Let us remind you about sanctions

For late submission of the SZV-M form, liability is established under Article 17 of the Law on Personalized Accounting No. 27-FZ. All cases in which a company may be fined are listed in the tables:

Penalties for SZV-M

| What can you be fined for? | Fine amount | Legislative norm |

| The deadline for submitting the SZV-M was missed (late or non-submission is not important) | For a company: 500 rub. for each insured person | Part 3 Art. 17 of Law No. 27-FZ |

| For an official of the policyholder (manager, accountant): 300-500 rubles. | Art. 15.33.2 Code of Administrative Offenses of the Russian Federation | |

| Error in personalized information (the object of sanctions is each insured person, regardless of whether one or more errors were made regarding his data) | For a company: 500 rub. for each insured person | Part 3 Art. 17 of Law No. 27-FZ |

| For an official of the policyholder (manager, accountant): 300-500 rubles. | Art. 15.33.2 Code of Administrative Offenses of the Russian Federation | |

| Submission of SZV-M on paper instead of an electronic form ( for the number of employees from 25 people) | For a company: 1000 rub. | Part 4 Art. 17 of Law No. 27-FZ |

The amount of the fine depends on the number of insured persons whose data was submitted in violation of the deadline. Thus, if the organization employs a large number of people, then late submission of the form can result in a very large fine.

It is one thing if the subject did not submit the SZV-M on time without a good reason. It is clear that going to court in this case is unlikely to help. However, it happens that the policyholder is fined for very offensive reasons. For example, when the delay occurred due to the fact that on the last day of filing reports there was no electricity or Internet in the office. Often, deadlines are missed due to the fact that an error is discovered in a timely submitted form , the correction of which is carried out outside the deadline for submitting reports. Let's look at similar cases next.

Administrative fine for the manager

In addition to the fine for the company, the Code of Administrative Offenses provides for administrative liability for officials - from 300 to 500 rubles. Here the courts are in no hurry to help the manager. Even if the company managed to defend itself and was not fined, the directors will most likely be fined.

See also “Penalties for supplementary SZV-M must be paid to the director.”

But the situation with entrepreneurs has recently changed. If an individual entrepreneur acts as both an insurer for hired personnel and an official, he cannot be issued 2 fines. We are talking about an administrative fine under Art. 15.33.2 Code of Administrative Offenses of the Russian Federation. It should no longer apply to individual entrepreneurs. The corresponding addition to this article appeared thanks to the law of December 16, 2020 No. 444-FZ.

The law came into force on December 27, 2019. But in fact, the fines were canceled already in February 2022 by the Constitutional Court (resolution No. 8-P dated 02/04/2019). The Constitutional Court then indicated that punishing an individual entrepreneur who had already been fined for failure to submit personalized reports as an insurer (Article 17 of the Law “On Accounting” dated 04/01/1996 No. 27-FZ) also under Art. 15.33.2 of the Code of Administrative Offenses of the Russian Federation is unlawful. This results in double responsibility, and this is unacceptable.

Error in the original SZV-M form

The policyholder submitted the SZV-M on time, but after that he discovered an error in it. To correct it, he submits an updated form, but this happens later than the 15th.

, the Instructions for maintaining personalized records , came into force . Paragraph 39 of this document states that sanctions are not applied to entities that independently correct their mistakes. However, during inspections of earlier periods, Pension Fund specialists often impose fines .

Let us say right away that in such cases, arbitrators usually side with the policyholders. Examples are the resolutions of the Far Eastern District AS dated 04/10/17 No. F03-924/2017 and the Volga District AS dated 01/17/18 No. F06-28745/2017. Argument: since the policyholder independently discovered and corrected the error before the Fund learned about it, it is unlawful to impose a fine.

The same thing is said in the resolution of the Administrative District of the North Caucasus District dated September 20, 2017 No. A20-3775/2016. The only difference is that it deals with the submission of reports in electronic form.

Fine for non-compliance with order

Since 2022, a new fine related to SZV-M has appeared in the legislation on personalized accounting. Note that it is not related to the out-of-date presentation of monthly reporting. The new fine concerns the method of submitting the SZV-M.

