What kind of certificate is this anyway?

Certificate 2-NDFL is confirmation of official income and withheld tax. The employer sends such a certificate to the tax office for each employee. The tax office sees where a particular person works, what his salary is for the year and by month, and how much personal income tax he paid.

Certificate 2-NDFL is needed for various purposes. For example, to apply for a deduction when buying an apartment or paying for treatment. This certificate also confirms official income for the bank to take out or refinance a loan.

Usually a 2-NDFL certificate is ordered at work. The accounting department will issue it at any time and for any period of work.

What is a 2-NDFL certificate?

The abbreviation NDFL stands for personal income tax. This includes any income and profit, regardless of the source of their receipt - work in a budgetary organization, with an individual entrepreneur, etc.

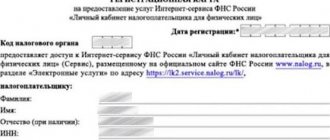

Certificate 2-NDFL was developed in a special way to indicate all relevant information about the taxpayer. Visually, the document includes the following blocks of information:

- “header” - indicates the code of the territorial tax authority;

- information block is the taxpayer’s financial data for a specific time interval (profit received, tax paid, deductions);

- details of the responsible person - signature of the accountant/manager and stamp of the organization (optional).

The document in question is issued by a tax agent, represented by the employer. Such a certificate is usually necessary for obtaining a loan, submitting information to judicial authorities, when applying for a visa and many other situations.

Also see “Who has the right to sign for 2-NDFL”.

Help on form 2-NDFL in 2020

/ Download (valid until the end of 2022) View information Below is detailed information on how to fill out The following situations are considered: 1.

2. ATTENTION! From January 1, 2022, Form 2-NDFL will be updated again. What has changed + new forms can be viewed in. 2-NDFL is an official document about the income of an individual received from a specific source (usually an organization or individual entrepreneur) and the personal income tax withheld from this income. Organizations and individual entrepreneurs submit certificates only in case of payment of income to employees and other individuals.

But individual entrepreneurs do not draw up form 2-NDFL for themselves. You are required to submit certificates both to the tax office and to your employees. 2-NDFL employees are issued within three working days from submitting an application for a certificate.

- On the government services portal you can obtain a 2-NDFL income certificate in electronic form

A certificate may be needed when leaving a job and moving to another job, filing tax deductions, applying to a bank for a loan, applying for a visa to a significant number of countries, applying for a pension, adopting a child, submitting documents for various benefits, etc. .

When is it necessary to issue a 2-NDFL certificate to an employee?

Often banks and other organizations use the 2-NDFL certificate to find out about a person’s income and solvency. It may be needed, for example:

- upon dismissal, to convey to the next employer information about the standard deductions provided;

- to receive a standard, property or social deduction from the Federal Tax Service at the end of the year;

- to confirm income from the bank when receiving a loan;

- when contacting embassies to obtain a visa;

- in other cases: to calculate a pension, when adopting a child or participating in various legal proceedings (especially regarding the resolution of labor disputes), when calculating the amount of alimony payments and other payments.

The tax agent is obliged to issue a certificate if an individual has submitted a corresponding application. Not only employed employees, but also former employees and other individuals who received payments from a tax agent can request a certificate. The form of such a certificate of income for 2022 is approved by Appendix No. 4 to Order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11 / [email protected] But if an employee requests information for 2022 and earlier periods, the certificate must be issued according to that form that was in effect at that time. For 2022 and 2022, it was approved by Appendix No. 5 to the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

Compared to the form that is submitted to the tax office and was previously issued to employees, the income certificate for employees for 2021 is slightly simplified. Information about the number, attribute of the certificate, and notifications for deductions is excluded from it. However, a section with information about the tax agent has been added.

If an employee, including a former employee, has applied for a certificate of income, it must be issued within 3 working days, in accordance with Article 62 of the Labor Code of the Russian Federation. The certificate must be signed by the manager. If an employee resigns, then the certificate must be issued on the last day of his work. For other income recipients, the period for issuing a certificate upon application is up to 30 working days.

How can you use a document electronically?

The electronic format of KND 1151078 expands the possibilities of using the form: the certificate can be sent by Russian post, having previously printed the document, or it can be sent by e-mail. In .xml format, the form can be attached to a set of papers to submit a 3-NDFL declaration through the taxpayer’s personal account or other similar procedures. An individual also has the right to print an electronic certificate downloaded in .pdf format in order to sign and take it to the authority that requested the document.

