- What is the accounting profession?

- What types of accountants are there and what do they do?

Chief Accountant

- Public sector accountant

- Commercial accountant

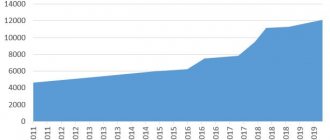

Accountant - salary levels by number of jobs

The salary of an accountant of average qualification level on the labor market in Russia. The fluctuation from the minimum to the maximum wage value is mainly related to regional affiliation.

| Share of accountants in the Russian Federation | Monthly payment level | In US currency |

| 7% | from 55,001 ₽ | from $740 |

| 3% | from 50,001 ₽ to 55,000 ₽ | from $673 to $740 |

| 8% | from 45,001 ₽ to 50,000 ₽ | from $605 to $673 |

| 9% | from 40,001 ₽ to 45,000 ₽ | from $538 to $605 |

| 6% | from 35,001 ₽ to 40,000 ₽ | from $471 to $538 |

| 18% | from 30,001 ₽ to 35,000 ₽ | from $404 to $471 |

| 29% | from 25,001 ₽ to 30,000 ₽ | from $336 to $404 |

| 16% | from 20,001 ₽ to 25,000 ₽ | from $269 to $336 |

| 2% | from 15,001 ₽ to 20,000 ₽ | from $202 to $269 |

| 2% | up to 15,000 ₽ | up to $202 |

Salary statistics for some professions and specializations

A large proportion of vacancies are in the following professions and specialties: leading accountant, senior accountant, chief accountant, payroll accountant, deputy chief accountant.

Overview of salaries for some professions and specializations

| Profession, position | Average salary, rub. | Median salary, rub. | how many vacancies with salaries were taken into account // total vacancies // date of calculation of salaries |

| leading accountant | 79878.0 | 71000.0 | 5257 vac. (with salary) 6918 vac. 02/04/2022 |

| senior accountant | 79898.0 | 71000.0 | 5239 vac. (with salary) 6903 vac. 02/04/2022 |

| Chief Accountant | 79885.0 | 71000.0 | 5187 vac. (with salary) 6848 vac. 02/04/2022 |

| payroll accountant | 54066.0 | 51000.0 | 1386 vac. (with salary) 1733 vac. 02/05/2022 |

| chief accountant's assistant | 78579.0 | 71000.0 | 1083 vac. (with salary) 1449 vac. 02/04/2022 |

| assistant accountant | 44675.0 | 39000.0 | 1020 vac. (with salary) 1140 vac. 02/05/2022 |

| accountant-cashier | 41874.0 | 39000.0 | 661 vac. (with salary) 748 vac. 02/04/2022 |

| economist accountant | 55378.0 | 51000.0 | 360 vac. (with salary) 432 vac. 02/08/2022 |

| accountant calculator | 58190.0 | 51000.0 | 336 vac. (with salary) 392 vac. 02/04/2022 |

| accountant (bank) | 60051.0 | 59000.0 | 255 vac. (with salary) 334 vac. 02/04/2022 |

| accountant (production) | 70033.0 | 57000.0 | 240 vac. (with salary) 309 vac. 02/04/2022 |

| accountant (construction) | 93756.0 | 91000.0 | 90 vac. (with salary) 125 vac. 02/06/2022 |

| accountant (remote) | 52009.0 | 51000.0 | 107 vac. (with salary) 122 vac. 02/05/2022 |

| accountant (accountant) | 44700.0 | 41000.0 | 80 vac. (with salary) 102 vac. 02/05/2022 |

| chief accountant (construction) | 108000.0 | 99000.0 | 60 vac. (with salary) 86 vac. 02/06/2022 |

| HR accountant | 46849.0 | 47000.0 | 53 vac. (with salary) 58 vac. 02/06/2022 |

| accountant (housing and communal services) | 67432.0 | 59000.0 | 37 vac. (with salary) 44 vac. 02/06/2022 |

| accountant (trainee) | 29667.0 | 27000.0 | 18 vac. (with salary) 43 vac. 02/22/2022 |

| accountant | 48889.0 | 47000.0 | 36 vac. (with salary) 41 vac. 02/05/2022 |

| novice accountant | 47667.0 | 39000.0 | 12 vac. (with salary) 21 vac. 02/05/2022 |

| accountant (budgetary institution) | 62619.0 | 67000.0 | 21 vac. (with salary) 21 vac. 03/04/2022 |

| accountant (outsourcing) | 78556.0 | 67000.0 | 9 vac. (with salary) 12 vac. 01/26/2022 |

Average salary of accountants by job title

How much on average the salary of accountants in the Russian Federation changes when they improve their qualifications, experience, or choose a certain direction is shown in the tables below.

