The presence of a vehicle (VV) significantly increases the owner’s potential: in speed and range of movement, in a variety of recreational places, in increasing business profitability. But in addition to additional opportunities, such property also imposes obligations, in particular, to pay the annual transport tax.

Let us remind you that when calculating the tax, the category of transport, its capacity and the regional tax rate are taken into account. Even for vehicles of one purpose, for example, for passenger cars, the owners of which are a fairly large percentage of our fellow citizens, the spread in tax amounts is quite large. The more expensive and more powerful the car, the greater the amount of tax that must be paid to its owner. At the same time, benefits are provided for socially important transport, as well as for car owners from the least protected segments of the population.

The presented material will be useful primarily to individuals. Of course, organizations also pay transport tax, but a legal entity, even if there is a benefit, is required to annually file a declaration indicating the reasons why payments have not been made. And for private owners, it is enough to enter the data once into the sample application for a tax benefit if they have rights to the privilege.

Preferential categories

The legislation allows for a number of grounds for obtaining tax breaks. Thus, some vehicles are not considered at all as an object of taxation according to federal regulations. This includes rowing boats, passenger cars equipped for use by disabled people, fishing vessels, agricultural transport, medical aviation, etc. The full list is given in paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

In turn, preferences for privileged categories of citizens are established at the regional level, since transport tax collections replenish the regional budget. Most regions provide benefits:

- For pensioners.

- Heroes of the USSR and the Russian Federation.

- Disabled people of groups I and II.

- Large families.

- Veterans (disabled) of combat operations.

- Labor veterans.

- Representatives of a disabled child.

- Chernobyl victims and other persons who suffered radiation sickness due to working with nuclear installations.

Of course, not all subjects of the Russian Federation have introduced such benefits, and in some, if they have been introduced, they are differentiated depending on certain factors. For example, it is useless to write an application for tax benefits for pensioners in Moscow - the capital does not provide tax privileges for personal transport of this category of the population. And in St. Petersburg, the benefit will only apply to pensioners who own a domestic car with a capacity of up to 150 hp. With.

You can find out more about the availability of transport tax benefits in your region in this article.

What documents will you need to provide?

To receive transport tax benefits, applicants must provide the following general list of documents:

- application in the officially established form;

- ID card (passport of a citizen of the Russian Federation);

- power of attorney from the taxpayer’s representative (provided if the applicant cannot independently submit documents to receive transport tax benefits);

- technical passport of the vehicle (PTS).

Depending on the basis for receiving the benefit, you will need to attach other documents.

Additional documents

In paragraph 3 of Art. 361.1 of the Tax Code of the Russian Federation states that persons who have the right to apply for tax breaks, together with the application, can provide documents confirming this right. However, these papers will differ depending on the category of beneficiaries to which a particular taxpayer belongs.

The following may be added to the main list of papers::

- Certificate from the Pension Fund about the amount of pension (for retired persons). Information on transport tax benefits for pensioners is given in this material.

- Certificate proving the presence of disability (provided by disabled categories of taxpayers). Features of collecting transport tax from disabled people and information on obtaining benefits can be found here.

- A certificate confirming the status of a large family (provided by one of the parents with many children). Read about whether there are transport tax benefits for families with many children and how to get them here.

- A document confirming the status of a war veteran (required from persons who in the past participated in the Second World War, in hostilities on the territory of the USSR, the Russian Federation, etc.);

- Certificate of a veteran of labor (for categories of taxpayers who are entitled to transport tax benefits, such as Heroes of Socialist Labor, holders of the Order of Labor Glory, etc.). The rules for applying for benefits and paying transport tax for labor and combat veterans are given here.

- Certificate of participation in the operation to eliminate the consequences of radiation (required to be provided by citizens who were exposed to radiation due to the disaster at the Chernobyl nuclear power plant, who participated in nuclear weapons testing, etc.).

- Other documents.

When contacting the tax authority, one very important point should be taken into account. Benefits valid in one region of the Russian Federation may not apply in another. For example, in St. Petersburg, pensioners are exempt from paying transport tax (if the car is domestically produced with a power of up to 150 hp), but for Moscow such an exemption is not provided.

Tax deduction according to the Platon system

A special place among the beneficiaries is occupied by owners of heavy vehicles with a maximum weight of more than 12 tons, registered in the register of vehicles of the toll collection system (the so-called “Plato”).

Let us recall that one of the main goals of the transport tax is to replenish the budget in order to restore roads. The Platon system does the same thing: it collects funds for the damage that heavy trucks inevitably cause to highways. To avoid the situation of double payments, it was allowed to deduct payments for “Plato” from the amount of transport tax (Federal Law No. 249-FZ of 07/03/2016). As a result:

- The tax is not transferred at all if payments to compensate for damage to roads exceeded (or were equal to) the amount of tax for the same period;

- The tax is reduced by the amount of the payment if the latter was less than the amount of the calculated transport tax.

