What is the liability for non-payment of taxes?

The Tax Code of the Russian Federation states that for prolonged non-payment of taxes, a citizen may face:

- administrative;

- tax;

- criminal liability.

Responsibility measures are enshrined in Chapter 25 of the Tax Code of the Russian Federation. In addition, the deadlines for the transfer of fiscal fees and insurance contributions are established for each type of payment. If the taxpayer violates deadlines or does not pay to the budget, he will be issued penalties and a penalty.

Administrative

Violators are subject to administrative liability for tax evasion under the Code of Administrative Offenses of the Russian Federation. An administrative fine is imposed on responsible officials - the manager, the chief accountant.

Usually, fines are issued according to the administrative code. But there is a more serious punishment - disqualification of the leader (Article 3.11 of the Code of Administrative Offenses of the Russian Federation). If the regulatory authorities disqualify the director, you will have to appoint a new manager, change the statutory documents and make changes to the Unified State Register of Legal Entities.

IMPORTANT!

After the statute of limitations (one year) has expired, administrative liability for non-payment of taxes by a legal entity and other violations of tax legislation is not assigned. For violations of laws and accounting regulations, the statute of limitations is longer—two years.

Administrative measures for violations in the field of taxation

An administrative offense is an unlawful, guilty action (inaction) of an individual or legal entity for which administrative liability is established by the Code of Administrative Offenses or the laws of the constituent entities of the Russian Federation on administrative offenses.

Forms of guilt when committing an administrative offense. An administrative offense is recognized as committed intentionally if the person who committed it was aware of the illegal nature of his action (inaction), foresaw its harmful consequences and desired the occurrence of such consequences or consciously allowed them or was indifferent to them.

An administrative offense is recognized as committed through negligence if the person who committed it foresaw the possibility of harmful consequences of his action (inaction), but without sufficient grounds for this, he arrogantly counted on preventing such consequences or did not foresee the possibility of such consequences, although he should have and could have had them. foresee.

It is not an administrative offense for a person to cause harm to legally protected interests in a state of extreme necessity, i.e. to eliminate a danger that directly threatens the personality and rights of a given person or other persons, as well as the legally protected interests of society or the state, if this danger could not be eliminated by other means and if the harm caused is less significant than the harm prevented.

An individual who, at the time of committing illegal actions (inaction) was in a state of insanity, is not subject to administrative liability, i.e. could not realize the actual nature and illegality of his actions (inaction) or manage them due to a chronic mental disorder, temporary mental disorder, dementia or other painful mental state.

Composition of persons subject to administrative responsibility. A person who has reached the age of sixteen at the time of committing an administrative offense is subject to administrative liability.

A legal entity is found guilty of committing an administrative offense if it is established that it had the opportunity to comply with the rules and regulations, for violation of which the Tax Code or the laws of a constituent entity of the Russian Federation provide for administrative liability, but this person did not take all measures depending on it to comply with them .

An official is subject to administrative liability if he commits an administrative offense in connection with failure to perform or improper performance of his official duties.

For the purposes of the Administrative Code, an official is:

- a person who permanently, temporarily or in accordance with special powers exercises the functions of a representative of government, i.e., vested in the manner prescribed by law with administrative powers in relation to persons who are not officially dependent on him;

- a person performing organizational-managerial or administrative-economic functions in state bodies, local government bodies, state and municipal organizations, as well as in the Armed Forces of the Russian Federation, other troops and military formations of the Russian Federation.

Managers and other employees of other organizations, as well as persons engaged in business activities without forming a legal entity, who have committed administrative offenses in connection with the performance of organizational-managerial or administrative-economic functions, bear administrative responsibility as officials, unless otherwise provided by law.

The composition of administrative offenses in the field of taxes and fees and responsibility for their commission are specified in Chapter. 15 Code of Administrative Offenses (Articles 15.3-15.7 and Article 15.11). For the commission of administrative offenses in the field of taxation, administrative penalties are currently applied in the form of an administrative fine.

Imposing an administrative penalty on a legal entity does not relieve a guilty individual from administrative liability for a given offense, just as bringing an individual to administrative or criminal liability does not exempt a legal entity from administrative liability for a given offense.