By level of responsibility

| Space occupied | Average monthly payment level | In US currency |

| Chief Accountant | 45 510 ₽ | $601 |

| Senior accountant | 32746 ₽ | $431 |

| Accountant | 32 276 ₽ | $426 |

| Junior accountant | 32 148 ₽ | $425 |

| Accountant trainee | 17 746 ₽ | $234 |

By direction name

Many of the vacancies mean almost the same direction, but the amount of income (studied on the basis of more than 200 thousand advertisements) can vary significantly.

Top high and low salaries for accountants

Data on the most valuable specialists is provided based on data from recruiting agencies from the largest cities. Note that IFRS specialists are valued only slightly less than chief accountants, exceeding the income of deputy chief accountants. This is explained by the still small number of specialists in international reporting. And the leaders in income are financial directors, whose functions in medium and small companies are divided between chief accountants and general directors.

Highest salaries

| Specialization | Basic | Average | High |

| Chief Accountant | 89 | 121,5 | 222,5 |

| Chief accountant's assistant | 72,5 | 90 | 150 |

| IFRS specialist | 87,5 | 110 | 187,5 |

| Financial Director | 136,5 | 180,5 | 141,5 |

In terms of low salaries, accounting trainees are expected to lead the way. Let us note that even such generally low-paid specializations as assistant accountant and accountant-cashier are paid at a decent level at the level of good specialists.

Lowest salaries

| Specialization | Basic | Average | High |

| Accountant-cashier | 43 | 53,5 | 70,5 |

| Assistant accountant | 36 | 45,5 | 70,5 |

| Trainee | 16 | 17 | 19 |

From the tables above it can be seen that at the level of good and top specialists recruited through recruitment agencies, salaries differ greatly from the base ones. It is also clear that in large cities, accounting specialists in many areas earn more than the national average. We can conclude that the salary of accountants of 30 thousand rubles consists of a large number of low-paid vacancies in all regions, compensating for the relatively small number of high-paid vacancies in the largest cities.

Average salaries of accountants by geography

The dynamics of average wages varies significantly from one subject to another in any profession. As for the basic salary of accountants, its indicators are displayed in the infographics and tables below.

- Warm color - above the national average;

- Cold - less.

Regions with the highest average salaries for accountants

List of top regions with salaries exceeding the national average from 4 to 35 percent.

