Example

The organization (Moscow) owns land plots with the cadastral value:

- in Moscow - 14,000,000 rubles;

- in Samara - 2,518,000 rubles.

The plot in Moscow was purchased in 2022, the entry was made in the Unified State Register of Real Estate on October 20.

Both plots are classified as other land plots, the tax rate is 1.5%.

For a land plot in Moscow, an organization has the right to a benefit: payment of tax in the amount of 30% of the calculated amount (clause 1.4 of article 3.1 of the Moscow Law of November 24, 2004 N 74).

Types of odds

They are listed in Article 396 of the Tax Code, which deals with the procedure for calculating land tax.

The reasons for applying the coefficient may occur if:

- a plot of land was purchased for housing construction, the coefficient depends on the duration of construction (Kuv);

- the plot was owned by taxpayers for an incomplete number of calendar months per year - depending on the time of use (Q);

- During the tax period, the taxpayer was assigned or canceled a benefit (Cl).

The coefficient Kv is the ratio of the number of whole months of land ownership to the number of months in a year.

However, if ownership rights appeared before the 15th or disappeared after the 15th inclusive, part of the month is accepted as full.

Conversely, if ownership arose after the 15th or disappeared before the 15th, the month is excluded from the time of ownership of the land plot.

For example, the right to property was registered on October 11. The calendar year is 12 months, until January 1 there are 2 full months and 1, which is accepted as full.

Then:

Kv = 3 ÷ 12 = 0.25

However, if the right is registered on October 21, then:

Kv = 2 ÷ 12 = 0.167.

As with any other tax, land tax has a list of beneficiaries. The application of benefits is regulated at the following levels:

- Federal - provisions of the Tax Code of the Russian Federation, Chapter 31 - benefits provided in accordance with Part 5 of Article 391.

- regional - each subject of the Russian Federation must set tax rates for a specific category of payers every year, as well as an additional list of beneficiaries, in addition to those established by the Tax Code of the Russian Federation.

In this case, the benefit is taken into account using the coefficient Kl, as the ratio of full months without applying the benefit to the number of calendar months in a year. An incomplete month of the beginning or end of the right to a benefit is taken as a full month.

If the right to a tax benefit arose on July 2, then:

Cl = 6 ÷ 12 = 0.5.

Regulatory regulation

Land tax is calculated and paid in accordance with the legislation of municipalities on the territory of which land plots owned by the organization are located.

General calculation formula:

Where:

- Kv - coefficient of land ownership, if the organization owns the object for an incomplete reporting (tax) period;

- Ki is the coefficient of use of the cadastral value (CV), if the CV changed during the period;

- Kl is the coefficient of use of the benefit if the benefit is applied during an incomplete reporting (tax) period.

The deadline for paying land tax for 2022 (4th quarter) is the same for all taxpayers, until March 1, 2022 (clause 1 of Article 397 of the Tax Code of the Russian Federation).

Increasing coefficients for land tax during housing construction: new trends

Letter of the Ministry of Finance of Russia dated October 13, 2020 No. 03-05-05-02/89412 is devoted to the conditions for applying increasing coefficients when calculating land tax. We are talking about a tax in relation to a land plot acquired (provided) for housing construction. An ordinary letter in which the Ministry of Finance, answering a question asked, simply reproduced the norm from the Tax Code of the Russian Federation. But the fact is that the RF Armed Forces presented the tax authorities with a big surprise. The letter doesn’t say anything about it, but we figured it out and will share it with you.

So. In relation to land plots acquired or given ownership to companies on the terms of conducting housing construction on them, land tax is calculated taking into account coefficient 2

during the three-year construction period (clause 15 of article 396 of the Tax Code of the Russian Federation).

The three-year report is maintained from the date of state registration of rights to these land plots until the state registration of rights to the constructed property. And for a period exceeding the three-year construction period, the tax is calculated taking into account the coefficient 4

flesh until the date of state registration of rights to the constructed object.

Thus, the condition for the application of these coefficients when calculating land tax is the fact of state registration of ownership of a land plot with the type of permitted use for housing construction.

At the same time, the application of these coefficients ceases in the event of state registration of the right to a constructed real estate object, for the construction of which the corresponding land plot was acquired or provided to the companies.

The most important thing: if construction is completed in three years, all overpayments of taxes will be returned to the company. Otherwise, you can say goodbye to your money.

And everything went on like this until there was one company that found this procedure completely unfair. The fact is that she received a housing construction project from local authorities for a period of 10 years. It was necessary to demolish the old houses, prepare the territory, and then start construction. But this meant that if the land for building a house was taxed, the company would face a permanently increased tax. And given the current cost of land, the amounts turned out to be quite sensitive.