If the administrative offense committed is of minor significance, the judge, body, or official authorized to resolve the case of an administrative offense may release the person who committed the administrative offense from administrative liability and limit himself to an oral remark.

Tax

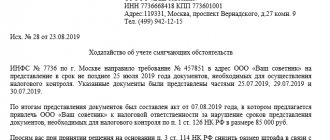

The statute of limitations for tax violations is three years. Delay in payment or non-payment of tax in the Russian Federation requires a fine in the amount of 1/300 of the Central Bank refinancing rate for each day of delay (for individual entrepreneurs and individuals). Legal entities have a different scheme: for the first 30 days they will pay 1/300 of the refinancing rate, and from 31 days - 1/150 for each day of delay (Article 75 of the Tax Code of the Russian Federation).

IMPORTANT!

If a taxpayer filed a return on time and indicated the amount to be paid, but did not transfer contributions to the budget, he will be charged not a fine, but a penalty.

For example, a fine for non-payment of taxes by an individual on property is assessed after December 1 of the year following the accounting year (Article 409 of the Tax Code of the Russian Federation). If the owner does not pay the amount requested by the Federal Tax Service, he will be charged a penalty in the amount of 1/300 for each day of delay.

Employers have additional responsibilities and penalties. If an organization does not withhold personal income tax or withholds it but does not transfer it to the budget, it will be charged not only a fine, but also a penalty (Article 123 of the Tax Code of the Russian Federation). The amount of the fine is from 20% to 40% of the amount of non-withheld income tax (Article 122 of the Tax Code of the Russian Federation). The same rule applies to other obligatory fiscal payments and insurance contributions.

Prosecution for tax offenses: what and who faces the consequences

An offense in the fiscal sphere is an illegal action (inaction), for which liability is established in the Tax Code of the Russian Federation, committed by a taxpayer, insurance premium payer, or tax agent. The list of possible tax offenses is given in Chapter. The Tax Code of the Russian Federation is divided into the following main groups:

- violation of the procedure for registering a taxpayer with the Federal Tax Service;

- violation of the procedure for submitting tax reporting;

- errors in accounting, which led to a distortion of the tax base;

- non-transfer (including payment not in full) of insurance premiums, fees and taxes;

- failure to provide tax authorities with the requested documentation or submission of inaccurate data.

Each group contains a wide range of actions (or inactions) of persons violating a certain rule of law, for each of which a range of responsibility is determined depending on the severity of the offense.

The responsibility of persons for committing tax offenses is determined not only by the Tax Code of the Russian Federation, but also by the Code of Administrative Offenses of the Russian Federation, and for serious acts - by the Criminal Code of the Russian Federation. The variety of punishments is due to the same variety of violations, as well as their varying degrees of severity and the amount of damage caused to the state budget.

It is possible to prosecute a violator for illegal acts in the field of fiscal legislation only by decision of the Federal Tax Service or a court. They can punish:

- organization;

- IP;

- an individual, if at the time of the violation he was sixteen years old (Article 107 of the Tax Code of the Russian Federation).

The category of the guilty person also determines which court will hear the case:

- for entrepreneurs and organizations - arbitration court;

- for individuals – a court of general jurisdiction.

In order for a company, entrepreneur or individual to be found guilty, the following conditions must simultaneously be met:

- basis in the form of a current legislative framework;

- proven fact of committing an illegal act;

- a formalized decision of the authorized body to impose a penalty or the presence of signs of a tax crime established as a result of operational measures

In addition, an important condition is compliance with the statute of limitations: prosecution for committing a tax offense is permissible only within three years from the date of its commission (Clause 1 of Article 113 of the Tax Code of the Russian Federation), with the exception of criminal offenses. For offenses falling under Article 120 (gross violation of tax accounting rules) and 122 of the Tax Code of the Russian Federation (non-payment of taxes, fees, insurance premiums), the three-year period is counted from the day following the end of the reporting period. If the violation is classified as a criminal offense, the statute of limitations may extend to ten years.

Criminal

The most serious offense is criminal. In Art. 198-199 of the Criminal Code of the Russian Federation indicates the amount of criminal liability for non-payment of taxes - for acts on a large scale from 2,700,000 rubles for 3 financial years in a row. Acts on an especially large scale start from 13,500,000 rubles for 3 financial years in a row.