Please note that in 2022, it is possible to report using the SZV-M form “on paper” only if the report includes information for less than 25 people. If the report includes 25 or more insured persons, then you need to submit the report in the form of an electronic document signed with an enhanced qualified electronic signature (paragraph 3, paragraph 2, article 8 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) ) registration in the compulsory pension insurance system").

If in 2022 an organization or individual entrepreneur does not comply with the specified requirement regarding the method of submitting the SZV-M, then inspectors from the Pension Fund of the Russian Federation will have the right to impose a new fine of 1,000 rubles. Since 2022, this fine has been added to Article 17 of Federal Law No. 27-FZ dated April 1, 1996.

Forgotten employees

The accountant submitted the SZV-M in a timely manner, but due to carelessness did not include one employee in the form. To correct this oversight, a supplemental form was submitted with the employee's information. However, the accountant did not manage to submit it on time. As a result, a fine of 500 rubles followed.

If there is only one forgotten employee or there are several, it doesn’t matter. But in large companies, such forgetfulness can result in very tangible problems.

Is it legal to impose a fine in such a situation? After all, only the supplementary form was submitted beyond the deadline for submitting reports, while the primary one was submitted on time. Arbitration practice is ambiguous, for example:

- Resolution dated December 25, 2017 No. F03-5001/2017. The judges sided with the Pension Fund. The argument is this: in the supplementary form, information about forgotten employees was submitted for the first time. They were missing in the original form, therefore information about them was received by the fund late.

- Resolution of the AS of the East Siberian District dated October 5, 2017 No. A78-1989/2017. The court supported the insured. In his opinion, the supplementary form SZV-M is, in essence, a correction of errors in the original report . And no fine is imposed for this.

So, judicial practice suggests that in such a situation there is still a chance to challenge the fine. So if the amount is really significant, you should go to court.

Problems due to maintenance work

Situation

The employer delayed the deadline for submitting the SZV-M and tried to send the report electronically to the Pension Fund on the last day. There were glitches on the Internet, which is why the SZV-M was never delivered to the transport server. The company was still able to send a report the next day when the network was restored.

The Pension Fund decided to fine the organization because it violated the deadline for submitting the SZV-M.

Solution

The employer did not agree with the imposed fine and went to court to resolve the conflict situation. The judicial authorities sided with him, arguing that the company presented letters from the provider about the lack of Internet connection services due to maintenance work.

The Arbitration Court of the East Siberian District issued Resolution No. F02-2402/2020 dated June 23, 2020, in which it indicated that the employer was unable to pass the SZV-M through no fault of his own. And on this basis, the fine imposed by the Pension Fund was cancelled.

Incorrect data for several employees

In the following example, we will talk about challenging not the very fact of imposing a fine, but its amount.

The organization employs 100 people. SZV-M was submitted on the last day of the deadline, but was not accepted. The reason is that incorrect information was provided for three employees (SNILS or Taxpayer Identification Number). The accountant has no choice but to correct the errors and submit the form later than the 15th. The Fund considered that the report was submitted in violation of the deadline and imposed a fine of 500 rubles for each insured person . That is, the amount of the fine was 50 thousand rubles.

The insurer did not agree with this. In his opinion, the fine should be calculated based on the number of persons for whom incorrect data was indicated on the originally submitted form. With this calculation, the fine should be only 1.5 thousand rubles. Who is right?

Again, there is no consensus among the arbitrators on this matter. There were decisions when the judges took the side of the Fund (resolution of the Far Eastern District Court of November 21, 2017 No. F03-4421/2017). But there are also opposite outcomes of the proceedings, for example, the resolution of the Court of Justice of the West Siberian District dated 08/23/17 No. A27-22235/2016. It states that a report with errors regarding individuals cannot be considered not submitted in full . Accordingly, it is unlawful to calculate the fine based on the total number of insured persons.

Thus, taking into account the practice of arbitration courts, insurers have a chance to challenge such a fine. Whether to use it or not depends on the scale of the “disaster.”