| Region, Territory, Republic | Average monthly payment level | In US currency |

| Kamchatka Krai | 43 083 ₽ | $569 |

| Chukotka Autonomous Okrug | 42 286 ₽ | $559 |

| Magadan Region | 41 762 ₽ | $552 |

| Yamalo-Nenets Autonomous Okrug | 40 882 ₽ | $540 |

| Moscow region | 40 464 ₽ | $535 |

| Sakhalin region | 39 450 ₽ | $521 |

| Khanty-Mansiysk Autonomous Okrug - Ugra | 36 737 ₽ | $485 |

| Leningrad region | 36 313 ₽ | $480 |

| The Republic of Sakha (Yakutia) | 36 109 ₽ | $477 |

| Murmansk region | 35 751 ₽ | $472 |

| Primorsky Krai | 35 236 ₽ | $465 |

| Khabarovsk region | 34 006 ₽ | $449 |

| Amur region | 33 440 ₽ | $442 |

| Nenets Autonomous Okrug | 33 369 ₽ | $441 |

Other regions, in descending order

| Region, Territory, Republic | Average monthly payment level | In US currency |

| Krasnoyarsk region | 30 739 ₽ | $406 |

| Arhangelsk region | 29 595 ₽ | $391 |

| Novosibirsk region | 29 496 ₽ | $390 |

| Republic of Crimea | 29 151 ₽ | $385 |

| Irkutsk region | 29 068 ₽ | $384 |

| Kaluga region | 29 061 ₽ | $384 |

| Sverdlovsk region | 29 019 ₽ | $383 |

| Voronezh region | 28 928 ₽ | $382 |

| Komi Republic | 28 803 ₽ | $380 |

| Transbaikal region | 28 416 ₽ | $375 |

| Tyumen region | 28 339 ₽ | $374 |

| Tula region | 28 150 ₽ | $372 |

| Republic of Tatarstan | 27 987 ₽ | $370 |

| Kaliningrad region | 27 973 ₽ | $370 |

| Nizhny Novgorod Region | 27 948 ₽ | $369 |

| Ryazan Oblast | 27 755 ₽ | $367 |

| Region, Territory, Republic | Average monthly payment level | In US currency |

| The Republic of Buryatia | 27 702 ₽ | $366 |

| Krasnodar region | 27 582 ₽ | $364 |

| Republic of Karelia | 27 278 ₽ | $360 |

| Rostov region | 26 782 ₽ | $354 |

| Yaroslavl region | 26 649 ₽ | $352 |

| Tomsk region | 26 640 ₽ | $352 |

| Kemerovo region | 26 596 ₽ | $351 |

| Belgorod region | 26 550 ₽ | $351 |

| Tver region | 26 009 ₽ | $344 |

| Chelyabinsk region | 25 864 ₽ | $342 |

| Jewish Autonomous Region | 25 863 ₽ | $342 |

| Samara Region | 25 829 ₽ | $341 |

| The Republic of Dagestan | 25 702 ₽ | $340 |

| Vologda Region | 25 518 ₽ | $337 |

| Republic of Bashkortostan | 25 515 ₽ | $337 |

| Region, Territory, Republic | Average monthly payment level | In US currency |

| Republic of North Ossetia-Alania | 25 441 ₽ | $336 |

| Vladimir region | 25 413 ₽ | $336 |

| Bryansk region | 25 367 ₽ | $335 |

| Omsk region | 25 360 ₽ | $335 |

| Volgograd region | 25 215 ₽ | $333 |

| Saratov region | 25 133 ₽ | $332 |

| Lipetsk region | 25 033 ₽ | $331 |

| Perm region | 24 985 ₽ | $330 |

| Novgorod region | 24 954 ₽ | $330 |

| The Republic of Khakassia | 24 919 ₽ | $329 |

| Ivanovo region | 24 727 ₽ | $327 |

| Kabardino-Balkarian Republic | 24 577 ₽ | $325 |

| Stavropol region | 24 423 ₽ | $323 |

| Altai region | 24 222 ₽ | $320 |

| Smolensk region | 24 127 ₽ | $319 |

| Region, Territory, Republic | Average monthly payment level | In US currency |

| Tyva Republic | 23 786 ₽ | $314 |

| Kostroma region | 23 688 ₽ | $313 |

| Kursk region | 23 588 ₽ | $312 |

| Tambov Region | 23 500 ₽ | $310 |

| Republic of Kalmykia | 23 385 ₽ | $309 |

| Ulyanovsk region | 23 327 ₽ | $308 |

| Chechen Republic | 23 232 ₽ | $307 |

| Kirov region | 23 177 ₽ | $306 |

| Oryol Region | 23 105 ₽ | $305 |

| Penza region | 23 077 ₽ | $305 |

| Chuvash Republic | 22 904 ₽ | $303 |

| Udmurt republic | 22 601 ₽ | $299 |

| The Republic of Mordovia | 22 523 ₽ | $298 |

| Astrakhan region | 22 332 ₽ | $295 |

| Altai Republic | 21 874 ₽ | $289 |

| Orenburg region | 21 764 ₽ | $287 |

| Republic of Adygea | 21 329 ₽ | $282 |

| Mari El Republic | 21 099 ₽ | $279 |

| Pskov region | 20 937 ₽ | $277 |

| Kurgan region | 20 591 ₽ | $272 |

| Republic of Karachay-Cherkessia | 19 969 ₽ | $264 |

| The Republic of Ingushetia | 18 169 ₽ | $240 |

What factors influence salary size?

The level of salaries of specialists and managers in the field of accounting and auditing is influenced by the following factors:

- his place in the hierarchy of accounting positions, ranging from assistant accountant to financial director or chief accountant;

- if we are talking about accountants, then the area of work that is carried out by a specialist (taxes, primary documentation, salaries and personnel, bank-client, etc.);

- the industry in which the company operates (industry, construction, oil and gas sector, services, etc.);

- whether the employee has or does not have impressive work experience, certain professional certificates, specialized knowledge (IFRS, US GAAP, foreign language, etc.);

- location of the company office.

Specialist position

According to a salary analysis, in the second quarter of 2022, the average salary of an accountant was 65,000 rubles, a deputy chief accountant was 97,500 rubles, and a chief accountant was 105,500 rubles.

Thus, promotion to deputy chief accountant increases the accountant's salary by 50%.