The Criminal Code of the Russian Federation regulates the procedure for compliance with the norms and rules of current legislation. If a taxpayer deliberately does not pay or evades transferring fees, he faces punishment under the Criminal Code of the Russian Federation (clauses 3, 8 of the resolution of the plenum of the Supreme Court of the Russian Federation No. 64 of December 28, 2006).

They will also be punished for fraud with tax transactions - under Art. 159 of the Criminal Code of the Russian Federation. This also takes into account the forgery of documents for VAT reimbursement. The penalty for fraud is a fine of 120,000 rubles or imprisonment for up to 2 years. If the manager and chief accountant are recognized as an organized group, they will be imprisoned for up to 10 years with a mandatory penalty of up to 1,000,000 rubles.

IMPORTANT!

Understatement of the tax base due to mechanical or computational errors in the declaration is not grounds for criminal penalties.

Violation of the rules for preparing a tax return

Instructions for filling out tax returns for federal, regional and local taxes are published by the Ministry of the Russian Federation for Taxes and Duties in agreement with the Ministry of Finance of the Russian Federation, unless otherwise provided by the legislation on taxes and fees.

In case of violation of the rules by a legal entity, liability arises in accordance with paragraph 4 of Article 120 of the Tax Code of the Russian Federation.

The violation must be expressed in untimely or incorrect reflection in the declaration of income and expenses of the taxpayer, sources of income, calculated amount of tax and (or) other data related to the calculation and payment of tax. According to this norm, liability comes in the form of a fine in the amount of three thousand rubles.

If a violation is committed by an individual, liability arises in accordance with Article 121 of the Tax Code of the Russian Federation.

If an individual is required to file a return, he must first collect all documents confirming the income received and expenses incurred related to their receipt, the right to reduce total income and the right to income tax benefits. It should be borne in mind that when declaring, not any expenses are taken into account and accepted by the tax authorities, but only those provided for by the legislation on income taxation.

The subject of violations of the rules for preparing a tax return is an individual who is obliged to submit a tax return.

The form of guilt can be either intentional or careless.

Signs of violation of the rules for preparing a tax return are non-reflection or incomplete reflection of income (expenses), as well as errors leading to an underestimation of the amount of taxes payable.

The above acts entail a fine of five thousand rubles.

Administrative liability for tax offenses

An administrative offense is an unlawful, guilty action (inaction) of an individual or legal entity, for which the Code of Administrative Offenses of the Russian Federation has established administrative liability, while individual entrepreneurs are equated to officials.

A person is considered innocent until his guilt is proven and established by the body that examined the case. Irremovable doubts about a person's guilt are interpreted in favor of that person.

The following circumstances are recognized as mitigating administrative liability: repentance; voluntary reporting by a person of an offense committed by him; prevention by the person who committed the offense of its harmful consequences, voluntary compensation for the damage caused or elimination of the harm caused; committing an offense in a state of strong emotional excitement (affect) or due to a combination of difficult personal or family circumstances; commission of an offense by a minor or a pregnant woman or a woman with a young child.

The body considering the case of an administrative offense may recognize other circumstances as mitigating. If these circumstances exist, a minimum fine may be applied.

The following are recognized as circumstances aggravating administrative liability: continuation of illegal behavior, despite the demand of authorized persons to stop it; repeated commission of a similar offense within a year; involvement of a minor in committing an offense; commission of an offense by a group of persons; committing an offense during a natural disaster or other emergency circumstances, while intoxicated. If these circumstances exist, the maximum fine may be applied.

It is also possible to simultaneously hold an organization and an official of the organization liable if the article of the Code of Administrative Offenses provides for both an official and a legal entity as a subject.