When correcting an error in SZV-M threatens with a fine

If there is a violation of the deadline for submitting the SZV-M, the organization may face penalties. This can happen even if the organization independently made adjustments and corrected previously made errors in the SZV-M.

According to paragraph 2 of Art. 11 of Law No. 27 approved a list of personal data that an organization must transfer to the Pension Fund about each of its employees.

Review of the Determination of the Constitutional Court of the Russian Federation dated April 23, 2020 No. 824-O. The organization transferred all the necessary information about employees to the Pension Fund in the form of personalized records in the SZV-M form within the period established by law, and later independently discovered an error in its own reporting and submitted a clarifying form to the Pension Fund.

As a result, the Pension Fund of Russia applied penalties to the organization, in accordance with Part 3 of Art. 17 of Law No. 27-FZ for violation of reporting deadlines. This decision was challenged, after which it was canceled and declared invalid due to the fact that, according to the provisions of the legislation of the Russian Federation, organizations have the legal right to independently identify and correct identified errors in the previously submitted personal data of employees, if the organization discovered the data errors before they were discovered by Pension Fund employees when checking the statements.

However, for the same violation they were prosecuted under Art. 15.33.2 Code of Administrative Offenses of the Russian Federation of the General Director.

The courts came to the conclusion that the organization’s independent elimination of errors in reports submitted on time, as well as the refusal to hold it accountable, are not grounds for releasing the head of the organization from administrative liability.

In response to this, the general director appealed to the Constitutional Court of the Russian Federation with a request to recognize Art. 15.33.2 of the Code of Administrative Offenses of the Russian Federation does not comply with the law. According to the manager, the fine imposed on him is a fine for an act that is not recognized as an offense of the organization.

The Constitutional Court did not see any contradictions with the Constitution of the Russian Federation and did not accept the complaint for consideration. As the judges explained, the responsibility provided for by the Code of Administrative Offenses for managers contributes to the realization of citizens' right to social security. Such legal regulation allows law enforcement agencies to assess the real circumstances of the case and does not exclude the possibility of releasing a person from liability and applying a reprimand to him if the act is insignificant.

Late reporting: fines 2022

Organizations and individual entrepreneurs making payments and other remuneration to individuals are required to submit a report in the SZV-M form to the territorial divisions of the Pension Fund of Russia. This obligation is enshrined in 2022 in paragraph 2.2 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” The same law also provides for liability in the form of fines for late delivery of SZV-M. Article 17 of the law states that failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) false information will entail a fine of 500 rubles in relation to each insured person.

If you want to know how much you will be fined for late submission of SZV-M in 2022, then you need to multiply 500 rubles by the number of individuals about whom you must report - employees and those with whom your organization has entered into civil law contracts.

Example

Let’s assume that the organization is late in submitting the SZV-M report for January 2022. It had to be submitted no later than February 15th. However, in fact, the report was submitted to the Pension Fund only on February 22. A total of 105 people are listed in the report. Therefore, the fine for late submission of SZV-M in 2022 will be 52,500 rubles (500 × 105). Below in the table we present the amount of fines for late submission of SZV-M in 2022. As an example, we give fines from 1 to 25 individuals in the report (inclusive).

| How many individuals are there in SZV-M | Amount of fine |

| 1 | 500 rub. |

| 2 | 1000 rub. |

| 3 | 1500 rub. |

| 4 | 2000 rub. |

| 5 | 2500 rub. |

| 6 | 3000 rub. |

| 7 | 3500 rub. |

| 8 | 4000 rub. |

| 9 | 4500 rub. |

| 10 | 5000 rub. |

| 11 | 5500 rub. |

| 12 | 6000 rub. |

| 13 | 6500 rub. |

| 14 | 7000 rub. |

| 15 | 7500 rub. |

| 16 | 8000 rub. |

| 17 | 8500 rub. |

| 18 | 9000 rub. |

| 19 | 9500 rub. |

| 20 | 10,000 rub. |

| 21 | 11,000 rub. |

| 22 | 11,500 rub. |

| 23 | 12,000 rub. |

| 24 | 12,500 rub. |

| 25 | 13,000 rub. |

Late submission of SZV-M due to error correction

The policyholder sent the SZV-M form on time, but subsequently discovered an error in the already submitted report. In order to correct the situation, the employer submitted clarifications , but they were received by the fund after the end of the period allotted for submitting reports .

