New form

By Order of the Federal Tax Service of Russia dated January 15, 2018 No. ММВ-7-21/ [email protected] changes were made to the tax notification form.

Distribution of new notifications has already begun. Users of the “Taxpayer’s Personal Account” on the Federal Tax Service website were the first to see them.

Let us remind you that if a taxpayer has registered as a user of his personal account and, at the same time, has not additionally stated that he wants to receive notices and payment documents in paper form, then the tax authorities will post them only in his personal account.

If a citizen is not a user of the “Personal Account”, then the documents will be delivered through post offices by registered mail.

Title page

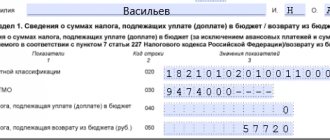

The title page of the notification contains the following information:

- TIN and checkpoint of the organization;

- code of the tax authority to which the notification is submitted (see notification submission scheme);

- date of notification;

- code of the reason for submitting the notification (for example, code “01” when switching to paying tax at the location of the responsible OP);

- attribute of the contents of the notification (for example, if the notification includes a title page and notification 1, then attribute “1” is selected);

- full name of the organization in accordance with the constituent documents;

- contact phone number (without spaces or dashes).

The field “This notice is compiled on ____ pages” indicates the number of pages on which the notice is compiled. The field value is filled in automatically and recalculated when its composition changes (sections are added/removed).

When filling out the field “with supporting documents or their copies on ___ sheets,” the number of sheets of supporting documents or their copies is reflected. Such documents may be: the original or a certified copy of a power of attorney confirming the authority of the taxpayer’s representative, etc.

The section of the title page “I confirm the accuracy and completeness of the information:” reflects:

- Manager - if the document is submitted by the taxpayer;

- Authorized representative - if the document is filed by a representative of the taxpayer. In this case, the name of the representative and details of the document confirming his authority are indicated.

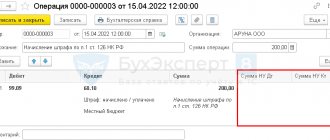

What changed

The following changes have been made to the consolidated tax notice:

when recalculating the tax amount specified in a previously sent tax notice, only a section of the tax notice will be generated with recalculation for the corresponding tax in relation to the taxable item for which the recalculation was made;

sections with recalculation of taxes are supplemented with the columns “Amount of previously calculated tax (rub.)” and “Amount to be paid additionally (+), to be reduced (-) (rub.)”;

in the tables for the calculation (recalculation) of land tax, the words “Housing Construction Coefficient” are replaced with “Increasing Coefficient”;

the tax notice will include personal income tax payable, not withheld by the tax agent;

In the case of transmission of a tax notice in electronic form through the taxpayer’s personal account, information about the taxpayer’s address is not included in the tax notice.

Let us add that the block with tax recalculation is included in the notification only if the Federal Tax Service has recalculated the previously accrued tax, for example, at the request of the taxpayer or if the Inspectorate has received new information from the registration authorities.

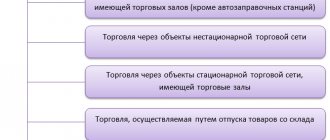

Terms and conditions of transition to a special order

Legal entities and individual entrepreneurs will be able to apply a special procedure for transferring payments to the budget (that is, transfer a single tax payment) from July 1 to December 31, 2022. This is stated in paragraph 1 of the new Article 45.2 of the Tax Code of the Russian Federation.

To switch to EPP, you need to take two steps:

1. Conduct a reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, and interest. The reconciliation should not reveal any discrepancies.

Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

2. Submit an application for the application of a special procedure for paying taxes and other payments. The submission deadline is from April 1 to April 30, 2022, but no later than one month after reconciliation. The application should be sent to the Federal Tax Service at the location of the company (place of residence of the individual entrepreneur) in electronic form via telecommunication channels. The application format will be approved by the Federal Tax Service.

