When transferring any payment to the country's budget, you must indicate the UIN. If this code is specified correctly, then you can be sure that the transfer carried out by your organizations will be quickly identified by the recipient. In the event that the UIN is not indicated, or an error is made in its numerical sequence, the payment may be lost among other unidentified payments whose senders cannot be found.

Why do you need a UIN and how to use it?

As a result, you may have various problems associated with hanging, for example, debts that you do not have. Let's look at how the UIN is used, what important things it reflects, and clarify other important points.

What is UIN

The abbreviation UIN stands for “unique accrual identifier” . The required identifier is represented by a numerical sequence, which is a kind of assistant in transferring funds to the budget.

The introduction of UIN took place in order to reduce the total volume of payments of an unclear nature. In addition, it is also needed in order to reduce the number of payments lost on the way to the place of receipt . In addition to a unique identifier, the UIN can also be called a kind of index, which plays almost the same role as the postal code to which you send your parcels or letters.

What does the UIN look like on the receipt?

So, the UIN consists of a certain number of digits , which can be:

- or 20 pieces;

- or 25.

UIN is used to make payments to government bodies of varying significance and purpose

Each payment has its own sequence, not repeated for other money transfers. The code numbers in a row carry certain data. Further in the table, let's study what information they reflect.

Table 1. What data is reflected by this or that figure of the unique accrual identifier

| UIN code example | 111 3 444 444 444 444 444 5 |

| Code indicating the party receiving the payment | 111 |

| Reserve number (often the code of the government agency to which the payment being sent is due) | 3 |

| Unique number of a specific document | 444444444444444 |

| Check number, determined according to a special algorithm | 5 |

If you do not know the UIN, when making a transfer, enter 0 in the required column

We ask you to pay attention to the fact that there is no general list in which all possible UIN encodings will be indicated, since in each case a unique number is assigned to money transfers , which is formed for the first time before assigning a specific payment.

UIN - what is it in the payment order details and what is it for?

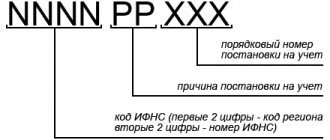

UIN is a universal accrual identifier, which is a 20-digit code.

It is very similar in structure to kbk. But they should not be confused - these are different codes. It must be indicated when filling in field 22 in the payment order. This code is assigned to an accrual made by a certain authority to the recipient. It is indicated in the receipt or demand that is sent to the payer.

When the latter generates payment documents for transfer, the subject must write it down in the appropriate section of the order. This code is used to compare the accrual and the payment made.

When specifying Win in the payment order, the transfer should quickly go through the budget payment system and get exactly where it is needed. After all, if the UIN is specified, additional checks on the INN, KPP, and KBK numbers are omitted by the system in order to speed up the transfer of money.

Indicating this code in the payment document allows you to fulfill the existing obligation in a timely manner. This is due to the fact that credit institutions report the necessary information to the state register of information on payments sent to government agencies, which speeds up the process of posting them.

The UIN is present on receipts not only for tax payments, but also for other transfers, for example, a fine for UIN. This also includes payment for services of government agencies at various levels (federal, regional or local).

Existing statistics show that the use of UIN has significantly reduced the number of “lost” payments.

Attention! In addition to the UIN, there is also a UIP code - a unique payment identifier. It is also recorded in field 22 of the payment document. However, this code applies to non-budgetary payments that are made within the framework of an agreement concluded between the parties.

In which translations may you need to indicate the UIN?

Any credit institution will necessarily require you to indicate this numerical sequence in payment documentation if the money you transfer will then go to one of the levels of the state budget (federal, regional, municipal).

Payments that require the indication of this numerical sequence generally fall into the following categories:

- payment of tax remittances;

- making insurance payments;

- repayment of customs duties;

- introduction of duties into various structures of the country;

- payment for services provided by various official departments;

- fines and penalties assessed by the State Road Safety Inspectorate, etc.

If you make a mistake in the UIN

Using the UIN number, taxes, insurance contributions and other payments to the budget are automatically recorded. Information about payments to the budget is transmitted to the GIS GMP. This is the State Information System about State and Municipal Payments. If you specify the wrong code, the system will not identify the payment. And the obligation to pay will be considered unfulfilled. And as a consequence of this:

- the company will incur debt to the budget and funds;

- continue to accrue penalties;

- you will need to clarify the payment and find out its “fate”;

- the money will arrive to the budget or funds with a delay.

How to find out the UIN code and use it when transferring funds

Finding out the individual UIN encoding you need is quite simple. Since it is made in budget-type payments, you will be assigned the necessary digital sequences by the organization representing the budget sector, which will issue the details you need to make the payment.

You can find out the UIN code in various ways

No. 383-P issued by the Bank of Russia , called “On the rules for transferring funds,” the numerical sequence of interest to us will be indicated if it is generated by the recipient of the funds.

This gives rise to a requirement that must be strictly observed: if, upon receiving the details for paying the tax fee, you were also given the UIN, you must enter it in the “body” of the receipt. If the number was not received, then in place of the column in which it is usually indicated, you will need to put a number 0.

