How does length of service affect the calculation of pensions?

With the introduction of the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ, in 2002 the length of service taken into account for the old-age pension began to be determined in a new way. Its main function was to establish the right to receive a pension. It began to be called insurance, and its distinctive feature was that it was linked to the fact of payment of insurance premiums to the Pension Fund during this period. At the same time, the amount of the pension began to depend not on length of service, but on the amount of contributions paid.

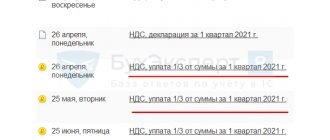

The minimum insurance period required to obtain the right to a pension was determined in Law No. 173-FZ to be 5 years. It was applied until 2015, from the beginning of which the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ came into force, establishing 15 years of experience as the minimum required and a transition period for its full application.

A transitional period has been established from 2015 to 2024, during which the length of the insurance period giving the right to receive a pension increases by 1 year annually. Thus, in 2015 its duration was 6 years, in 2016 - 7 years. In 2024, as a result of this growth, the minimum required insurance period will become 15 years.

What is the difference between work experience and insurance experience?

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

| Seniority | Insurance experience |

| seniority is the length of periods of work; length of service is taken into account when determining the right to certain types of pensions; The length of service is counted towards the insurance period for receiving a pension. | insurance period – duration of periods of work; the insurance period is taken into account when determining the right to an insurance pension and its amount; During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation. |

What is included in the conditions for granting a pension?

According to Law No. 400-FZ, the right to assign an insurance pension arises when 3 conditions are met simultaneously (Article 8):

- a certain age has been reached: 60 years for men and 55 years for women;

- insurance period required for the corresponding year has been earned ;

- the required number of pension points has been accumulated - at least 30.

These conditions correspond to the generally established procedure for assigning a pension. However, there are 2 more types of reasons that allow you to accrue your pension early. Conventionally, they can be divided:

- For special ones related to the implementation of labor functions in special conditions (Articles 30 and 31 of Law No. 400-FZ). They make it possible to reduce the retirement age if the required number of years have been worked under these conditions and the total insurance period reaches certain values.

- Preferential benefits due to certain life circumstances of specific citizens (Article 32 of Law No. 400-FZ). They are also tied to certain amounts of existing insurance experience and, if the circumstances depend on the temporary factor, to the required number of years of existence in them.

Calculation of insurance experience: step-by-step instructions

To calculate an employee’s insurance experience, you need to:

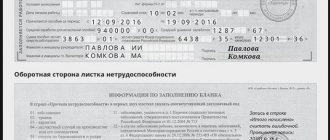

- Determine which periods of labor and other activities can be taken into account in the calculation, in accordance with current legislation.

- If certain periods are not reflected in the work book, request supporting documents. They can be: employment contracts;

- certificates from previous places of work;

- extracts from orders;

- military ID, etc.

Sometimes the submitted documents contain incomplete dates. For example, when filling out, you may not indicate the date and month of the beginning or end of the working period. In this case, the following rules apply:

- if only a year is indicated, then the calculation is carried out from July 1 and to July 1, respectively - for example, the certificate indicates that the employee worked as a priest in the parish in 2002-2003, then the calculation is carried out from July 1, 2002 to July 1, 2003;

- if the month and year are specified, then the 15th day is used for calculations: thus, a record of experience from April to September 2010 should be taken into account as experience from April 15 to September 15, 2010.

The amount of insurance coverage is determined on the last day before sick leave. For example, sick leave was issued from August 5, 2022, which means the length of service is calculated as of August 4, 2021.

Types of insurance experience and calculation of individual periods

The insurance period includes periods of 2 types:

- Labor, during which contributions to the Pension Fund were paid (Article 11 of Law No. 400-FZ). This includes periods of work or other income-generating activities carried out on the territory of the Russian Federation or outside it.

- Non-labor items of a certain list that are between working periods (Article 12 of Law No. 400-FZ).

Such non-work periods of time are:

- military and equivalent service;

For information on how to formalize the dismissal of an employee conscripted into the army, read the article “The procedure for dismissal in connection with conscription into the army (nuances).”

- stay on sick leave;

- parental leave for children up to 1.5 years (but not more than 6 years);

- periods of registration in the employment service in connection with unemployment;

- imprisonment for reasons subsequently found to be unfounded;

- time spent caring for a disabled person;

- periods of impossibility of employment for wives of military personnel or employees of Russian Federation institutions located abroad, at the husband’s place of service or work (but not more than 5 years);

- time of cooperation under a contract with the operational investigative service.

The length of each individual period is included in the insurance period based on its actual calendar period (Clause 1, Article 13 of Law No. 400-FZ). But in some cases, special accounting rules apply (clauses 6–7 of Article 13 of Law No. 400-FZ):

- Work that is seasonal and performed over a full season is considered to be performed for a full year. However, if other work took place in the same year, then their total duration cannot exceed 12 months.

