The provision of subsoil to legal companies is formalized by a special state permit (license), confirming the right of its owner to use a certain territory for a specific purpose during a specified time period. For the exploitation of a plot of territory, mandatory transfers of funds to the state budget are provided, paid upon receipt of permission to carry out specified types of activities on the subsoil plot (Federal Law No. 2395, 02/21/1992).

Payers and payments

The subsoil use payment system provides for transfers:

- periodic (regular);

- one-time (when adjusting the boundaries of the exploited land territory and other measures and procedures defined in the text of the license);

- type of auction fee (with the participation of a company in a competition for obtaining a permit (license) for subsoil use).

Regular payments for the use of land are classified as non-tax transfers of a mandatory nature, paid for obtaining the opportunity to be present for permitted purposes in a certain territory. The Federal Tax Service of the Russian Federation controls the correctness and accuracy of the calculation, the amount of payment received into the budget and the timeliness of its payment.

Payment is made by companies and entrepreneurs (residents and non-residents of the Russian Federation), recognized as users of subsoil (in accordance with the permits issued to them and the executed production sharing agreement), including those who have rights to:

- exploration and prospecting activities, as well as assessment of mineral deposits in the allocated territory;

- study and assessment of sites from the point of view of their suitability for construction work, operation of buildings not related to the process of obtaining minerals;

- operation of underground buildings that are not associated with the process of obtaining minerals, except for buildings of shallow depth (no more than 5 meters), and construction work.

There is no regular payment for:

- Exploitation of the subsurface territory for:

- procedures for their geological study;

- creation of objects protected by the state, cultural, scientific or other purposes.

- Mineral exploration:

- in areas with deposits that are already being used for industrial development;

- within the boundaries of the mountain allotment area intended for their extraction.

Payment deadlines

Make regular payments quarterly no later than the last day of the month following the reporting quarter, that is:

- for the first quarter – no later than April 30;

- for the second quarter – no later than July 31;

- for the third quarter – no later than October 31;

- for the fourth quarter - no later than January 31.

This is stated in paragraph 4 of Article 43 of the Law of February 21, 1992 No. 2395-1.

The deadline for transferring one-time payments is determined on the basis of a license for the use of subsoil or a production sharing agreement (paragraph 5 of Article 40 of the Law of February 21, 1992 No. 2395-1).

Payment calculation

Calculation and determination of the rate for the land fund is carried out for plots separately. The indicator is determined by the structure for managing the state natural resources fund (regional, federal). The contribution rate is indicated in the license permitting the use of a specific subsoil territory.

The rate is calculated:

- for 1 km2 of territory (taking into account the discovered mineral resource and the type of work performed), when assessment, exploration and prospecting activities are carried out on it;

- for 1 unit of mineral resources intended for storage (1 thousand m3, ton), when construction is underway on the allocated site or underground structures are being operated.

The taxable base is considered to be:

- when searching for and assessing deposits - the size (area) of the site allocated for use minus the size of its returned share and territories with discovered deposits;

- in the case of deposit exploration activities - the size of the site allocated for use minus its returned share and the part where the volumes of the discovered mineral deposits are calculated and entered into the state register of reserves;

- during the construction and use of underground structures that are not related to the extraction of minerals on the site - the amount of discovered minerals accepted for storage.

For your information! Data on the size of each area (returned share of the site, used site, open deposits, recorded mineral deposits) are recorded in the text of the license or in the text of amendments to the permit.

Section V. Payments for subsoil use

1. Regular payments for the use of subsoil are collected for granting subsoil users exclusive rights to search and evaluate mineral deposits, mineral exploration, geological study and assessment of the suitability of subsoil areas for the construction and operation of structures not related to the extraction of mineral resources, construction and operation of underground structures not related to mining, with the exception of shallow engineering structures (up to 5 meters) used for their intended purpose.

Regular payments for the use of subsoil are collected from subsoil users separately for each type of work carried out in the Russian Federation, on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation (as well as leased from foreign states or used on the basis of an international treaty, unless otherwise established by an international treaty).

For the purposes of this article, the construction and operation of underground structures not related to mining also includes the construction of artificial structures and the laying of cables and pipelines under water.

Regular payments for subsoil use are not charged for:

- use of subsoil for regional geological study;

- use of subsoil for the formation of specially protected geological objects that have scientific, cultural, aesthetic, sanitary, health and other significance. The procedure for classifying subsoil use objects as specially protected geological objects that have scientific, cultural, aesthetic, sanitary, health and other significance is established by the Government of the Russian Federation;

- exploration of mineral resources in deposits that have been put into commercial operation, within the boundaries of a mining allotment granted to the subsoil user for the extraction of these minerals;

- exploration of a mineral within the boundaries of a mining allotment granted to the subsoil user for the extraction of this mineral.

