Accounting by cards

To pay by card, the organization must enter into an agreement with the supplier, after which a special fuel card will be issued. Such a card contains information about what petroleum products can be purchased using it, in what quantities, about related services, as well as the amount of funds that can be used to purchase fuel and services.

Most often, the card is provided free of charge with subsequent return. But, if a separate fee is required for it, then the capitalization of its value is formalized in the form of receipt of the service. To do this, you need to create a “Services (Act)” receipt by going through the “Purchases” and “Receipts” menus. This is shown in more detail below.

In this case, the fuel card is accounted for in off-balance account 006. It is reflected through the “Operations” menu and then “Operations entered manually.”

If you did not have to pay for the production of the card, it should still be reflected in the same off-balance sheet account; the conditional price of one ruble is simply indicated.

At the end of the month, the supplier must provide documents indicating how much fuel was purchased in liters. Based on these documents, accounting is carried out on account 10.03.1 “Fuel”. Registration is carried out in the “Purchases” menu, then “Receipt”, through “Receipt of goods (invoice)”.

You need to create a new document with the same name, specify the necessary data, and also add rows to the “Products” tabular section using the “Add” or “Selection” button. You should also indicate the type of item, that is, fuels and lubricants.

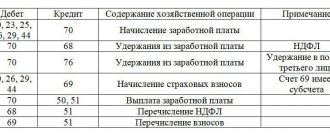

As a result, the receipt of fuel and lubricants was carried out and the Dt posting was generated. 10.3 – Kt. 60. The registration of fuel purchases using the card is completed.

Service Temporarily Unavailable

But if concentrated coolant, which is ethylene glycol with a water content of no more than 5%, belongs to the group of flammable substances (that is, it’s a stretch to talk about a fuel and lubricant), then its derivatives used in everyday life (in particular, Tosol-40 , Tosol-65), are fire and explosion proof. And they don’t lubricate anything. True, they do have code 38.20 according to the Harmonized System for Description and Coding of Goods. But the arguments remain unclear as to why products with this code should be considered fuel and lubricants.

Moreover, following the letter, individuals cannot sell the following:

— anti-knock agents, antioxidants, tar formation inhibitors, thickeners, anti-corrosion substances and other additives ready for petroleum products (including gasoline) sludge and other liquids used for the same purposes as petroleum products (code 3811);

- mixed alkylbenzenes and mixed alkylnaphthalenes, except for substances of heading 2707 or 2902 (code 3817);

— hydraulic brake fluids and other ready-made fluids for hydraulic transmissions, not containing or containing less than 70 wt.% of oil or oil products obtained from bituminous minerals (code 3819).

Let's summarize: on the one hand, individual traders who trade in various petroleum products and auto chemicals will have to carefully reconsider their assortment in order to avoid conflict situations. On the other hand, while the regulatory legal acts do not establish what should be understood by fuel and lubricants, the positions of those who do not intend to deal with this are also strong. After all, if a product is not flammable and does not lubricate anything, then why should it be considered fuel and lubricants?

“All about accounting”, No. 69 (980), July 26, 2004

Hello, in this article we will try to answer the question “Does antifreeze belong to fuels and lubricants or not?” You can also consult with lawyers online for free directly on the website.

This interval is usually very long and ranges from 2 to 5 years. On the one hand, this is very good; I filled it with antifreeze and forgot about this problem for the next few years. On the other hand, sometimes they forget about replacements altogether.

TOSOL is a non-freezing liquid poured into engines. The number on the TOSOL-40 packaging, as mentioned above, corresponds to the sub-zero freezing temperature of the liquid, or more precisely, to the loss of its fluidity. Our (Russian) most popular TOSOL-40 consists of 45 percent water, 53 percent ethylene glycol and 2 percent additives.

