When and for what are bonuses awarded?

The concepts of various labor remuneration payments are presented in the Labor Code of the Russian Federation.

And although in Art. 129 of the Labor Code of the Russian Federation does not specifically indicate what a quarterly bonus is and what it consists of; the justification follows from the definition of wages. A bonus is an amount that is periodically paid to an organization to encourage and provide material incentives to employees (Article 191 of the Labor Code of the Russian Federation). According to the law, bonuses are not an obligation, but a right of the employer. The organization establishes the frequency, size and procedure of bonuses. The basic rules of incentives are enshrined in the collective agreement, individual labor agreements with employees, provisions on remuneration and bonuses. The timing of the issuance of additional material incentives is prescribed in the collective agreement and local regulations (letter of the Ministry of Labor No. 14-1 / OOG-1293 dated 02.14.2017, No. 14-1 / OOG-9132 dated 06.21.2020).

IMPORTANT!

If local regulations do not stipulate quarterly bonuses, then the employer has the right not to pay bonuses. If the organization has prescribed the incentive procedure in its internal regulations, then bonuses are paid without fail and within the time limits established in the regulations.

The employer has the opportunity to choose the form of quarterly incentives - monetary, material (gifts), reward (certificate of honor or title). The grounds and types of incentives are prescribed in the bonus regulations. Typically, quarterly bonus payments are due:

- for effective (intensive, productive) work;

- implementation of a plan;

- compliance with labor discipline;

- project implementation;

- performing specific tasks, etc.

Bonuses are one-time or periodic. Employers pay monthly, quarterly, semi-annual or annual bonuses. But there are also exceptions. 79-FZ dated July 27, 2004 indicates when a quarterly bonus is paid to civil servants - civil servants are not given bonuses (Article 55 79-FZ). Only one-time incentives are awarded for civil service.

ConsultantPlus experts told us what to do if the bonus was awarded after the employee’s dismissal. Do I need to pay it? Find out for free.

to read.

Bonus nuances

Is the payment included in the calculation of holiday pay?

In accordance with Art. 114 of the Labor Code of the Russian Federation, vacation pay is calculated from average earnings, which, according to the norms of Art. 139 of the Labor Code of the Russian Federation includes all types of income received from the employer, therefore, yes, quarterly bonuses are taken into account.

I was deprived of my bonus - what should I do?

If the payment has not been accrued, then it is necessary to carefully study the bonus provisions and check the order on depreciation. When the grounds referred to by the employer are specified in the regulations and took place in reality, the deprivation of payment is justified. If, after studying the documents, the employee continues to consider the deprivation of bonuses to be illegal, then he should contact the labor inspectorate or court to resolve the dispute.

Read more: Can bonuses be deprived for disciplinary action?

Will an employee be paid after dismissal?

Yes, if this is provided for in the employee’s internal regulations or employment contract.

Read more: Bonus for a dismissed employee.

Should I pay a deceased employee?

After the death of an employee, his relatives have the right to receive the income actually earned, but not received by him, including, if provided for by the regulations, additional material remuneration.

Should I pay personal income tax?

All payments from the employer are subject to personal income tax on the same basis as wages.

Is there a regional coefficient?

If the employer is located in a region where a regional coefficient is established, then the index is taken into account when calculating bonuses.

Is there a bonus during the probationary period?

An employee of a preschool educational institution is interested in whether she is entitled to a quarterly bonus if she came to work at a kindergarten in December and was given a probationary period - in accordance with Art. 70 of the Labor Code of the Russian Federation, an employee on a probationary period is subject to all local regulations of the employer, including the provision on additional material incentives. This rule applies to all employees, regardless of organizational and legal structure and form of ownership.

Will they be paid for the vacation period?

If the provision provides for additional financial incentives in proportion to the time actually worked, then no additional payment is accrued for the vacation period.

When promotion is deprived

According to the rules, when paying a bonus based on the results of work for the quarter, the objects of the bonus are the employees of the organization. Employees are encouraged in accordance with the bonus regulations and other internal regulations. The employer provides not only the procedure for incentives, but also cases in which the employee is deprived of additional incentives.

The same provision prescribes the frequency of payments and the procedure for calculating the salary bonus for 3 months of work (once a quarter). That is, the maximum number of such periodic payments per year is 4. To receive a quarterly payment, the employee must comply with the established work schedule, work efficiently and fulfill the production plan (if there is one). Here's what they're depriving of financial incentives for:

- for violations of labor discipline or standards established in the organization;

- receiving comments and reprimands;

- failure to fulfill official duties, tardiness, absenteeism, etc.

IMPORTANT!

Deprivation of bonuses is a non-disciplinary sanction under Art. 192, 193 Labor Code of the Russian Federation. The grounds for deprivation of material incentives are established by the employer and set forth in local regulations.

Order for payment of quarterly bonus

In order to pay the quarterly bonus, it is necessary to issue an order to this effect. The order is issued by the head of the organization (director, general director, etc.). If the bonus is paid to the employees of an individual entrepreneur, the order is issued by the individual entrepreneur himself.

It is recommended to use unified forms approved by Goskomstat Resolution No. 1 of January 5, 2004, although this is not mandatory from January 1, 2013.

The first form is No. T-11. It is necessary if you need to pay a bonus to one employee.

To download the document, click on the picture

The second form is No. T-11a. It is necessary if you need to pay bonuses to several employees.