2. The amount of regular payments for the use of subsoil is determined depending on the economic and geographical conditions, the size of the subsoil plot, the type of mineral, the duration of work, the degree of geological exploration of the territory and the degree of risk.

A regular payment for the use of subsoil is charged for the area of the license area provided to the subsoil user, minus the area of the returned part of the license area. Payments for the right to use subsoil are established in strict accordance with the stages and stages of the geological process and are charged:

- at the rates established for carrying out exploration work for deposits - for the area of the subsoil plot in which the reserves of the corresponding mineral (except for the area of the mining allotment and (or) mining allotments) are established and taken into account by the State balance of reserves;

- at the rates established for carrying out work on the search and evaluation of mineral deposits - for the area from which the territories of discovered deposits are excluded.

The rate of regular payment for the use of subsoil is established for one square kilometer of subsoil area per year.

The specific rate of regular payment for subsoil use is established by the federal body managing the state subsoil fund or its territorial bodies separately for each subsoil plot for which a subsoil use license is duly issued, within the following limits:

(rubles per 1 sq. km of subsoil area)

| Bid | ||

| Minimum | Maximum | |

| 1. Rates of regular payments for the use of subsoil for the purpose of searching and evaluating mineral deposits | ||

| Hydrocarbon raw materials | 120 | 360 |

| Hydrocarbon raw materials on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation, as well as outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 50 | 150 |

| Precious metals | 90 | 270 |

| Metal minerals | 50 | 150 |

| Placer deposits of minerals of all types | 45 | 135 |

| Non-metallic minerals, coal, oil shale and peat | 27 | 90 |

| Other solid minerals | 20 | 50 |

| The groundwater | 30 | 90 |

| 2. Rates of regular payments for the use of subsoil for the purpose of mineral exploration | ||

| Hydrocarbon raw materials | 5 000 | 20 000 |

| Hydrocarbon raw materials on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation, as well as outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 4 000 | 16 000 |

| Precious metals | 3 000 | 18 000 |

| Metal minerals | 1 900 | 10 500 |

| Placer deposits of minerals of all types | 1 500 | 12 000 |

| Non-metallic minerals | 1 500 | 7 500 |

| Other solid minerals | 1 000 | 10 000 |

| The groundwater | 800 | 1 650 |

| 3. Rates of regular payments for the use of subsoil during the construction and operation of underground structures not related to mining | ||

| Storage of oil and gas condensate (rubles per 1 ton) | 3,5 | 5 |

| Storage of natural gas and helium (rubles per 1,000 cubic meters) | 0,2 | 0,25 |

The amount of regular payments for the use of subsoil is included by organizations in other expenses associated with production and sales, taken into account when determining the tax base for corporate income tax, in equal shares throughout the year.

3. The amounts of regular payments for the use of subsoil, the conditions and procedure for their collection during the implementation of production sharing agreements are established by production sharing agreements within the limits established by this article.

When executing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements”, the conditions for calculating and paying regular payments established by these agreements are applied.

When implementing production sharing agreements concluded after the entry into force of the Federal Law “On Production Sharing Agreements” and before the entry into force of this article, the payment of regular payments for the use of subsoil, the conditions and procedure for their collection are established by these agreements in accordance with the legislation of the Russian Federation in force on the date of signing of each such agreement.

4. Regular payments for the use of subsoil are paid by subsoil users quarterly no later than the last day of the month following the expired quarter, in equal shares of one-fourth of the payment amount calculated for the year.

The procedure and conditions for collecting regular payments for the use of subsoil from subsoil users carrying out prospecting and exploration of deposits on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation, as well as outside the Russian Federation in territories under the jurisdiction of the Russian Federation, are established by the Government of the Russian Federation , and the amounts of these payments are sent to the federal budget.

5. Regular payments for the use of subsoil are collected in cash and credited to the federal, regional and local budgets in accordance with the budget legislation of the Russian Federation.

6. Subsoil users, on a quarterly basis, no later than the last day of the month following the end of the quarter, submit to the territorial bodies of the Federal Tax Service and the federal executive body authorized by the Government of the Russian Federation in the field of natural resources at the location of subsoil plots, calculations of regular payments for the use of subsoil in the forms approved The Ministry of Finance of the Russian Federation in agreement with the Ministry of Natural Resources of the Russian Federation.