Accounting for fuel and lubricants upon receipt by advance payment

If the driver buys gasoline himself with cash, he needs to fill out an advance report to reflect this. Before this, the payment of funds to the employee must be formalized. It is recorded in the document “Cash Withdrawal”, the type of transaction is “Issue to an accountable person”. The image below shows a sample.

When this document is completed, you need to create an expense report. This is done in the “Bank and Cash Desk” section. The pictures show where the required subsection is located and what the document will look like.

To create it, click the button and fill out the “Advances” tab: reflect the issuance document (in this case, it is “Issue of an advance”) and the documents attached to the report. After this, fill out the tabular part - it should indicate what fuel is purchased, its price and volume.

As a result, fuel and lubricants will be capitalized through an advance report. Postings: Dt. 10.3 – Kt. 71.01. To receive a printed document, you can use the “Print” button.

What is fuel and lubricants - decoding and description

Fuel and lubricants are “fuels and lubricants”, various products made from oil. These goods belong to the industrial variety, so their sales are carried out exclusively by specialized companies.

The production of everything related to fuels and lubricants occurs in strict accordance with accepted standards and requirements. Therefore, each batch must be accompanied by documentation with laboratory test results confirming its quality.

Buying fuel and lubricants today is quite simple. In general, the concept of fuels and lubricants includes an extensive list of petroleum products used as:

- Fuel - gasoline, diesel, kerosene, associated petroleum gas.

- Lubricants – oils for engines and transmissions, as well as plastic substances.

- Technical fluids - antifreeze, antifreeze, brake fluid and so on.

Fuels and lubricants – products obtained as a result of oil distillation

Write-off of fuel and lubricants in 1C 8.3

In 1C 8.3, waybills are used to record write-offs. Information from them must be verified with reports provided by the employee, which reflect data from waybills and gas station receipts.

Both gasoline and any other fuel and lubricants are written off using the document “Demand-waybill” - the screenshot below shows how to find it.

In it you need to indicate the parameters of fuel and lubricants, as well as the account to which they will be written off - this is done using the “Selection” and “Add” buttons highlighted in the following screenshot. The write-off account itself is determined by the type of activity the organization conducts. So, for a trading enterprise it is 44.01, and when written off for general business needs it is 26. If you check the box on the “Materials” tab as shown below, then the accounts can be indicated on the line with the nomenclature. If it is not installed, you will need to fill them out on a separate tab.

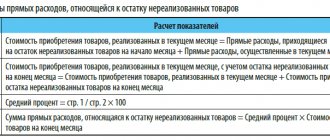

The cost of gasoline written off as an expense when making a claim-invoice will be taken into account at the average.

Based on the expense report, this document can also be generated. You need to open the report, or the entire journal with them, click the “Create based on” button and select the document.

If you have any more questions regarding how to write off fuel and lubricants, you can contact our specialists in working with 1C 8.3 - they are always ready to advise you.

Operations with technical liquids

Document: POL = petroleum products? Or what else can’t be traded by an individual retailer?

Commentary on the letter of the State Committee for Regulatory Policy and Entrepreneurship dated June 21, 2004 No. 4123

POL = petroleum products? Or what else can’t be traded by an individual retailer?

Read also: What is the difference between synthetics and semi-synthetics?

An individual owner is prohibited from selling fuels and lubricants (hereinafter referred to as fuels and lubricants). Everything is short and extremely clear. The only thing left to do is to decide what is included in this concept. However, as the State Committee for Entrepreneurship of Ukraine indicated in the commented letter, today the concept of “fuel and lubricants” is not standardized. Simply put, the regulations do not clearly indicate which products are fuels and lubricants and which are not.

Now let's move on to specifics: should we count the fuels and lubricants "Litol-24" ("Litol 24RK") and "Tosol"? The answer from the State Committee for Entrepreneurship is yes. The arguments are in the letter.

As for Litol-24, the logic is ironclad: according to GOST 21150-87, it is an anti-friction multi-purpose waterproof lubricant. And according to the manufacturing technology, it’s a typical grease. In addition, it is flammable. Why not fuel and lubricant!

