What does this code mean

The tax identification number is a unique 12-digit code. It has been assigned to every citizen of the Russian Federation since 1999. This personal account is opened once and remains unchanged throughout life. His data is not adjusted when changing his last name, marital status or passport document.

The identification code is opened by tax office employees. The corresponding certificate is issued to the person. For individuals, it is a “tag” before the tax authorities. Using this code, inspectors instantly determine what taxes he needs to pay and what payments the person has made previously.

Why do you need a TIN?

The tax number is a mandatory detail of its carrier, which is indicated in tax returns, reporting, payment, legal and other documents. The most basic thing for which a TIN is needed is to organize information about citizens and organizations that are tax payers. Since the number is unique, it avoids confusion associated with the fact that people can have completely identical full names, and organizations within the same city can have the same names and carry out activities within the same type. The use of TIN allows you to significantly speed up the solution of problems related to the processing of personal data. In particular, the use of an identifier makes it easier to find data, prevents repetitions and errors, and prevents payments from being sent to the wrong recipient.

In addition, the TIN of a person or enterprise can serve as a source of necessary information about its carrier, which is sometimes necessary for conducting various checks. For example, using this code you can easily find out in which region and in which tax office its bearer was registered. Additionally, it allows you to obtain data about the year of birth of a person or the year of registration of a legal entity by analyzing the serial number.

Why does an individual need a TIN?

This information will be needed in the following situations:

- When applying for a job.

- For registration of social benefits, budget payments and subsidies.

- To participate in preferential government programs.

- When concluding financial transactions.

- For authorization on various Internet portals, for example, the State Services website.

When transferring various taxes and fees, it is advisable to indicate the TIN. Having a unique payer number will help avoid confusion in documents. In some cases, banks also request a certificate when applying for a loan. Using the code, they check whether the borrower has debts on taxes, alimony, and other budget payments.

What does the Taxpayer Identification Number look like?

This is a light beige numbered form that contains information about the person; the document is issued on a sheet of A4 paper. What details should be:

- Personal data that completely repeats the information in the passport - last name, first name, patronymic of the taxpayer;

- Date and place of birth;

- Gender of the person;

- The date when the citizen was registered with the territorial tax authority;

- And the 12-digit number itself, which is the person’s identifier.

The document must have a wet stamp from the tax structure and the signature of the head of the organization.

How to get a TIN

To obtain an identification number, you must contact the tax office at your place of residence. Provide your civil passport and fill out an application in the prescribed form. Within five days, the certificate is issued in person.

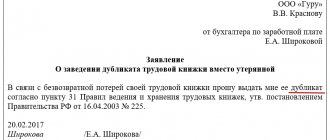

If this document is lost, it can be restored. You need to submit a corresponding application to the tax office at your place of residence. A duplicate is issued within 2-3.

If necessary, a TIN can be assigned to a child, even before he receives a civil passport. The application is accepted from the child’s legal representative - parents, guardians or adoptive parents.

Re-obtaining TIN

To restore the TIN certificate (in case of loss or theft), an individual must apply in person

or

through a representative

to any Federal Tax Service Inspectorate (MRI Federal Tax Service), and submit the following documents:

- Application in any form for the issuance of a duplicate TIN certificate.

- Identity document (Russian passport).

- A document confirming registration at the place of residence (5th page of the Russian passport).

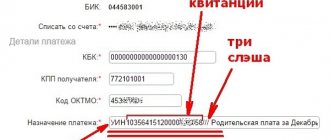

- Paid receipt of state duty in the amount of 300 rubles

(pay the state duty). - A copy of a document confirming the authority of a representative of an individual (notarized power of attorney).

If you change your place of residence, get it again

new certificate

is required

.

Note

: replacing the TIN due to a change in full name, gender, date and place of birth is completely free. At the same time, the legislator specifically notes that in these cases, replacing the TIN is not the responsibility of the citizen.

How to find out TIN

If you only need to know the code and do not need a document confirming its issuance, then there is no need to contact the tax office. This information can also be found on the Internet:

- Go to the website of the Russian Tax Service.

- Go to the “Find out TIN” section.

- In the form that opens, indicate: full name, passport details and date of birth.

- If a citizen is registered for tax purposes, his identification code will be displayed in the result period.

Through the website of the Federal Tax Service, you can find out the TIN of any person, possessing his personal data.

On the State Services portal, information about the TIN is provided only to its owner. In your personal account, you need to set the search query “Find out your TIN” and instantly receive an answer.

What is TIN

The abbreviation “INN” stands for “taxpayer identification number.” This is a combination of 12 digits for individuals and individual entrepreneurs and 10 digits for legal entities. It is the “key” to your information “box” in the tax service. It records information about you, the taxes you pay and the deductions you receive. TIN is required for tax registration of every citizen in the Russian Federation. A taxpayer number is assigned to a person without fail. All information about the TIN and the rules for its assignment is contained in Order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/435 dated June 29, 2012.