The average salary of a chief accountant is 8.2% higher than that of a deputy and 62.3% higher than that of an accountant. The average salary for an accounting assistant in the second quarter of 2022 is 24.6% lower than the average income for an accountant.

Accounting department

Depending on the area of accounting, the average salary of a specialist varies from 49,000 rubles to 113,000 rubles. The salary of an accountant depends on the requirements of employers for professional training and the volume of work on the site.

The lower level corresponds to the salaries of specialists who do not have extensive work experience. Most often, these are specialists occupying the position of assistant accountant, accountant in the primary documentation area, or accountant-cashier. This can also include accountants in the bank-client section, but provided that the number of banks is small. At the minimum wage level, specialists with little work experience are hired.

Specialists working in the areas of tax accounting and cost accounting, with significant work experience and high qualifications who know how to work with VAT, can count on a high level of salary.

If an accountant is employed in the payroll area, then his income will depend on the number of employees in the company and their work schedule. The size of the salary of accountants in the inventory area is influenced by the size of the business and the type of activity of the company.

Often an accountant in a company combines several areas, for example, working with suppliers and salaries. The bank-client and fixed assets sections invariably remain separate. And during the pandemic and resource reductions, the tax accounting area was often transferred to the chief accountant.

Requirements for experience and knowledge

Over the past year, employers have begun to demand versatility. To reduce their own risks, companies are more picky about candidates, choosing more professional applicants.

When hiring chief accountants, employers want to see relevant work experience, skills in preparing balance sheets and passing tax audits.

Chief accountants with minimal experience or deputy chief accountants applying for promotion can count on a minimum salary and work in a small company.

The work experience of a chief accountant that suits the employer usually varies from 2 to 10 years. In most cases, three years of experience is sufficient.

In our experience, for a third of companies, experience at enterprises in similar industries, for example, manufacturing, construction or trade, is also important. Companies are also looking for accountants who have work experience in large or foreign firms. In these cases, candidates are expected to have excellent knowledge of a foreign language, mainly English, and knowledge of IFRS or US GAAP. These skills also increase the salary a specialist can expect.

For employers, it remains an important factor to have a higher specialized education, knowledge of PCs, 1C: 8.3 and participation in automation and modernization of accounting. In addition to higher accounting or financial education, completed advanced training courses and attendance at specialized seminars are also required.

Specially valued are chief accountants who have experience working with all areas of accounting, are able to organize the work of the entire department and solve complex problems. The most valuable applicants must also possess qualities such as responsibility, hard work, thoroughness and integrity. Registration in Moscow or the Moscow region is required for the chief accountant in 27% of cases.

Industry

The industry in which the company operates also affects the salary level of accountants. For example, to work in the service sector, accountants with little experience and low qualifications are required. That's why wages are lower here.

The most in demand are specialists with experience in the fields of construction, manufacturing, and the financial sector. Another industry that is most profitable in terms of salary levels is the oil and gas industry.

The amount of salary an accountant will receive is determined by the complexity of accounting in the industry and the level of financial responsibility.

Office location

Due to the fact that Moscow is extremely congested in terms of transport, financial workers, like any other personnel, tend to choose a job closer to their place of residence. This trend is also noticeable in the wishes of employers. For them, an important criterion is the proximity of the selected specialist’s residence to the place of work - this reduces the risk of a specialist leaving the company due to inconvenient territorial accessibility and performance.

In some cases, due to the remote location of the office, employers are forced to raise wages in order to attract a highly qualified employee.