But with “Tosol” everything is not so clear. “Tosol” is a coolant, which is covered by GOST 28084-89. The main component of such liquids is ethylene glycol (dibasic alcohol).

Setting up subaccount 10.03.1 “Fuel”

In the example considered below, one warehouse is used for the receipt of fuel. If an organization has several vehicles, a warehouse can be created for each of them, after which turnover and balances will be taken into account separately.

You should start setting up by keeping records on account 10.03.01 in the context of warehouses. To do this, open this account and check the “By warehouses” field (shown in the screenshot below). This way you will receive an additional sub-account, and you can keep records in warehouses only by quantity, or by quantity and amount.

Let's try to repost the created documents by changing the warehouse. After this, the warehouse will be displayed in the postings, and you can add the “Warehouses” subaccount when creating the balance sheet.

In the SALT, a conditional warehouse is allocated - a new one created, in the case under consideration it is “Car”.

For the fuel that was purchased earlier, the warehouse is not indicated in the SALT.

Do you have any questions about accounting for fuels and lubricants in 1C? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Types of fuel related to fuels and lubricants

Since most of everything related to fuels and lubricants is fuel, let’s look at its types in more detail:

- Gasoline . Provides operation of internal combustion engines. It is characterized by rapid flammability, which is forced in mechanisms. When choosing the right fuel, you should be guided by such characteristics as composition, octane number (affecting detonation stability), vapor pressure, etc.

- Kerosene . Initially it served a lighting function. But the presence of special characteristics made it the main component of rocket fuel. This is a high rate of volatility and heat of combustion of TS 1 kerosene, good tolerance to low temperatures, and reduced friction between parts. Given the latter property, it is often used as a lubricant.

- Diesel fuel . Its main varieties are low-viscosity and high-viscosity fuels. The first is used for freight transport and other high-speed equipment. The second is for low-speed engines, for example, industrial equipment, tractors, etc. The affordable price of fuel, low explosion hazard and high efficiency make it one of the most popular.

Natural gas in liquid form, also used to fuel cars, is not a product of petroleum refining. Therefore, according to accepted standards, it does not apply to fuels and lubricants.

Three main types of fuel related to fuel and lubricants

What is antifreeze and why is it needed?

Another article about coolant. The information will be really useful, if you want, I collected it “bit by bit.” The bottom line is this - many owners of foreign cars pour red antifreeze into their iron horses, others pour green, and still others pour blue! But what is the difference between these substances? The differences are of course in color, that's all? What, for example, will happen if you mix green and red antifreeze?

The payer of excise tax to the budget is an organization, individual entrepreneur or other person that carries out operations for the sale or production of excisable goods.

Ethylene glycol was known in the second half of the 19th century, but became widespread only after the First World War. In the 20s of the last century, it began to be used to turn water into “antifreeze,” which translated from English meant “against frost.” Over time, antifreeze began to be produced on an industrial scale.

The production of everything related to fuels and lubricants occurs in strict accordance with accepted standards and requirements. Therefore, each batch must be accompanied by documentation with laboratory test results confirming its quality.

Initially it served a lighting function. But the presence of special characteristics made it the main component of rocket fuel. This is a high rate of volatility and heat of combustion of TS 1 kerosene, good tolerance to low temperatures, and reduced friction between parts.

No way. Prepared TOSOL is colorless and is colored so that it is not accidentally drunk. Usually a color is chosen that is unnatural for living nature.

Fuels and lubricants also include special liquids, including coolants and brake fluids.

Thus, these Guidelines RD 34.09.105-96 establish only the general procedure for accounting for fuel at power plants.

Inventory must be carried out monthly as of the first day of each month (clause 1.4 of RD 34.09.109).

It just so happens that a lot of attention is paid to motor oil, and most car enthusiasts quite easily navigate the intricacies of names, letters and numbers that divide oils into different classes. But antifreezes are undeservedly forgotten. Many people believe that the requirements for the liquid in the engine cooling system are small - as long as it does not freeze in winter and does not boil in summer. And in vain.