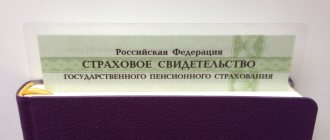

This is what the TIN looks like:

The word Certificate catches the eye and some people sometimes confuse this and start looking for another document. But if you look lower at the numbers, then to the left of them you can see the decoding of the TIN - Taxpayer Identification Number.

Similar requirements are used for organizations and individual entrepreneurs - they are assigned a TIN for the entire period of their existence. Without an identification number, a legal entity or individual entrepreneur cannot legally work.

TIN and religion

Many believers, due to their religious beliefs, would like to refuse a tax number. But current legislation does not provide for a procedure for canceling or destroying a TIN.

The leadership of the Federal Tax Service comments on this issue as follows. If a believer has received a tax receipt that contains his identification code, he may not pay this document. He needs to go to the bank branch and fill out the payment document himself. It is not necessary to indicate the TIN. But payments must be made to the budget within the established time frame.

But the payer must understand that without a TIN, the payment risks being lost. Full name is not unique information. There is a risk that money will be credited to the wrong taxpayer.

A tax identification number is mandatory for all citizens of the Russian Federation, regardless of their religious beliefs. Whether you want it or not, it will be assigned to you automatically when taxes are calculated. Persons who are officially employed pay income tax, so they must have a code.

It is advisable to contact your local tax office and receive a certificate. It may be useful in the future when applying for loans, concluding financial transactions, or contacting budgetary structures.

5 / 5 ( 2 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Types of TIN

In the Russian Federation there are 4 (four) types of TIN:

- TIN of an individual . Consists of 12 Arabic digits, the first of which indicate the code of the subject of the Russian Federation, the next two - the number of the local tax office, the next six - the number of the taxpayer's tax record and the last two - “check digits” to check the correctness of the entry;

- TIN of an individual entrepreneur . Assigned upon registration of an individual as an individual entrepreneur;

- TIN of a legal entity . Represents a record of a sequence of 10 Arabic digits: the first two are the code of the subject of the Russian Federation in accordance with Article 65 of the Constitution, the next two are the number of the local tax inspectorate, the next five are the number of the taxpayer’s tax record in the territorial section of the OGRN and the last is the check digit;

- TIN of a foreign legal entity . Assigned from January 1, 2005. The number always starts with the numbers “9909”, the next five digits correspond to the Foreign Organization Code, the last one is the check digit.

A legal entity, along with an INN, is assigned a reason for registration code (RPC), which makes it possible to identify each separate division of the organization.

Comments: 5

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexei

02/02/2022 at 16:09 The article states that citizens have 2 mandatory documents - a passport and an INN, the Federal Tax Service website states that “A INN for citizens is a right, not an obligation” https://www.nalog.gov .ru/rn91/news/activities_fts/5294601/ Please clarify whether obtaining a TIN is the responsibility of all citizens of the Russian Federation or is a TIN only necessary for those who want to do business?

Reply ↓ Anna Popovich

02/02/2022 at 21:48Dear Alexey, in accordance with paragraph 7 of Article 84 of the Tax Code of the Russian Federation, each taxpayer is assigned a single taxpayer identification number (TIN) throughout the entire territory of the Russian Federation for all types of taxes and fees. Receiving it is voluntary, but the TIN is required even when applying for a job, therefore, receiving it is actually mandatory.

Reply ↓

03.12.2021 at 15:51

This question has long arisen: if I privatized the house and land, then it is already my property, the question is: why do I pay taxes then? And another question, if this is my property, why should I ask permission to build something on my land. To be honest, something doesn’t smell clean here, they are fooling people as they want

Reply ↓

07/20/2021 at 13:03

Hello. My question is, I have one tax identification number in my hands, but the government services on the website have a different tax identification number, what should I do?

Reply ↓

- Anna Popovich

07/20/2021 at 14:40

Dear Vitaly, you can find out the correct TIN at this link. If discrepancies are confirmed, you must contact the tax office at your place of residence in person, by mail or electronically on the website of the Federal Tax Service of Russia (www.nalog.ru).

Reply ↓

What can you find out from the TIN, and why is it needed?

The individual taxpayer number provides complete information about the citizen - full name, region of residence, registration address, where and by what authority it was registered with the tax service. The TIN must be indicated in reports, declarations, applications or any other documents submitted to the tax service. It is also used not only in the economic sphere or to improve the quality of tax control, but also in almost all social spheres of society.

The existence of an individual number speeds up the processing of any personal data and prevents the repetition of information and errors that the applicant may make. The TIN allows you to eliminate confusion when identifying persons with the same last names, first names, patronymics, and residential addresses. TIN of organizations also prevents errors when finding organizations with the same name or type of activity.

We issue a TIN online

You can get the code without even leaving your home. To do this, you need to visit the official resource of the Federal Tax Service, go to the “Registration of an individual” section. To issue an ID:

- Fill out an application on the website;

- Register it in the proposed manner and send it to the tax office for processing;

- A report on the processing process will be sent to your email address (specified during registration);

- Contact the tax office at the place of registration and pick up the completed TIN.

To obtain a taxpayer number, you will need to provide a special registration number that will be sent to you by email.