Almost all companies carry out settlements with suppliers and contractors. These calculations must be properly organized and taken into account.

Question: How to reflect in the accounting of a production organization that has a territorially separate branch allocated to a separate balance sheet, payment by the parent organization for production services provided to the branch, if the costs of payment for services form the cost of production of the branch, and settlements with suppliers and contractors are transferred by the branch to the balance sheet of the parent organization ? The cost of production services provided to the branch and forming the cost of production of the branch amounted to 600,000 rubles. (including VAT RUB 100,000). The provision of services is confirmed by an acceptance certificate for the services provided. The organization uses the accrual method of tax accounting. View answer

The concept of settlements with suppliers and contractors

Suppliers and contractors are entities typically engaged in the following activities:

- Supply of raw materials.

- Provision of services.

- Repair and construction.

Transactions with the entities in question are divided into two types:

- Purchase of rights or property. For example, this could be a sales deed or a supply agreement.

- Settlements with contractors. For example, this is a contract agreement for the provision of services.

Question: How to reflect in accounting the calculations for a claim issued to a supplier (contractor, other counterparty)? View answer

All payments are made on the basis of agreements between both parties. They are produced after receiving goods or services. Calculations are made based on the invoice. This paper must be registered in the Accounting Journal. To account for calculations, account 60 of the same name is used. Accounting is carried out here in these areas:

- According to settlement papers for which payment is made.

- Based on calculations performed during scheduled payments.

- For settlement papers for which there are no invoices.

- Based on excess valuables discovered upon acceptance.

- For advances paid.

Let's consider the basic tasks of accounting for settlements with counterparties:

- Creation of an information system about the status of settlements, which will be used by managers, founders, and investors.

- Collection of documentary evidence of compliance of the company’s activities with legal acts.

- Ensuring compliance with established payment forms.

- Tracking the status of receivables and payables.

- Prevention of overdue debts.

- Control over the implementation of the delivery plan.

- Control over the implementation of contract clauses.

- Ensuring timely receipt of valuables.

Account information is used by both external and internal users. External users can be both investors and regulatory authorities.

The main difficulties of accounting with suppliers, contractors and clients

It is no secret that mutual settlements with counterparties are not only an expensive process, but also time-consuming. Thus, specialists from the international agency PricewaterhouseCoopers found that the average company regularly makes 19 copies of one document, which results in costs for:

- $20 ─ human resource;

- $120 ─ searching for a lost document and working on the consequences (1 out of 20 documents are lost in the process);

- up to 8 hours ─ file recovery.

In addition to all this, it is worth adding the costs of storing and transporting documents, resolving disputes with counterparties, paying fines for late payments, and much more. The reason this type of error occurs is the fact that 59% of all invoices are in paper format. In this case, paperwork passes through different departments, which creates the risk of lost, duplicate, or non-payment of invoices.

What solution?

An automated accounting system with counterparties will allow you to control and analyze all costs. Thus, providing you with an excellent basis for planning and reducing costs.

| According to a study by the international company Aberdeen Group, enterprises that use an automated settlement system when working with counterparties reduce their costs for all these processes by 40 - 60%. |

We hope this information was useful to you.

We also want to inform you that very soon there will be accounting for balances and mutual settlements with counterparties in RemOnline. In the meantime, you can get acquainted with other features of the service: order management, warehouse accounting, manager dashboard, etc. So subscribe to RemOnline Academy updates, as well as to our Telegram channel. Stay up to date with all the important news. comments powered by Disqus

Normative base

IMPORTANT! A sample of filling out the log of settlements with suppliers and contractors from ConsultantPlus is available here

All operations performed by an accountant must comply with regulations. These acts are documents establishing the methodology and accounting procedures. The company's accounting must comply with International Accounting Standards.

Let's consider all other regulations governing calculations:

- Federal Law “On Accounting” No. 402. The law contains rules for regulating accounting and its maintenance. The act states that all accounting provisions must comply with regulatory documents.

- Tax Code of the Russian Federation. Based on the code, receivables, the fulfillment of which is impossible, are classified as non-operating expenses.

- Civil Code of the Russian Federation. Approves the need to carry out any transactions with counterparties on the basis of a previously concluded agreement. It also establishes the deadline for collecting receivables.

