Employer Responsibilities

To register as an employee, an entrepreneur needs:

- Conclude an employment contract, according to which you pay wages at least twice a month. The amount of remuneration must correspond to the established minimum wage.

- Register with the Social Insurance Fund as an employer - come with documents no later than 30 days after signing the first employment contract. The pension fund will receive information about the employer automatically.

- Transfer tax from an employee’s salary and make contributions to the following types of insurance: pension, medical, temporary disability, industrial accidents.

After payments are made on time, the entrepreneur must submit the relevant reports.

Tax structure

When paying a salary to an employee, 2 types of taxes arise:

- Personal income tax (NDFL), which is considered a tax of an individual, but the company withholds and transfers the tax to the budget. The employee receives the amount on the card, and all taxes on salary remain hidden for him.

- The insurance premiums that a company pays from the payroll amount are a “tax” of the company (by definition, insurance premiums are not considered a tax - they are just insurance premiums). Payroll = salary in hand + personal income tax.

Insurance premiums are divided into 3 types:

- Contributions to the pension fund (PFR) are the employee’s “pension”.

- Contributions to the compulsory health insurance fund (MHIF) are “free” medicine.

- Contributions to the social insurance fund (SIF) are unemployment benefits; maternity benefits; additional payments for individuals who worked in hazardous production.

Insurance premium rates differ depending on the size of the payroll:

Insurance premium rates before and after 04/01/2020 (Clause 9 of Article 2 No. 102-FZ of 04/01/2020).

To benefit from reduced rates, the company must be in the register of small and medium-sized businesses (clause 9 of Article 2 No. 102-FZ of 04/01/2020). To do this, the company must meet 2 requirements:

- Revenue no more than 2 billion per year.

- The average number of employees per month for a calendar year is no more than 250 people.

Companies also have insurance contributions for injuries to the Social Insurance Fund. Rates for these insurance premiums range from 0.2-8.5%. The more dangerous the activity, the higher the rate. For example, a company that develops software will have an injury rate of 0.2%. For a company that mines coal, the rate will be 8.5%.

Let's use an example to explain the logic for calculating payroll taxes.

For example, an employee of an IT company receives 100,000 rubles:

- Payroll = 100,000 / 0.87 = 114,943 rubles, where 14,943 rubles are personal income tax and 100,000 rubles in hand.

- Insurance premiums = 12,792 × 30.2%2) × 15.2% = 3,863 + 15,527 = 19,390 rubles

- Total company expenses = 114,943 + 19,390 = 134,333 rubles.

For every 100 rubles that an employee receives in hand, the company will pay 34 rubles in taxes.

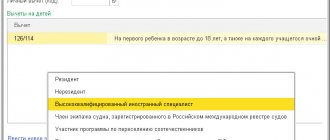

Income tax for employees

The state collects personal income tax from the salary of each employee. As a result, the person receives the money minus this payment. The tax rate is 13%. Personal income tax is withheld from the last part of the monthly salary.

Example of personal income tax calculation

The individual entrepreneur has a manager with a salary of 30,000 rubles. According to the agreement, the advance is paid on the 5th, and the second part of the salary is paid on the 25th. At the end of the month, the employee was awarded a bonus in the amount of 6,000 rubles.

The employer must transfer to the manager on the 5th the first part of the salary - 15,000 rubles, and on the 25th the rest minus income tax: (15,000 + 6,000) - 13% × (30,000 + 6,000) = 16,320 rubles.

The employer will need to transfer 4,680 rubles to the personal income tax account to the tax account on the day the employee is paid or the next day.

How to reduce personal income tax?

Deductions that apply only to certain categories of your employees will come to the rescue:

Standard deductions

- 3000 rub. monthly for military personnel, disabled people of the Second World War (although this category has almost disappeared), and persons who have received radiation exposure.

- 500 rub. monthly for participants in the Great Patriotic War, for people who donated bone marrow to save someone’s life, disabled people of one of the disability groups, people who were imprisoned in a concentration camp.

- A deduction in the amount of one thousand four hundred rubles to three thousand rubles monthly for the first child and for each subsequent child.

