How to calculate revenue?

For the purposes of calculating and controlling revenue, the following rules apply:

Rule 1. Control the amount of revenue

The right to exemption is lost from the 1st day of the month in which revenue exceeds RUB 2,000,000.

Example

applies VAT exemption from 1 May. It is necessary to control revenue for:

- May June July

- June July August

- August, September, October

- Etc.

Rule 2. Revenue is calculated according to accounting data

Rule 3. We take into account the nuances of calculation

- Revenue is calculated without VAT;

- Advances are not taken into account in the calculation.

Rule 4. Only revenue that is subject to VAT is included in the calculation

According to paragraphs 3 and 4 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 No. 33, receipts from transactions not subject to VAT are not taken into account in revenue.

The following receipts are not subject to VAT:

- From activities in respect of which UTII or PSN is applied;

- From transactions that are exempt from VAT on the basis of Article 149 of the Tax Code of the Russian Federation;

- From transactions that are not recognized as subject to VAT on the basis of Article 146 of the Tax Code of the Russian Federation;

- From the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation.

No need to take into account

According to a published letter from the tax department, which was discussed with the Ministry of Finance of Russia (letter dated April 21, 2014 No. 03-07-15/18197), the amount of revenue for the purpose of applying the provisions of Article 145 of the Tax Code of the Russian Federation should be calculated only in relation to transactions for the sale of goods (works, services) subject to VAT.

The fact is that, within the meaning of paragraph 1 of Article 145 of the Tax Code of the Russian Federation, the institution of exemption from the duties of a VAT payer is aimed at reducing the tax burden in relation to those who have insignificant turnover in the sale of goods (work, services) subject to this tax. This is the legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation, which is set out in Resolution No. 10252/12 dated November 27, 2012. Therefore, the revenue limit should be calculated only in relation to transactions subject to VAT.

EXAMPLE Sigma LLC decided to exercise the right to be exempt from obligations related to the calculation and payment of VAT under Article 145 of the Tax Code of the Russian Federation. The company planned to do this in June. Over the previous three months, the company’s revenue from the sale of goods (work, services) amounted to: – for March – 990,600 rubles. (including VAT – RUB 151,108); – for April – 653,000 rubles. (including VAT – RUB 99,610); – for May – 704,400 rubles. (including VAT – RUB 107,451). In addition, in May, Sigma LLC sold a plot of land it owned for RUB 340,000. Operations for the sale of a land plot are not recognized as subject to VAT taxation (subclause 6, clause 2, article 146 of the Tax Code of the Russian Federation). The total amount of revenue for three months excluding taxes amounted to 2,329,831 rubles. (990,600 – 151,108 + 653,000 – 99,610 + 704,400 – 107,451 + 340,000). However, when determining the revenue limit that gives the right to apply the said exemption, the company excluded the amount received from the sale of a plot of land. Since RUB 1,989,8831. (2,329,831 – 340,000) less than 2,000,000 rubles, the company can take advantage of the right to be exempt from VAT from June.

How to exercise the right to release?

You can start applying the exemption from the first day of any month. To do this, no later than the 20th day of the month from which the exemption applies, you must submit to the Federal Tax Service:

- Notice “On the use of the right to exemption from the taxpayer’s obligations related to the calculation and payment of VAT”;

- An extract from the balance sheet and/or profit and loss statement (of the organization) or an extract from the book of income and expenses (IP);

- Extract from the sales book.

It is also necessary to restore VAT on the residual value of fixed assets (intangible assets) and on the value of inventories that, before the application of the exemption, were not used in transactions subject to VAT.

How to apply for VAT exemption

You can be exempt from VAT from the beginning of any month. To do this, submit an application and a package of documents before the 20th day of the month in which you are ready to work without VAT (which means the upcoming three months will bring in revenue of less than 2 million rubles).

For tax purposes, collect documents:

- notification in the form approved by order of the Ministry of Finance dated December 26, 2019 No. 286n;

- invoice journal and its copy;

- an extract from the balance sheet for a company or an extract from the KUDiR for an individual entrepreneur for three months;

- an extract from the sales ledger for three months.

Please enter in your application:

- information about the individual entrepreneur or company;

- details of your tax office, to which you are sending your application;

- the date from which VAT exemption is planned;

- revenue volume for the previous three months;

- list of supporting documents.