By capitals of subjects

Top cities

| City | Average monthly payment level | In US currency |

| Anadyr | 46 831 ₽ | $619 |

| Petropavlovsk-Kamchatsky | 46 462 ₽ | $614 |

| Yuzhno-Sakhalinsk | 46 405 ₽ | $613 |

| Magadan | 46 153 ₽ | $610 |

| Moscow | 45 574 ₽ | $602 |

| Yakutsk | 41 901 ₽ | $554 |

| Vladivostok | 41 407 ₽ | $547 |

| Saint Petersburg | 41 362 ₽ | $546 |

| Salekhard | 40 558 ₽ | $536 |

| Murmansk | 40 029 ₽ | $529 |

| Khanty-Mansiysk | 38 245 ₽ | $505 |

| Khabarovsk | 37 833 ₽ | $500 |

| Ekaterinburg | 33 974 ₽ | $449 |

| Krasnoyarsk | 33 683 ₽ | $445 |

| Simferopol | 33 322 ₽ | $440 |

Rest

| City | Average monthly payment level | In US currency |

| Voronezh | 32 532 ₽ | $430 |

| Novosibirsk | 32 438 ₽ | $429 |

| Chita | 32 329 ₽ | $427 |

| Blagoveshchensk | 32 205 ₽ | $425 |

| Irkutsk | 32 184 ₽ | $425 |

| Nizhny Novgorod | 32 134 ₽ | $424 |

| Kazan | 31 789 ₽ | $420 |

| Tyumen | 31 739 ₽ | $419 |

| Tula | 31 656 ₽ | $418 |

| Kaliningrad | 31 539 ₽ | $417 |

| Arkhangelsk | 31 504 ₽ | $416 |

| Krasnodar | 31 401 ₽ | $415 |

| Rostov-on-Don | 31 366 ₽ | $414 |

| Ryazan | 30 490 ₽ | $403 |

| Naryan-Mar | 30 318 ₽ | $400 |

| City | Average monthly payment level | In US currency |

| Samara | 30 251 ₽ | $400 |

| Tver | 30 135 ₽ | $398 |

| Kaluga | 30 093 ₽ | $398 |

| Ulan-Ude | 30 069 ₽ | $397 |

| Ufa | 29 960 ₽ | $396 |

| Syktyvkar | 29 691 ₽ | $392 |

| Petrozavodsk | 29 547 ₽ | $390 |

| Makhachkala | 29 482 ₽ | $389 |

| Vladimir | 29 463 ₽ | $389 |

| Belgorod | 29 381 ₽ | $388 |

| Volgograd | 29 116 ₽ | $385 |

| Chelyabinsk | 29 074 ₽ | $384 |

| Kemerovo | 28 913 ₽ | $382 |

| Yaroslavl | 28 906 ₽ | $382 |

| Ivanovo | 28 872 ₽ | $381 |

| City | Average monthly payment level | In US currency |

| Permian | 28 798 ₽ | $380 |

| Velikiy Novgorod | 28 720 ₽ | $379 |

| Vladikavkaz | 28 619 ₽ | $378 |

| Birobidzhan | 28 519 ₽ | $377 |

| Tomsk | 28 485 ₽ | $376 |

| Saratov | 28 320 ₽ | $374 |

| Barnaul | 28 318 ₽ | $374 |

| Smolensk | 28 278 ₽ | $374 |

| Omsk | 28 136 ₽ | $372 |

| Vologda | 28 023 ₽ | $370 |

| Lipetsk | 27 757 ₽ | $367 |

| Stavropol | 27 368 ₽ | $362 |

| Bryansk | 27 055 ₽ | $357 |

| Abakan | 27 045 ₽ | $357 |

| Nalchik | 26 933 ₽ | $356 |

| City | Average monthly payment level | In US currency |

| Kostroma | 26 862 ₽ | $355 |

| Kirov | 26 607 ₽ | $351 |

| Tambov | 26 599 ₽ | $351 |

| Kursk | 26 372 ₽ | $348 |

| Penza | 26 126 ₽ | $345 |

| Saransk | 26 054 ₽ | $344 |

| Ulyanovsk | 25 998 ₽ | $343 |

| Pskov | 25 891 ₽ | $342 |

| Grozny | 25 744 ₽ | $340 |

| Eagle | 25 708 ₽ | $340 |

| Astrakhan | 25 218 ₽ | $333 |

| Cheboksary | 25 215 ₽ | $333 |

| Magas | 25 125 ₽ | $332 |

| Izhevsk | 25 033 ₽ | $331 |

| Orenburg | 24 813 ₽ | $328 |

| Yoshkar-Ola | 24 717 ₽ | $327 |

| Elista | 24 652 ₽ | $326 |

| Kyzyl | 24 623 ₽ | $325 |

| Mound | 24 314 ₽ | $321 |

| Gorno-Altaisk | 24 290 ₽ | $321 |

| Maykop | 23 379 ₽ | $309 |

| Cherkessk | 21 820 ₽ | $288 |

How to become an accountant

There are several ways to become an accountant. Let's look at the most common ones, starting with the most accessible:

Accounting courses - anyone can take them and receive a special certificate. There are no entrance exams required. You can sign up for accounting courses with a regular school education behind you. Training takes place on a paid basis. Upon completion, a corresponding certificate is issued. After completing the courses, you can get a job as an assistant accountant.