Responsibility for administrative offenses in the field of taxation is established by Articles 15.3 - 15.9 and 15.11 of the Code of Administrative Offenses.

table 2

Administrative responsibility

| № | Type of offense | Base | Who is responsible | Fine |

| 1 | Violation of the deadline for registration with the tax authority | Art. 15.3 Code of Administrative Offenses of the Russian Federation | Officials, except individual entrepreneurs | 500 – 1000 rub. |

| 2 | Violation of the deadline for registration with the tax authority, associated with conducting activities without registration with the tax authority | Art. 15.3 Code of Administrative Offenses of the Russian Federation | Officials, with the exception of individual entrepreneurs | 2000 – 3000 rub. |

| 3 | Violation of the deadline for submitting information to the tax authority or the body of the state extra-budgetary fund about opening or closing an account with a bank or other credit organization | Art. 15.4 Code of Administrative Offenses of the Russian Federation | Officials, except individual entrepreneurs | 1000 – 2000 rub. |

| 4 | Violation of deadlines for submitting a declaration to the tax authority | Art. 15.4 Code of Administrative Offenses of the Russian Federation | Officials, except individual entrepreneurs | 300 – 500 rub. |

| 5 | Failure to submit on time or refusal to submit to the tax authorities, customs authorities and bodies of the state extra-budgetary fund documents or other information necessary for the implementation of tax control. Or presentation of such information incompletely or in a distorted form | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation | Citizens | 100 – 300 rub. |

| 6 | The same | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation | Officials, except individual entrepreneurs | 300 – 500 rub. |

| 7 | Gross violation of the rules of accounting and presentation of financial statements[1] | Art. 15.11 Code of Administrative Offenses of the Russian Federation | Officials, except individual entrepreneurs | 2000 – 3000 rub. |

An administrative case is considered initiated from the moment the protocol is drawn up. The Code of Administrative Offenses provides for both open and closed consideration of cases. A person against whom proceedings are being conducted for an administrative offense has the right to: get acquainted with all the materials of the case; give explanations; present evidence; file petitions and challenges; use legal assistance from a lawyer; enjoy the right to protection of rights and legitimate interests by legal representatives; participate in the consideration of the case.

The following persons have the right to draw up a protocol on tax violations: judges; officials of internal affairs bodies, tax and customs authorities. The protocol shall indicate the date and place of its compilation, position, surname and initials of the person who compiled the protocol, information about the person against whom the case was initiated, surnames, first names, patronymics, addresses of the place of residence of witnesses, if any, place, time of commission and event offenses, article of the Code of Administrative Offenses providing for liability, explanation of the person against whom the case was initiated. In addition, the protocol must indicate that the person against whom the case has been initiated has been informed of their rights and obligations.

The protocol is signed by the official who compiled it, the person against whom the case was initiated. These persons have the right to refuse to sign the protocol, about which a corresponding entry must be made in it. A copy of the protocol, at the request of the person against whom the case has been initiated, may be handed over against signature. The person against whom the case has been initiated has the right: to familiarize himself with the protocol; provide explanations and comments that must be attached to the protocol.

A protocol is drawn up immediately after a violation is detected. If additional clarification of the circumstances of the case or information about the person against whom the case is being initiated is required, then a protocol is drawn up within two days from the moment the offense was discovered.

Criminal liability

| № | Type of crime | Base | Who is responsible | Fine | Arrest | Deprivation of liberty | Deprivation of the right to a position or activity | Statute of limitations |

| 1 | Tax evasion from an individual by failure to submit a tax return, or by including knowingly false information in a tax return, committed on a large scale[2] | Part 1 Art. 198 of the Criminal Code of the Russian Federation | Individual entrepreneurs, lawyers, notaries, other individuals | from 100,000 to 300,000 rubles. or income for a period of 1 to 2 years | From 4 to 6 months. | Up to 1 year | — | 2 years |

| 2 | The same thing committed on an especially large scale[3] | Part 2 Art. 198 of the Criminal Code of the Russian Federation | Individual entrepreneurs, lawyers, notaries, other individuals | from 200,000 to 500,000 rubles. or income for a period of 18 months to 3 years | — | Up to 3 years | — | 6 years |

| 3 | Evasion of taxes from an organization by failure to submit a tax return or other documents, or by including knowingly false information in a tax return or such documents, committed on a large scale[4] | Part 1 Art. 199 of the Criminal Code of the Russian Federation | Gene. director, chief accountant, and other responsible persons | from 100,000 to 300,000 rubles. or income for a period of 1 to 2 years | From 4 to 6 months. | Up to 2 years | Up to 3 years | 2 years |