- 1200 rub. monthly for parents of full-time students, for parents of children under eighteen years of age with disabilities

All standard deductions are subject to limitations. If during a calendar year the income of an employee who is subject to one or another deduction reaches a total of 350 thousand rubles, all deductions for this employee are suspended. (Article 218 of the Tax Code of the Russian Federation)

Social deductions

- A deduction that is equal to the amount of donations made to a charitable organization or for a charitable purpose.

- A deduction that is equal to the amount spent on paying for the education of any employee or his children. And it doesn’t matter – their own or adopted ones.

- A deduction that is equal to the amount of money paid for the provision of medical services. Does not apply to all medical services. A specific list can be found on the website of the government of the Russian Federation.

- A deduction in the amount of an additional contribution by the employee to the funded part of the pension or to its insurance part.

All of the above tax deduction options also have a certain limit - up to the maximum income of an individual established by Article 219 of the Tax Code of the Russian Federation - 120 thousand rubles per year for one employee (except for donations).

Investment deductions

We are talking about income received as a result of the sale of securities. Or it can be a deduction equal to interest income from funds in an individual investment account (No more than 400 thousand rubles). More details can be found in Article 10.2-1 39-FZ.

Investment deductions are limited to the amounts specified in clause 2 of Article 219.1 of the Tax Code of the Russian Federation. It can be determined by the calculation mechanism described in this article.

Property deductions

- A deduction that is equal to the amount of cash costs for the construction or purchase of a house, apartment, or plot of land for subsequent development.

- A deduction that is equal to the amount paid to repay interest on loans (targeted) or cash loans.

- A deduction that is regulated by Article 220 of the Tax Code and is equal to the amount of funds received after the sale of one’s own real estate.

Professional deductions

Here, civil law agreements (GPC) come into consideration.

A deduction can be made in relation to an employee hired under such an agreement. These are individuals who receive royalties for certain actions - the creation or execution of works of science and art.

Also, expenses incurred to generate profit must be included in this deduction option. They must be documented, which is stipulated in Article 221 of the Tax Code of the Russian Federation.

The individual entrepreneur himself determines, based on the nuances of the social status, personal data and life circumstances of each employee, what tax he will pay to the Federal Tax Service. (Clause 6, 7 of Article 226 of the Tax Code of the Russian Federation).

Important: remember that there are specific deadlines regulating the mandatory payment of tax from an employee. This must be done no later than the day following the day of payment of wages.

Insurance premiums for employees

These payments are paid by the entrepreneur at his own expense; it is prohibited to deduct them from the employee’s salary.

In 2021, individual entrepreneurs and companies had to transfer to the Federal Tax Service for an employee:

- for pension insurance - the rate is 22%;

- for health insurance - the rate is 5.1%;

- for social insurance - the rate is 2.9%.

Payment for accident insurance must be transferred to the Social Insurance Fund - a rate of 0.2-8.5%. The size depends on the labor hazard class and is determined by the main OKVED code of the entrepreneur. The deadline for sending insurance premiums is until the 15th day of each month following the month of accrual.

In total, the minimum amount of all insurance contributions was 30.2% of the employee’s salary.

According to Article 6 of Federal Law No. 102-FZ dated April 1, 2020, representatives of small and medium-sized businesses transfer contributions to employees whose wages are above the minimum wage (for 2022, 12,792 rubles), at the following rates:

- for pension insurance - the rate is 10%;

- for health insurance - the rate is 5%;

- for social insurance – the rate is 0%.

In 2022, small businesses will have to monthly divide employee salaries into two parts - the minimum wage and the amount in excess of it. After that, apply a different tariff calculation to each amount: the first - general, and the second - reduced.

KBK for payment of contributions

| Insurance contributions for pension insurance to the Federal Tax Service for employees in 2019-2020 | 182 1 0210 160 |

| Insurance contributions to the Federal Tax Service for health insurance for employees | 182 1 0213 160 |

| Insurance contributions to the Federal Tax Service for compulsory social insurance in case of temporary disability and in connection with maternity for employees | 182 1 0210 160 |

| Insurance contributions to the Social Insurance Fund against industrial accidents and occupational diseases for employees | 393 1 0200 160 |

Benefits for individual entrepreneurs in the IT field

Entrepreneurs who operate in the modern technology industry have received reduced tariff rates since 2022 (Law No. 265-FZ):

- pension insurance – 6%;

- health insurance – 0.1%;

- social insurance – 1.5%;

In order to obtain the right to apply preferential rates, the employer must:

- conduct primary activities in the information technology industry - develop and maintain your own computer products;

- manufacture electronics and the components needed for them.

