What is the simplified tax system

The simplified taxation system, or as it is affectionately called “simplified”, is the choice of more than 2 million small businesses. It allows you to optimize the tax burden and minimize the costs of reporting preparation. Suitable for both individual entrepreneurs and legal entities.

This special regime involves the payment of a single tax, which replaces three taxes of the main system:

Unlike other special regimes, the simplified tax system does not apply to a separate type of activity, but to everything that the company does. For this reason, the simplification cannot be combined with the main taxation system, which also applies to all activities of the company. The only possible combination in 2022 is the simplified tax system + patent.

Income or income reduced by expenses

The simplified system involves two taxation options. If you choose the simplified tax system “income”, your tax base is maximum, but the interest rate is minimum - 6%. If you choose “income minus expenses,” then, on the contrary, you have a minimum tax base (approximately equal to profit), and the maximum interest rate is 15%. Making the right choice means finding a balance for your enterprise between the amount of interest and the taxable object from which it is calculated.

Regional authorities can reduce the tax rate under the simplified tax system “income” to 1%, and under the simplified tax system “income minus expenses” to 5%. Thus, in Moscow, the rate for those using the simplified tax system “income minus expenses” has been reduced by one and a half times and amounts to 10%, and in St. Petersburg it has been reduced by half and amounts to 7%. In the Sverdlovsk region, newly registered individual entrepreneurs in certain areas of business on any tax object pay only 1%.

The main selection criterion for a business owner is the share of expenses. If they account for more than 65% of revenue, then it makes sense to apply the simplified tax system “income minus expenses.” Many people do this:

- retailers where the price of a product includes its purchase;

- catering establishments and manufacturing companies that have high costs for purchasing materials;

- companies are at the stage of their formation, when not everything is streamlined in the procurement system and there is a lot of spending on the acquisition of fixed assets.

It is more profitable for them to pay the maximum interest, but taken from a small amount, than the minimum interest, but taken from a huge amount, which includes expensive expenses.

If expenses account for less than 65% of revenue, then it is more profitable to use the simplified tax system “income”. This is what many enterprises in the service sector do to the public: beauty salons, household repair shops, car services, legal offices. Deducting expenses from income does not significantly reduce their tax base, so they prioritize low interest rates.

Conditions for switching to simplified tax system

The simplified tax system usually employs those who deal with counterparties in special regimes. If you often supply goods or provide services to enterprises on OSNO, then using a simplified system will only hinder you from concluding transactions. It’s all about VAT: in the simplified system you don’t pay this tax, but your counterparties in the main system do, and with any purchase of goods or order of services from you, they will have to lose on the deduction of input VAT. Therefore, in practice, a trend has taken hold: organizations on OSNO are reluctant to buy anything or order from suppliers in special modes.

The size of the business is also limited. In order not to lose the right to simplified taxation, you must comply with the following limits:

You can go beyond the limits a little, but subject to paying tax at a higher rate. If your annual turnover reaches the range from 154.8 million to 206.4 million* rubles and/or the number of employees is in the range of 100-130 people, then the rate for you this year will increase:

For legal entities there are also incoming requirements, without which they will not be transferred to the simplified tax system:

Transition deadlines

There are two options for submitting an application for the simplified tax system:

- when registering an individual entrepreneur, simultaneously with other papers;

- within 30 days after registration.

Submitting a notification along with registration documents

The advantage of this option is that it saves time on visiting the inspection again to submit a notification. The application is submitted along with other documents, and the individual entrepreneur immediately begins to apply the simplified form after registration.

The downside is the risk of refusal to accept an application to switch to a simplified system in inspections that only deal with the registration of individual entrepreneurs and LLCs. For example, in Moscow, all individual entrepreneurs are registered by only one inspection - Federal Tax Service Inspectorate No. 46, and it does not matter in which district of Moscow the future individual entrepreneur lives.

If this happens, don’t worry, there is a backup option. After registration, but within 30 days, an individual entrepreneur can submit a notification to the tax office at the place of permanent residence.

Recently, the risk of registration inspections refusing to accept a notification on the simplified tax system has decreased to almost zero.

Submission of documents within 30 days after registration

This option is convenient for those individual entrepreneurs who have not fully decided on the taxation system, forgot or were refused to submit a notification at the same time when registering an individual entrepreneur.

Despite the fact that the application is submitted after registration, the individual entrepreneur will be transferred to the simplified tax system from the date of creation. But if the entrepreneur does not meet the 30-day deadline and submits the notification later, he will be placed under the general taxation regime, in which he will have to work until the end of the year. So don't tighten it too much.