The deduction is valid for both individuals and companies.

New rules in the Tax Code of the Russian Federation

The procedure for calculating the amount of transport tax and advance payments for it is regulated by Art. 362 of the Tax Code of the Russian Federation. From January 1, 2022, Federal Law No. 305-FZ dated July 2, 2021 supplemented it with new paragraphs 3.2 – 3.4.

When will taxes stop being charged?

According to clause 3.4, in relation to a vehicle, the ownership of which has been terminated due to its forced seizure on the grounds provided for by federal law, the calculation of tax stops from the 1st day of the month in which it was seized from the owner.

Where to apply

The basis is statements by the taxpayer. Moreover, it can be submitted to any tax authority of your choice.

Documents for the application

Documents confirming the forced seizure of the vehicle can be attached to the application. Individuals can submit all this through the MFC (“My Documents”).

The tax office itself will request such documents through its own channels if:

- The Federal Tax Service does not have them;

- the payer did not submit them himself.

The deadline for execution of such a request is 7 days from the date of receipt.

The tax office must inform the taxpayer of non-receipt of information upon request within 3 days. Then he must submit supporting documents to the tax authority himself.

Application consideration period

The tax office considers an application to terminate the calculation of tax due to the forced seizure of a vehicle within 30 days from the date of its receipt.

If a request has been made, the head (his deputy) of the tax authority has the right to extend the period by no more than 30 days, notifying the taxpayer.

Result of consideration

In the manner specified in the application, one of two documents will be received from the tax office:

- notice of termination of tax calculation in connection with the forced seizure of a vehicle (among other things, the period from which tax calculation ceases must be indicated);

- message about the absence of grounds for this (with grounds for refusal).

How to apply for a transport tax benefit

By default, notices sent by the IRS do not take into account your individual exemptions. They must be activated independently by contacting the tax office at the place of registration. To complete a package of documents, which includes:

- Personal Statement;

- Identification;

- TIN;

- Documents for the vehicle (registration certificate, certificate of registration of ownership);

- Documents confirming the right to the benefit (pension certificate, certificate of disability, certificate of a large family, etc.).

From January 1, 2022, the free form was replaced by an official application for tax benefits (order dated November 14, 2022 No. ММВ-7-21 / [email protected] ).

Sample application for transport tax benefit

If the benefit applies to a participant in the Platon system, the application shall indicate:

in line 4.5.1 – “entry in the Toll Register”;

in line 4.5.2 – “toll collection system operator”;

in line 4.5.3 – the date of payment to the operator according to the Register data (the latest in time for the tax period for which the tax benefit was claimed);

in line 4.5.4 - the period for which the payment was made in relation to the vehicle (according to the Register);

in line 4.5.5 – we do not indicate anything (dash).

To submit an application, you can choose the most convenient way:

- Through the taxpayer’s personal account on the Federal Tax Service website;

- By mail to the territorial office of the tax department;

- Through an authorized MFC;

- Personally.

Electronic form

In abc. 5 paragraph 3 art. 361.1 of the Tax Code of the Russian Federation states that, if desired, a taxpayer can submit an application for a relief on transport tax in electronic form . At the same time, the format for transmitting information in this way is prescribed in Appendix No. 3 to the Order of the Federal Tax Service of the Russian Federation.

Submission conditions

Submission of an application electronically is carried out through the taxpayer’s personal account (LKN) on the Federal Tax Service website. Moreover, if a citizen has not previously used this method, he will have to first appear at the tax authority and gain access to his account.

You can also enter the LKN through the State Services website or using an electronic signature.

In addition, the generated electronic application for benefits will need to be signed with an enhanced electronic signature.

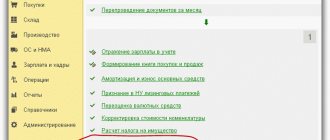

Step-by-step instruction

Submitting an electronic application to receive a transport tax benefit is carried out in the following order::

- First of all, you need to go to the official website of the Federal Tax Service of the Russian Federation and log into your LKN, entering your login (or TIN) and password in a special window.

- After successful login, you should select the “Application for property tax benefits” section.

- A new page will be displayed on which you will need to go through 3 stages in sequence: editing, sending and results.

- In the “Editing” tab, some of the information will already be filled in (full name of the taxpayer, data from the tax office where the request will be sent, etc.). You just need to select:

- type of fee (in this case it is transport tax);

- indicate the details of the documents confirming the right to the benefit, and also attach a scanned version of them.

- Next, you should go to the “Sending” section, sign the document with an enhanced non-qualified (qualified) electronic signature and send it to the tax authority by clicking on the “Submit” button.

- After successful submission, the “Results” tab will open, which will display the date the application was sent.

Registration of benefits for land and property

An application for a land tax benefit and an application for a property tax benefit are completed in the same way.