College or school - here you can get secondary vocational education. You can enter a college or school after 9th or 11th grade. Training takes 3 or 5 years. All graduates are issued a corresponding diploma of secondary specialized education. Having a secondary education, you can work in a separate area, calculate wages, and work with a client bank.

Higher economic education - you can only get it by enrolling in a university. In addition to specialized economic institutes, almost every university has an economics department. It also allows you to obtain a specialty in economics, which allows you to work as an accountant. To advance your career and become a Chief Accountant, it is advisable to immediately enroll in a specialized financial and economic university. Such a diploma will subsequently allow you to obtain a professional certificate as a Chief Accountant or Auditor.

The profession of an accountant allows you to earn a good salary and get a job in almost any city in the Russian Federation. However, regular changes in legislation require constant training and advanced training. The disadvantages of this profession also include regular reporting. During this period, many workers are forced to overwork or even go to work on their days off. To summarize, we can say that how much an accountant receives largely depends only on his desire to learn and improve his skills. This specialty is in great demand and allows you to really earn very good money.

What is the salary of a chief accountant?

As analysts from the recruiting portal Superjob noted, an accountant will climb the career ladder if he serves as an ordinary employee for at least three years. To become a manager, you must not only have a specialized education, but also understand financial legislation and tax law. The chief accountant receives up to 100 thousand rubles in Moscow. Salaries vary depending on the activities of the organization, as well as the work experience of the applicant.

Accountants' income in 2022

What is an accountant responsible for?

In the harsh domestic realities, the initial task of an accountant is to correctly prepare documents for submission to banks and government agencies: the tax service and Rosstat. Inaccurately filled out documents can lead to a lot of bureaucratic problems. Over the past 2-3 years, tax officials, who were previously not known for their leniency, have been finding fault with every piece of paper, trying to justify new fines against entrepreneurs.

In banks, over the last year or two, the situation has been the same: incorrectly completed reports can serve as an excuse for delaying payments and money transfers. There are cases where even large banks actually confiscated money, citing the inability of accounting entries to explain their origin.

Therefore, correctly filling out reports provided to government organizations and banks is task number one for a Russian accountant.

The second most important task of an accountant is management accounting. Managers and owners, after reading the statements, should see:

- main ratios (liquidity, profitability, etc.) and their dynamics;

- structure and dynamics of sales, costs, profits;

- what happens to the largest customers and suppliers;

- incoming and outgoing cash flows.

The accountant must be prepared to answer questions about the received figures for the entire company, and not just for some private transactions.

The third area of responsibility of an accountant is filling out and preparing daily accounts, certificates and postings. This is necessary not only to streamline reporting, but also to ensure that inspectors - both tax authorities and auditors - do not find a reason to find fault and impose a fine.

In addition to these three components, the accountant is responsible for the correct completion of reporting, development of accounting policies, document flow schedules, and so on. However, if an accountant works in a large company, then the scope of responsibility is much lower.

How much does a chief accountant earn: job conditions

If you study vacancies on hh.ru and group them by salary level, you will get the following picture:

| Salary | Company level | Experience as a chief accountant | Required skills and knowledge |

| 500–1000$ | Production or import and sale of highly specialized goods, for example, furniture, tools. They often look for an accountant and chief accountant rolled into one | from 3 years |

|

| 1000–2000$ | Chains of stores, national corporations | from 5 years |

|

| Above 2000$ | B2B services, international corporations | from 7 years |

|

The following conclusions can be drawn from the table data.

1. The requirements for a chief accountant for a salary in the low and medium price range are almost identical. These are specialized skills and education. The difference in salary depends on the size of the company itself that is looking for an employee.

There is also a difference in the experience requested. But, most likely, if you demonstrate mastery of relevant skills, then this point will not be decisive.

2. To qualify for a salary above the market average, in addition to mastering core skills, you need management competencies, an understanding of business processes and a whole range of soft skills. And also a love for self-development in the profession, which is confirmed by additional professional qualifications and certificates.

The skills required by a chief accountant are described on the international website Glassdoor as follows:

- Bachelor's degree in accounting, finance or related discipline or an equivalent combination of education, training and experience;

- 2-5 years of experience in accounting/finance;

- Intermediate to advanced level of knowledge and experience in Excel and other Microsoft Office applications;

- strong analytical and problem solving skills;

- Experience with accounting software;

- Excellent interpersonal skills for effective communications within the company;

- in-depth knowledge of accounting and account reconciliation;

- high attention to detail.

Salary level of a chief accountant according to data collected on the Glassdoor platform