Tax notice

Appendix to the Order of the Federal Tax Service of Russia dated October 5, 2010 N ММВ-7-11/ [email protected]

KND form 1165025

FEDERAL TAX SERVICE Tax authority ___________________________________ code _________ Tax authority address: _________________________________________________ Taxpayer Identification Number ____________________ Checkpoint ___________________ Reception time ____________ Contractor ______________________ contact phone number __________________ ———————————————————————— ¦For your information, we inform you: ¦ ¦ ¦ - if you have the right to tax benefits, then in ¦ ¦ ¦ in accordance with the legislation on taxes and fees ¦ ¦ ¦ You need to present to the tax authority documents that ¦ ¦ ¦ are the basis for the provision of tax benefits; ¦ ¦ ¦ - information about the presence of arrears and arrears of penalties and ¦ ¦ ¦legislative acts regulating the procedure for calculating taxes¦ ¦ ¦is posted on the website of the Federal Tax Service of Russia www.nalog.ru ¦ ¦ ¦"Taxpayer's Personal Account" and on the website ____________¦ ¦ ¦ (the website of the Office of the Federal Tax Service of Russia for the subject of the Russian Federation is indicated); ¦ ¦ ¦ - in accordance with Article 45 of the Tax Code of the Russian Federation, you have the right to fulfill the obligation to pay tax(s) ahead of schedule; ¦ ¦ ¦ - for late payment of tax, a penalty is charged at a rate equal to one three hundredth of the current refinancing rate of the Bank of Russia for each day of delay; ¦ ¦ ¦- OKTMO - code of the municipality at the location of the taxable object. ¦ ¦ ————————————————————+————— TAX NOTICE N ______ —————————————————— ——————— ¦F.I.O. taxpayer¦ ¦ INN ¦ ¦ ————————-+—————————+——-+————— ——————————————— —————————— Section 1. Calculation (recalculation) of transport tax ——————————————————————————————— - ¦Tax- ¦Object ¦State-¦Tax-¦Share ¦Tax- ¦Quantity¦Amount ¦Calculated-¦Amount ¦Amount of Tax-¦ ¦tax ¦reg-¦reg-¦ in ¦gov ¦months, ¦ tax amount, ha to surcharge, period of taxation, registration base, legal rate, for which the tax will be calculated (+)/to (year) ¦ ¦ ¦ sign¦ ¦ ¦(rub.)¦production ¦benefits ¦(rub.) ¦decrease ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦will be distributed-¦(rub.)¦ ¦previously ¦(-) ( rub.) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦calculation, re-¦ ¦ ¦(rub.) ¦(gr. 9 - ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦calculation to ¦ ¦ ¦ 1 ¦gr. 10) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦year ¦ ¦ ¦ ¦ ¦ +——+——-+———-+——+——+——+———-+——+———+——-+— ———+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ +——+——-+———-+——+——+——+— ——-+——+———+——-+————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——-+——-+———-+——+—— +——+———-+——+———+——-+———— —————————————————————————— —————- ¦Based on the legislation on taxes and fees, you ¦(date)¦ Total according to OKTMO: ¦ ¦ ¦obligated to pay up to ¦ ¦(gr. 10 + gr. 11)¦ ¦ ———————————————————+——+——————+———— 1 Tax amount according to previously sent tax notice N _____ For reference. As of __.__.____. According to OKTMO _____________ you have an overpayment of _______ rubles. 2 As of __.__.