Read also: Is it possible to install a turbine on Yamz 238

Coolant is a chemical substance used in the engine cooling system, and is characterized by improved freezing and boiling characteristics, which allows the vehicle to be operated at any outside temperature.

The authoritative standard is AFNOR (French Association for Standardization) NFR 15-601 BASF. In addition to the general standards, many car manufacturers apply their own specifications with additional requirements. There are quite a lot of them and there is no point in listing them in this article. The G standard system of the Volkswagen concern, which separates antifreezes by color, is very popular.

Federal Law of the Russian Federation of December 6, 2011 N 402-FZ “On Accounting” and Methodological Guidelines approved by orders of the Ministry of Finance of Russia.

It should be borne in mind that, based on a literal reading of the text of clause 6 of PBU 5/01, these expenses are included in the cost price only if information and consulting services are provided by the organization. If similar services are provided by a private entrepreneur, the organization does not have the right to include these expenses in the cost of fuel and lubricants.

Normal operation of an internal combustion engine is possible only with the correct functioning of the cooling system, which ensures the removal of excess heat and its release into the atmosphere. The majority of organizations are unlikely to have the ability to produce fuel on their own, so we will not consider this method of receiving material supplies. Let's consider the remaining methods.

And yet, what is antifreeze? Antifreeze is a glycol base (ethylene glycol or propylene glycol) and a package of additives (anti-corrosion, anti-foam, stabilizing). Ethylene glycols are low-freezing aqueous solutions of polyhydric alcohols. Pure ethylene glycol is an oily liquid with a sweetish taste, with a boiling point of 196°C and a freezing point of -12.3°C.

There are no standards yet regulating the service life of antifreeze and the conditions of endurance tests. Antifreeze certification is optional.

The last 3 items have been included in this list since January 10, 2017 (Clause 6, Article 2 of the Law “On Amendments...” dated November 30, 2016 No. 401-FZ).

Their quality depends on the presence of additives in the composition - additional substances that improve performance characteristics. Supplements can improve one or several indicators at once. There are, for example, anti-wear or detergent, protecting spare parts from the build-up of deposits.

Motor oil which subaccount of accounting

You will learn about current changes in the CS by becoming a participant in the program developed jointly with Sberbank-AST JSC.

Students who successfully complete the program are issued certificates of the established form. The program was developed jointly with Sberbank-AST JSC. Students who successfully complete the program are issued certificates of the established form.

In a budgetary institution, several cars were in disrepair and were not used. To repair these vehicles, the institution purchased the necessary spare parts, engine oil and special fluids (antifreeze, brake fluid, power steering fluid). Oil and liquids in delivery notes are indicated in pieces (cans). The employee of the institution who carried out the repair of these cars received the specified supplies from the warehouse. Spare parts were written off. How should oils and automotive fluids be considered in this situation?

Having considered the issue, we came to the following conclusion: The institution’s commission for the receipt and disposal of assets may decide to write off motor oil and special liquids from the balance sheet in quantities not exceeding the filling volumes established by the manufacturer for specific models of vehicles. The remaining volumes of material assets specified in the question may be subsequently written off according to the norms or in another manner established by the accounting policy of the institution.

For your information: According to the changes planned for introduction to Procedure No. 209n, subsection 343 of KOSGU will include the costs of paying for contracts for the purchase (manufacturing) of special fluids (shock absorbers, hydraulics, cooling, anti-icing, recoil and brake fluids) used in various types of equipment . This circumstance is an additional argument in favor of accounting for special liquids in account 0 105 03 000 “Fuels and lubricants”.