If you pay money directly through a payment terminal, and it does not accept your payment, which contains the number 0 instead of a unique accrual identifier, then try leaving this column empty .

What UIN code should organizations indicate in payment orders in 2022?

Organizations enter a UIN code only when they transfer to the budget the amount specified in the request for payment of a tax, fee, insurance premium, penalty or fine. Such a requirement may come from the tax office. Funds have the right to charge policyholders certain types of fines. For example, the Pension Fund may demand payment of a fine for failure to provide annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for failure to submit annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for violating the deadline or procedure for submitting 4-FSS.

Fill out and submit SZV-STAZH (SZV-ISKH, SZV-KORR) and EDV-1 via the Internet Submit for free

In such a situation, the accountant needs to take two simple steps.

- Determine which UIN is included in the request for payment of a tax, fee, insurance premium, penalty or fine.

- Duplicate it in field 22 of the payment slip, which is issued in connection with the fulfillment of the requirement.

It is very important not to make mistakes when transferring the code from the request to the payment. An incorrect value will result in the payment not being identified. As a result, the organization’s debt will not be written off in a timely manner, which will lead to further accrual of penalties.

The situation is different if the organization calculates the payment amount independently. This is exactly what happens when paying current taxes, fees and contributions, the amount of which is indicated in the declaration, calculation or other document. For example, VAT at the end of the quarter, income tax at the end of the year, personal income tax for the month, etc. And in some cases, the organization itself calculates arrears for past periods and penalties. Then there is no need to specify a unique identifier.

ATTENTION. The bank is obliged to accept and execute a payment without a UIN if a legal entity transfers current payments for taxes or contributions, or repays arrears calculated on its own. The main thing is that the company does not forget to reflect its Taxpayer Identification Number.

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

There is another reason why the organization does not reflect the UIN. This is a situation where a payment request is received, but the unique accrual identifier is not there. Under such circumstances, the accountant is not able to indicate the UIN on the payment slip.

Where can I get a UIN to fill out a receipt?

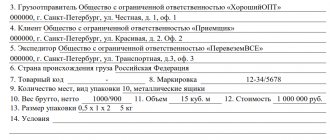

Carefully study the receipt that was issued to you for payment:

- state duty;

- personal income tax.

Note the highlighted areas

Look carefully at the areas highlighted in red in the picture. They indicate the location of the so-called document index, which, in essence, is a complete analogue of the identifier we are studying. It should be used to transfer funds.

- The first three digits of this number designate the Treasury-based revenue manager .

- The following single digit is responsible for designating the body to which you are sending funds .

- The next number reflects the type of payment you are making .

- The next group of numbers is a unique identifier for this transfer.

- The last digit will be a unique designation of our UIN number .

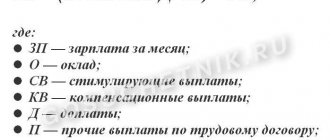

Decoding UIN

There is a reason for this length of the code, because all parts of the code are decrypted in a special way.

| Number combination | Decoding |

| 1 — 3 | Information about the recipient of funds |

| 4 | Does not have a designation, is set to 0 |

| 5 — 19 | Document index, shows payment number |

| 20 — 25 | It is calculated in a special way and is the last combination of numbers |

If the UIN has a combination of 20 numbers, then the numbers from 5 to 19 are identical.

Where to get a UIN to pay the state fee

In almost one hundred percent of cases, when transferring funds to government agencies as a fee, you have to fill out the UIN field.

In any case, the issuance of the required number is carried out by government agencies that will accept payment from the transferring person

When making a payment using this particular official paper, the UIN is displayed in the upper segment of the payment document received for the transfer of funds.

Payment of state duty can be done in two ways:

- clarify the transfer details on the electronic resource of the government agency you are interested in;

- receive a receipt in person from the same structure, which will subsequently be used for payment, and pay with it.

Please note: the receipt index is a complete analogue of the UIN code; in fact, it is simply the same numerical sequence, just designated slightly differently. It will be indicated only if the receipt for payment is generated by the organization receiving the payment.

If you look at the data that you need to make a transfer on the website, provided that it does not have a service responsible for generating the UIN code simultaneously with other information for payment, unfortunately, you will not be able to receive it. Then you need to put the number 0 in the corresponding column when transferring funds in favor of government agencies.

Please note: it is prohibited to use the UIN if the required duty has already been paid and the specific code for it has been used. The fact is that it will no longer be unique, and as a result, nothing will save your money transfer from being lost in the total mass of unclear payments.

When the UIN code is not necessary

In some cases it is not necessary to enter an identifier. In particular, the code is not needed when transferring current payments. Individual entrepreneurs and legal entities themselves calculate the amount of taxes and pay them based on the tax return.

Let's look at an example. The legal entity pays VAT. The requisite in this case may be the KBK. It is indicated in field 104. Individual entrepreneurs and individuals can use the TIN as a code. However, if nothing is indicated on line 22, the payment will not be accepted. Therefore, you need to write “0” in this line.

