv indicated that Rosarkhiv Order No. 236 dated December 20, 2019, which approved the List of standard management archival documents, does not have retroactive force. The retention periods established by this List apply to all documents completed in office work, including before the entry into force of the specified Order. The exception is documents that have already been included in the inventory of permanent storage cases and acts on the allocation for destruction of documents that are not subject to storage, if the inventories and acts were approved before the entry into force of this Order (Letter dated March 13, 2020 N R/M-479).

For government bodies, organizations subordinate to them, as well as for credit institutions, separate lists of archival documents are approved, indicating their storage periods (Part 1, 1.1 of Article 23 of Law No. 125-FZ).

The storage periods for documents on personnel are provided for in Parts 1 and 2 of Art. 22.1 of Law No. 125-FZ:

- if the paperwork was completed before 01/01/2003 - 75 years;

- if the paperwork was completed after 01/01/2003 - 50 years.

The specified periods do not apply to those documents on personnel for which the List of standard management archival documents (other lists) establishes a different storage period (Part 4, Article 22.1 of Law No. 125-FZ).