The title page for these applications is identical, as are the fields for indicating the document giving the right to tax preferences. The only difference is in the designation of taxable property in respect of which the benefit will be applied.

Thus, an application for a pensioner’s land tax benefit will contain the cadastral number of the land plot and be confirmed by the number of the taxpayer’s pension certificate.

An application for a property tax benefit will differ only in specifying the type of real estate and its inventory, conditional or cadastral number.

Fill out the application

General information:

- The form of the document was approved by Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ [email protected]

- You must fill out the form carefully, entering each letter or number in a separate cell.

- You can enter information by hand or on a computer. With the second option, it is important to remember that the taxpayer’s signature must be “living”.

- The form contains 4 sheets, but to receive the benefit for the tax we need, only the title page and the page on which the specified benefit is declared are filled out. Blank sheets do not need to be attached to the document.

Sheet 1 (title)

This part of the document should contain the following information:

- TIN. If an individual does not know his number, he can use the service on the tax website at the link: https://service.nalog.ru/inn.do (see our instructions on how to find out the TIN through the Federal Tax Service website). If it is not possible to find out the TIN, you can leave the line blank, but you will have to fill out additional lines in the application (we will discuss them later).

- Federal Tax Service code at the location of the property for which the benefit is being requested. You can find it here: https://service.nalog.ru/addrno.do.

- FULL NAME. Each word must be written on a separate line: 2.1 - last name, 2.2 - first name, 2.3 - patronymic.

- Date and place of birth data (lines 2.5 and 2.5). To be filled in if the TIN line has not been filled in.

- Information about the identity document (section 2.6). Also filled out if the TIN has not been entered. When filling out field 2.6.1 (document type code), you need to select the code of your document. For a passport of a citizen of the Russian Federation it is “21”, a passport of the USSR is “01”, a birth certificate is “02”.

- Phone number. It must be entered in the format 8(900)0000000, without spaces or dashes.

- The method of receiving a response with the result of consideration of the application. “1” - at the tax authority, “2” - by mail.

- Number of document sheets. There must be at least 2 of them - “002”.

- Number of attachment sheets to the document. The format is similar to the point above.

- Confirmation of the accuracy of the information entered. Here we put “1” if an individual submits documents in person; in this case, the remaining data, except for the signature and date, does not need to be filled out. You must enter the number “2” if the documents are handed over by an authorized person. In this case, write his full name and details of the power of attorney, date. And the authorized person must sign.

At this point we have finished filling out the first sheet.

Sheet 2

This is the fourth sheet on the form. If a pensioner requests a benefit only for property tax, then you only need to fill out this sheet, skip the second and third. If you need to apply for benefits for other taxes (transport, land), then enter the data into the appropriate sheets.

So, for a property tax benefit, fill out the sheet by entering the following information:

- TIN again.

- Page number. If this is the second sheet of the application, then put “002”.

- Last name and initials of the pensioner.

- Data about the property. Here indicate the codes of the type of property, its number (cadastral, conditional or inventory).

- Information about the benefit. The period of provision, the beginning of the validity period of the benefit, the name of the document on the basis of which the benefit came (pension certificate or other document - they are listed in the form). Next, enter the name of the authority that issued the document, the date of issue and its validity period.

- Signature of the pensioner, date of filling out the document.

Attention! You can also list multiple real estate properties. The form has sections for two objects. If there are more of them, then you can simply take an additional sheet, indicating its number.

When to apply for tax relief

We recommend that you claim your rights to reduce tax fees before April-May. That is, before the start of the formation and mass distribution of notifications about the amount of transport tax for the previous period. In this case, the application will be taken into account when drawing up the notification, which will save you from the need for recalculation.

You do not need to renew your benefit application annually. If you have already claimed your rights to the benefit and did not indicate time restrictions, it will be automatically extended.

If an application for a benefit was submitted after the fact, the Tax Code allows for recalculation. But only for the last three years (clause 3 of Article 363 of the Tax Code of the Russian Federation).

Cancellation of transport tax

Much was written about the imminent abolition of this type of tax at the beginning of 2018; moreover, the Ministry of Transport and the President of the Russian Federation have repeatedly spoken out in support of its elimination. But so far things have not gone beyond intentions.

At the initiative of a number of deputies, on June 5, 2022, bill No. 480908-7 “On amendments to the Tax Code of the Russian Federation regarding the abolition of transport tax” was submitted. To compensate for the shortfall in revenue, the document proposes an increase in fuel excise taxes. Hypothetically, this would solve at least two problems:

- reducing the tax burden for those who rarely use their vehicle;

- eliminating the problem of non-payment (the collection rate of this tax in the constituent entities of the Russian Federation does not exceed 50%).

However, the bill did not pass beyond preliminary consideration by the State Duma.

On July 2, 2022, the relevant committee returned the project for revision. Thus, it is premature to talk about abolishing the tax. Read more about this in our article. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.