Deadline for submitting notification of transition to simplified tax system

By default, switching to the simplified tax system or changing the tax base is possible only from the new year, and an application for this must be submitted no later than December 31 of the previous year. That is, when submitting an application during 2022, you will be able to apply the simplified system or change the tax base only from January 1, 2022.

For legal entities switching from OSNO to the simplified tax system, the filing period is actually limited to the last three months of the year, because they need to indicate income for the first nine months and the residual value of fixed assets as of October 1.

Only two categories of taxpayers are not tied to December 31:

Taxpayers who have lost the right to use the simplified tax system cannot apply for simplified taxation starting next year.

For example, in the third quarter of 2022, the company exceeds the maximum possible annual turnover limit for a simplifier of 206.4 million rubles. Starting from this quarter, it automatically switches to the main system and cannot apply for the use of the simplified tax system from the next 2022 - only from 2023.

Application form

The notification of the transition to the simplified tax system when registering an individual entrepreneur does not have to be filled out on the form recommended by the Federal Tax Service (form 26.2-1). It can be compiled in free form on a regular piece of paper.

Despite the possibility of submitting an application to the simplified tax system in any form, we still recommend using the official form (26.2-1) - this will eliminate the possibility of refusal to accept the document.

The official application form was approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3/ [email protected] and is valid in 2022.

Fill out the simplified taxation system notification and other documents for individual entrepreneur registration

The notification is universal and is suitable for both the simplified tax system 6% and the simplified tax system 15%. Form 26.2-1 can be downloaded here:

How to fill out a notice of transition to the simplified tax system

There are two forms approved by the Order of the Federal Tax Service of Russia:

- Form 26.2-1 - for switching from another tax system or for applying simplification from the start of business. We will look at filling it out line by line in this article.

- Form 26.2-6 - to change the object of taxation within the framework of the already applied simplified tax system. A very simple form: if you still have difficulties with it, you will find all the answers in the analysis of the previous form.

We fill out the notification about the transition to the simplified tax system

Step 1. TIN and checkpoint

In the TIN line, indicate the taxpayer number. If you are an individual entrepreneur, your individual taxpayer number will occupy all the cells of the line. If you represent an organization, your number will be shorter, so you need to put dashes in the empty cells, like this:

In the checkpoint line, you must indicate the reason for registration code, which is assigned to the taxpayer-legal entity along with the TIN. If you are an individual entrepreneur, put dashes in each cell of this line, like this:

If you submit a notification as a newly formed individual entrepreneur or legal entity within 30 calendar days from the date of registration, then put dashes in all the cells of the TIN and KPP line, like this:

The default number of document pages is “001” - leave it as is.

Step 2. Tax authority code

You can always look up the code of your tax authority on the Federal Tax Service website in the “Determination of Federal Tax Service Details” section. To do this, indicate your registration address if you are an individual entrepreneur, or legal address if you represent an organization, and you will see all the contact information for your tax office, including its four-digit code.

For example, for entrepreneurs and organizations registered in the Butyrsky district of Moscow, the tax authority number is 7715:

We enter it into our form:

Step 3. Taxpayer attribute code

If you submit a notification on the day of submitting documents for registration as an individual entrepreneur or legal entity, then indicate the number “1”.

If you submit a notification within 30 calendar days from the date of registration, but not on this day itself, then indicate the number “2”.

If you are switching from another SNO or are a former UTII payer, then indicate the number “3”.

For those who were on UTII in the third quarter of 2022!

Despite the words “except for UTII payers” opposite the code “3” at the bottom of the notification, you should still indicate the number “3” and not “2”. The fact is that the document form was drawn up a long time ago and does not yet take into account the fact that the UTII no longer exists. Those who applied imputation until the end of 2022 and did not change the tax system on time, from the beginning of 2022 automatically switched to OSNO, which means in fact they are switching to a simplified system not from UTII, but from OSNO. Be careful, your number is “3”.

Step 4. Name of the organization or full name of the individual entrepreneur

If you are an individual entrepreneur, write down your last name on the first line, your first name on the second line, and your middle name (if you have one) on the third line. Put dashes in all empty cells, like this:

If you represent an organization, write its full name on the line - as indicated in the charter of your organization. Separate words with spaces, like this:

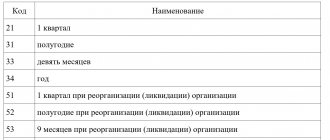

Step 5. Date of transition to simplified tax system

If you are switching to a simplified tax system from any other tax system, then indicate the number “1” on the first line, and specify the year on the second, like this:

If you are switching to a simplified tax system at the same time as submitting documents for tax registration or within 30 calendar days from the date of registration, indicate the number “2” on the first line and do not indicate anything on the second line:

Code “3” was relevant for payers of the single tax on imputed income when it still existed. Now there is no reason to use it, even among former UTII payers.