The text of the notification fits on one and a half pages, while half the page is occupied by the header and title of the document. Filling it out is not difficult; it can be done by hand or using a computer. The application is signed by the director of the company and the accountant or the individual entrepreneur himself, certified by his signature and submitted in two copies to the tax office in person or by mail. There is no need to wait for a response from the tax office - just work without VAT from the beginning of the month indicated in the application and try not to “go overboard” with the proceeds.

Here is a sample application:

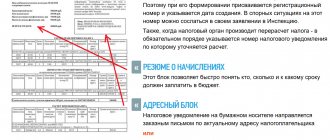

What to do with the VAT return?

For the period during which the VAT exemption was applied, declarations are not provided.

If the exemption is applied from the first month of the quarter, then the restored VAT is included in the declaration for the last quarter preceding the application of the exemption.

If the exemption applies from the second or third month of the quarter, then the declaration for this quarter must be submitted according to the general rules. In this case, the declaration reflects only transactions for the period of the first quarter before the start of application of the exemption. Such a declaration also includes the restored VAT.

Payment of VAT during the transition period

In practice, a situation may arise that the company purchased goods before it began to use the right to exemption, and will sell them during the period when the VAT exemption is already in effect.

In this case, the VAT accepted for deduction before receiving the exemption will have to be restored. For unsold goods and unused materials, VAT is refunded in full. From January 1, 2015, the procedure for VAT restoration is as follows (clause 8 of Article 145 of the Tax Code of the Russian Federation):

- if the exemption is applied from the first month of the quarter, then VAT is restored in the last quarter before the exemption is used;

- if the exemption is applied from the second or third month of the quarter, then VAT is restored in the quarter from which the exemption is applied.

In tax accounting, the restored VAT is included in other expenses (clause 2, clause 3, article 170 of the Tax Code of the Russian Federation).

EXAMPLE On September 5, Aktiv JSC purchased a batch of goods from a supplier for 118,000 rubles. (including VAT - 18,000 rubles). The amount of VAT on goods received was accepted for deduction in accordance with the generally established procedure. From October 1, “Active” uses the right to exemption from VAT. In September, no goods were sold. Consequently, in the third quarter (September), the amount of VAT on goods (18,000 rubles) must be restored and included in other expenses. The Aktiva accountant will make the following entries: September 5 DEBIT 60 CREDIT 51 - 118,000 rubles. – money is transferred to the supplier in payment for goods; DEBIT 41 CREDIT 60 – 100,000 rubles. (118,000 – 18,000) – goods are capitalized on the company’s balance sheet (at purchase price excluding VAT); DEBIT 19 CREDIT 60 – 18,000 rub. – VAT paid to the supplier of goods is taken into account; DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 – 18,000 rubles. – VAT is accepted for deduction. September 30 DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 – 18,000 rubles. – the amount of VAT accepted for deduction before the start of the exemption was restored; DEBIT 91-2 CREDIT 19 – 18,000 rubles. – the restored VAT amount is included in other expenses. Please note: to simplify the records, in this situation you can make one entry: DEBIT 91-2 CREDIT 68 subaccount “VAT Calculations” – 18,000 rubles. – the restored VAT amount is included in other expenses.

For fixed assets and intangible assets, VAT is restored from their residual value (according to accounting data). Such explanations are provided by financiers and tax service specialists (letter of the Ministry of Finance of the Russian Federation dated April 12, 2007 No. 03-07-11/106, letter of the Department of Tax Administration of the Russian Federation for Moscow dated May 5, 2003 No. 24-11/23897).

But the judges do not agree with this position. They believe that if fixed assets have already been used for some time for operations subject to VAT, then there is no need to restore the tax. Moreover, the Tax Code does not contain rules for restoring the tax for depreciable property during the transition to VAT exemption (Resolution of the Federal Antimonopoly Service of the North-Western District dated May 18, 2005 No. A52/7134/2004/2).

However, the legitimacy of such a position will most likely have to be proven in court. Therefore, if you want to completely exclude possible claims during the audit, follow the requirements of the tax authorities.

note

VAT must be reinstated in the last quarter preceding the exemption. However, the Tax Code does not specify in which month of the quarter this should be done. Therefore, the company will not violate anything if it restores the tax on the last day of a particular quarter: March 31, June 30, September 30 or December 31.

This means that if, for example, you began to apply the VAT exemption in April, then you will need to restore the tax from the residual value calculated as of March 31 (that is, taking into account January, February and March depreciation). This way you will pay less VAT to the budget.

How to confirm compliance with the conditions of release?

