What is OKTMO code

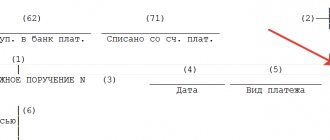

OKTMO is a digital designation that is assigned to each municipal entity in the Russian Federation. In the payment order, the OKTMO code is entered in accordance with the rules for filling out payment slips (Order of the Ministry of Finance No. 107n). According to these rules, the fields and lines of the payment order are filled in in a certain way, and if any of the required details are not specified in the document, the payment order will not be accepted by the bank for execution.

Important! The OKTMO code is one of the required details and its indication in the payment order is necessary.

Consequences of errors in a payment document

The execution of payment orders for payment of tax payments should be treated with the utmost care.

How to correctly fill out a payment order Filling out a payment order in 2022 - 2022 - sample Main fields of a payment order in 2022 - 2022 (sample) Basic details of a payment order

Errors made in a payment order can lead to the following undesirable financial consequences for the taxpayer:

- the tax may not go to the required budget;

- the tax may be declared unpaid;

- the tax may be recognized as paid in violation of the deadline.

This entails at least the payment of a penalty, but can also lead to the payment of a fine and re-payment of tax (clause 2 of Article 57, Article 75, clause 1 of Article 122, Article 123 of the Tax Code of the Russian Federation). In addition, lengthy proceedings with the tax office are likely.

Why is OKTMO needed in a payment order?

OKTMO is an indication of the territory in which a certain taxpayer carries out its activities and also receives income from it. This code was introduced so that the received payment could be quickly identified and also included in the budget of a specific municipality.

Important! If we take into account that OKTMO is an indication that a payment is to be allocated to a specific budget, then if the code is incorrectly specified, the funds will simply go to the budget of another municipality.

Error in OKTMO when paying by barcode

In the case of manual entry, we can correct the erroneous OKTMO ourselves and enter the correct one, but what to do if we want to pay using the barcode on the receipt, and the barcode itself contains an 11-digit OKTMO. When paying using a barcode in which OKTMO is equal to 11 characters, an error may appear on the Sberbank terminal - “The OKTMO field is not filled in correctly.”

Or, in general, the terminal may freeze on one screen and, when you press the “Next” key, show the same screen without obvious errors.

Here you can try to recognize the barcode yourself and generate it again, but it is better not to do this, as you can make a mistake in the contents of the barcode. Therefore, if an error occurs with the barcode, it is better to make the payment manually or contact the organization to reissue the receipt.

Have you tried paying using the old OKTMO of 11 characters? Leave your comments below.

How to find your OKTMO

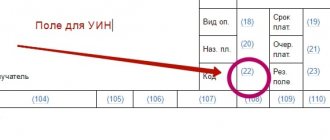

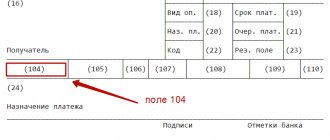

When filling out a payment slip, it may be difficult to determine the OKTMO code. The values of these codes are indicated in the All-Russian Classifier of Municipal Territories (OKTMO), approved by order of Rosstandart No. 159-st dated June 14, 2013. This classifier has replaced the Classifier of Administrative Territorial Divisions (OKATO), that is, if OKATO was previously indicated in the payment order, now the code OKTMO should be indicated. In the payment order, OKTMO is indicated in field 105.

Important! The company issues a payment order for taxes and duties, or to the address of its counterparty. Such a document must be drawn up correctly, without errors. Otherwise, the recipient of the funds simply will not receive them.

The OKTMO code consists of 8 or 11 digits. The last three digits of the eleven-digit code represent the designation of a specific small settlement. If a taxpayer has difficulties determining his OKTMO, then you can find out your code on the Federal Tax Service website (www.nalog.ru). The service presented on the tax website allows you to find out your code using the directory by entering the municipality. If OKTMO must be indicated in the payment slip for payments at customs, then the code must be taken from the territory that accumulates this payment (

Where and how OKTMO codes are indicated, and what is not an error

So, now OKATO codes are written down on the form of each payment order that is issued for paying taxes. It is also indicated in all tax returns, for example:

- according to VAT;

- according to the simplified tax system;

- income tax;

- land, transport tax, etc.

In addition, OKTMO is recorded in the form 2-NDFL, 3-NDFL, as well as in a single tax return. All of the documents listed above have a separate line consisting of 11 cells or, as they are called, acquaintances. It is designed specifically for the OKTMO code.

But it can consist of 8 digits (for a municipality) or 11 digits (for rural, urban settlements). The eight-digit code is written in this line from left to right, with one digit in each cell. The remaining three cells must be filled with dashes. This is the correct spelling.

Error in OKTMO in the payment order to the Federal Tax Service

If OKTMO is indicated incorrectly in the payment order, then this will not affect the flow of funds into the budget. If an organization discovers an error in its payment slip, it will need to contact the tax authority and submit an application to clarify the details (Article 45 of the Tax Code of the Russian Federation). You can make such an application in free form, since there are no special forms for it.

The document should include the following information: (click to expand)

- date of payment, amount indicated in the payment order, as well as purpose of payment;

- incorrectly specified details;

- correct value of the attribute;

- a link to a regulatory document on the basis of which the payment can be clarified;

- list of documents attached to the application.

In addition to the application, you should provide a copy of the payment order in which the error was made, as well as a bank statement confirming the transfer of the specified amount.

If the tax office finds an error in OKTMO in the payment slip, it may offer to reconcile the calculations. The tax office makes a decision on reconciliation within 10 working days from the date of receipt of the relevant application from the employer. The tax office is obliged to notify the taxpayer of the decision.