- Order of the Ministry of Finance dated April 27, 2012. Also regulates accounts receivable.

- Accounting chart of accounts and instructions for its use. Establishes the need to include accounts receivable as other expenses.

Settlements with contractors and suppliers are also regulated by local regulations of the company itself. These acts must not contradict the law.

Composition of accounts payable

Accounts payable, as can be seen in Figure 2, as well as accounts receivable, are divided by type of debt and by period of formation.

Composition of accounts payable

[flat_ab id=”5"]

The essence of the composition of accounts payable is similar to the composition of accounts receivable. The only difference is who is the debtor and who is the creditor, therefore it is necessary to consider the composition of accounts payable from the side of the debtor company.

Every enterprise has accounts payable. These are the obligations of the organization, characterizing the amount of debts due for payment in favor of other persons. The repayment period for accounts payable is no more than twelve months after the reporting date. This debt is regulated in accordance with the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n.

Thus, the concept of receivables and payables is revealed through debt to: an organization or organization; in this case, an organization should be understood as any legal entity registered in accordance with the legislation of the Russian Federation; an individual entrepreneur, an individual or an individual; authority or authorities. Optimization of calculations and the level of receivables and payables requires special attention from the financial authorities of companies, which is determined by the need, among other things, for constant control over the types of debt in question.

Suppliers and contractors are organizations that supply raw materials, materials and other inventory items, as well as provide various types of services (supply of electricity, water, gas, etc.) and perform various works (current and major repairs of fixed assets, etc.).

If a business requires the supply of raw materials, then it is important to choose quality suppliers. The number of such partners depends on the company’s field of activity. Basically, managers have to independently search for suppliers. This process is not only tedious, but also complex, as there can be significant risks.

It is important to know what types of suppliers exist so as not to make a mistake with your choice.

1. Manufacturers. Some managers take the simple route and purchase finished goods from manufacturers, and then sell such products. It is easier to choose a supplier here, because you can learn about the quality and benefits of the product from consumers. And also the demand for a specific type of product is also not difficult to find. The information is mostly available, and in the same way, you can check the supplier for honesty.

2. Distributors. Such suppliers are considered intermediate. If it is not possible to directly purchase goods from a supplier, then this type will come to the rescue. The fact is that distributors are suppliers who buy goods from manufacturers and sell them at a high price. This doesn't turn out to be very profitable. But nevertheless, such suppliers are more reliable. After all, they themselves select the goods according to demand and quality.

3. Craftsmen. Such suppliers offer to purchase goods of their own production. This is advantageous in that such products will be exclusive to business. But it is important to understand that such products will really be relevant to the consumer. It is also more difficult to select suppliers of this type. After all, there are not always reviews on the quality of their products.

The procedure for organizing accounting of payments

Let's consider the main stages of organizing calculations:

- Preparation of documents. All transactions must be confirmed by settlement documentation and agreements. The main primary document is the agreement with the counterparty. This could be a purchase and sale agreement, supply agreement, or contract agreement. Sometimes property is acquired only on the basis of an invoice or a power of attorney for the acquisition of objects.

- Synthetic accounting. Transactions with counterparties are recorded on synthetic account 60. Reflection is made on the basis of the information specified in the agreement and settlement documents. A score of 60 is considered passive in most cases. The debit records the occurrence of a payable debt, and the credit records its payment. Account 60 will be active only when an advance is paid to the supplier.

- Analytical accounting. Invoice 60 is formed on the basis of settlement papers from the supplier. If one of the parties to the transaction has not fulfilled its financial obligations, a receivable is formed. It can be presented to suppliers for failure to fulfill the terms of the agreement, to contractors for downtime and existing defects, to banking institutions for the amount debited from the company’s account by mistake.

