A modern enterprise, especially if it sells retail products, has many forms through which it reports to the tax authority. By the way, before Federal Law 54 came into force, which directly regulated the use of new forms of cash register equipment, the only possible equipment was outdated machines without online capabilities. And since, unlike newer models, they cannot communicate with the Federal Tax Service in real time, strict financial reporting measures had to be implemented. In this review, we will talk about the Z-report for the cash register, describe what it is and how to work correctly with this form of documentation.

What kind of reporting is this?

It happens exactly once every 24 hours. And these are not advisory requirements, but strictly mandatory. If the withdrawal procedure has not been carried out within 24 hours, the cash register will simply be blocked. He won't be able to function.

This form is full-fledged documentation marking the closure of the shift. All information received is carefully stored in the company’s accounting department, awaiting its fate. Specifically, getting to know the Federal Tax Service. After each cancellation period, there are exactly 24 hours left when the cashier has the opportunity to make a withdrawal again. If this does not happen, not only the equipment may be blocked, but also financial fines from the authorities.

It is noteworthy, but this manipulation is not needed by the enterprise itself. It does not use the information received in any way. There is no logic to conducting your own checks on them. And no one will monitor these findings on a daily basis for each specific device. And identifying dishonesty of employees in this way is also pointless. And the 24 hour range doesn’t fit anywhere. It is not difficult to guess that this scheme is necessary only for tax audits.

It is worth understanding that there is no need to make any such insinuations in new equipment. It itself, without employee intervention, transmits information on each transaction or other operation directly to the tax authorities. It’s convenient and simple, and the company itself doesn’t need extra paper. But not everywhere the new century has replaced the old. These disciplines are mandatory only in some organizations with the forms of legal entities. But individual entrepreneurs can quite legally use outdated equipment. And many of them took advantage of this indulgence, not rushing to switch to new models.

Procedure for filing an application to close a cash register

Fill out the application for deregistration of the cash register using the form approved by the Federal Tax Service order dated May 29, 2017 No. ММВ-7-20/ [email protected] (Appendix No. 2). If you do this in your personal account on the tax or OFD website, you will only need to enter the required information in the fields, and the system will generate an application and send it to the Federal Tax Service.

If you decide to take the application personally to the inspectorate, fill it out on paper. But this opportunity will soon no longer exist: officials plan to make changes to 54-FZ, and then it will be possible to communicate with the tax office regarding cash registers only through your personal account on the Federal Tax Service website or the OFD office.

The application must indicate:

- name of the organization or name of the individual entrepreneur;

- TIN;

- cash register model;

- factory number;

- reason for closing the device;

- information from the report on closing the financial fund (if it was possible to create it): the day and time the report was created, its number, the fiscal sign of the document.

The tax office reviews the application within 10 working days and, if there are no errors in it, issues a card deregistering the cash register.

How to withdraw a Z-report at the end of the day

There is a certain set of details that must be reflected in this kind of check, withdrawn after a specific shift. Such a list is established by law; the specifics are contained in the order of the tax authority dated March 21, 2017.

This is the name of a legal entity; it is permissible to provide the owner’s data in some forms of enterprises, address and TIN, as well as information about the employee carrying out the act of removing the document with cancellation. The check itself must contain the number, the number of transactions, the amount of funds accepted, the cash balance at the opening and closing, details of the equipment itself, and the number of discounts taken into account. If there have been returns, they will also be processed. The full date when the procedure was performed is also indicated.

The formation is automatic; the employee does not have to enter any information manually. It is enough to carry out a manipulation consisting of a certain sequence of pressing keys/buttons on the equipment model. Which ones exactly depend on the type of device and manufacturer. There are different options. It is recommended that you read the instructions for use in the attached instructions.

Remember that if the withdrawal was not processed within 24 hours, then this is an automatic violation of current legislation. It will not remain without consequences in any case.

Report on closing the fiscal drive

Together with the application to close the cash register, data from the report on the closure of the fiscal drive is transferred to the tax office. The same report goes to the OFD and then goes to the tax office.

If the fiscal drive is broken , you do not need to make a report, but you will have to send the drive to the manufacturer for examination. He must report the results to the entrepreneur and tax authorities through the CCP office within 30 working days. If it turns out that it is possible to read data from the device, the owner of the drive must transfer it to the inspectorate no later than 60 days after sending the application to close the cash register.