Important! If an error in OKTMO was made in the payment order for the payment of insurance premiums, then there is no need to send clarification. This is due to the fact that the tax office does not take into account the value of OKTMO when distributing contributions. This payment will not be included in the outstanding payments; it will be taken into account in a special settlement card with the budget, where OKTMO will be indicated in accordance with the place of activity of the organization.

SAMPLE APPLICATION

How to fix the error

There is no unified sample - clarification of payment to the tax office. Therefore, you will have to prepare a written appeal in any form.

If the company has approved letterhead, then the letter can be written on it. Follow the basic rules of business correspondence when preparing your appeal. The application form for clarification of payment to the tax office must contain the following details:

- Date, number, amount of the payment order in which the inaccuracy was identified.

- Enter the purpose of payment for the incorrect payment order.

- Indicate the field in which there was a typo, error, or indicate the value of the incorrect attribute.

- Then write down which value for this attribute will be correct.

To the completed application form for clarification of payment to the tax office, attach a copy of the payment order in which incorrect information was identified.

IMPORTANT!

If, due to an error in the payment, representatives of the Federal Tax Service assessed penalties, they may be cancelled. After reviewing your application, tax officials must decide whether to clarify the payment or not. If the decision is positive, then the accrued penalties will be reversed (clause 7 of Article 45 of the Tax Code of the Russian Federation, clause 12 of Article 26.1 of Law No. 125-FZ, clause 11 of Article 18 of Law No. 212-FZ as amended, in force until 01/01/2017 , Letter of the Federal Tax Service No. ZN-4-22/10626a, Pension Fund of the Russian Federation No. NP-30-26/8158 dated 06/06/2017).

Sample application form for clarification of payment to the tax office for 2020

After we have drawn up a sample - a letter to the tax office about clarification of payment, we will move on to another type of business correspondence: not with the Federal Tax Service, but with the Social Insurance Fund.

Penalty for incorrectly specified OKTMO in a payment order

Organizations and entrepreneurs quite often make mistakes in the tax payment details, so the Federal Tax Service requires the development of a bill introducing a fine for incorrectly indicated OKTMO. Today, tax payments must be made even if the OKTMO is incorrectly specified, however, if the bill is approved, then you will have to pay for errors.

A bill has been submitted to the State Duma, according to which it is proposed to punish taxpayers for errors in indicating OKTMO in payment orders for the payment of personal income tax. Currently, an error in this detail does not result in a fine being imposed on the taxpayer. The tax authorities resolve this situation on their own by redirecting funds to the required budget. The explanatory note to the bill notes that situations where tax is actually paid outside the place where the company operates are quite common. In this regard, local budgets suffer constant losses, for example, in personal income tax, which is a budget-forming region for many. Therefore, in order to reduce the number of errors in payment orders, it is possible in the future to establish the real responsibility of the taxpayer.

When the bill is adopted, the Tax Code will provide an additional basis for recognizing the obligation to pay tax as unfulfilled in the event of an error in OKTMO. It is proposed to introduce a fine of 20% of the amount of unpaid tax.

If an error in OKTMO was discovered by the tax authorities

If the tax office discovers an error in OKTMO in the payment slip, you will first receive a demand for payment of the resulting arrears with accrued penalties and fines. The arrears will need to be paid within eight working days from the date of receipt of the request. Unless, of course, it specifies a longer period of time to pay the tax.

If the debt is not repaid within the established period, the Federal Tax Service will begin the procedure for collecting the arrears. This means that the tax authorities will write off the required amount from your account. And the same amount will be blocked to ensure payment of the arrears.

If the demand was not made, the tax authorities do not have the right to write off taxes for collection.

How long your account will be blocked is stated in paragraph 7 of Article 76 of the Tax Code.

The suspension of transactions of a taxpayer-organization on his bank accounts and transfers of his electronic funds is valid from the moment the bank receives a decision of the tax authority to suspend such operations, such transfers and until the bank receives a decision of the tax authority to cancel the suspension of transactions on the accounts of the taxpayer-organization with the bank, decision of the tax authority to lift the suspension of transfers of its electronic funds

For several days you will not be able to manage your money until the payment is “attached” to your OKTMO again. During this time, you will actually pay the tax twice, as well as penalties and fines, and you will have an overpayment.

Which fields in the payment order do not need to be corrected?

Important! If a company transfers tax on the basis of a submitted declaration, then OKTMO in the payment order should be indicated in accordance with this declaration.

There are quite a few fields in the payment document in which certain details must be entered. Among them there are those that tax authorities do not pay much attention to. These include fields in which you enter:

- taxable period;

- taxpayer status;

- date, document number;

- basis of payment, type of payment.

These errors do not need to be corrected. An error in the order of payment is also insignificant. With the exception of mistakes made by companies that currently have some financial difficulties. For example, the company’s current account does not have sufficient funds, or the account has restrictions on expense transactions. In this case, this field will be checked first.

What problems will an error in OKTMO lead to?

Thus, an incorrect OKTMO can cause you serious problems.

Firstly, you will have to urgently write an application to clarify the payment.

Secondly, if the tax office discovers an error in the OKTMO before you and you do not have time to transfer money from one OKTMO to another or pay off the arrears on time, the Federal Tax Service will write them off from your account again.

Thirdly, if your account is blocked, you will be deprived of the opportunity to manage money in an amount equal to your tax debt for several days.

Fourthly, you will have an overpayment of tax, which will have to be returned within a month, and in practice, sometimes longer. In this case, you will have to return separately the overpayment of tax and separately accrued penalties and fines.

Read in the taker

New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

What every accountant needs. The full scope of always up-to-date accounting and taxation rules.