- Inventory of calculations. An inventory is needed to confirm the correctness of the information specified in accounting and reporting. There are situations in which an inventory is a mandatory measure. The list of such situations is specified in Federal Law No. 402. In particular, the inventory is carried out before the formation of annual reporting. Checking the correctness of calculations is carried out by analogy with an inventory of material assets. To carry out the procedure, it is necessary to convene an inventory commission. The result of her work is documented using an act. During the procedure, the amounts in account 60 are checked. To solve this problem, settlement reconciliation acts are generated. During the inventory, the accuracy of the amounts of receivables and payables, the identity of balances, the validity of accrued debt, and the accuracy of settlements with financial institutions are checked. Verification involves the generation of reconciliation reports.

Important! The act drawn up during the inventory must be kept for 5 years. The document must reflect all the required information: company name, accounting accounts, debt amounts, etc.

Basic rules for using account 60

All information is entered into account 60 on the basis of the invoice received when purchasing goods, the certificate of work performed when receiving services. The documents under consideration, on the basis of paragraph 4 of Article 9 of Federal Law No. 402, can be filled out using both unified and proprietary forms.

Settlements with debtors and the composition of receivables

Currently, in conditions of great competition, many business entities widely use in their activities such types of settlement transactions as installment payments, phased repayment of the agreed amount, etc. But it is necessary to take into account that if the time of delivery of the product does not coincide with the time of receipt of the agreed amount of money for it, then accounts receivable .

If we consider the balance sheet of an enterprise, accounts receivable are included in assets, that is, property. At its core, it is part of the organization’s property, which belongs to it by right of ownership, but is owned by other persons - business entities. It is assumed that in the future this debt will be repaid in cash or through barter by supplying goods (providing services, performing work).

In accounting theory, a significant number of definitions of accounts receivable have already been formulated from various points of view. So, F.N. Filina defines the category under consideration as follows: “ Accounts receivable is the amount of debts due to an enterprise from legal entities or individuals as a result of economic relations with them.” Yu.A. Babaev offers the following definition: “ Receivables are understood as the debt of another organization, employees and individuals of this organization.” In other words, this is the debt of buyers for purchased products, of accountable persons for amounts of money issued to them on account, etc.”

Accounts receivable, as can be seen in Figure 1, are divided by type of debt and by period of formation.

Composition of accounts receivable

By type of debt there are:

— debt for goods, works, services of a commercial organization. Such debt in the balance sheet is, as a rule, the most voluminous and significant. This debt is associated with the implementation of the main activities of a commercial organization. This type of debt can be generated both from commercial companies and from non-profit structures, authorities, local administrations operating under the state order system, etc.

— overpayment of payments to the budget and extra-budgetary funds. This type of debt, as a rule, arises due to overpayments on advance payments for various taxes, including insurance contributions transferred to the budget, which from 2022 are also subject to regulation by the Tax Code of the Russian Federation;

— debt of accountable persons. It represents the amount of funds that were issued to a certain circle of persons on account, and at the moment advance reports for these funds have not been provided or they have not been returned to the organization’s cash desk;

— advance payments. Prepayment by buyers and customers for products and services that will be supplied or provided in the planned period.

Accounting entries

Settlements with suppliers and contractors involve the use of the following transactions:

- DT60.2 KT51. Transfer of advance payment to the supplier.

- DT10.1 KT60.1. Acceptance of ordered products for deduction.

- DT19 KT60.1. Reflection of VAT on purchased products.

- DT76 KT60.1. Filing a claim for product shortages.

- DT60.1 KT60.2. Settlement of advance payment.

- DT10.1 KT76. Additional delivery of products.

- DT19 KT76. Reflection of VAT on additional delivery.

- DT68 KT76. Use of the right to supply VAT on advance deduction. The basis of the procedure is the invoice.

- DT08 KT60.1. Acceptance of services provided.

- DT19 KT60.1. Reflection of VAT on services provided.

- DT60.1 KT51. Payment of the remaining amount for services.

- KT76 KT68. Recovering VAT from advance payment.

As part of settlements with counterparties, it is possible to offset similar claims. This is one of the forms of repayment of obligations. Offsetting a similar counterclaim is regulated by Article 410 of the Civil Code of the Russian Federation. If both parties to the agreements have a debt to each other, the obligations may be reduced by the amount of the smaller debt. Offsetting is not carried out in the cases specified in Article 411 of the Civil Code of the Russian Federation. For example, this is a debt for alimony, compensation for damage to health. The offset is reflected by this posting: DT19 KT60.1.