Step 6. Selecting an object of taxation

Here there should be no difficulty in specifying the required code. It is not easy to choose the object of taxation: to understand what is more profitable for your company - to calculate 6% of income or 15% of the difference between income and expenses.

Don’t be afraid to make a mistake with your choice: if you send an application in advance and some time before the deadline for its submission you decide that it is more profitable for you to work on a simplified basis with another tax object, simply submit a new, corrected application - there is no need to withdraw the old one. And if you want to refuse to switch to the simplified tax system, simply notify of your refusal within the same time frame.

Step 7. Organization's income for 9 months

Income for 9 months of the current year is indicated only by organizations switching from the basic system to the simplified one. All individual entrepreneurs put dashes:

If you used UTII or PSN in combination with OSNO, consider the income received only under OSNO. Perhaps it will be zero if you conducted activities only on imputation and/or patents:

If there is annual income under the OSNO as of October 1, all that remains is to make sure that it does not exceed 112.5 million rubles - this is one of the requirements for the simplified tax system - and write it down:

Step 8. Residual value of fixed assets as of October 1

This column is also intended only for organizations. An individual entrepreneur puts dashes in it:

The representative of the legal entity indicates the cost of fixed assets of production, taking into account their revaluation (if it was carried out) and minus their depreciation - as of October 1 of the year of filing the notification.

If you keep accounting in a special program, then the OS statement will help you find out the residual value, and if it is not there, then you will find everything necessary for the calculation in the balance sheets for accounts 01 and 02.

The residual value of the fixed assets should not exceed 150 million rubles.

Step 9. Taxpayer or taxpayer's representative

If you are an individual entrepreneur or the head of an organization, then in the column about the number of sheets of the supporting document, put dashes, and below indicate the number “1”.

If you are acting on behalf of the head of an organization, you will need documents confirming your authority. Therefore, in the top column, indicate how many sheets the document you are attaching occupies, and on the next line indicate the number “2”:

Choosing the simplified tax system as a taxation system

To switch to the simplified tax system, a legal entity or individual entrepreneur submits to the Federal Tax Service inspection at the place of registration a message about the application of the simplified tax system according to the form No. 26.2-1 recommended by the order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3 / [email protected] . The order also contains instructions on how to fill out the notification. He is directed by:

- when switching to a simplified system from the date of registration;

- when the tax system changes in the next tax period.

In the first case, the filing deadline is 30 calendar days from the date of registration (clause 2 of article 6.1 of the Tax Code of the Russian Federation, clause 2 of article 346.13 of the Tax Code of the Russian Federation). In the second, you need to do it before December 31 of the year that precedes the year in which the changes apply.

IMPORTANT!

The transition to the simplified tax system during the calendar year is not provided for existing legal entities and individual entrepreneurs.

To select a simplification, you must meet a number of criteria, which are slightly different for entrepreneurs and organizations. An individual entrepreneur has the right to switch to this special regime if:

- it employs less than 100 people;

- income less than 150 million rubles.

Legal entities have the right to apply the simplified tax system in 2022 if:

- number of employees - less than 100;

- income for 9 months of 2022 did not exceed 112.5 million rubles when working on the simplified tax system (clause 2 of article 346.12 of the Tax Code of the Russian Federation);

- residual value of fixed assets - less than 150 million rubles;

- the share of other companies in the authorized capital is less than 25%;

- the company has no branches;

- activity does not relate to the financial sector (banks, insurers);

- earnings for last year amounted to less than 150 million rubles (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

Use free instructions from ConsultantPlus experts to switch to the simplified tax system from another tax system.

How to submit a notification of transition to the simplified tax system

The fastest and most reliable way is to send a scanned copy of the paper notice and related documents (if any) through the taxpayer’s personal account or through your electronic document management operator. To do this, you will need an enhanced qualified signature.

Also, a notification with attached documents can be given to your inspector in person at the department or sent by registered mail to the address of your Federal Tax Service office. When sending by mail, be sure to make a list of documents and order a notification of receipt. The date of sending the notice is considered to be the day on which you delivered the registered letter to the post office, and not the day the letter was received by the tax service.