- Work on the creation of copyrighted works is considered to have been carried out for a full year if the amount of insurance contributions paid from the income from these works for the year to the Pension Fund of the Russian Federation exceeds their fixed amount established by the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation...” dated July 24, 2009 No. 212-FZ . If the amount of the premium paid is less than their fixed amount, the number of months of insurance experience to be taken into account can be calculated in proportion based on the fact that the fixed amount of contributions corresponds to 1 year. In this case, the calculated length of service cannot be less than 1 month.

To learn about what social payments citizens can take advantage of during non-working periods, read the article “Compensation payments under the social security system.”

Common Questions Answered

Question No. 1. I was on maternity leave for a total of 7 years and 5 months. Is it really possible that the entire period of childcare will not be included in the insurance period?

Answer: According to the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions” (with amendments and additions), no more than 6 years of care are counted in the insurance period of each parent, if they do not coincide in time or care is provided for different children. Moreover, it is worth noting that the insurance period includes leave to care for a child until he reaches the age of 1.5 years, but in total no more than 6 years. Thus, 6 years of care will be included in the insurance period, 1 year 5 months will not.

Question No. 2. I have an entry in my work book that I was a member of a collective farm from 1992 to 1995. The Pension Fund told me that this period is not included in the length of service. Clarify please.

Answer: The fact is that having membership in a collective farm does not mean having work experience. To calculate work experience, it is necessary to have work activity, because in accordance with clause 66 of the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for the establishment of insurance pensions” (with amendments and additions), the calendar years indicated in the collective farmer’s work book, in which there were no not a single exit to work are excluded from the count.

How to correctly calculate experience

A separate section of Government Resolution No. 1015 dated 02.10.2014 is devoted to the procedure for calculating the insurance period

- Determine the periods included in the length of service according to the personalized records of the Pension Fund of Russia, and in the absence of such data - according to documents or testimony.

- Take into account only those working periods that correspond to the payment of insurance premiums, and only those non-working intervals that formed between working periods.

- If the periods that can be included in the length of service coincide, take into account only one of them, the most profitable for calculating the pension.

- The period of care for the same child should be included in the period of care of only one of the parents.

- When calculating the insurance period for calculating an old-age pension, do not take into account periods that have already been taken into account when calculating pension payments under the laws of a foreign state or calculating a pension on other grounds.

- Periods with special rules for accounting for length of service (for seasonal work or the creation of original works) should be formed in such a way that their resulting length does not exceed the maximum possible normal calendar length.

- If necessary, labor periods that arose before the entry into force of Law No. 400-FZ can be taken into account in the insurance period according to the rules that were in force during these periods.

The length of each period included in the insurance period is determined as the number of calendar days in the interval between the end date of the period and the date of its beginning, plus 1 day. In this case, every 30 days are considered 1 month, and every 12 months - 1 year. Subject to this rule, all periods of the insurance period are summed up, resulting in its total duration.

What will change in calculations from January 1, 2022

Order of the Ministry of Labor dated June 9, 2022 No. 388n added new periods to the rules for calculating the length of insurance that should be taken into account when applying for sick leave or maternity benefits. The changes affected citizens who worked in other states before receiving Russian citizenship.

Accounting for labor and other periods on the territory of another state is possible if appropriate agreements have been concluded between Russia and that country. For example, such agreements apply to citizens of Belarus and Kazakhstan in accordance with Part 2 of Art. 1.1 of the 255th Federal Law and clause 3 of Art. Section 98 XXVI Treaty on the Eurasian Economic Union.

To include working periods in the territory of another state in the insurance period, you need to provide a work book or other supporting documents:

- to the employer or to the Social Insurance Fund - for employees;

- in the FSS - for individual entrepreneurs, lawyers, notaries, private security guards.

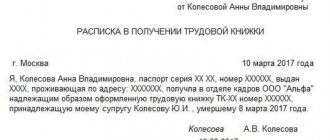

The procedure for confirming experience

If personalized accounting information is incomplete or insufficient to take into account all the circumstances relevant to the assignment of a pension, they can be supplemented with documents. In this case, the document may be in electronic form.

The requirements for the preparation of such documents are described in detail in the sections of Government Resolution No. 1015 dated 02.10.2014. These include:

- work books;

- labor and civil contracts;

- certificates from place of work or service;

- certificates from other bodies and persons.

If it is not possible to obtain documents, it is permissible to take into account data on insurance experience based on testimony. However, witnesses do not have the right to evaluate working conditions.

