Many businessmen use a simplified taxation system because it allows them to significantly reduce payments to the budget. Let’s talk about one of the simplified options - the simplified tax system “Income minus expenses”.

What is the simplified tax system “Income minus expenses”

- Tax rate - up to 15% (20%)

- Tax calculation - what income and expenses to take into account

- Reporting - declaration, KUDiR and accounting

Who is suitable for simplified taxation system 15%

What taxes can you avoid paying with simplification?

Who can apply the simplified tax system

How to pay tax under the simplified tax system “Income minus expenses”

Pros and cons of the simplified tax system “Income minus Expenses”

What is the simplified tax system “Income minus expenses”

The tax base with this simplified version is determined as the difference between income and expenses. This is the main difference from the simplified tax system “Income”, in which costs do not affect the amount of tax.

Tax rate - up to 15% (20%)

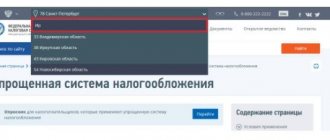

The basic tax rate of the simplified tax system “Income minus expenses is 15%. Therefore, this option is often called simply “STS 15%”. However, regional authorities have the right to reduce the rate for this type of simplified payment to 5%, and in Crimea and Sevastopol - to 3%.

The tax rate that is currently in force in your region can be found at the end of the page about the simplified tax system on the Federal Tax Service website.

Since 2022, the “transition period” rule has been in effect (Federal Law No. 266-FZ dated July 31, 2020). For 2022, the rules are as follows: if a simplifier violates the first threshold of limits under the simplified tax system: revenue exceeds 164.4 million rubles, but not more than 219.2 million rubles, and the number of employees exceeds 100 people, but not more than 130 people, then the tax rate will increase up to 20%. If a simplifier violates the second threshold of limits, he will lose the right to work on the simplified tax system.

Tax calculation - what income and expenses to take into account

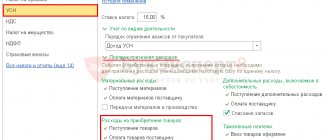

The simplified “Income minus expenses” method of calculation is similar to the income tax under the general tax system. However, there are also significant features:

- Income and expenses are accounted for “on payment”, that is, upon receipt or payment of money.

- The list of costs that can be recognized as expenses is closed. If an expense is not specified in Article 346.16 of the Tax Code of the Russian Federation, then it cannot be deducted from the taxable base, even if it is economically justified. Similarly, the tax office may refuse to account for expenses that are not supported by documents.

- All earnings from a business are considered income. This is usually revenue from the sale of goods or services. But there are also incomes that are not related to business and are still taken into account in the calculations - non-operating income (Article 250 of the Tax Code of the Russian Federation).

- In any case, the tax should not be less than 1% of revenue. If the calculation “on a general basis” resulted in a smaller amount, then you need to pay a minimum 1% tax.

Reporting - declaration, KUDiR and accounting

On the simplified tax system “Income minus expenses” there is one tax report required for everyone - the annual tax return. It is submitted once: organizations until March 31, and individual entrepreneurs - until April 30. The declaration form was approved by order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/ [email protected]

Entrepreneurs are exempt from accounting reports, but organizations using the simplified tax system are required to submit them. If a company fits the restrictions of the simplified tax system, it belongs to small enterprises, which means it receives the right to conduct accounting in a simplified form:

- use an abbreviated chart of accounts;

- use a simplified form of accounting;

- do not submit statements of cash flows and changes in capital.

The organization's accounting reports are submitted to the tax office by March 31.

If a simplifier has employees, then they also need to submit regular reports: information on the number of employees, calculations of insurance premiums, personal income tax, SZV-M, SZV-STAZH, 4-FSS and others.

You also need to keep a book of income and expenses (KUDiR) on the simplified tax system. She does not need to submit a tax return until she sends an official request.

Rates for payers with income above 150 million or with more than 100 employees

Since 2022, the norms of the Tax Code of the Russian Federation related to the loss of the right to the simplified tax system have been revised. “Simplified” residents do not lose the right to a special regime, but are required to use increased tax rates if (clauses 1.1, 2.1 of Article 346.20 of the Tax Code of the Russian Federation as amended by Federal Law No. 266-FZ of July 31, 2020):

- their income since the beginning of the year amounted to less than 200 million, but more than 150 million rubles;

- the average number of employees was less than 130, but more than 100 people.