Situations in which 2-NDFL may be useful;

- execution of loan agreements;

- collection of papers for the formation and sending of 3-NDFL in the personal account of the fee payer;

- when preparing documentation for a trip to another country: to confirm income;

- registration of pensions and benefits;

- for the court in various legal proceedings, for example, registration of alimony, etc.

KND 1151078 can be obtained immediately on the tax service website: there is no need to wait for registration, since the document has already been generated.

Services for filling out 2-NDFL for employees

There are quite a few free online platforms for filling out the 2-NDFL certificate on the Internet. For example, by clicking on this link, you will be taken to a website where you can fill out 2-NDFL online for free.

Here you need to enter information about:

- the tax agent is the employer;

- taxpayer is an individual in respect of whom the certificate is being filled out;

- income by income codes by month;

- deductions;

- signatories

The certificate can be printed, and if you register, you can save it.

Employees can independently print out 2-NDFL in their personal taxpayer account. The certificate is issued for the previous year. 2-NDFL will be signed with an enhanced electronic tax signature. Such a certificate can be provided to the bank when applying for a loan. See details here.

How to obtain a 2-NDFL certificate through the taxpayer’s personal account

In a personal account, an individual can view the documentation, also in .pdf format. KND 1151078 is located in the History of Income Forms tab, which reflects materials on profits for recent years when the person studied, worked or was registered with the Employment Center.

To use the form in electronic form, the service administration offers to download online forms with digital signature, and if the form needs to be printed, then it is allowed to use KND 1151078 without a signature. After downloading the documentation to a personal computer, the certificate is printed and signed by hand.

Before receiving a 2-NDFL certificate through the taxpayer’s personal account, you need to log in to your personal account as a fee payer. Instructions for receiving 2-NDFL on the personal page of the fee payer:

- Open the main login page and log in using one of the following methods:

- using the login-password scheme;

- using an electronic key;

- using your login details to the State Services server.

- Enter the My Taxes tab, where the fees that an individual pays will be displayed. Below are insurance deductions and a button labeled Income Information that you need to click on.

- It is now possible to see documentation of profits for all years. When 2-NDFL for 2018 is displayed in the taxpayer’s personal account, an entry about this will appear in the current section. Typically, the Federal Tax Service uploads forms for the previous year in June of the period following the previous one. That is, for 2022, the form will appear in the section during June 2022.

- If KND 1151078 has not yet been uploaded to the server, then when you click on the profit information button, a window will appear without the required form.

- In this situation, you will have to contact the accounting department of the company where the citizen works. Or to the employer, if the company is small and does not have an accountant on staff.

- After this procedure, in the window that appears, you can save the document on your PC. To do this, you need to click on the link of the form Certificate 2-NDFL or Certificate 2-NDFL with signature.

- The certificate must be saved in a convenient place on your personal computer.

Further, the citizen has the right to use it for its intended purpose.

Step-by-step instructions for obtaining 2-NDFL

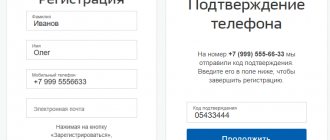

To access the information contained on the State Services, as well as the Federal Tax Service website, you must register by providing information about yourself. Information about the user is needed to identify him and gain access to all services of the Russian government.

Registering an account on the State Services portal

When the user lands on the site, fields appear to be filled out. They include:

- Full Name;

- email (needed to send messages);

- cell phone number, you will immediately receive a message with a confirmation code. A place to enter a numeric value will appear in the center of the monitor.

- TIN (Taxpayer Identification Number).

- SNILS number;

The portal will then ask for a password. Each user comes up with it independently. It may contain:

- numbers;

- punctuation marks;

- uppercase and uppercase letters.

The password must be written down or remembered; it will have to be entered in the future. This is the user’s personal access key to the State Services resource. It is needed not only to obtain 2-personal income tax; the portal’s capabilities are extensive.

The account must be confirmed. The following methods are available:

- at any accounting center, the full list is presented on the page esia.gosuslugi.ru/public/ra/;

- at the post office;

- in bank offices.

The confirmation procedure is required to maintain the confidentiality of information to which the user of the State Services portal will have access. This also applies to the 2-NDFL certificate, since only after assigning the status of a confirmed account can it be ordered through the Nalog.ru website.