| 4 | The same thing committed by a group of persons by prior conspiracy on an especially large scale[5] | Part 2 Art. 199 of the Criminal Code of the Russian Federation | Gene. director, chief accountant, and other responsible persons | from 200,000 to 500,000 rubles. or income for a period of 1 to 3 years | — | Up to 6 years | Up to 3 years | 10 years |

| 5 | Failure to fulfill the duties of a tax agent in personal interests, committed on a large scale (Large amount is defined in Article 199 of the Criminal Code of the Russian Federation, footnote 4) | Part 1 Art. 199.1 of the Criminal Code of the Russian Federation | IP, gen. director, chief accountant, and other responsible persons | from 100,000 to 300,000 rubles. or income for a period of 1 to 2 years | From 4 to 6 months. | Up to 2 years | Up to 3 years | 2 years |

| 6 | The same thing committed on an especially large scale (Especially large scale is defined in Article 199 of the Criminal Code of the Russian Federation, footnote 5) | Part 2 Art. 199.1 of the Criminal Code of the Russian Federation | IP, gen. director, chief accountant, and other responsible persons | from 200,000 to 500,000 rubles. or income for a period of 2 to 5 years | — | Up to 6 years | Up to 3 years | 10 years |

| 7 | Concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes should be collected | Art. 199.2 of the Criminal Code of the Russian Federation | The founders of the organization, gen. director (manager) and other responsible persons | from 200,000 to 500,000 rubles, or income for a period of 18 months to 3 years | — | Up to 5 years | Up to 3 years | 6 years |

Thus, from January 1, 2010, the Criminal Code of the Russian Federation has been in effect in a new, more acceptable version for taxpayers. Federal Law No. 383-FZ of December 29, 2009 provides that a person who has committed a crime for the first time is exempt from criminal liability if he has fully paid the amounts of arrears, penalties and fines (Articles 198, 199, 199.1 of the Criminal Code of the Russian Federation). This amendment applies to persons who are under investigation or who are serving a sentence.

Since January 1, 2010, the amount of arrears has been significantly increased, which can lead to criminal liability (Articles 198, 199 of the Criminal Code of the Russian Federation). For legal entities – three times, for individuals – six times (Table 3).

Article 116. Violation of the deadline for registration with the tax authority

1. Violation by a taxpayer of the deadline established by Article 83 of this Code for filing an application for registration with the tax authority in the absence of signs of a tax offense provided for in paragraph 2 of this article,

entails a fine in the amount of five thousand rubles.

2. Violation by the taxpayer of the deadline established by Article 83 of this Code for filing an application for registration with the tax authority for a period of more than 90 days

entails a fine in the amount of 10 thousand rubles.

Article 117. Evasion of registration with the tax authority

1. Conducting activities by an organization or individual entrepreneur without registration with the tax authority

entails a fine in the amount of ten percent of the income received during the specified time as a result of such activity, but not less than twenty thousand rubles.

2. Conducting activities by an organization or individual entrepreneur without registering with the tax authority for more than three months

entails a fine in the amount of 20 percent of income received during the period of activity without registration for more than 90 days.

Article 118. Violation of the deadline for submitting information on opening and closing a bank account

1. Violation by a taxpayer of the deadline established by this Code for submitting information to the tax authority about opening or closing an account in any bank

entails a fine in the amount of five thousand rubles.

2. Excluded

Article 119. Failure to submit a tax return

1. Failure by a taxpayer to submit a tax return to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees, in the absence of signs of a tax offense provided for in paragraph 2 of this article,

entails the collection of a fine in the amount of 5 percent of the amount of tax payable (additional payment) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 100 rubles.

2. Failure by the taxpayer to submit a tax return to the tax authority for more than 180 days after the expiration of the deadline established by tax legislation for the submission of such a return

entails a penalty of 30 percent of the amount of tax payable on the basis of this declaration, and 10 percent of the amount of tax payable on the basis of this declaration, for each full or partial month starting from the 181st day.

3. Excluded

Article 120. Gross violation of the rules for accounting for income and expenses and objects of taxation

1. Gross violation by an organization of the rules for accounting for income and (or) expenses and (or) objects of taxation, if these acts were committed during one tax period, in the absence of signs of a tax offense provided for in paragraph 2 of this article,

entails a fine in the amount of five thousand rubles.