If the cash register is lost or stolen , report it to the police and take a certificate of registration of the application - it will be needed to deregister the cash register. An application to close the cash register must be submitted no later than 1 business day after receiving a police certificate. In this case, a report on closing the fiscal drive will also not be needed.

If the fiscal drive is in order, generate a report on its closure.

- Make sure that all receipts for completed transactions are included in the OFD, otherwise an error signal will appear when archiving data. Create a report on the closure of a shift and look at the status of the exchange with the OFD in it: if some checks have not been sent, you will see their number and the date of the first check not sent in the list.

- Create a report on closing the FN - detailed instructions for each model should be in the user manual. In extreme cases, a service center specialist will help you. Make sure that when creating a report, the cash register is connected to the Internet so that the report goes to the OFD.

- Save or print the report - the data from it will be needed when filling out the application.

- Remove the used fiscal drive from the cash register. After this, it must be stored for 5 years and presented to regulatory authorities upon request, even if you have closed the business.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

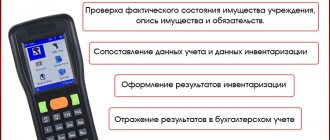

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

How to work with the Evotor device

This type belongs to the latest forms. It fully complies with all legal requirements in this area and is a “smart” terminal. More operations are performed automatically. It is quite simple to create a closing act on it.

Enough:

- In the main menu, find a note about creating reports.

- The employee will be transferred to a special section where all information from the last cancellation period is displayed. Financial transactions, income and expenses, etc.

- You need to select an action - close the shift.

- Next, you only need to print the generated document.

Validity period of the FN

Fiscal accumulators come in two types according to their validity period: 15, 36 months. Their application depends on taxation and the scope of activity of the entrepreneur:

36 month storage

| Storage for 15 months

|

Those who are registered with OSN can apply any FN, the main thing is that the model is on the list of those approved by the tax service. It is worth considering some nuances that can lead to the drive being blocked:

- data has not been transferred to the OFD for more than 30 days - the blocking is removed immediately after sending the information;

- The FN was re-registered more than 11 times - this is the maximum provided by law. If the limit is exceeded, you will have to install a new chip.

| Read also: “Fiscal accumulator 13 and 36 months. Which one should I use? |

Z-report on the cash register: what is it and their features of preparation

The modern market previously had a huge selection of equipment in this field. With amendments to the law, the range has undergone changes. However, many samples are still functioning successfully.

"Mercury 185F"

To switch to compilation mode, you will need the “MODE” button. You will need to press it again. The number of times depends on the settings. In the menu that opens, you need to start forming. To do this you will need the “IT” key. When pressed, the procedure is initiated. But user details are required to log in. If they are not installed in advance, you can enter . Or the one that is used at a given point.

"Mercury 180"

There are practically no differences with the previous paragraph. Only the button that will lead to the menu changes to the new “AN/RE”. The rest of the process is organized according to the same scheme.

"Orion 110F"

This is perhaps the easiest option for working specifically on the stated task. We will need a third mode for printing. Find the appropriate option change button and double-click on it. The display will show your selection. All that remains is to click on “enter” and agree with the chosen solution.

"Pioneer 114F"

It is necessary to open the main window with the definition of the procedure mode. There you will find the note “CCP reports”. This is the section we need. In the window that appears, close the shift by double-clicking the enter button.

Instructions on how to form at different cash desks

ATOL

ATOL cash register equipment is used by many entrepreneurs. Before making a report on the closure of the ATOL 30F fiscal accumulator, make sure that all data has been transferred to the Federal Tax Service. Then follow these steps:

Step 1. Connect the cash register to your computer via a USB port. The CCP registration application will open automatically, after which you should select “Close FN archive” in the menu.

Step 2. Synchronize the cash register and PC. Check that the date and time on the cash register and computer match.

Step 3. Select “Close FN” and wait until data archiving is complete.

The next question is how to get a report on the closure of an ATOL 90F fiscal drive or any other cash register of this brand? The receipt will be printed automatically while sending encrypted information to the tax data operator.

Shtrikh-M

To generate a report on the closure of the Shtrikh-M fiscal storage device, follow these steps:

- Connect the cash register to your PC and run the Driver Test program.

- In the menu on the left, select “FN” and make sure that all data has been transferred to the operator (the number of untransmitted messages is 0).