Basic inspection questions

The main audit issues are given in the Methodological Recommendations for carrying out audits of the legality of certain financial and business transactions, approved by the Federal Treasury on December 31, 2019 (see Appendix 2). It follows from the recommendations that during the control event you should:

1. Study the accounting policy documents regarding the accounting of accounts payable for settlements with suppliers and contractors.

2. Conduct an analysis of balances on accounts payable for settlements with suppliers and contractors in comparison with similar indicators of previous periods (in particular, for unreasonable growth of indicators).

3. Check that the total amount of the accounts payable register for settlements with suppliers and contractors corresponds to the total amount of the turnover sheet data (f. 0504036).

4. Check whether the balances in the relevant accounts have been reconciled with the data of creditors and compare them with similar indicators of previous periods. Compare the turnover of accounts payable for settlements with suppliers and contractors with similar indicators of previous periods.

5. Check for unaccounted liabilities.

6. Check whether data on accounts payable to managers, members of advisory bodies (supervisory board) and other affiliated persons of the control object (if any) are disclosed separately in the reporting.

Primary documents for supplier accounting

The payments to suppliers section works in two directions: “we buy something from suppliers” and “we pay for purchases.” For each direction we have our own primary documents.

1. Primary documents from the supplier to us

Agreement

One of the very first documents is a purchase and sales agreement, which is concluded between companies. However, it may not exist, but firms cooperate. In practice, I noticed that when the tax office checks our company and draws attention to the lack of an agreement, then our company concludes one with the supplier.

In any case, the contract is insurance for each participant, supplier and our company, against any unpleasant affairs of one or the other. For example , a supplier supplied or provided us with something. Or, we paid the supplier in advance so that he would supply/bring us, for example, goods. And the supplier just “forgot” about us. In general, a contract is a legal document that describes the obligations of two parties and the consequences for failure to comply.

Invoice from supplier

The second document from the supplier is an invoice for payment, which indicates what exactly we are buying, how much it costs and bank details. This document does not have any legal force, but only provides background information. In this case, such a document serves as the basis for payment. Those. If our company decides to pay, then the basis for payment will indicate the account details: number such and such, from the number of such and such, from the counterparty of such and such, for such and such an amount.

Expense invoice, or Certificate of service, work performed

The supplier presents these documents to our company as the final result: goods and materials were delivered, service was provided, work was completed. The signature and seal of these documents on our part confirms our consent. And these documents already have legal force.

Supplier invoice

The supplier attaches this type of document to the Invoice, Certificate of Service or Work Completed. This document is issued by those supplier companies that pay Value Added Tax (VAT). This document repeats the contents of the Invoice for payment, the Invoice, and the Acts. But the main point of an invoice is to show how much VAT is included in the total amount of goods/services invoiced (we’ll talk about VAT in other articles).

2. Primary documents in our company

Making a purchase

As you understand, our company needs to prepare documents for the purchase. Regardless of what we buy: materials, goods, fixed assets, services, we draw up a document of the appropriate type “Receipt/Purchase of something”. If required, we register the supplier's invoice.

Making a payment

For our part, we pay the supplier. To decide which primary documents we will use, we need to decide How we will pay: Cash or Non-cash (Cash or non-cash). Once we decide, all we have to do is select the documents we need.

Examples of primary documents for accounting settlements with suppliers

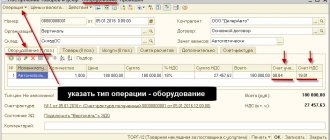

Receipt of services

Now let's record the services. This is documented in the document “Receipt - Services (Act)”.