By the 20th day of the month following the 12th month of application of the exemption, you must provide the following to the Federal Tax Service:

Documents confirming that within 12 months the revenue was within 2,000,000 rubles. for every 3 consecutive calendar months (extract from the balance sheet/profit and loss account and sales ledger);

Notification of the extension of the use of the right to exemption over the next 12 calendar months or the refusal to use this right.

Validity period of the benefit

After notifying the Federal Tax Service about the application of the exemption, the company has the right not to pay VAT for 12 months. After the year has passed, notify the tax office of the extension of the grace period or the refusal of the benefit.

The taxpayer has the right to refuse to apply the exemption at any time. And sometimes you may lose the right to it. A particularly common cause of such loss is exceeding the revenue limit. Monitor compliance with the revenue limit closely throughout the grace period. As soon as it is exceeded, the organization is obliged to pay VAT on a general basis. The benefit is lost from the first day of the month in which the excess occurred.

What happens if you do not provide documents for release?

If the taxpayer does not submit a Notice of transition to exemption and extension of the exemption period for the next 12 months, then he will not lose the right to work without VAT.

However, it is worth filing a notice to avoid blocking accounts due to the fact that the tax authority was not notified of the taxpayer's use of the exemption.

If the taxpayer does not provide documents confirming the legality of the application of the exemption, then he loses the right to this exemption for the entire period of its application. In this case, it is necessary to charge additional VAT, pay penalties and fines.

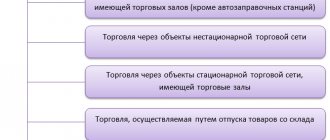

Who cannot benefit from the exemption

In conclusion, we recall that the provisions of Article 145 of the Tax Code of the Russian Federation do not apply to:

- to companies with the status of a participant in a project to carry out research, development and commercialization of their results;

- for firms and individual entrepreneurs who are engaged in the sale of excisable goods, including during the three consecutive calendar months preceding the exemption.

Persons conducting several types of activities, including the sale of excisable goods, can use the right to be exempt from VAT payer obligations under Article 145 of the Tax Code of the Russian Federation. But only for activities in which the sale of excisable goods does not occur, and if there is separate accounting for the sale of excisable and non-excise goods (see the definition of the Constitutional Court of the Russian Federation dated November 10, 2002 No. 313-O).

At the same time, even if an organization (individual entrepreneur) uses the tax exemption in question, VAT will still have to be paid:

- if it imports goods into the territory of Russia from abroad and other territories under its jurisdiction (clause 3 of Article 145 of the Tax Code of the Russian Federation);

- if she must transfer VAT to the budget as a tax agent.

Tax consultant A.A. Fokin

, for the magazine “Regulatory Acts for Accountants”

Commented document:

Letter of the Federal Tax Service No. GD-4-3/8911 dated May 12, 2014 “VAT: determining the composition of revenue for the purposes of applying exemption from the taxpayer’s duties”

How to save on VAT without violating the tax code

This e-book contains complete information about what legal ways to optimize VAT are provided for in Russian legislation. They are enough to reduce the tax burden of the enterprise and not take risks >>

If you have a question, ask it here >>

Invoice is the main document for VAT

The main document where you need to correctly indicate VAT is the invoice.

The rules for filling out an invoice used in calculations of value added tax (approved by Government Decree No. 1137 of December 26, 2011) stipulate that the VAT rate is indicated in column 7 of the invoice. For transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made (this refers to exemption from VAT under Article 145 of the Tax Code of the Russian Federation).

Let us remind you that such an exemption can be used on the general taxation system when for the previous 3 consecutive calendar months the amount of sales proceeds (excluding VAT) did not exceed a total of 2,000,000 rubles.

If the seller is exempt from VAT under Article 145 of the Tax Code of the Russian Federation, he remains obliged to issue invoices. In this case, in column 7 of the invoice they write “Without tax (VAT)” (or “Without VAT”, as stated in the rules). This is directly indicated by paragraph 5 of Article 168 of the Tax Code of the Russian Federation.

Let us note that if the Osvobozhdenie owner issues an invoice to the buyer with the allocated amount of VAT, then he needs to pay the entire amount of tax to the budget and submit a VAT return (clause 5 of Article 173 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Invoices for transactions without VAT

The Tax Code also mentions settlement and primary documents, where the tax must be highlighted in a separate line (clause 4 of Article 168 of the Tax Code of the Russian Federation). The code says nothing about contracts.

However, when concluding an agreement with a seller exempt from VAT under Article 145 of the Tax Code of the Russian Federation, the choice of wording must be approached with caution.