Section VI. Further…

Type and frequency of payment

Payments for the exploitation of subsoil are made in monetary terms and are subject to direction to the budget (territorial, federal) in accordance with the budgetary legislation of the Russian Federation. According to Federal Law No. 349 (December 2, 2013), the share of payment sent to the budget of a state subject is 60%, to the federal budget - 40% of the contribution for subsoil use.

Users of plots submit calculations of the amount payable to the Federal Tax Service and executive authorities involved in the field of natural resources. The deadline for transferring the calculation is one month after the last quarter, but not later than the last day of the month.

The payment procedure takes place at the location of the subsoil territory that has been transferred for use. The deadline for the transfer coincides with the deadline for submitting the payment calculation: no later than the last day of the month after the last quarter.

For your information! For untimely submission of the calculation, the consumer may be subject to punishment in the form of a fine, but for violation of the deadline provided for payment of the regular payment for subsoil use, penalties are not charged (Letter of the Federal Tax Service of the Russian Federation No. SD-4-3/1152, 06/28/2016). This type of transfer is not a tax or fee, therefore the provision of Article 75 of the Tax Code of the Russian Federation regarding the collection of penalties cannot be applied.

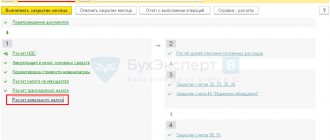

Regular payment accounting

According to accounting, settlements for payments for the use of state subsoil are reflected in account 76 (“Settlements with other creditors”) with the opening of separate sub-accounts for settlements for each type of payment (one-time, regular).

Expenses in these areas are included in expenses for ordinary activities and are subject to write-off in the reporting period in which they occurred.

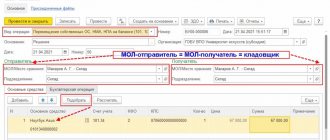

According to the Instructions for PS, PBU 10/99 (clause 5, 18), the following postings are made when:

- Accrual of the amount: Debit account. 20 (44, 29, 26, 23, 25) / Credit 76 credits.

- Transferring the amount: Debit account. 76 / Credit 51 accounts

Regular payments for subsoil use during the operation of an enterprise according to OSNO are indicated in other expenses related to production and sales (Article 264 of the Tax Code of the Russian Federation).

When using the accrual method, such amounts are recognized as expenses at the time they are accrued (on the last day of the quarter), when using the cash method - at the time they are sent to the budget (Article 273 of the Tax Code of the Russian Federation).

For your information! The amount of the payment is taken into account as another expense, except when it is established at an auction. Such values are included in the cost of admission (letters from the Ministry of Finance of the Russian Federation, 06/25/2015, 10/23/2015). In all cases, VAT is not applied.

Companies and entrepreneurs engaged in the extraction and sale of minerals do not have the legal opportunity to work under the simplified tax system. Regular contributions are not reflected in the taxable base when making tax payments on income (Article 346 of the Tax Code of the Russian Federation). When calculating the tax indicator from the difference between the values of expenses and revenues, amounts for subsoil use also cannot be taken into account - they are not in the list of expenses recognized when conducting activities according to the simplified taxation method.

With UTII, imputed income is taxed, and the extraction of natural resources is not included in the list of activities taxable under this method (Article 346 of the Tax Code of the Russian Federation).

Attention! The legislation of the Russian Federation does not provide benefits for regular payments for subsoil use.

BASIC

Tax accounting for regular payments and one-time payments for the use of subsoil is different. Let's look at each separately.

How to account for recurring payments

Include regular payments in other expenses associated with production and sales (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation).

If an organization uses the accrual method, recognize such payments as expenses at a time at the time they are accrued:

- established by the license for a one-time payment;

- on the last day of the reporting quarter when the regular payment is calculated.

This conclusion follows from the provisions of paragraph 1, subparagraph 1 of paragraph 7 of Article 272 and paragraph 2 of Article 318 of the Tax Code of the Russian Federation and is confirmed by the Ministry of Finance of Russia in letters dated May 21, 2013 No. 03-03-10/17856, dated March 14, 2013 No. 03-06-05-01/7648, dated August 29, 2011 No. 03-06-06-01/20, dated April 13, 2011 No. 03-03-06/1/237.

With the cash method, recognize the regular payment at a time at the time it is transferred to the budget (clause 3 of Article 273 of the Tax Code of the Russian Federation).