The company went to court to seek the truth. All three first instance courts rejected her. However, the Supreme Court of the Russian Federation, in its ruling dated September 17, 2020 No. 309-ES20-11143, decided that the company’s arguments deserve attention and referred the case to a meeting of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation.

In the Ruling of the Supreme Court of the Russian Federation dated October 15, 2020 No. 309-ES20-11143, the court, by and large, sided with the company. He decided that the increasing coefficients, as conceived by legislators, should prevent a situation where the owner of the site has the opportunity to build housing within the established time frame, but deliberately avoids doing so. In general, it is a stimulus almost in its literal Latin meaning.

But if housing construction within the specified time frame is impossible for completely objective reasons (Articles 46.1 and 46.2 of the Civil Code of the Russian Federation), then this provision of the Tax Code of the Russian Federation turns into the opposite, beginning to scare away bona fide investors. Strictly speaking, tax legislation must take into account the regulatory requirements of other industries (Resolutions of the Constitutional Court of the Russian Federation dated July 2, 2013 No. 17-P, dated December 21, 2018 No. 47-P, dated June 30, 2020 No. 31-P).

The court made a compromise decision. Having returned the case to the first instance, I set it a not so simple task: to determine exactly the moment when the company had the full opportunity to begin directly building housing. From this (and only this) moment, the use of increasing factor 2 is legal.

Well, the Federal Tax Service of Russia, in a letter dated October 23, 2020 No. BS-4-21/ [email protected], called on tax authorities to take into account the position of the RF Armed Forces in their current work.

Setting up land tax in 1C

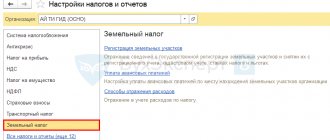

Install or check the land tax settings (Main - Taxes and reports - Land tax). Let's look at filling out each link.

Registration of land plots

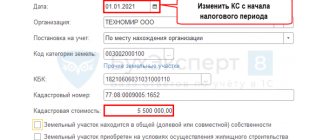

Check the registration card of the land plot that has been owned since the beginning of the year.

Create a record Registration of a land plot for a new plot registered in the Unified State Register of Real Estate in the 4th quarter.

In the Tax benefit , indicate the type of benefit and its amount (in our example, the tax is reduced by 70% - the tax is 30% of the calculated tax).

After setting up a land tax benefit, a link appears under the Tax benefit to fill out an Application for a benefit to the tax authority.

Payment of advance payments

Check the settings for advance payments in land tax payment areas. If the Advances are paid is set, the calculated tax for the year will be reduced by advance payments for the 1st, 2nd, 3rd quarters.

When calculating land tax in the Accounting 8 configuration in databases with releases before 3.0.106.60 , an error may appear: “At the end of the month, the operations for calculating advance payments for transport and land taxes are not filled in by mistake.”

To resolve the error, update to the specified release.

Ways to reflect expenses

The method of reflecting expenses can be established for all land plots or for each one separately.

Tax calculation

To calculate land tax at the end of the year, use the formula:

| Land tax | = | Cadastral value of the land plot (if there is a benefit in the form of a tax-free amount - minus this amount) | × | Land tax rate |

To calculate the land tax for a plot that is located on the territory of several municipalities, you need to determine the amount of tax for each part. To do this, use the formula:

| Land tax on part of a plot located on the territory of one municipality | = | Cadastral value of part of the land plot located on the territory of this municipality (if there is a benefit in the form of a tax-free amount - minus this amount) | × | Tax rate of land tax established in the territory of this municipality |

Such rules are established in paragraph 1 of Article 396 of the Tax Code.

If local legislation establishes reporting periods for land tax (I, II and III quarters of the calendar year (clause 2 of Article 393 of the Tax Code of the Russian Federation)), then during the year the organization must calculate advance payments for it.

To calculate the down payment, use the formula:

| Advance payment for land tax | = | 1/4 | × | Cadastral value of the land plot (if there is a benefit in the form of a tax-free amount - minus this amount) | × | Land tax rate |

If reporting periods are not established, there is no need to transfer advance payments.

This procedure follows from the provisions of paragraphs 6 and 9 of Article 396 of the Tax Code of the Russian Federation.

An example of calculating an advance payment for land tax. The land plot for which the advance payment is calculated is located on the territory of two municipalities

The organization owns a land plot with an area of 5 hectares, the cadastral value of which is 12,000,000 rubles. The site is located in two municipalities: 3.5 hectares - on the territory of one, 1.5 hectares - on the territory of the other.

For the category of land to which the site belongs, the same land tax rate is established in both municipalities - 0.3 percent of the cadastral value.