Companies and entrepreneurs who independently identify and correct their mistakes will not face a fine . This is directly stated in paragraph 40 of the Instruction, approved by order of the Ministry of Labor of Russia dated April 22, 2020 No. 211n.

If we look at precedents, it turns out that fines are avoided even by those companies that made corrections to their reports after the error was discovered by Pension Fund employees during an audit, which was reported to the organization.

For example, there is a precedent for how penalties were challenged by an individual entrepreneur who mixed up the columns in the reporting that were allocated for the name and patronymic. The judicial authorities expressed support for the entrepreneur due to the insignificant nature of the mistake (resolution of the Court of Justice of the West Siberian District in resolution dated December 14, 2018 No. A27-6320/2018). A similar decision was made in a case against a company that made a mistake in an employee’s patronymic (decision of the RF Armed Forces dated September 28, 2018 No. 309-KG18-14482).

What circumstances may be considered mitigating?

It is often possible to reduce the amount of the fine for late submission of SZV-M if the violations were committed by the policyholder under extenuating circumstances. And there are many examples of this in arbitration practice. Such circumstances may include:

- Short period of delay . In the understanding of judges, this is usually no more than 16 days.

- Primary violation . For those who have never done anything like this before, the fine for the first time can be reduced considerably.

- No arrears in payment of insurance premiums. If the payer is in good standing, they may meet him halfway and reduce the amount of sanctions.

- Technical problems : lack of communication, electricity, software failures, and so on. Often, fines are completely waived.

- Difficult life circumstances of persons on whom, due to their job responsibilities, the delivery of the SZV-M depends.

The following table provides examples of mitigating circumstances.

Table. What can mitigate the fine for submitting SZV-M in violation of the deadline?

| Judgment | Mitigating circumstances taken into account by the court | Pension Fund fine (in rubles) | Fine by court decision (in rubles) |

| Resolution of the Central District Court of September 4, 2019 No. A83-2432/2019 |

| 23 500 | 2 350 |

| Resolution of the AS of the West Siberian District dated May 21, 21 No. A70-18969/2020 |

| 39 000 | 3 900 |

| Resolution of the Volga-Vyatka District AS dated March 28, 2019 No. A43-18123/2018 |

| 556 000 | 278 000 |

| Resolution of the AS of the East Siberian District dated 09/06/17 No. A78-15400/2016 |

| 208 000 | 1 000 |

| Resolution of the Volga-Vyatka District AS dated March 28, 2019 No. A43-18123/2018 |

| 500 000 | 250 000 |

| Resolution of the AS of the Ural District dated May 24, 2017 No. A76-27244/2016 |

| 54 500 | 5 450 |

| Resolution of the Volga-Vyatka District Administration of July 17, 2017 No. A28-11249/2016 |

| 74 000 | 0 |

Find out how to correctly fill out the annual SZV-STAGE form.

How the Pension Fund will collect fines in 2022

The procedure for collecting fines for late submission of SZV-M and for failure to comply with the procedure for submitting a report is described in Article 17 of Federal Law No. 27-FZ dated April 1, 1996. The procedure for collecting fines consists of several stages. So, in particular, an act will be drawn up. Then you will be required to pay a fine for late submission of the SZV-M. It will need to be paid within 10 calendar days from the date of receipt. Or, a longer period may be set for payment of the fine directly in the requirement itself. You will need to pay the fine for late submission of SZV-M in 2022 at KBK 392 1 1600 140. It has not changed.