- In the top tab “Fiscalization of FN”, click on the button “Request for results of fiscalization”, then check the data specified for the old FN (TIN, tax regime, etc.).

- Go to the “Fiscal State” tab and select “Close Fiscal. mode".

What the report looks like for different models

Actually, everything remains at the discretion of the manufacturer. The law strictly regulates specific content, without which a check cannot be recognized as correct. But practically no recommendations are provided regarding the form of presenting this information. Accordingly, variations are allowed.

For online cash register "Mercury"

This model is distinguished by several factors. The receipt, expense and number of returns for each specific period are clearly described. The tax rate is displayed in a separate field. The title is generated automatically, based on past cancellation periods. The remainder is calculated without additional manipulations in a separate line. These are the differences between the funds that appeared and the current deductions. It is worth noting that the information is detailed and presented in a user-friendly form.

For the online cash register "Orion"

Unlike the previous model, this one is more stingy with information and less automated. It cannot be said that the content regulations are being violated. Expenses and receipts of financial resources, numbers, dates and narrow information on taxes - everything is there, but without rates and other additional features. But information that was not transmitted online is recorded.

Opening of the cash register shift. Shift opening report

The shift opening report is a fiscal document and is sent to the fiscal data operator (FDO). The report is generated when a cash register shift is opened on a cash register.

The report contains information:

- about cash register: registration number;

- factory number;

Check corrections, why it does not need to be reflected

In fact, this is a way of recording an error, inaccuracy or problem that has arisen. If the employee himself incorrectly completed the transaction, mandatory information was not reflected. In this option, you need to generate a correction check. It is noteworthy that this procedure easily corrects information, so there is no point in displaying it separately in the report. The final graphical result simply takes into account any edits and is guided by them. Therefore, the tax service does not need to note how many specific errors and failures there were at the enterprise.

What to do after removal

The received check must be submitted in strict form. It is sent directly to the application or the operator’s certificate, and is recorded in the log with a set of related data. These include the date, the total amount of funds before the opening and after the closing of the shift, specific records of expenses and income.

The further path depends on the specific scheme provided at the enterprise. The algorithm may change; there are no strict rules in this regard. The documentation goes to the shift supervisor, goes to the accounting department, is handed over to a manager or administrator, and even into the hands of the head of a branch or the entire company.

The main aspect is that information must be stored for at least five years from the date of receipt. And it is better to strictly observe this aspect; verification may reveal discrepancies.

To avoid fines and sanctions from the Federal Tax Service, and in addition, to simplify the reporting of this area to a minimum, it is most logical to use modern software techniques. The best of them are provided by the Cleverence project, because it:

- I have prepared boxed packages and am ready to provide individually developed systems for personal requirements.

- Focuses on mobile reporting management to simplify the task of control and implementation. An employee with a smartphone is enough to regulate the procedures.

- He knows Russian legislation very well, prepares applications based on current and even future regulations that are at the stage of adoption or approval.

Monitoring every day

What is a ZET cash register report? We have already clarified this a little. But they did not explain that removing it every 24 hours is a very important aspect. If the work proceeds normally, then everything is clear, no problems. But if the activity was frozen and the point did not actually carry out a single operation, everything becomes more complicated. Theoretically, comments from tax authorities indicate that in this case there is no need to carry out manipulations. There is always a chance to receive reasonable sanctions. It is also unclear that during the opening period there is almost always a certain amount of financial resources in the cash register. That is, one operation - reading the balance at the time of opening - must already be completed. It has already been completed automatically. Therefore, it is still recommended to carry out the procedure every 24 hours, even without activity.

What is the role of the z-report in CCP?

Z-report (or report with cancellation) - this is the name of the final report for previously used cash registers equipped with an EKLZ (electronic control tape). It is intended:

- to reset sales data for a shift;

- summarizing revenue per shift;

- recording data on sales results in fiscal memory;

- reflection of refunds and discounts, cancellation of checks;

- substantiation of information entered into the cashier's reporting on the cash register for posting to the operating cash desk (certificate report and journal of the cashier-operator).

A Z-report at old-style cash registers had to be generated at least every 24 hours (otherwise the cash register operation would be blocked) and had to be printed out.

Read about what unified forms can be used to generate cash reporting in the following materials:

- “Cashier-operator journal - sample filling (2021)”;

- “Unified form No. KM-6 - form and sample.”