Login to your personal account of the Tax Service through State Services

To make a 2-NDFL certificate through the State Services portal, the user needs to log into the website of the Federal Tax Service. After this, go to the taxpayer’s personal account at https://lkfl2.nalog.ru/lkfl/

On the authorization page, you should click “log in through State Services” and enter the login and password of the State Services portal. Now you will be taken to the tax website, where your personal data is stored, including the 2-NDFL certificate. Here you need to select the “my taxes” section

Order a certificate to confirm your income online

Next, you need to find a sign that says “Income Information.” This tab contains the history of 2-NDFL certificates for all past periods, this is convenient, because according to the law, a tax deduction can be obtained within three years. There will not be any particular difficulties in finding this information.

To obtain the form, you must click on the link “certificate 2-NDFL with signature.” Along with the downloaded file, the user automatically receives an electronic signature - it is similar to the seal that is placed on copies of documents.

In electronic form, it has similar legal force, along with the paper version. You will have a PDF file on your computer that you can:

- print;

- transfer to another electronic medium;

- send via the Internet to any department upon request.

Using your login and password of the State Services portal, you have access to documents from any computer, and completely free of charge.

Features of obtaining a document for military personnel

You can order a 2-NDFL certificate for a military personnel via the Internet; the procedure here is standard.

- Log in to the serviceman's personal account after completing the registration procedure.

- Information about income, deductions and other settlements with a person serving under a contract will be indicated here.

- Fill out an application to the military district to which you are assigned.

- The paper will be ready within 3 working days in accordance with the letter of the Ministry of Finance of the Russian Federation dated June 21, 2016 No. 03-04-05/36096.

- It will be sent by mail or delivered in person, depending on the method chosen.

Thus, the issuance process for military personnel is somewhat different, and the production time will be longer, since the Russian Federation is the employer.

For whom is it important to obtain a certificate online: costs

Considering the fact that the Russian Tax Service website provides the 2-NDFL certificate in electronic form, its scope of use is extremely limited. There is no doubt that this document is a full-fledged analogue of the paper version and has legal force. However, not all taxpayers are comfortable using this format. This can be explained by the inability to independently convert the electronic form into paper form, namely, print it as an equivalent document.

Example No. 1

When applying for a loan, the bank requires a certain package of documents: a passport, a copy of the work book, a 2-NDFL certificate, etc. It is usually impossible to provide the bank with some of the documentation in electronic form and some in paper form. In this case, you must scan all documents or provide paper originals, including 2-NDFL.

Here is another example confirming the irrelevance of an income certificate even in electronic form.

Example No. 2

You can download the 2-NDFL certificate through the taxpayer’s personal account, but the information will only be for the past year. This is explained by the fact that tax agents (employers) provide data on the income of their employees for the reporting period, namely for the past year. Certificates are sometimes needed for the last 3, 6 or 12 months of the current year. But such data cannot be on the Federal Tax Service website, since the employer has not yet sent such annual reports. As a result, you can get a 2-NDFL certificate online, but its relevance for many structures that require it will be zero.

A fair question is why this service is needed if it does not make life easier for taxpayers. For a bank, court or when applying for a visa, you will most likely still have to obtain a paper version of the certificate from your employer.

Also see “Certificate 2-NDFL in the tax office online: how to get it.”

How long is a 2-NDFL certificate valid?

The validity period of a document issued online is standard, like that of a paper counterpart. The period after receipt during which it can be sent to a third party depends on the category of institution:

- banks – up to 30 days;

- when applying for a mortgage – from 10 to 30 days;

- when submitting a declaration – within 1-2 months;

- when contacting government agencies - usually up to 10-14 days.

Is it possible to request a 2-NDFL certificate online again if the previous document is outdated? Of course, this can be done in a few clicks an unlimited number of times.

What does a 2-NDFL certificate look like?

The 2-NDFL certificate has a machine-oriented form and is intended for employers who report on paper. The new form should speed up the data processing process, as it will automate the scanning, recognition and digitization of received certificates.

A certificate of income and tax amounts for an individual in 2022 consists of two parts:

- “Certificate of income and tax amounts of an individual” includes information about the tax agent and four sections:

- Section 1. “Data about the individual who is the recipient of the income.” Fill in your full name, tax identification number, taxpayer status, country code, passport details.