2. The same acts, if committed during more than one tax period,

entail a fine in the amount of fifteen thousand rubles.

3. The same acts, if they resulted in an understatement of the tax base,

entail a fine in the amount of ten percent of the amount of unpaid tax, but not less than fifteen thousand rubles.

For the purposes of this article, a gross violation of the rules for accounting for income and expenses and objects of taxation means the absence of primary documents, or the absence of invoices or accounting registers, systematic (two or more times during a calendar year) untimely or incorrect reflection in the accounting accounts and in reporting business transactions, cash, tangible assets, intangible assets and financial investments of the taxpayer.

4. Eliminated

Article 121. Deleted.

Article 122. Non-payment or incomplete payment of tax amounts

1. Non-payment or incomplete payment of tax amounts as a result of underestimation of the tax base, other incorrect calculation of tax or other illegal actions (inaction)

entail a fine of 20 percent of the unpaid tax amounts.

2. Invalid as of January 1, 2004.

3. The acts provided for in paragraph 1 of this article, committed intentionally,

entail the collection of a fine in the amount of 40 percent of the unpaid tax amounts.

Article 123. Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes

Unlawful non-transfer (incomplete transfer) of tax amounts subject to withholding and transfer by the tax agent,

entails a fine of 20 percent of the amount to be transferred.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Article 124. Repealed from July 1, 2002.

Article 125. Failure to comply with the procedure for possession, use and (or) disposal of property that has been seized

Failure to comply with the procedure for possession, use and (or) disposal of property that has been seized, established by this Code,

entails a fine in the amount of 10 thousand rubles.

Article 126. Failure to provide the tax authority with information necessary to carry out tax control

1. Failure by the taxpayer (tax agent) to submit documents and (or) other information provided for by this Code and other acts of legislation on taxes and fees to the tax authorities within the prescribed period,

entails a fine of 50 rubles for each document not submitted.

2. Failure to provide the tax authority with information about the taxpayer, expressed in the refusal of the organization to provide the documents it has, provided for by this Code, with information about the taxpayer at the request of the tax authority, as well as other evasion from providing such documents or providing documents with deliberately false information, if such the act does not contain signs of violation of the legislation on taxes and fees provided for in Article 135.1 of this Code,

entails a fine in the amount of five thousand rubles.

3. Invalid as of July 1, 2002.

Article 127. Deleted.

Article 128. Liability of a witness

Failure to appear or evasion of appearance without good reason by a person called as a witness in a tax offense case,

entail a fine of one thousand rubles.

Unlawful refusal of a witness to testify, as well as giving knowingly false testimony

entail a fine in the amount of three thousand rubles.

Article 129. Refusal of an expert, translator or specialist to participate in a tax audit, giving a knowingly false conclusion or making a knowingly false translation

1. Refusal of an expert, translator or specialist to participate in a tax audit

entails a fine of 500 rubles.

2. Giving a knowingly false conclusion by an expert or making a knowingly false translation by a translator

entails a fine in the amount of one thousand rubles.

Article 129.1. Wrongful failure to report information to the tax authority

1. Unlawful failure to report (untimely reporting) by a person of information that, in accordance with this Code, this person must report to the tax authority, in the absence of signs of a tax offense provided for in Article 126 of this Code,

entails a fine of 1000 rubles.

2. The same acts committed repeatedly within a calendar year,

entail a fine of 5,000 rubles.

Who will be punished and if there is any debt?

Typically, punishment for non-payment of taxes is imposed on organizations (legal entities), but in certain situations, owners and responsible officials are punished. The inspectorate conducts an investigation, identifies the guilty employees and issues targeted penalties (letter of the Federal Tax Service No. ED-18-15 / [email protected] dated 09/06/2018).