Receive services from the supplier:

- Invoice 4523 dated 01/31/2015, invoice 4523 dated 01/31/2015

- Supplier MOSCOW UNITED ELECTRIC GRID COMPANY, JSC MOESK OJSC Name: JSC MOSCOW UNITED ELECTRIC GRID MOESK

- INN/KPP: 5036065113/ 772501001

- OGRN: 1057746555811

- Address: 115114, Moscow, Paveletsky 2nd Ave., building No. 3, building 2

- Electricity 35,000 rub. (account 25, Production workshop, Electricity)

Total: 35,000 rub. incl. VAT 5,338.98

We are adding another service

Receive services from the supplier:

- Invoice 110 dated 01/31/2015, invoice 110 dated 01/31/2015

- Supplier TMP No. 20 CJSC

- Lease agreement 15/011 dated 01/14/2015

- VAT in the amount of office rent is 15,000 rubles. (account 26, Administration, Rent)

- Workshop rent 45,000 rub. (account 25, Production workshop, Rent)

Total: 60,000 rub. incl. VAT 9152.55

Thus, in the 1C Accounting 8 program, services are included in cost accounts.

We looked at how inventory items are received and expenses related to inventory items are incurred. Includes services consumed by our organization. Now you can move on to completing your own practical task.

Interaction of the supplier settlement area with other accounts

I suggest you do the task yourself. From what you have read now, worked through the previous articles, write down the main accounting accounts with which account 60 interacts. If you can do it from memory, that’s great. If not yet, open the chart of accounts and try to choose. If you carefully studied the previous materials, then I’m sure you won’t need a chart of accounts.

Answers are available only to subscribers!

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

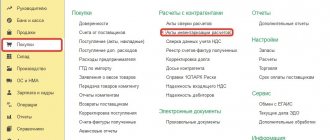

Receipt of additional expenses

Sometimes there are situations when, when purchasing inventory items, we separately engage a third-party transport company to deliver goods and materials. In accordance with accounting rules, expenses associated with the acquisition of inventory items must be included in the cost of these inventory items. In the 1C Accounting 8 program, the receipt of additional expenses is reflected in the document of the same name “Receipt of additional expenses. expenses" in the "Purchases" section.

The document is intended to reflect the services of third-party organizations, the costs of which are included in the cost of goods. The document can be entered based on the document Receipt (act, invoice).

When entering a document in the header, you can specify the following details:

- Currency — document currency. The currency is filled in automatically with the contract currency.

- The amount of expense is the amount of costs that are not related to a specific item, but are subject to distribution among all goods specified in the document.

- Distribution method - the method of distribution of costs for the goods specified in the document (proportional to the amount or proportional to the quantity).

- VAT rate and VAT amount - VAT on costs to be distributed to all goods specified in the document.

On the Products , a list of products is indicated, the price of which will include the reflected services of third-party organizations.

- Price - filled in automatically when specifying an item based on the Item Price register.

- Account and VAT Account - are filled in automatically when specifying an item based on the Item Account register.

- Add. expenses (amount) - intended to indicate the amount of additional expenses related to a specific item (in addition to the total amount of additional expenses indicated in the header of the document).

- Batch document - intended to indicate a specific receipt document to which additional payments will be attributed. expenses.

To fill out the Products , use the Fill button:

- Fill in upon receipt allows you to select a receipt document, the data of which will be transferred to the Products , while previously entered lines will be cleared.

- Add from receipt allows you to select a receipt document whose data will be added to the Items in addition to existing lines.

For organizations that pay income tax, in the Accounting account (AC) , you must fill in an account for additional expenses. It is allowed to indicate an account for accounting costs of distribution or other expenses in cases where the procedure for recognizing expenses in accounting and tax accounting differs. For such cases, you must fill in the Cost Item field.

, the Expenses (EC) field indicates the procedure for reflecting expenses in tax accounting.

The data on the Advances offset must be filled out if the method of advances offset By document .

For the document Receipt additional. expenses the following printed forms are provided:

- Add. expenses

- Help-calculation “Ruble amount of document in currency”

Based on the document Receipt of additional expenses, you can enter the following documents:

- Reflection of VAT accrual

- Reflection of VAT for deduction

- Payment order

- Debiting from current account

- Invoice received

- Cash withdrawal

Capitalize additional Delivery costs from the supplier:

- Invoice 55 dated 01/30/2015, invoice 55 dated 01/30/2015

- Supplier Gruzovichkoff LLC

- Agreement 41256 dated January 27, 2015

- VAT in total

- Cost 3500 rub.

- Distribute to invoice 41 dated January 29, 2015 (invoice amount 919,080 rubles) and invoice 45 dated January 30, 2015 (invoice amount 10,200 rubles)