- Section 2. “Total amounts of income and tax based on the results of the tax period.” Enter the tax rate, the total amount of taxable income, highlight the tax base, indicate the calculated and withheld tax amount.

- Section 3. “Standard, social and property tax deductions.” Indicate the deduction code and amount, and additionally enter information about the notification.

- Section 4. “The amount of income from which tax has not been withheld by the tax agent, and the amount of tax not withheld.” Indicate the amount of income from which tax was not withheld and the amount that was not withheld.

2. Appendix to the certificate “Information on income and corresponding deductions by month of the tax period.” Indicate the certificate number, reporting year 2022, tax rate and fill in the data by month. Take income codes from Appendix 1 to the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/387, deduction codes from Appendix 2 to the same Federal Tax Service order. Please note that standard, social and property deductions are not included in the application, as they are shown in section 3 of the help.

If a company employee has income that is taxed at rates other than 13%, they are displayed in separate sections. The amount of tax on this income is also indicated separately.

Tax ru: login to your personal account of the Federal Tax Service

People go to the tax website not only to find their answers to questions about taxation of citizens, but also to check payments for their taxable items in their personal account of the Federal Tax Service. Previously, you had to wait for the postman to come and throw the receipt in the mailbox, then go to the nearest bank and stand in a kilometer-long line at the cashier’s window with a payment order. As a result, it took almost the whole day to pay several receipts.

Now you can pay all possible taxes and duties yourself by going to the official tax website at https://www.nalog.ru/ , selecting the type of account (individual, individual entrepreneur or legal entity) and entering your login (your TIN) and password and then the “Login” button.

If you do not have information to log into your personal account, then register on the website of the federal tax service.

New functionality of the personal account of an individual taxpayer

According to the official website of the Tax Service www.nalog.ru, now form 2-NDFL is available not only for simply viewing information about the taxpayer, but also for downloading it to your computer. The process of obtaining a 2-NDFL certificate in your personal account is quite simple:

1. You must log in to the official website of the Federal Tax Service of Russia.

2. Go to the “Income Tax and Insurance Contributions” tab.

3. Click with the mouse cursor on the “Upload with electronic signature” tab.

4. Specify the folder on your computer or laptop to download the file.

As a result, the user receives an archived folder with xml, p7s and pdf files.

The personal account provides the income certificate itself in 2 types:

1. PDF with built-in digital signature.

2. XML (in this case, the digital signature comes separately as a p7s file).

If necessary, electronic signatures can be easily verified. So:

- the certificate in XML format is analyzed on the government services website;

- The PDF document requires the installation of additional software on your computer to verify the authenticity of the digital signature.

The option of obtaining a 2-NDFL certificate through a personal account on the website of the Russian Tax Service via the interface has practically not changed since the last time, when the Federal Tax Service only offered information about one’s income. The only difference is that now the document can actually be downloaded to your computer.

Attention!

Formally, it is logical to use the downloaded 2-NDFL certificate only in electronic form. It is not entirely intended to be printed on paper, since it will be almost impossible to verify the authenticity in this form.

The procedure for obtaining a tax deduction

To receive a tax deduction at the end of the year, you must perform a number of actions:

- Fill out a tax return in form 3-NDFL

- We receive a certificate from the accounting department from work about the amount of taxes paid in form 2-NDFL

- We prepare documents confirming the right of ownership of new housing: this can be a certificate of registration of the right to a residential building, an agreement and purchase of an apartment or room, if the residential property was purchased on credit - a loan agreement with a bank (targeted loan or mortgage), including a payment schedule and interest rate.

- We prepare payment documents that confirm the fact of transfer of funds to the seller

- If housing was purchased during marriage, you will need to provide a marriage certificate, as well as draw up a statement of agreement between the parties (husband and spouse) on the distribution of shares of the property deduction

- The last step is to provide all of the above documents to the tax service at your place of residence

Login to your personal account for individuals

According to Article 57 of the Constitution of the Russian Federation, all individuals are required to contribute fees and taxes to the state budget. This mechanism provides the state with a financial basis; through taxes paid, hospitals and schools are built, roads and elevators are repaired. For intentional or unintentional evasion of this duty, they are subject to tax, administrative, and even criminal liability. The tax is levied on property, cash income, land, hunting, and fishing. Just for convenient control over the accrual and payment of these debts, a personal account for individuals (LK FL) was created.