We list all types of fines for non-payment of tax payments in the table:

| Violation | Type of liability and penalty for late payment of taxes and contributions |

| Incorrect information was provided about the income of employees from whom tax was withheld | For each document with a violation you will have to pay 500 rubles (Article 126.1 of the Tax Code of the Russian Federation) |

| Unintentional failure to pay taxes and insurance premiums on time | 20% of the amount of arrears plus penalties (Part 1 of Article 122 of the Tax Code of the Russian Federation) |

| Deliberate non-payment of mandatory payments | 40% of the amount of arrears plus penalties (Part 3 of Article 122 of the Tax Code of the Russian Federation) |

| Non-payment due to violations of accounting procedures | The first is from 5,000 to 10,000 rubles per official. Repeated - from 10,000 to 20,000 rubles or disqualification for 1 or 2 years (Article 15.11 of the Code of Administrative Offenses of the Russian Federation) |

| An act committed by an individual entrepreneur on a large scale | Criminal punishment under Art. 198 of the Criminal Code of the Russian Federation:

|

| An act committed by a company on a large scale | Criminal punishment under Art. 199 of the Criminal Code of the Russian Federation:

|

| An act committed by an individual entrepreneur on an especially large scale | Criminal punishment under Art. 198 of the Criminal Code of the Russian Federation:

|

| An act committed by a company on an especially large scale | Criminal punishment under Art. 199 of the Criminal Code of the Russian Federation:

|

IMPORTANT!

There are no penalties or fines from the Federal Tax Service for late payment of the fine. The inspectorate sends a request to transfer penalties for violations, but does not set a deadline for payment. Penalties are charged for late tax payments and tax contributions.

The concept of a tax offense and the procedure for applying tax sanctions

For the first time in Russian tax practice, the Tax Code of the Russian Federation provides a clear definition of the concepts of “tax offense” and “tax sanction”.

A tax offense is an unlawful (in violation of tax legislation) action (inaction) of a taxpayer, for which the Tax Code of the Russian Federation establishes appropriate penalties.

Tax sanctions are applied to taxpayers whose guilt in committing a tax offense is proven. A tax sanction is a measure of responsibility for committing a tax offense. It is established and applied in the form of monetary penalties (fines) in the amounts established by the Tax Code of the Russian Federation.

At the same time, it is important to emphasize that the Tax Code of the Russian Federation stipulates the fundamental principles of bringing a taxpayer to tax liability. The main ones are the following:

– any taxpayer can be held accountable for committing a tax offense only on the grounds and in the manner provided for by the Tax Code of the Russian Federation;

– tax liability measures cannot be repeatedly applied to a taxpayer for committing the same violation of tax legislation;

– bringing a taxpayer-legal entity to responsibility for committing a tax violation cannot relieve its officials from administrative, criminal or other liability;

– holding a taxpayer accountable for violating tax laws does not relieve him of the obligation to pay taxes due;

– the basis for bringing a person to justice for a tax offense is the establishment of the fact of the commission of this violation by a decision of the tax authority that has entered into legal force;

– a taxpayer cannot be considered guilty of violating tax laws unless this guilt is proven in the manner prescribed by federal legislation;

– the taxpayer is not obliged to prove his innocence of committing a tax offense (this responsibility is assigned to the tax authorities);

– all doubts about the taxpayer’s guilt in committing a tax offense should always be interpreted in his favor.

This is also important to know:

What is the shelf life and how does it differ from the expiration date

The Tax Code of the Russian Federation contains conditions under which the taxpayer is not liable for violation of tax legislation. The essence of these circumstances is as follows.

1. The taxpayer’s guilt excludes actions committed by an official as a result of a natural disaster or other extraordinary and insurmountable circumstances.

2. The taxpayer is not responsible for violations of tax legislation if he was guided by written explanations of financial or other authorized state bodies and their officials. When these written explanations were based on incomplete or unreliable information provided by the taxpayer, this provision does not apply.

3. Actions containing signs of a tax offense committed by a taxpayer - an individual who was at that moment in a state in which this person could not be aware of his actions or manage them due to a painful condition - are excluded from guilt.

In addition to these three provisions, the court or tax authority, during the consideration of relevant cases, may recognize other circumstances that exclude the taxpayer’s guilt in committing a tax offense.

The application of a particular amount of financial sanctions for violation of tax laws depends on the circumstances mitigating or, conversely, aggravating the responsibility for committing a tax offense.

A circumstance mitigating liability for a tax violation is, in particular, one committed as a result of a combination of difficult personal or family circumstances; under the influence of threat, coercion or due to financial, official or other dependence; difficult financial situation of an individual. These circumstances are established by the court. At the same time, the court may recognize other circumstances not mentioned in the Tax Code of the Russian Federation as mitigating. If there is at least one mitigating circumstance, the amount of the financial fine is reduced by at least two times compared to the amount established by the Procedural Code of the Russian Federation.

