What is included in line 1250

Line 1250 of the balance sheet reflects highly liquid assets that are used to fulfill the company’s short-term obligations. The indicator for this line is the sum of the debit balance for the following accounts.

- Account 50 "Cashier". This is cash in the company's cash desk, including cash foreign currency.

Line 1250 does not take into account the balance of the “Cash Documents” subaccount. It is reflected in line 1260 “Other current assets.

- Account 51 “Current accounts” - amounts of non-cash money in current bank accounts, confirmed by bank statements.

- Account 52 “Currency accounts” is non-cash money in foreign currency held in foreign currency accounts in banks, assessed at the Central Bank exchange rate as of the reporting date.

Also included in the indicator for line 1250 are other funds:

- debit balance on account 55 “Special accounts in banks”;

- debit balance on account 57 “Transfers in transit”;

- cash equivalents accounted for in a special second-order subaccount to account 58 “Financial investments”.

Let's talk about them in more detail.

Long-term financial investments: for what period are they issued, to which account do they belong, what line is in the balance sheet?

Long-term financial investments on the balance sheet are financial investments with a period exceeding 12 months. Their analytical accounting is also kept on the account. 58. The amount of long-term financial investments in the balance sheet is line 1170. As in the case of short-term financial investments, the amount reflected in the balance sheet includes not only the debit balance of the account. 58. Here you also need to add the debit balances on your account. 55 and 73 in terms of assets classified as long-term financial investments. In these accounts, such assets include:

- deposits with a maturity of 12 months (Dt account 55.3);

- loans provided to employees of an organization with a repayment period of more than 12 months (Dt account 73.1).

The amount of account debit balances. 58 (subaccount “Long-term financial investments”), 55.3, 73.1 before it is reflected on line 1170 of the balance sheet, it must be reduced by the balance of the loan account. 59 (reserves for long-term investments).

More information about the accounting of this type of assets can be found in the material “Accounting for financial investments - PBU 19/02”.

Thus, the main difference in the characteristics of long-term and short-term investments is their duration. There are no other differences between short-term and long-term financial investments. Securities purchased by an enterprise can be a long-term source of investment, or they can be used for speculative purposes and purchased for a short-term period. Deposits can also be placed for different periods; the situation is similar with issued loans.

Other cash

The debit balance of account 57 “Transfers in transit,” included in the line indicator 1250, is the amounts “awaiting” credit to the account. These include:

- revenue transferred to collectors on the last day of the reporting period;

- amounts spent on the purchase of foreign currency, which after conversion will be credited to the foreign exchange account.

Line 1250 also reflects the debit balance of account 55 “Special accounts in banks.” These are funds listed in letters of credit, loan accounts, check books, other payment documents (except bills), in current, special and other special accounts. The exception is the balance in subaccount 55-3 “Deposit accounts”. They are reflected not in line 1250, but as part of lines 1170 “Financial investments” or 1240 “Financial investments (except for cash equivalents)” - depending on whether these investments are long-term or short-term).

Short-term financial investments: definition and line in the balance sheet

Investments in financial assets with a maturity of less than 12 months (acquired rights to receivables, short-term interest-bearing loans, deposits, securities, other financial investments) are short-term financial investments.

They are reflected on line 1240 of the enterprise’s balance sheet. Let us recall that 1240 is one of the asset lines of the balance sheet, characterizing the current assets of the enterprise. IMPORTANT! Clause 20 PBU 4/99 “Accounting statements of an organization” indicates that the company’s own repurchased shares must also be included among short-term financial investments. However, this directly contradicts paragraph. 4 clause 3 PBU 19/02 “Accounting for financial investments”. What should I do? There is a general legal principle according to which a contradiction between normative acts of the same level (PBU 4/99 and PBU 19/02 are normative documents of the same level) is resolved in favor of the one that has a later date of adoption. In our case, it is the norms of PBU 19/02 that must be followed, since it came into force in 2003, and PBU 4/99 - in 2000. Therefore, you should not classify your own repurchased shares as financial assets.

Line 1240 reflects the sum of the balance on Dt 58 (in terms of short-term financial investments), the balance on Dt 73 (in terms of short-term loans to personnel) and the balance on Dt 55 (in terms of short-term deposits). This amount should be reduced by the balance under Kt 59 in terms of the formation of reserves for short-term financial investments.

The difficulty is presented by the fact that for the count. 58 of the modern chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, hereinafter referred to as order No. 94n) there is no division into long-term and short-term financial investments. In this case, the enterprise independently has the right to open first and second order subaccounts in accordance with the goals of its accounting policy.

In addition, in the instructions for using the chart of accounts (order No. 94n) regarding the account. 58 explicitly states that an enterprise is obliged to “ensure the possibility of obtaining data on short-term and long-term assets.” Such a detailed division will also significantly simplify the process of drawing up a balance sheet for an enterprise.