By registering a taxpayer's personal account, the user can:

- Monitor the taxation of your property, transport, land;

- Control and repay debts;

- Return the amount of overpayments to your personal account;

- Receive tax notices;

- Print payment documents and pay at the bank;

- Make payments online without commission;

- Receive any advice from the Federal Tax Service remotely.

The capabilities of the office are expanded thanks to programs that can be downloaded on the website. For example, a program for filling out and sending declarations. To further simplify tasks, payment documents can be filled out online. One of the latest updates is the return of overpayments to your personal account. The site has tips that help a new user navigate their account. Consultation on any issue can be obtained in the “Typical Questions” section.

Be sure to read it! Garage purchase and sale agreement: how to draw up all the rules?

By login and password

After filling out the registration form during a personal visit to the tax office, the user has access to authorization on the nalog.ru portal page. Login details are printed on the card.

The following steps are required to login.

- Enter your Taxpayer Identification Number (TIN) in the first line.

- In the password field, enter the primary unique code.

- The “Login” icon will provide access to your personal page.

Through government services

If the user has already registered on the State Services platform, you can go through authorization using this service. Login as follows:

- Select the “Log in through State Services” field.

- Select authorization type: e-mail, cell phone or SNILS.

- Fill in the line with a unique password combination.

- The “Login” icon will redirect to your personal page.

To authorize, you must select a section to enter the taxpayer’s personal account. Without filling in the fields, follow the line marked with an arrow.

Via electronic digital signature

An electronic signature (ES) is an encrypted electronic key transferred to a physical medium: flash card, smart card, disk, Universal electronic card. The medium contains all the information about the user and acts as an analogue of a person’s real signature. The owner of an electronic signature has much wider opportunities to use his personal tax office. With it, you can submit declarations without going to the inspectorate, sign documents remotely, an individual can register an individual entrepreneur from his computer. At the same time, the possibilities are constantly expanding.

You can obtain an electronic signature at one of the centers licensed by the Ministry of Communications. The Ministry of Communications website has a list of accredited branches. You need to take with you:

- Passport;

- TIN;

- SNILS.

Only originals are suitable. At the branch, the documents are shown to the operator, who fills out an application; it must be signed. After this, the operator will issue a receipt for payment; such a service costs 1400-1600 rubles. You can pay at the nearest terminal or bank; the payment receipt must be given to the operator. After payment, the electronic signature carrier and instructions are issued. The owner of an electronic signature can register a personal account with the tax office without visiting the Federal Tax Service.

Is it possible to do 2-NDFL online: history of the issue

In 2014, a message appeared on the Federal Tax Service website, which spoke about obtaining data on the 2-NDFL certificate online (here is the exact link - https://www.nalog.ru/rn53/news/activities_fts/4645858/). Then most users read the information inattentively or saw what they wanted to see. Namely, the ability to download and print 2-NDFL online in your personal account.

In fact, payers were provided only with information about the submitted certificate as an obligation of the tax agent (information about income, deductions, etc.). It was not possible to download this document, nor was it possible to use its electronic version instead of paper.

This news was discussed on many forums for a long time and even options for downloading help were invented. For example, some users gave “instructions” on how to obtain 2-personal income tax online through their personal account. To do this, it was suggested to move the mouse cursor over the “print version” icon and download the document in PDF format. Or simply take a screenshot of the help screen and print it on a printer. But all these efforts were in vain for one simple reason - the printed file could not have legal force without the original signature of the tax agent.

Now you can download an income certificate on the tax website

You can now download the 2-NDFL income certificate. You will receive an official document with an electronic signature.

It has the same force as a certificate with the employer's seal. Such a certificate will be accepted by the bank, the new employer and anyone in general: it is certified by the tax authorities. Source: But there is a problem. Most likely, you will still have to take a certificate at work. Certificate 2-NDFL is confirmation of official income and withheld tax.

The employer sends such a certificate to the tax office for each employee. The tax office sees where a particular person works, what his salary is for the year and by month, and how much personal income tax he paid.

Ekaterina Miroshkina economistCertificate 2-NDFL is needed for various purposes.

We recommend reading: When Mosenergosbyt can turn off electricity for non-payment for legal entities

For example, to apply for a deduction when buying an apartment or paying for treatment. This certificate also confirms official income for the bank to take out or refinance a loan.

In what form should I submit 2-NDFL calculations?

According to paragraph 1 of Art.