The Tax Code of the Russian Federation does not allow regions to reduce rates in such a situation. Therefore, the St. Petersburg law does not apply to these cases. If a company or individual entrepreneur exceeded the limits on income and number, but remained within acceptable limits, from the beginning of the quarter in which this happened, tax on income over 150 million rubles. accrued at the rate:

- 8% for the object “income”;

- 20% for the “income-expenses” object.

Having received an income of over 200 million rubles. or having recruited more than 130 employees, the taxpayer will lose the right to “simplified taxation”.

Who is suitable for simplified taxation system 15%

If we compare the simplified tax system “Income” and the simplified tax system “Income minus expenses”, then the first has a lower tax rate, and the other has more ways to reduce the tax base. In general, without taking into account benefits and deductions, the “Revenue minus expenses” option will be beneficial if costs exceed 60% of revenue.

Example. The company's revenue for the year is 100 million rubles, expenses are 60 million rubles. For the “Income” option, the tax amount will be:

STS1 = 100 × 6% = 6 million rubles.

When using the “Income minus expenses” object:

STS2 = (100 – 60) × 15% = 40 × 15% = 6 million rubles.

In practice, the calculation for each business must be carried out individually, taking into account regional tax rates and cost structure.

For example, in Buryatia the simplified tax rate for “Income” and “Income minus expenses” is the same - 5%. In addition, when using the “Income” object, you can apply tax deductions (Article 346.21 of the Tax Code of the Russian Federation).

Simplified tax system “income minus expenses”: changes in 2018-2019

There have been few changes relating only to the simplified tax system “income minus expenses” since 2017: the BCC for paying the minimum tax has become the same as for the regular tax paid under the simplified tax system. But there are changes common to the special regime, and they are quite significant:

- The benefit on insurance premiums has been canceled for some simplifiers named in Art. 427 Tax Code of the Russian Federation;

- the moratorium on routine inspections of small businesses was extended until 2022;

- for several years (from 2022 to 2022) the application of the deflator coefficient to the value of income limits was suspended.

For more information about the deflator coefficient in 2017-2020, read the material “ New income limits under the simplified tax system will not change until 2022.”

What taxes can you avoid paying with simplification?

Tax accounting under the simplified tax system “Income minus expenses” differs from the general system. Simplified business is exempt from:

- Income tax (for LLC) or personal income tax (for individual entrepreneurs).

- Property tax, with the exception of objects that are taxed at cadastral value.

- VAT, except for imports and performance of duties as a tax agent.

Simplified people pay other taxes on a general basis if they have a taxable base. For example, land owners pay land tax, and vehicle owners pay transport tax.

Benefits on insurance premiums in 2022 can only be used by non-profit and charitable organizations using the simplified tax system. They are exempt from contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

All other simplifiers must pay mandatory insurance payments on a general basis.

Rates for taxpayers affected by the coronavirus pandemic

In 2022, St. Petersburg had reduced rates for another category of taxpayers - individual entrepreneurs and legal entities whose main activity is classified as industries affected by the coronavirus pandemic (Article 1.2 of Law No. 185-36). The list of such industries is given in the Appendix to Law No. 185-36, and the rates were:

- 3% for simplified tax system “income”;

- 5% - for the simplified tax system “income minus expenses”.

To apply these rates, it was also necessary to comply with the condition of paying the average salary to employees in an amount not lower than the regional minimum wage in 2022.

These rates do not apply when calculating taxes for 2022.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who can apply the simplified tax system

Both legal entities and entrepreneurs have the right to use the simplified form.

When planning to switch to the simplified tax system, first check whether your business belongs to the “forbidden” categories (clause 3 of article 346.12 of the Tax Code of the Russian Federation). In particular, they do not have the right to use simplified language:

- financial organizations (banks, insurers, pawnshops, funds, microfinance organizations);

- producers of excisable goods;

- gambling organizers;

- companies with branches.