EXAMPLE from ConsultantPlus: Under a bank deposit agreement, an organization transferred funds in the amount of RUB 3,650,000 to a deposit account in a bank on March 31. for a period of 91 days at 5% per annum. Under the agreement, interest is paid simultaneously with the return of the deposit amount at the end of the agreement. Upon expiration of the established period, the deposit account is closed, the funds and accrued interest are transferred by the bank to the organization’s current account. Interest accrual starts from... Get trial access to the K+ system and continue studying the example for free.

More information about how to work with the chart of accounts can be found in the article “Chart of accounts for accounting.”

What are cash equivalents?

Cash equivalents are by nature short-term financial investments, but with special properties.

These are highly liquid financial investments that can be easily converted into a predetermined amount of cash. Their peculiarity is also that they are subject to an insignificant risk of changes in value. This is the meaning of acquiring cash equivalents.

Cash equivalents may include:

- demand deposits opened in banks;

- financial investments purchased for the purpose of resale in the short term (usually within 3 months);

- loan amount, based on the timing and procedure for the borrower to repay the amount received. For example, with the condition of return at the first request of the lender (see letter of the Ministry of Finance dated February 6, 2015 No. 07-04-06/5027);

- bank bills purchased as a means of payment.

The company independently determines which objects are considered cash equivalents and consolidates this management decision in its accounting policies. But foreign currency cannot be considered a cash equivalent.

Examples of accounting for short-term investments

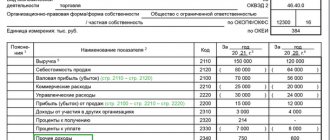

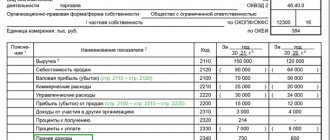

Example 1

In 2022, Aktsiya LLC decided to temporarily withdraw a certain amount of funds from circulation and place them as a bank deposit. Terms of the deal: deposit amount – 500 thousand rubles, contract period – 3 months.

Since the bank deposit agreement stipulates a period for the return of funds and it is 3 months, at the end of the reporting year, Aktsia LLC will display the amount of invested funds in line 1240 of the balance sheet.

Example 2

Solnyshko LLC and Kod LLC entered into an agreement on the provision of borrowed funds on December 12, 2017:

- loan amount: Solnyshko LLC provides a loan in the amount of 250 thousand rubles;

- repayment period of obligations: according to the agreement, the loan must be fully repaid, including all accrued interest on it, no later than 10/12/2018;

- borrowed funds are issued at 10% per annum.

Posting in the accounting records of Solnyshko LLC: Dt58.03 Kt51.

Since the terms of the loan agreement stipulate the terms of repayment of obligations, and there is also evidence that these funds were transferred for the purpose of generating additional income, this transaction is reflected in the accounting records of Solnyshko LLC as part of financial investments. Since the contract period is 10 calendar months, the company will display information about the short-term placement of funds in line 1240 of the balance sheet at the end of 2022.

Balance sheet, line 1240: what does this include?

Since the 2nd section of the balance sheet is being considered, it means that we are talking exclusively about working capital, i.e. the amounts of such investments cannot be directed directly to the acquisition of fixed assets or intangible assets, the construction of buildings or the modernization of production. The concept of short-term investment includes only operations for placing a company's money in assets that do not have a material form, but are capable of generating income, for example, interest on loans or the difference in the price of resold shares.

Thus, in the balance sheet line 1240, its interpretation, includes financial investments, which mean the acquisition:

various securities (CS) - state, municipal or commercial;

debt securities, in particular, bills with a set value and a maturity date within 12 months;

shares in the authorized capital of third-party companies, including subsidiaries or dependent companies;

Accounting entries upon receipt of financial investments

Financial investments can come to the organization in various ways:

- as a contribution to the authorized capital;

- as a result of donation;

- as a result of making a contribution to a joint activity within a simple partnership;

- as a result of purchase and so on.

Below are the main receipt transactions.

| Debit | Credit | Description |

| 58 | 76 | We bought a financial investment and reflected the costs of its purchase, including contract costs, intermediary fees and others |

| 58 | 75 | The founders replenished the authorized capital through financial investments |

| 58 | 91 | The cost of financial investments increased after revaluation |

| 58 | 01 / 04 / 10 41 / 43 / 50 / 51 / 52 | Contributed to the authorized capital of a third-party company with fixed assets, intangible assets, raw materials, etc. |

| 58 | 50 / 51 / 52 | Issued a loan in cash, from a current or foreign currency account |

Concept and accounting of financial investments

According to clause 43 of the Regulations on accounting and financial reporting in the Russian Federation dated July 20, 1998 (as amended and supplemented) (hereinafter referred to as PBU), financial investments are:

- investments of a business entity in shares (bonds, other securities) issued by various joint-stock enterprises and the state;

- borrowed funds provided to other enterprises.

Registration of financial investments is carried out on the basis of documents confirming the right to own them.

Objectives of financial investments:

- receiving income (in the form of interest, dividends);

- resale;

- other benefits.

Along with the benefits, the company also transfers all financial risks associated with financial investments.

Clause 44 of the PBU prescribes taking into account financial investments (investments) in the amount of expenses actually incurred for their acquisition.