Obtaining a UIN to pay a fine from the traffic police

When paying a fine to the State Road Safety Inspectorate, you can specify the identification number in the resolution, thanks to which the above-mentioned authority will hold you administratively liable.

Those areas of the document where the UIN is indicated are highlighted in red.

In this case, the number you are interested in will be generated automatically, namely:

- according to the date on which the protocol was drawn up;

- by protocol serial number.

If you received a receipt for payment of a fine, according to the scheme described above, study its upper part and find the index you need there.

Is it possible to use the same UIN for different payments?

But when you pick up the decree, don’t be alarmed, it won’t be there. In this case, the UIN is reflected as a resolution number . Pay attention to the header of the application. There is a barcode there, and underneath it is the sequence of numbers that interests us.

We recommend that you read an article on the topic - If the license is expired, what is the fine: what affects the size of the fine and how can it be reduced?

UIN for individual entrepreneurs

Individual entrepreneurs, notaries, lawyers, heads of peasant (farm) households and other individuals indicate either the Taxpayer Identification Number (TIN) or the UIN (UIN) in their payments. If both of these details are not filled in, the bank will not accept the payment order. That is, the principle is this (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133):

- if the individual entrepreneur indicated his INN in the payment, then in the “Code” field instead of the UIN, 0 is entered;

- if the UIN is specified, the TIN is not filled in.

Using UIN when paying taxes

If you are an ordinary citizen, an individual, and pay tax, then you do not need to look for this number, just use the receipt details issued by tax service specialists.

How to use UIN to pay a particular tax

The receipt will come to you in the form of a notification by mail, or you can use its electronic version posted on the website of the Federal Tax Service.

If the fee is paid by a citizen representing an entrepreneurial organization, or it is paid by a legal entity, then they do not need to indicate the UIN, since instead they will enter the KBK - budget classification code .

UIN and current payments

When paying current taxes, fees, and insurance premiums calculated by payers independently, the UIN is not established. Accordingly, there is no need to indicate it in field 22. Received current payments are identified by tax authorities or funds by TIN, KPP, KBK, OKTMO (OKATO) and other payment details. A UIN is not needed for this.

Also, the UIN does not need to be indicated on the payment slip when paying arrears (penalties, fines), which you calculated yourself and did not receive any requirements from the Federal Tax Service, Pension Fund or Social Insurance Fund.

When paying all current payments, in field 22 “Code” it is enough to indicate the value “0” (FSS Letter No. 17-03-11/14-2337 dated 02/21/2014). There is no need to use quotation marks. Just enter - 0.

If, when transferring current payments in field 22, you indicate “0”, then banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133 ). At the same time, do not leave field 22 completely empty. The bank will not accept such a payment.

Organizations can indicate both the INN and the UIN on their payments at the same time. Or they can only indicate the TIN, since the UIN is not always known. But then there should be 0 in field 22.

Where can I get information about the UIN number?

Since the unique identifier is determined by the administrator of the relevant taxes and other fees, its value can be found in the following ways:

- Find out by directly visiting the enterprise, institution, organization to which the payment will be addressed (go to its website) or which accumulates such receipts.

- Visit the above resource of the Russian Tax Service website;

- You can find out the UIN number from a credit institution that makes payments to the state budget to specific recipients.

There is a misconception that the bank can always tell you the UIN. However, this is only possible in a situation where the administrator of incoming payments has entered into an agreement with a credit institution for the formation of a UIN.

What to do if the data is entered incorrectly

Quite often it happens that an error is made in the 20-25 digital code. In this case, the payment may or may not be approved: it all depends on the bank and the prevailing circumstances. The transfer may be rejected if:

- the account is open only for identification payments;

- The sender and recipient have an account at the same financial institution.

To summarize, it is worth saying that when filling out payment orders, the UIN and UIP are entered in column number 22. In the event that the transfer of funds is not made upon request or the sender does not have an identifier, the number 0 is entered in this column.

Why fill out field 22 and how to do it

Identifiers are usually used by legal entities and entrepreneurs when making government payments. In such cases, you will have to indicate the UIN and UIP.

You need to enter the 25-digit code in field 22. If there is no assigned identifier, then you just need to enter the number “0”.

Attention! Never leave field 22 blank.

When filling out the form, taxpayers must indicate the TIN, where “payer’s TIN” or UIP is in the field where “” code”. If there is a TIN, then the second field will contain “0”.

Types of payments with UIN and methods of making them

If government authorities require an individual entrepreneur or legal entity to make a payment, they will have to enter the UIN or UIP on the form. It could be:

- tax;

- penalty;

- state duty;

- insurance fee;

- fine.

You can pay in different ways. Eg:

- Using the State Services portal. You can get there using the link – https://www.gosuslugi.ru/.

- At a bank branch. A bank employee will not only help you carry out the transaction, but will also tell you how to fill out the form. You can also find a sample there.

- Via terminal. There is no need to enter identifiers here, just click on zero.

See below for an example of filling.