If you have access to ConsultantPlus, find out how to organize cash accounting in a small company and what cash documents to draw up in each specific case. If you do not have access to the system, get a trial demo access for free.

Peculiarities

Let us compile the key nuances concerning this special form of reporting.

- Any already formed “Z” has its own number. Accordingly, every omission will be noticeable and easily detected even during a superficial check.

- It is impossible to repeat the procedure. After all, the equipment itself also “remembers” it. And it can be removed from memory.

- No one forbids removing the “zoke” more than required by law. At least every hour. But it is worth remembering that all copies must be sent to the appropriate authorities, properly formatted and attached.

- If there really were no operations, but you don’t want to take risks, you can withdraw a zero check.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

If you lose your Z-report

Any emergency can occur at an enterprise. And no one has canceled ordinary negligence. And due to operator errors, accounting problems, and human forgetfulness, you can lose the necessary papers. And if you simply ignore this point, then penalties for the company will begin to loom very clearly on the horizon.

We need to act quickly. To begin, draw up a loss act. And even though it is drawn up by an ordinary employee who was responsible, it must be read and signed by a senior employee. Shift supervisor, manager, administrator, director.

Next, the employee must attach an explanatory note. Under what circumstances and why the incident occurred. And then, using the EKLZ, restore the lost data and again record the analogue of the “zette”, which is sent to the journal. Remember that without calling a specialist, you will not be able to access the data.

Z-reports of online cash register

The use of cash register systems implies the movement of cash of an organization or individual entrepreneur. The Z-report implied closing and resetting the cash register once a day, and the proceeds were handed over to the administrator (senior cashier) for further collection. Based on the Z-report, the cashier generated: a cashier’s certificate-report and a cashier-operator’s journal. These documents reflected the movement of money through the cash register for the shift and were transferred to the accounting department.

The document was displayed once a day (at the end of each shift), that is, it is necessary to prepare a report for each shift. Generating a Z-report seems to be a simple operation depending on the specific cash register.

However, there were the following restrictions:

- on weekends there was no need to reset the cash register

- on weekdays, in the absence of cash transactions, the Z-report was taken with zero indicators, and cashier reports were also compiled on its basis.

Z-reports, which were supposed to be stored for 5 years, lost their essence when using an online cash register.

Important! After switching to an online cash register, organizations and individual entrepreneurs received the right to abandon the document flow of old cash registers or retain it. And these old documents that are optional for use can be filled out in any form.

If you didn't take it off on time

For example, an employee simply did not have time to take readings, and as a result, more than 24 hours passed. And it was not in vain that we noted that the norm applies specifically to a day. Any excess, even for a minute, is a discrepancy. Many enterprises in such an incident simply try to hide this fact. After all, the likelihood that information will eventually emerge is low. In fact, everything is revealed very easily with any ordinary check. Moreover, if a company operates on a simplified taxation system, then the probability of revealing an error reaches huge percentages. KUDIR will easily record discrepancies in information regarding the transaction.

In any case, it is worth initiating the procedure with explanations and restoration of lost data. Of course, this is a lot of unnecessary fuss, but you can’t go against current legislative norms. And this should not be allowed to happen in the future. After all, frequent mistakes will easily attract the close attention of tax authorities who suspect criminal intent in this scheme.

Sanctions and fines

The legal sphere is regulated by the Code of Administrative Offences. Specifically, this is Article 19. There are two possible outcomes - if there was no intent or if it could not be found. In this case, the employee himself will receive a fine of 500 rubles. But the company faces more serious consequences, up to five thousand. And if intent was found, then evasion from the requirements of the supervisory authority will also be added. Which will add a couple of thousand rubles to the fines already issued. It will be unpleasant if the tax authorities are already looking at the company with suspicion.

What is a fiscal drive and why is it needed?

A fiscal drive is a microchip that is installed in a cash register. Starting in 2022, it replaced the outdated EKLZ. FN performs several functions:

- device memory - stores all generated receipts during operation in the cash register;

- encrypts information with a crypto code to protect it from changes;

- transmits information to the fiscal data operator, as required by law.

Any online cash register without a fiscal drive does not work. Also, a cash register without a FN cannot be registered with the Tax Service, and if you use a cash register without a FN, you may receive a fine. Any interference with the operation of the chip threatens to block not only the chip itself, but also the cash register equipment as a whole, as a result of which all that remains is to purchase a new part and register the device again.