____. According to OKTMO _____________ you have arrears in the amount of __________ rubles. and arrears of penalties in the amount of __________ rubles. ————————————————————————— Section 2. Calculation (recalculation) of land tax ———————————————— ——————————————————— ¦Tax- ¦Kadast-¦Place ¦Tax-¦Share ¦Not about-¦Tax- ¦Quantity-¦Coefficient-¦Amount ¦Calculated- ¦Amount ¦The amount of ¦the ¦levy ¦found- ¦vaya ba-¦ in ¦lag-¦gova ¦per month- ¦rate ¦levied¦tax,¦log to ¦ ¦period¦number ¦ for (what is the right rate for citizens, for foreigners the amount calculated for payment (+)/ (year) land-land-dastro- ¦ tax- ¦ (%). (rub.) ¦ ¦ ¦plot¦plot¦cost- ¦ ¦amount ¦ ¦last ¦housing- ¦ ¦ ¦(rub.) ¦(gr. 11 - ¦ ¦ ¦ ¦(address)¦capacity) ¦ ¦(rub. )¦ ¦calculation, ¦ ¦ ¦ 1 ¦gr. telst-¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+——-+——-+——-+——+——+——+—— —+——-+——+——+——-+————+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ 13 ¦ +— —+——-+——-+——-+——+——+——+———+——-+——+——+——-+————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——-+——-+——-+——-+——+——+——+———+——-+——+——+— —-+———— ———————————————————————————————————— ¦Based on the legislation on taxes and fees You are obliged ¦ (date)¦ Total according to OKTMO: ¦ ¦ ¦ to pay up to ¦ ¦ (gr. 12 + gr. 13) ¦ ¦ ————————————————————-+——-+———————+———— 1 Tax amount according to previously sent tax notice N _____ For reference. As of __.__.____. According to OKTMO _____________ you have an overpayment of _______ rubles. 2 As of __.__.____. According to OKTMO _____________ you have arrears in the amount of __________ rubles. and arrears of penalties in the amount of __________ rubles. ————————————————————————— Section 3. Calculation (recalculation) of property tax for individuals ————————————— ———————————————————— ¦Tax-¦Object ¦ Place ¦Tax¦Share ¦Tax- ¦Quantity¦Amount ¦Calculated-¦Amount on- ¦Amount on- ¦ ¦new ¦tax-location¦base (in-¦in ¦gov ¦months, ¦tax- ¦tax, ¦tax-to-incorporation¦ ¦period ¦cover-¦ object ¦ventari- ¦right¦rate¦ for which ¦amount ¦numerical ¦late(+)/to ¦ ¦(year) ¦nia ¦ (address) ¦zatsionnaya¦ ¦% ¦production ¦benefits ¦tax¦previously ¦decrease¦ ¦ ¦ ¦cost ¦ ¦ ¦lasts ¦(rub.)¦(rub.)¦(rub.) 1 ¦(-) (ruble)¦ ¦ ¦ ¦ ¦most) ¦ ¦ ¦calculation, ¦ ¦ ¦ ¦(gr. 9 - ¦ ¦ ¦ ¦ ¦(rub.) ¦ ¦ ¦over- ¦ ¦ ¦ ¦gr. 10) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦even to year¦ ¦ ¦ ¦ ¦ +——-+——-+———-+ ———+——+——+———-+——+——+———-+———-+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ +——-+——-+———-+———+——+——+———-+——+——+———-+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ———+——-+———-+———+——+——+———-+——+——+———-+ ———— ————————————————————————————————— ¦Based on the legislation on taxes and fees, you are obliged ¦(date )¦ Total according to OKTMO: ¦ ¦ ¦pay up to ¦ ¦ (gr. 10 + gr. 11)¦ ¦ ————————————————————-+——+——————+———— 1 Tax amount according to previously sent tax notice N _____ For reference. As of __.__.____. According to OKTMO _____________ you have an overpayment of _______ rubles. 2 As of __.__.____. According to OKTMO _____________ you have arrears in the amount of __________ rubles. and arrears of penalties in the amount of __________ rubles. —————————————————————————— Appendix: Payment document(s) for payment of tax(s) under this tax notice. 2 Attention. The amount in the payment document is indicated minus the overpayment of tax (this line is filled in only if there is an overpayment) —————————— cutting line ——————————- Form KND 1165025 TAX NOTICE N _________________ on payment of: transport tax in the amount of ____________ rubles; land tax in the amount of ____________ rubles; property tax for individuals in the amount of __________ rubles; FULL NAME. taxpayer __________________ INN ________________ Address __________________________________________________________ RECEIVED “__” ______________ 20__ ___________________________ (signature of the taxpayer)

Note. The tear-off counterfoil is filled out and remains with the tax authorities if the tax notice is delivered to the taxpayer in person.

Source - Order of the Federal Tax Service of Russia dated October 5, 2010 No. ММВ-7-11/ [email protected] (with amendments and additions for 2013)