Answer prepared by: Expert of the Legal Consulting Service GARANT Gurashvili Georgiy

Response quality control: Reviewer of the Legal Consulting Service GARANT Member of the Union for the Development of Public Finance Antonina Sukhoverkhova

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

————————————————————————- *(1) See, for example, Question: In what account is antifreeze accounted for? Does antifreeze belong to fuels and lubricants? (response from the Legal Consulting Service GARANT, July 2022)

© NPP GARANT-SERVICE LLC, 2022. The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

All rights to the materials on the GARANT.RU website belong to NPP GARANT-SERVICE LLC. Full or partial reproduction of materials is possible only with the written permission of the copyright holder. Rules for using the portal.

The GARANT.RU portal is registered as an online publication by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor), El No. FS77-58365 dated June 18, 2014.

LLC "NPP "GARANT-SERVICE", 119234, Moscow, st. Leninskie Gory, 1, building 77,

8-800-200-88-88 (free long-distance call)

Editorial office (ext. 3145),

Advertising department (ext. 3136), Advertising on the portal. Media kit

If you notice a typo in the text, highlight it and press Ctrl+Enter

Source

Antifreeze - types, labeling, expiration date, differences from antifreeze

If we talk about ethylene glycol and others, then this is a simple dihydric alcohol that has a sweetish odor and a viscous consistency - it can withstand positive temperatures of 196 degrees, but negative temperatures of only “-11” degrees Celsius further freezes.

The only document that regulates the quality of coolant is GOST 28084-89. It does not provide for the addition of either glycerin or methanol to the coolant. Mixing antifreeze and antifreeze with distilled water is permissible, since the coolant contains about 70%.

The latter are a symbiosis of substances obtained artificially with natural results of oil refining.

Unlike water, antifreeze does not expand when frozen and does not form a solid solid mass. A loose mass of water crystals is formed in an ethylene glycol environment. Typically, such a mass does not lead to freezing of the radiator and does not prevent the engine from starting.

Such proposals are still encountered, for example, on behalf of the so-called “Association of Antifreeze Manufacturers.”

Read also: Procedure for connecting high-voltage wires UAZ

Especially for “narrow-minded” people, they came up with the idea of painting coolants in different colors, so someone still manages to mix them.

Accordingly, when selling them, an individual entrepreneur also has the right to apply the taxation system in the form of UTII. Urgent news for all entrepreneurs: .

They significantly reduced the service life of engines, which were generally quite good, but few people associated such a decrease with the low quality of the coolant. Antifreeze (the exact name is Antifreeze “Tosol-A”, later Antifreeze “Tosol-AM”) was developed in the late 60s at the closed institute of GosNIIOKhT, in a department called TOS (Technology of Organic Synthesis). Hence the name of the product - TOSol - is original and euphonious.

In their storage, fuels and lubricants are very unpretentious. They do not need special storage equipment or a special system for maintaining special temperature conditions. In rare cases, special conditions for storing fuels and lubricants are possible - then they are indicated in the documentation for this product.

Even not frozen, but crystallizing antifreeze can cause a radiator leak. Adding water can only be justified if it evaporates, which changes the composition of the liquid towards increasing density. This should be done by first draining the antifreeze from the engine into a container and pouring it back into the system after mixing.

At the same time, I would like to note that the methodological instructions RD 34.09.109 are not legislative acts on accounting. The current regulatory documents regulating the procedure for conducting an inventory of property were developed and adopted later than the Methodological Instructions RD 34.09.109.

This article does not pretend to be complete; it examines only the myths that the author most often encountered in his practical work.

It is worth considering the legal status of this document. Guidelines RD 34.09.109 were approved on December 19, 1986 by the Main Scientific and Technical Directorate of Energy and Electrification of the Ministry of Energy and Electrification of the USSR. The validity period of these Guidelines was established from 01/01/1987 to 01/01/1992.

This article does not pretend to be complete; it examines only the myths that the author most often encountered in his practical work.

Motor transport organizations, as a rule, have a large fleet of vehicles, and the costs of fuel and lubricants occupy, perhaps, the most significant place in the costs of their operation.