An aggravating circumstance is the commission of a tax offense by a person who was previously held accountable for a similar offense. In the presence of aggravating circumstances, the fine is doubled. If a taxpayer has committed at least two tax offenses, then tax sanctions are applied to him for each such offense separately.

Types of tax offenses and liability for their commission

| In the form of a tax violation | Responsibility |

| Art. 122. Non-payment or incomplete payment of tax (fee) amounts (as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other illegal actions (inaction)) (see text in the previous edition) |

|

| Art. 125. Failure to comply with the procedure for possession, use and (or) disposal of property that has been seized | (see text in the previous edition)

|

| Art. 128. Responsibility of a witness (failure to appear or evasion of appearance without good reason of a person called in a tax offense case as a witness; unlawful refusal of a witness to testify, as well as giving knowingly false testimony) |

|

| Art. 116. Violation of the deadline for registration with the tax authority (for an individual entrepreneur) |

|

| Art. 117. Evasion of registration with the tax authority (conducting activities by an individual entrepreneur without registration with the tax authority) |

|

| Art. 119. Failure to submit a tax return (for taxpayers required to submit returns) |

|

Characteristics of tax offenses

According to Art. 106 of the Tax Code of the Russian Federation, a tax offense is recognized as a committed illegal (in violation of the legislation on taxes and fees) act (action or inaction) of a taxpayer, tax agent and other persons, for which liability is established by the Tax Code of the Russian Federation.

This definition contains the following set of the most important legal features of a tax offense.

Wrongfulness of the act

A tax offense is an act that violates the laws on taxes and fees. Illegality is the legal form (expression) of the material characteristics of the social property of a tax offense. Only an act provided for by the legislation on taxes and fees is considered a tax offense. Consequently, acts containing elements of offenses listed in Chapters 16 and 18 of the Tax Code of the Russian Federation, but not violating the legislation on taxes and fees, cannot be classified as tax offenses.

An unlawful act can be committed in the form of an action (for example, preventing tax authorities from accessing the taxpayer’s territory; refusal to provide the tax authorities with the necessary information, etc.) or inaction (for example, failure to submit reports to the tax authorities; failure by the taxpayer to pay the amount of tax due; failure to transfer by the bank to the budget of the corresponding tax payments on behalf of their clients; failure by the tax agent to withhold the amount of personal income tax, etc.).

Guilt

A tax offense is committed guilty (intentionally or through negligence). Guilt means the mental attitude of a person in the form of intent or negligence to the act committed and its consequences, as provided for by the Tax Code of the Russian Federation. The form of guilt is a mandatory sign of a tax offense, since one or another type of it is always contained in the norms of the Tax Code of the Russian Federation that define the elements of offenses, and most of the elements of tax offenses established in it presuppose the presence of a careless form of guilt.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Regarding tax offenses, the volitional signs of a guilty mental attitude are expressed in the desire for an attack, in a conscious assumption, in the hope of preventing consequences. If the offender does not have the will to commit a tax offense, he is responsible for failure to use his abilities to prevent harmful consequences;

Punishability of the act

Committing a tax offense entails negative consequences for the offender in the form of tax sanctions. Punishability is a formal sign of a tax offense, since a tax offense is recognized as a committed illegal act of fiscally obligated persons, liability for which is provided for by the Tax Code of the Russian Federation. Establishing liability for tax offenses only by the Code is an imperative norm, and, thus, no other regulatory legal acts can contain provisions related to tax liability.

The essence of punishability as a formal sign of a tax offense is the threat of applying punishment to guilty persons if they violate the ban on committing any acts or not committing actions, the legal characteristics of which are enshrined in Chapters 16 and 18 of the Tax Code of the Russian Federation.

Determination by the authorized bodies in the behavior of the person held accountable of all legal signs of a tax offense provides grounds for qualifying the act committed by him as a tax offense and applying appropriate enforcement measures.

A tax offense is the actual legal basis of legal liability and is therefore characterized by a set of objective and subjective features that form the composition of a tax offense, which is the features (elements) established by the rules of tax law, the totality of which allows us to consider an unlawful act a tax offense.