If everything is fine with the type of business, then check its scale and composition of owners:

- For an LLC using the simplified tax system “Income minus expenses”, the share of legal entities in the authorized capital should not exceed 25%.

- The residual value of fixed assets should not exceed 150 million rubles.

- The average number of employees should not be more than 100 (130) people.

- Revenue should not exceed:

- for those who plan to switch to the simplified tax system from 2023 - 123.3 million rubles for 9 months;

- for those who already work on the simplified tax system - 164.4 (219.2) million rubles per year.

How to pay tax under the simplified tax system “Income minus expenses”

The tax period under the simplified tax system is a calendar year. Organizations must pay their budget by March 31 of the following year. The simplified procedure for individual entrepreneurs “Income minus expenses” provides for payment of tax by April 30.

But, in addition to the final payment, all businessmen must make quarterly advance payments throughout the year. The deadline for their payment is the 25th day of the month following the reporting period.

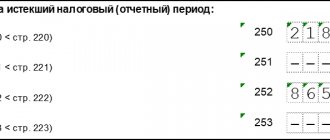

The advance payment for each period is calculated in the same way as the amount for the year as a whole. The difference between revenue and costs should be multiplied by the tax rate. The difference is determined by the cumulative total from the beginning of the year. If we are talking about an advance for 6, 9 months or an annual amount, then you need to subtract the previously listed advances.

The minimum tax is not paid during the year. If at the end of the interim period the amount payable is less than 1% of revenue, then it should be transferred. If a loss is incurred during the reporting period, then there is no need to pay an advance.

Example.

The businessman’s income and expenses for 2022 by quarter are shown in the table. For the calculation we will use the standard rate of 15%.

thousand roubles.

| Period | Income | Expenses |

| 1st quarter | 700 | 500 |

| 2nd quarter | 850 | 550 |

| 3rd quarter | 1 000 | 900 |

| 4th quarter | 900 | 600 |

We will also summarize the calculation of advances and tax amounts in a table.

| Period | Income, n.i.* | Expenses, n.i.* | Tax base, n.i.* | Tax, n.i.* | Tax payable |

| 3 months | 700 | 500 | 200 | 30 | 30 |

| 6 months | 1 550 | 1 050 | 500 | 75 | 45 |

| 9 months | 2 550 | 1 950 | 600 | 90 | 15 |

| Year | 3 450 | 2 550 | 900 | 135 | 45 |

*cumulative total since the beginning of the year

Application of the simplified tax system by legal entities

The use of the simplified tax system by legal entities implies exemption from payment of the following taxes:

— corporate income tax,

- tax on property of organizations, with the exception of property in respect of which the tax base is calculated as cadastral value,

— VAT, with the exception of the tax paid when importing goods into the territory of the Russian Federation, as well as the tax paid in connection with the performance of the functions of a tax agent.

Legal entities using the simplified tax system send a tax return no later than March 31 of the year following the expired tax period (year).

Advance payments are transferred no later than 25 calendar days from the end of the quarter. Advance payments paid are counted against tax based on the results of the tax (reporting) period (year). At the end of the year, the tax is paid no later than March 31 of the year following the expired tax period (year).

Legal entities using the simplified tax system are required to maintain a Book of Income and Expenses in the form approved by Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n “On approval of the forms of the Book of Accounting of Income and Expenses of organizations and individual entrepreneurs using a simplified taxation system, the Book of Income of individual entrepreneurs using patent taxation system, and procedures for filling them out.”

In addition, organizations using the simplified tax system are required to maintain accounting records and submit financial statements to the tax authorities in the generally established manner.

simplified tax system (income)

The tax base is income.

The tax rate established by the Tax Code of the Russian Federation is 6%, but the introduction of regional rates is provided depending on the categories of taxpayers.

According to Art. 1-3 of Law No. 31-OZ of June 15, 2009 for taxpayers - legal entities who first switched to a simplified taxation system after December 31, 2022 and carrying out one or more of the following types of business activities: “types of activities included in the subgroup “Retail trade in footwear” in specialized stores”, “Retail trade in medicines in specialized stores (pharmacies)”, the tax rate is determined at 4%.