How to account for one-time payments

Tax accounting for a one-time payment for the use of subsoil depends on how its size is established: as a result of an auction, competition or not. Let's look at this in more detail.

Situation: how to take into account a one-time payment for the use of subsoil when calculating income tax?

If the payment amount is set at an auction or competition, include it in the cost of the license. In other cases, record the payment as a separate other expense.

Experts from the Russian Ministry of Finance believe that a one-time payment based on the results of an auction or competition is associated with obtaining a license. The one who offers the highest single payment amount wins the auction. At the competition, the amount of the payment also affects the opportunity to win a license (clauses 70 and 113 of the Administrative Regulations, approved by order of the Ministry of Natural Resources of Russia dated June 17, 2009 No. 156). Therefore, an organization that received a license through a competition or auction should take the payment into account in its cost, and not as a separate expense. This is evidenced by letters from the Ministry of Finance of Russia dated October 23, 2015 No. 03-03-06/1/61172, dated June 25, 2015 No. 03-03-06/1/36750.

For details on the procedure for accounting for license expenses, see How to record expenses for obtaining a subsoil use license.

If an organization received a license without an auction or competition, the one-time payment does not need to be taken into account in its cost. Officials believe that in this case the payment is not related to obtaining a license - the ability to obtain a permit does not depend on its size. Therefore, take it into account as a separate other expense (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). This is stated in letters of the Ministry of Finance of Russia dated October 23, 2015 No. 03-03-06/1/61172, dated June 25, 2015 No. 03-03-06/1/36750, dated March 27, 2015 No. 03- 03-06/1/17157, dated July 23, 2013 No. 03-03-06/1/28990.

Regular and one-time payments for the use of subsoil are not subject to VAT. This follows from the provisions of subparagraph 17 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation and is confirmed in the letter of the Ministry of Finance of Russia dated January 21, 2004 No. 04-02-05/3/1

An example of how one-time and regular payments for the use of subsoil are reflected in accounting and taxation. The organization applies the general tax regime and uses the accrual method

Alpha LLC received a license for geological exploration of subsoil, development of mineral deposits and collection of mineralogical collection materials. The organization did not participate in the auction or competition.

The license was issued on January 1, 2015. The license is valid until December 31, 2025.

The license provides for a one-time payment in the amount of RUB 1,500,000. The payment deadline is determined by the start of field development work. The organization has been conducting exploration of deposits in the area since the beginning of 2016. The annual amount of regular payments for this type of work is 150,000 rubles.

In accounting, Alpha's accountant made the following entries.

January 2016:

Debit 20 Credit 76 subaccount “Settlements for one-time payments for subsoil use” – RUB 1,500,000. – a one-time payment for the use of subsoil has been accrued;

Debit 76 subaccount “Settlements for one-time payments for subsoil use” Credit 51 – RUB 1,500,000. – a one-time payment is transferred.

At the same time, the one-time payment in full was recognized by the accountant as a reduction in the base for calculating income tax as another expense.

Quarterly, starting from the first quarter of 2016, Alpha’s accountant calculates a regular payment for the use of subsoil. At the same time, in accounting for April 30, July 31 and October 31, 2016, the following entries are made:

Debit 20 Credit 76 subaccount “Settlements for regular payments for subsoil use” – 37,500 rubles. (RUB 150,000: 4) – regular payment for subsoil use has been accrued.

At the same time, the accrued regular payment is recognized by the Alpha accountant as a other expense to reduce the base for calculating income tax for this reporting period.

The Alpha accountant reflects the transfer of a regular payment to the budget as follows:

Debit 76 subaccount “Settlements for regular payments for subsoil use” Credit 51 – 37,500 rub. – a regular payment is transferred to the budget.

Responsibility for violation of legal norms

If a company uses subsoil in the absence of state permission, then a fine may be applied to the culprit, and the company will also be obliged to compensate for the loss caused (Article 7 of the Code of Administrative Offenses of the Russian Federation).

The amount of loss from unauthorized use of the territory is calculated according to the mineral extraction tax (mineral extraction tax) rates.

Tax authorities have no grounds for holding violators of payments for the use of state subsoil plots accountable due to the non-tax nature of regular payments.

When establishing cases of violation of the current legislation, the Federal Tax Service sends a request for revocation or suspension of the permit providing for the possibility of using subsoil to the Service for Supervision in the Sphere of Natural Resources (ROSPRIRODNADZOR), the Subsoil Use Agency (ROSNEDRA).