We described detailed conditions for applying reduced tariffs in the article.

Attention! In order to take advantage of the reduced rate, you must meet the criteria of a small and medium-sized enterprise

Amelina Tatyana Vladimirovna, general director of the company

SME criteria

Limit value of the average number of employees for the previous calendar year (clause 2, part 1.1, article 4 of Law No. 209-FZ of July 24, 2007)

- 15 people – for micro-enterprises;

- 16–100 people – for small enterprises;

- 101–250 people – for medium-sized enterprises

Income for the year, according to tax accounting rules, should not exceed (Clause 3, Part 1.1, Article 4 of Law No. 209-FZ dated July 24, 2007, Government Resolution No. 265 dated April 4, 2016):

- 120 million rub. – for micro-enterprises;

- 800 million rub. – for small businesses;

- 2 billion rubles. – for medium-sized enterprises

An example of calculating insurance premiums at a reduced rate

If we take all the data from the previous example (salary + employee bonus = 36,000 rubles) and take into account that, according to OKVED, the professional risk class of a manager corresponds to the tariff value of 0.2%, then:

- pension insurance = 36,000 × 10% = 3,600 rubles.

- medical insurance = 36000 × 5% = 1800 rubles

- social insurance = 0 rubles.

- accident insurance = 36,000 × 0.2% = 72 rubles.

In total, an individual entrepreneur will have to pay 5,400 rubles to the Federal Tax Service, and 72 rubles to the Social Insurance Fund.

How much taxes does an employer pay for an employee in 2022?

Any organization or entrepreneur is required to pay taxes not only for themselves, but also for their employees. At the same time, the legislation establishes a payment procedure that cannot be violated.

For each employee, the company pays two types of taxes: personal income tax and insurance premiums.

Personal income tax

Despite the fact that personal income tax is an employee’s personal tax, the obligation to withhold tax on the income of an individual lies with the employer. Since the employer is considered a tax agent, and therefore an intermediary who calculates, withholds and transfers tax on the income of its employees to the state budget.

Personal income tax is deducted from employee remuneration, but does not increase the tax burden on the employer.

For residents of the Russian Federation, the tax rate is 13%. From January 1, 2021, the personal income tax rate has become progressive, and the amount of payment now depends on the employee’s income. If the salary for the year exceeds 5 million rubles, then it is subject to personal income tax of 15%. At the same time, the increased rate does not apply to all income, but only to that part that goes beyond 5 million rubles.

For non-residents of the Russian Federation, personal income tax remains at 30%.

For example, the salary under the employment contract of employee Ivan from company A is 30,000 rubles per month, for the year the employee’s income will be 360,000 rubles.

We calculate personal income tax: 30,000 x 13% = 3,900 rubles

Employee Ivan receives 26,100 rubles “in hand.” (30,000 – 3,900).

Insurance premiums

Employers make monthly contributions to extra-budgetary funds for their employees. These payments entitle the insured person (i.e., the employee) to receive pensions, free medical care, temporary disability benefits, benefits in connection with an occupational disease or injury, as well as maternity benefits.

Employers pay contributions from their own funds, but not from employees’ funds, as is the case with personal income tax.

Insurance premiums are calculated and transferred according to the tariffs set forth in Art. 425 Tax Code of the Russian Federation:

— pension insurance in the Pension Fund of Russia (PFR) — 22%. This tariff is used if the cumulative total of payments for each employee from the beginning of the year does not exceed 1,465,000 rubles. If the amount of insurance contributions for pension insurance is above the established limit, then the rate is 10%.

- social insurance in case of temporary disability and in connection with maternity in the Social Insurance Fund (SIF) - 2.9%. The limit for calculating social contributions is 966,000 rubles. Payments over the established limit are taxed at a 0% rate.