In order to distribute the amount of the advance payment for land tax between the two municipalities, the accountant determined the cadastral value of each part of the land plot.

The cadastral value of part of a land plot with an area of 1.5 hectares was: 1.5 hectares: 5 hectares × 12,000,000 rubles. = 3,600,000 rub.

The cadastral value of part of a land plot with an area of 3.5 hectares is equal to: 12,000,000 rubles. – 3,600,000 rub. = 8,400,000 rub.

The amount of advance payment for land tax is:

- for part of a land plot with an area of 1.5 hectares, 2,700 rubles. (RUB 3,600,000 × 0.3%: 4);

- for part of a land plot with an area of 3.5 hectares 6,300 rubles. (RUB 8,400,000 × 0.3%: 4).

The total amount of the advance payment for land tax is 9,000 rubles. (2700 rub. + 6300 rub.).

Calculate the land tax payable at the end of the calendar year using the formula:

| Land tax | = | Land tax calculated for a calendar year | – | Advance payments of land tax paid during the calendar year |

This procedure is determined by paragraph 5 of Article 396 of the Tax Code of the Russian Federation. Apply it only when tax reporting periods are established by local law.

If the real right to a land plot arises or terminates during the year, then calculate the land tax (advance tax payments) taking into account the coefficient Kv:

| Kv coefficient | = | The number of full months during which the land plot was owned (permanent (perpetual) use) in a given tax (reporting) period | : | Number of calendar months in the tax (reporting) period |

When determining the number of full months during which the land plot was in ownership (permanent (perpetual) use), the months in which the real right to the plot arose in the period from the 1st to the 15th inclusive ( ceased in the period from the 16th th to the last number inclusive). Months in which the right to a plot arose in the period from the 16th to the last day of the month (stopped in the period from the 1st to the 15th inclusive) are not taken into account when determining the number of full months.

Calculate land tax using the formula:

| Land tax (including Kv) = Land tax × Kv coefficient |

To calculate advance payments for land tax, use the formula:

| Advance payment for land tax (including Kv) | = | Advance payment for land tax | × | Kv coefficient |

This procedure follows from the provisions of paragraph 7 of Article 396 of the Tax Code of the Russian Federation, paragraphs 5.17–5.19 of the Procedure approved by order of the Federal Tax Service of Russia dated October 28, 2011 No. ММВ-7-11/696.

Situation: should an organization pay land tax for the year if the property right to a land plot was registered in the second half of December?

Answer: no, you shouldn't.

The organization is a payer of land tax from the moment the right of ownership, the right of permanent (perpetual) use to a land plot recognized as an object of taxation in accordance with Article 389 of the Tax Code of the Russian Federation (clause 1 of Article 388 of the Tax Code of the Russian Federation) arises.

If the right to a land plot arises during the tax period, then calculate the land tax taking into account the coefficient Kv (clause 7 of Article 396 of the Tax Code of the Russian Federation). To do this, use the formula:

| Land tax | = | Cadastral value of the land plot (if there is a benefit in the form of a tax-free amount - minus this amount) | × | Land tax rate | × | Kv coefficient |

Such rules are established in paragraph 7 of Article 396 of the Tax Code of the Russian Federation.

In this case, the coefficient Kv will be equal to zero, since December cannot be taken as the full month during which the organization owned this land plot (clause 7 of Article 396 of the Tax Code of the Russian Federation). Therefore, the land tax for this year will also be zero. The Russian Ministry of Finance expresses the same opinion in letter dated September 8, 2006 No. 03-06-01-02/36.

Calculation of land tax

Land tax is calculated automatically by the regulatory operation Calculation of land tax in December 2022 (Operations - Closing the month - Calculation of land tax).

Postings

You can check the calculated tax in the Help-calculation of land tax for 2022 .

The buyer of a plot for individual housing construction will pay double tax

On February 10, 2022, the State Duma of the Russian Federation adopted in the first reading a bill (No. 27073-7) on increasing land tax coefficients for unfinished housing construction projects. The new law covers legal entities - developers, as well as individuals - owners of land plots for individual housing construction (IHC).

The new law directly states that it will not affect gardeners and summer residents.

The provisions of the bill propose to amend Article 396 of the Tax Code of the Russian Federation.

The innovations will affect land plots owned by individuals and (or) organizations on which, in accordance with the permitted use, housing construction or individual housing construction is envisaged. The calculation of the amount of land tax in relation to such land plots will be made taking into account the increasing coefficient.

The emergence of this bill is due to the fact that owners of residential buildings are in no hurry to put them into operation and register.

The bill adjusts the procedure for applying coefficients for calculating the amount of land tax, taking into account the timing and types of housing construction determined by urban planning legislation.