In 2022, PFR units have the right to collect any fines for SZV-M exclusively in court. This is directly stated in Article 17 of the Federal Law dated 04/01/1996 No. 27-FZ (as amended by the Federal Law dated 07/03/2016 No. 250-FZ). Pension Fund authorities do not have the right to write off fines for SZV-M directly from bank accounts.

It is worth noting that in 2016, the PFR authorities actually had the right to write off fines for SZV-M in a pre-trial manner and write off fines directly from the accounts of payers. This possibility was provided for in Article 17 of the Federal Law of April 1, 1996 No. 27-FZ. However, starting from 2022, the Pension Fund of Russia does not have such an opportunity.

Late submission of SZV-M: how to avoid a fine

In order to avoid paying a fine, you must avoid violating the rules for submitting a report on insured persons . It is most convenient to prepare and submit documentation and reporting to the Pension Fund not on the deadline for submitting reports, but at least 2-3 days before the deadline allotted by inspectors for submitting documentation expires. This minimizes the risk of being late, for example due to technical failures. Otherwise, you may run into penalties for failure to provide SZV-M.

Read the step-by-step guide to filling out the SZV-M

When submitting reports, it is necessary to check the information sent to the Pension Fund as carefully and thoroughly as possible. Even after the transfer of documentation is completed. In the event that the policyholder independently discovers an error and does it earlier than the Pension Fund employee, the organization is exempt from paying penalties.

In a situation where the fine has already been issued and its amount is significant, do not be afraid to go to court . It is the arbitrators who will be able to decide what amount is appropriate for lateness or errors made in the SZV-M. Judicial practice confirms that judges often reduce the amount of penalties when an organization refers to a minor delay or the presence of mitigating circumstances, such as technical failures that were not the fault of the company, equipment breakdown, or in the case of a first-time offense.

use the Kontur.Extern web service to prepare and check reports feel most comfortable . All current updates and test programs are installed without user intervention. If the data entered by the policyholder does not meet the requirements for filling out the form and control ratios, the system will certainly warn him about this and tell him how to correct the errors. And timely correction of errors will save the accountant from the need to submit “clarifications,” go to court or pay fines.

How to challenge a Pension Fund fine for SZV-M

When filing an objection to the PFR inspection report for the purpose of subsequent appeal in court, you must indicate one or more of the following circumstances:

- the insignificance of violation of the deadline for submitting reports;

- objective circumstances: system failure, PC failure;

- the employee did not notify in a timely manner about the change in personal data or brought the documents late;

- first time mistake;

- corrections were made before the Pension Fund discovered the violations;

- no damage to the budget.

Penalties can be completely canceled by a court decision, provided that there have been violations of the law on the part of the Pension Fund in terms of:

- formation of an act of violation;

- compliance with the deadlines for sending the report to the policyholder;

- providing the opportunity to voluntarily correct the error;

- deadlines for issuing SNILS to employees.

The number of procedural errors found directly affects the court's decision to cancel or reduce the fine.

It is quite possible to appeal the decision of the Pension Fund without going through the fund itself. In this case, objections to the inspection report must be sent directly to the court .

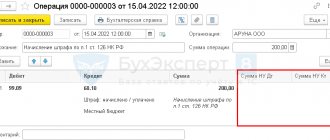

How to pay a fine for SZV-M

In the case when the management of an organization decides to voluntarily pay the imposed penalties, it is important to remember that the payment order has a number of features and nuances in the columns:

- purpose of payment;

- KBK (always check that it was the KBK that was indicated for fines received from the Pension Fund);

- OKTMO (put the code that is defined for your company by Rosstat).

In the remaining fields, that is, in all except KBK and OKTMO, enter one zero. The purpose of the payment is less unified, but it is better to indicate in it as much information as possible to identify the payment:

- company registration number as an insurer;

- details of the document imposing penalties on the organization or requirements for its payment

Most often, organizations decide to pay the fine after the fine has expired, which is usually 10 days after the company is required to pay. Missing the deadline for paying a fine is a kind of signal for the Pension Fund to begin preparing a lawsuit. Therefore, after making a decision to pay, you must make sure that there is no claim against the company, otherwise the fine will be charged to the company again.