230 of the Tax Code of the Russian Federation, tax agents keep records of income received by employees, including under civil law contracts. It is also the responsibility of the tax agent to record all benefits provided to the employee. Clause 2 Art. 230 of the Tax Code of the Russian Federation states that information on accrued income and tax withheld and paid to the budget system must be submitted to the tax office at the place of registration as part of form 6-NDFL.

ATTENTION! Until the end of 2022, employers submitted 2-NDFL as an independent report. From 2022, information on employee income is submitted as part of the 6-NDFL calculation as Appendix No. 1.

A sample of filling out Appendix No. 1 with information about employee income received in 2022 was prepared by ConsultantPlus experts. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Is it possible to fill out 6-NDFL online, read this article.

2-NDFL must also be issued to employees at their request within 3 days. Read about contracting the issuance of 2-NDFL to employees here.

The income certificate forms for the tax office and for employees are different, both of them were approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] You can download them for free by clicking on the desired image below:

If, for various reasons, it is impossible to use special software that allows you to fill out and print 2-NDFL certificates, you can resort to the service of filling out 2-NDFL online. Let's look at services that allow you to do this for free.

How can I get 2-personal income tax online?

The time when this certificate could only be ordered from the employer, waiting several days for its production, has passed. Now you can use this service remotely, receiving the necessary information instantly - immediately after applying. This service is provided to the population by the Federal Tax Service (Federal Tax Service).

Where to find a certificate on the State Services website...

How to order a certificate through State Services? The procedure for obtaining a document is carried out in several steps.

To get started, log into the Public Services portal: www.gosuslugi.ru. To log in, use the information provided during registration.

The account must be verified. If previously this required personal presence, for example, at the MFC, then in 2022 you can undergo the procedure remotely, for example, through Sberbank.Online, that is, without leaving your home. Other banks also provide a similar service.

On the main page of the State Services portal, select the “All services” button.

Next, select the “Authorities” tab and among them - the “Federal Tax Service” (Federal Tax Service of Russia) tab.

Here, click on the “Information and Contacts” tab, and then click on the “Website->Go” link.

You will be redirected to the Federal Tax Service website: www.nalog.ru.

In fact, the State Services resource directs the user to the Federal Tax Service Inspectorate portal - this is where the document is provided.

Therefore, you don’t have to “walk” the long path (through the State Services portal), but immediately go to the tax inspectorate’s website, to your taxpayer’s personal account (PA).

... and in the Tax Inspectorate’s LC

In order to get inside the account, you need to log in. This can be done using the login and password received from the Inspectorate, or you can log into your personal account with the data from the State Services portal. To do this, select the link: “Log in through ESIA government services.”

In the “My Taxes” tab, select “Income Data”, then “Reference History”

The 2-NDFL certificate is now available in the taxpayer’s personal account. You can see the entire history of your income for past tax periods.

Now the document can be downloaded, printed online for free, or sent by email. The certificate is certified by a signature in electronic form.

When does 2-NDFL appear in the LC? You will be able to find and obtain the certificate as soon as it is received by the tax authority. Although it is possible to receive a document for the current month, the full information is usually displayed with delays. For example, information for 2022 will be available from June 2022. But it happens that this happens earlier.))

But income data is not always displayed in your personal account. Sometimes this section of the 2-NDFL certificate may not be available. Well... In this case, you will have to do it the old fashioned way: contact your employer for a paper version of the document.

About the capabilities of the public services portal

The unified portal of state and municipal services (EPGU) began operating in 2009. The purpose of its launch is the transition to electronic document management and automation of all management processes in the Russian Federation. Initially, the site had limited functionality: users could only get reference information on it. Subsequently, however, the gosuslugi.ru resource developed - and now Russians are provided with full-fledged government services online in an amount exceeding 350.

What does the site allow you to do, besides processing 2-NDFL through government services? For example, an individual can:

Loan “Cash (online application)” Alfa-Bank, Person. No. 1326

from 15.9%

rate per year

up to 5 million

for up to 7 years

Apply now

- register at the clinic;

- register a car;

- obtain a driver's license;

- apply for registration as an individual entrepreneur;

- initiate the registration of a foreign passport.

To gain access to a wider range of services, users need to register with the Unified Identification and Authentication System (USIA), a unified identification and authentication system. By mid-2022, its database included 50 million Russian citizens. Now we will consider in detail the procedure for obtaining a 2-NDFL certificate through government services: what is required from the user for full registration and how the document is issued.