The bill establishes that the tax amount is calculated taking into account coefficient 2 over a three-year period, starting from the month of entering into the state real estate cadastre (GKN) information about the establishment (change) of the permitted use of a land plot involving housing construction. If after this period the house is not registered, the tax coefficient is doubled.

The tax amount is calculated taking into account coefficient 4 for a period exceeding three years, up to the month of state registration of rights to a constructed residential building or the month of obtaining permission to put an apartment building into operation or the month of approval of the territory planning project.

On plots for individual housing construction, the tax will be charged taking into account coefficient 2 after 10 years from the date of state registration of rights to the land plot, until the house is registered.

In relation to land plots owned by individuals on which individual housing construction is envisaged, according to the bill, the tax will be calculated taking into account coefficient 2 after 10 years from the date of state registration of rights to the land plot up to the month of state registration of rights to the constructed individual residential house.

Let us recall that since 2005, Article 396 has been in force in the Tax Code of the Russian Federation, which provides for the calculation of land tax with a double coefficient for land tax for plots for individual housing construction.

Now, in accordance with the bill, it will be provided that the transfer of ownership of a land plot to another person, the division of a land plot, the allocation or consolidation of land plots will not interrupt the passage of time.

Thus, the buyer of a land plot intended for individual housing construction, if there is an unfinished house on such a plot that has not passed state registration, should be aware that the obligation to pay land tax with a double coefficient may pass from the previous owner to him.

Lawyer Svetlana Zhmurko

Make an appointment for a consultation with a lawyer by phone: 8(985)998-58-08

News

- Complex cadastral works will be paid for by contributions from gardeners

Permalink

- There is no longer a need to notify SNT about the general meeting

Permalink

- Sample request to postpone a hearing

Permalink

- Neighborhood rights will be written into law

Permalink

- Consultation with a lawyer at the Moscow Union of Gardeners in February 2020

Permalink

Latest publications in the press (All publications)

New laws for gardeners: the most important changes for the 2021 summer season

TVNZ

The neighbor's dacha is abandoned and overgrown with weeds: how to register it for yourself

TVNZ

Can an apartment be taken away from the owner?

TVNZ

Why do they want to extend the dacha amnesty for another five years?

TVNZ

“New settlers have become insolent”: deputies demand to protect developers from consumer extremism

TVNZ

Payment of land tax

Form a payment order for the payment of land tax from the List of Organizational Tasks (Main - Organizational Tasks).

The link opens the Land Tax Payment Assistant .

If, when opening the assistant, in the Calculation of amount it is indicated No tax payable , make sure that the routine operation Calculation of land tax is carried out for the reporting (tax) period.

Follow the link Calculation of land tax for 2022, go to Help-calculation of land tax for 2022. It is formed with selection by the Federal Tax Service, where the tax is paid. And it is convenient for checking the correctness of land tax calculations.

We looked at how to calculate land tax for 2022 in 1C 8.3 Accounting, the deadlines for paying land tax for 2022, and how to check the correctness of land tax calculation in 1C.

Example 1

Situation

The cadastral value of the land plot as of 01/01/2018 is 5,000,000 rubles. The ownership of it was registered on March 12, 2018. The information that became the basis for determining the cadastral value due to a change in the type of permitted use was entered into the Unified State Register of Real Estate on November 10, 2018. The changed cadastral value as a result of the change in permitted use amounted to 3,000,000 rubles. The established tax rate is 0.3%.

Solution

Based on the conditions, coefficient Kv = 10 months. : 12 months = 0.8333.

What and how to fill out in the land tax return:

| Declaration details | What to indicate |

| First Section 2, line 050 | Cadastral value as of 01/01/2018, taking into account the Ki coefficient: 8 months. : 10 months = 0.8000. |

| Second Section 2, line 050 | Cadastral value changed in the current tax period due to a change in permitted use, taking into account Ki: 2 months. : 10 months = 0.2000. |

The amount of calculated tax is calculated as follows:

| According to the first Section 2 | According to the second Section 2 |

| The product of the cadastral value as of 01/01/2018 (5 million rubles), tax rate (0.3%), coefficient Kv (0.8333), coefficient Ki (0.8000), divided by 100 | The product of the changed cadastral value (3 million rubles), tax rate (0.3%), coefficient Kv (0.8333), coefficient Ki (0.2000), divided by 100 |

As a result, the amount of calculated tax will be as follows:

| According to the first Section 2 | According to the second Section 2 |

| (RUB 5,000,000 × 0.3% × 0.8333 × 0.8000) : 100 = RUB 10,000 | (RUB 3,000,000 × 0.3% × 0.8333 × 0.2000) : 100 = RUB 1,500 |