To download the document, click on the picture

After the order is issued, it is necessary to sign it and familiarize employees with it.

***

Thus, quarterly bonus payments can be made in any organization, but their mandatory nature is established exclusively in internal documents, such as local acts and collective agreements. The bonus itself at the end of the quarter is paid on the basis of an order, which is drawn up in Form No. T-11 (for one employee), or in Form No. T-11a (for several employees).

How to calculate

There are several ways to calculate a bonus: based on salary, for actual time worked, based on points, and others. Such methods are used in budgetary institutions, and in commercial and non-profit organizations. The calculation procedure, as well as the indicators for bonuses, are prescribed in the salary regulations and the collective agreement of the organization. Main calculation methods:

- in a fixed amount - the employer sets the absolute indicators of periodic bonuses;

- as a percentage - the manager determines what percentage of the salary the bonus is, and monetary incentives are calculated as a share of the salary, tariff or average salary;

- for actual work time - the actual time worked by each employee is calculated, and the amount of payments is determined based on this indicator;

- share of revenue (plan) is a fixed percentage by which the amount of transactions carried out or contracts concluded for the quarter is multiplied. This is the employee's bonus;

- points. The point system provides for the accumulation of points over the period of work. Each point has a monetary value. The bonus payment is calculated as the product of the total number of points for the period and the cost of one point.

These are not all calculation methods. The organization has the right to provide one of the above or develop a specific mechanism for quarterly bonuses. The main requirement is to consolidate order in local labor standards.

Example of calculation from salary

A current example of calculating an employee’s salary: Viktorova V.V. works as a chief accountant. Her salary is 15,000 rubles. She was given a bonus for the fourth quarter of 2022 - 100% of her salary for intensive work. In this case, the formula for calculating the quarterly bonus is as follows:

The payment will be: 15,000 × 100% = 15,000 rubles.

Calculation option if the incentive order specifies shares. Viktorova V.V. receive a quarterly bonus in the amount of 1/2 of the salary:

15,000 × 1/2 = 7,500 rubles.

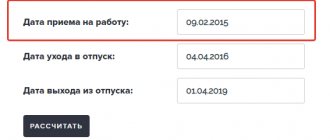

Example of calculation for time worked

Here is an example of calculating bonuses for actual time worked: Aleksandrova A.A. works at the NGO “Gosuchetnik.ru” as an accountant. The standard working time for the fourth quarter of 2022 is 63 working days. The employee missed three working days during this period and took leave without pay. Based on the results of her work in the quarter, she was given a financial incentive: the amount of her official salary, taking into account the actual time worked. Salary for the specified period is 35,000 rubles.

The procedure is as follows: the specific amount of the bonus is determined by a fixed percentage, usually of the amount of time actually worked. Incentive = 35,000 / 63 days × 60 days (63 days - 3 days) = 33,333.34 rubles.

Find out for free in ConsultantPlus how to take bonuses into account when calculating average earnings.

to read.

Calculation of fixed premium

If the bonus for the quarter is set in a fixed form, the salary to be paid should be calculated according to the rules:

- bonuses are added to the salary, the resulting amount is increased taking into account the coefficient;

- Withhold personal income tax and advance payment from accrued earnings.

Let's calculate bonuses based on the following information: an employee of Parus LLC receives a salary of 25,000 rubles, the bonus for the quarter is 10,000 rubles. upon reaching planned production.

- 25000 + 10000 = 35000 rub. — bonuses accrued;

- 35000 – 13% = 30450 rub. — salary to be paid minus personal income tax.

In case of illness

When bonuses are stipulated in local regulations, the employer is obliged to pay incentives. If an employee was sick during the quarter, he will be paid part of the bonus payment, removing the days missed from the calculation. In this case, the quarterly bonus is calculated for the actual time worked:

- Establish standard working hours for the quarter.

- Determine the number of days worked and days missed due to illness.

- The amount of payments is calculated based on the amount of salary and the number of days actually worked.

But only on the condition that such a basis is established in the labor regulations of the organization.

Quarterly bonus payment deadline

Since we are considering a quarterly bonus, it is obvious that it is paid based on the results of three months of work by members of the workforce. However, not all so simple.

The work of employees for the quarter will be assessed, but the question remains open - when exactly will the quarterly bonus be accrued and paid? The answer to this question was given by the Russian Ministry of Labor in letter dated September 23, 2015 No. 14-1/OOG-8532.

The quarterly bonus is paid after the assessment of the enterprise's performance for the quarter is completed. How long such an assessment lasts is not specified; accordingly, each organization may apply its own deadlines (of course, within reason). In practice, in most organizations quarterly bonuses are accrued and paid the next month after the end of the quarter (for example, for the 1st quarter of the year - in April). After the bonus is accrued, by virtue of Part 6 of Art. 136 of the Labor Code of the Russian Federation, it must be paid within 15 days. The transfer is made together with the salary or advance payment.

Are personal income tax and insurance premiums calculated?

Personal income tax and insurance premiums for premium remuneration are transferred in the prescribed manner - 13% of personal income tax and contributions at current rates.

If we talk about how the quarterly bonus is calculated in a budget organization, then the rules are the same. Additional remuneration is paid along with wages and is subject to insurance premiums and personal income tax. The only exception is that public sector employees need to develop a justified provision on bonuses and clearly define cases of incentives depending on the area of the organization’s work. Otherwise, the Accounts Chamber and the Audit Office will classify the payments as misuse of budget funds.