A commercial enterprise can charge to the accounts of financial results (a non-commercial enterprise - to increase expenses) the amount of the difference between the actual costs of acquiring debt securities (bills) and their nominal value (in equal shares during the period of circulation of the securities after accrual of the income provided for by them).

Professional participants in the securities market have the right to revaluate investments in securities acquired for the purpose of subsequent sale, according to stock exchange quotations.

All enterprises regularly conduct inventories of inventory items. Find out how to do it correctly.

You can find out who the principal is in an agency agreement here.

Examples of financial investments

Objects of financial investments can be:

- shares of other organizations,

- bonds of state and municipal loans,

- other debt securities,

- contributions to the authorized capital of organizations (including affiliates and subsidiaries),

- bank deposits,

- receivables received as assignments of claims.

Types of financial investments

Financial investments are divided into:

- short-term (up to 1 year),

- long-term (tenure period exceeds 1 year).

Accounting and postings

At the time of acquisition, financial investments (investments) are valued at the purchase price, including direct costs associated with the acquisition (brokerage fees; fees for banking, consulting and other services).

Synthetic accounting is maintained on account 58 “Financial investments”

Sub-accounts opened to this account for analytical accounting:

- 58-1 “Units and shares”

- 58-2 “Debt securities”

- 58-3 “Loans provided”

- 58-4 “Deposits under a simple partnership agreement.”

An enterprise can provide for the creation of reserves if there is a steady downward trend in the value of financial investments. Reserve amounts are recorded in account 59 “Provisions for impairment” .

Typical wiring

| Debit | Credit | Name of business transaction |

| 58 | 76 | Reflected acquisition (shares; bonds) |

| 51 | Short-term loan provided | |

| Loan provided at interest | ||

| 91 | Reflected increase in market value of shares | |

| Monthly allocation (in equal shares) of the difference between the purchase and par value of bonds when the purchase price is below par | ||

| 76 | 91 | Interest due on bonds accrued (monthly) |

| Interest accrued on the interest-bearing loan provided (monthly) | ||

| The difference between the contractual and book values of the transferred property (contribution to a simple partnership) is attributed | ||

| Accounts payable written off when bonds are repaid | ||

| The amount of the share sale agreement is reflected | ||

| 91 | 76 | Intermediary services for the acquisition of financial investments (broker, consulting, others) are taken into account |

| 58 | Reflected decrease in market value of shares | |

| Monthly allocation (in equal shares) of the difference between the purchase and face value of bonds if the purchase price is higher than the face value | ||

| Disposal of bonds (redemption) | ||

| The actual cost of shares sold was written off | ||

| 99 | ||

| 59 | A reserve has been created to reduce the cost of financial investments | |

| 51 | 76 | Payment received for shares sold |

| Bonds redeemed (at par value) | ||

| Interest received on the loan provided | ||

| 58 | Repayment of the loan provided | |

| 59 | 91 | The increase in the cost of financial investments is attributed |

| Write-off of the reserve (disposal of financial investments for the depreciation of which a reserve was created) |

Find out who calculates the cash balance limit and who approves it.

The formula for calculating gross profit can be found in this article.

Accounting entries upon disposal of financial investments

The disposal of financial investments is associated with the repayment by the debtor of its monetary obligations. Write off the initial cost of the retiring asset as part of other calculations. The table contains the main disposal transactions.

| Debit | Credit | Description |

| 90 / 91 | 58 | The cost of disposed investments was written off as other expenses / Reflected the revaluation of shares by which the current market value is determined |

| 91 | 58 | Discount of financial investment |

| 50 / 51 | 58 | The debtor repaid the loan, repaid the bill |

| 50 / 51 / 52 / 01 / 04 / 10 / 41 | 58 | Received a return of property previously contributed to the authorized capital of another organization |

| 76 | 58 | The share of participation in the authorized capital of another company has been reduced |

Cost of financial investments

For example, Alpha LLC bought 350 shares of Sberbank, which rose from 100 rubles to 110 rubles in a month. Let's calculate how much the cost of the package has increased:

350 shares × (110 rubles - 100 rubles) = 3,500 rubles.

An accountant at Alpha LLC constructs the wiring:

Debit Credit Sum Description 58 91.1 3 500 Overvaluation of shares

Account for financial investments that are not traded on the stock market at their original cost. In addition to the costs of acquiring an asset, the cost of financial investments should include:

- costs of paying for services related to the purchase of financial investments;

- the amount of remuneration to intermediaries;

- other costs associated with the acquisition of assets.

For example, 350 shares of Sberbank were purchased for 35,000 rubles. To purchase the securities, Alpha resorted to the help of a broker, who was paid 2,000 rubles for his services, and an intermediary, whose services cost 1,000 rubles.

Alpha's accountant makes the following entries:

Debit Credit Sum Description 58 76 35 000 Reflected the purchase of shares 58 60 2 000 Received advice from a broker 58 76 1 000 Intermediary services reflected The cost of financial investments will be: 35,000 rubles + 2,000 rubles + 1,000 rubles = 38,000 rubles.