— medical insurance in the Federal Compulsory Medical Insurance Fund (FFOMS) — 5.1%

— insurance premiums for insurance against accidents and occupational diseases in the Social Insurance Fund — from 0.2 to 8.5%. The rate depends on the class of professional risk and is determined according to OKVED codes for the main type of activity in which the employer is engaged. FSS divisions annually set the amount of contributions for each policyholder.

Thus, returning to our example with employee Ivan, company A. will pay the following insurance premiums every month under unchanged conditions:

— on OPS: 30,000 x 22% = 6,600 rubles

- but OSS: 30,000 x 2.9% = 870 rubles

— for compulsory medical insurance: 30,000 x 5.1% = 1,530 rubles

— for “injuries”: 30,000 x 0.2% = 60 rubles

It turns out that company A. pays insurance premiums for employee Ivan in the amount of 9,060 rubles per month and 108,720 rubles per year.

Total: tax expenses per employee will be 3,900 + 9,060 = 12,960 rubles per month (personal income tax + insurance contributions) or 155,520 rubles per year.

Every employer must comply with this payment procedure in relation to its employees if an employment contract has been concluded with them.

If an employer has entered into a civil law agreement (CLA) with an individual for the performance of work or provision of services, the procedure for tax payments changes.

The employer is obliged to withhold personal income tax in the general manner, since it also acts as a tax agent. The legislation exempts the employer from calculating and paying tax only in cases where the agreement is concluded with an individual entrepreneur, self-employed person, notary or lawyer. Such performers pay personal income tax on their own.

For insurance premiums, the employer is not required to pay contributions for social insurance and insurance against accidents and occupational diseases. But it is obliged to pay contributions for compulsory pension and health insurance.

When paying taxes and insurance contributions from payments to employees, it is important to remember that the employer is also obliged to comply with the payment deadlines established by law and prescribed in the Tax Code of the Russian Federation.

If the payment procedure and deadline are violated, the employer is subject to fines and sanctions. Request a call back

Reports for your employees

In addition to timely payment of all contributions, the entrepreneur is obliged to submit reports on this:

| Report | Due dates |

| 6-NDFL to the Federal Tax Service | quarterly until April 30, August 2, November 1 and general annual report until March 1 |

| 2-NDFL to the Federal Tax Service (as an annex to 6-NDFL) | annually until March 2 |

| 4-FSS in FSS in paper form | until the 20th of April, July, October and January |

| 4-FSS in FSS in electronic version | until the 25th of April, July, October and January |

| on insurance premiums and the average number of employees in the Federal Tax Service | until the 30th in April, July, October and January |

| data on the average number of employees (as part of the calculation of insurance premiums) | annually until January 20 |

An entrepreneur is required to submit all of the listed reports, even if he has 1 employee.

Employees on other terms

In some cases, it is more convenient and cheaper for individual entrepreneurs to use the work of specialists without hiring staff. More information about such situations:

An individual under a civil contract. The employer will have to calculate and pay almost the same amount to the budget as for a regular employee. It is necessary to list personal income tax, medical and pension insurance.

Individual entrepreneur or self-employed. This specialist is obliged to pay taxes for himself; he will only need to pay remuneration for the work according to the contract.

The second option is clearly more profitable for the individual entrepreneur. But he threatens with large fines and additional assessments of unpaid taxes from regulatory authorities.

Maximum amounts of accruals for individual entrepreneurs

Rates for social and pension contributions may change for employers who pay their subordinates well. There are maximum amounts of employee income at which tariffs change:

- pension contributions until the end of the year will be only 10% if the employee receives from 1,465,000 rubles per year;

- Social insurance contributions are not charged if the employee’s annual income is more than 966,000 rubles.

These rates are revised every year.

How can an individual entrepreneur save on fees?

Due to the amount of insurance premiums, reduce taxes under certain taxation systems:

- The general taxation system or “simplified” income minus expenses. Here, all expenses for insurance premiums are considered as expenses. Therefore, the amount of income tax is reduced.

- Single tax on imputed income or “simplified” income. The amount of contributions is subtracted from the amount of taxes, but there is a limit on the amount of reduction - up to 50% of the tax.

An alternative is to outsource some of the company's tasks.

Outsourcing of accounting is a colossal saving on the staff of accountants. If you want to optimize your expenses, our company will take care of all your accounting and reporting to the Federal Tax Service. Read more about our services by following the link