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

How to find out your length of service and whether you need to calculate it yourself

Data on the insurance experience of persons registered with the Pension Fund comes mainly from employers as part of personalized accounting information. Persons paying fixed contributions are also included in the Pension Fund, so the necessary information about the length of service of most citizens in the Pension Fund is available and can be obtained there:

- or by written request;

- or through an electronic account.

in calculating the insurance period yourself. When all the conditions required for granting a pension are met, the Pension Fund must check, using the documents submitted by the citizen, the correctness of the information he has and, if necessary, make all the necessary adjustments, focusing on the most beneficial option for the pensioner to take into account the insurance period and other circumstances.

How is an employee's length of service calculated?

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

The influence of length of service on the amount of pension

There are 3 types of experience:

- Total length of service is the number of years worked at the main or additional job, as well as the time spent on parental leave.

- Special experience is awarded for work in special conditions, increased severity or danger, if by law this type of activity is difficult or dangerous.

- The insurance period is a generalized period during which contributions to the insurance fund were transferred.

All pension issues are regulated by the law on pension provision FZ-166. The labor pension directly affects the length of service and depends on contributions to the pension system. Payments are calculated taking into account:

- state pension;

- conditional funded pension from the employer;

- individual 10% contributions.

Insurance period on sick leave

The insurance period for calculating sick leave and maternity leave is the time worked under an employment contract and periods of state or municipal service. As well as periods of other activities during which the employee was subject to compulsory insurance in case of temporary disability and in connection with maternity. This follows from paragraph 2 of the rules for calculating and confirming insurance experience (approved by order of the Ministry of Labor dated 09.09.20 No. 585n).

ATTENTION . The insurance periods “for pensions” and “for sick leave” may be the same. But they may differ. One of the most common examples is parental leave. When calculating the length of service for a pension, a child care period of up to 1.5 years is taken, and for sick leave benefits - up to 3 years.

The formula and methodology for calculating the insurance period for sick leave are the same as those used when calculating a pension (see “Insurance period for sick leave”).

We would like to add that the easiest way to calculate the insurance length of service without errors is to use a calculator. It will do all the calculations online and instantly display the results.

Insurance experience for pension insurance

From birth, an individual has an individual account opened in the Pension Fund. This account records all pension insurance payments made by the employer or other person, including the citizen himself. The period during which contributions to the Pension Fund were paid will constitute the main part of the insurance period when calculating the pension.

Important!

| Year of pension assignment | Minimum insurance period |

| 2020 | 11 years |

| 2021 | 12 years |

| 2022 | 13 years |

| 2023 | 14 years |

| 2024 and later | 15 years |

The pension due to a citizen is calculated on the basis of the individual pension coefficient. Its value, in turn, depends on the insurance period.

- military service;

- periods of being on sick leave and receiving appropriate benefits;

- period of receiving unemployment benefits;

- the period of care of one of the parents for the child until he reaches one and a half years old (no more than six years in total);

- length of stay in custody or in places of detention of persons brought to criminal liability without justification, etc.

It is necessary to take into account that such periods cannot be included in the insurance period if before or after them no insurance contributions were paid to the Pension Fund for the individual.

An employee can work part-time. In this case, insurance premiums will be paid by each policyholder. However, only one of the periods can be included in the insurance period. The period for calculating the insurance period is taken based on the individual’s application.

If a citizen worked abroad, and this period was taken into account when determining a pension in another country, such a period is not included in the insurance period.

Rules for calculating and confirming insurance experience

To assign a pension, length of service is taken into account. This is the totality of all periods of paid activity in production or in another field for which transfers were made to the Pension Fund of Russia (PFR).

What applies to insurance experience?

The rules for calculating and confirming insurance experience at the legal level are laid down in two documents:

- in Law No. 400-FZ of December 28, 2015;

- in Decree of the Government of the Russian Federation No. 1015 of October 2, 2014.

The term “experience” is understood as the sum of periods of work of a citizen:

- officially issued;

- for which transfers were made to the solidarity budget of the Pension Fund.

At the same time, the word “work” means any type of paid, socially useful activity. For example, creative individuals or individual entrepreneurs also work like workers in mines and factories. The main criterion for the insurance period is the payment of contributions:

The rules for calculating work periods are as follows:

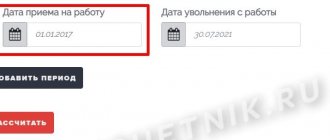

The procedure for calculating length of service

The methodology for calculating insurance periods was approved by order of the Ministry of Health and Social Development No. 91 of 02/06/2007. The document contains fundamental rules that are used by all personnel officers and other specialists.

They can be briefly summarized as follows:

- Continuous periods are periods of work with one employer.

- They are calculated by subtracting the date of dismissal from hiring.

- The insurance period is the totality of the above data obtained over the entire period of work.

- The following axioms are used in calculations:

- a year consists of 12 months;

- one month consists of 30 days (no matter how indicated in the calendar).

- If, when calculating days, there are more than 30, then you should convert them into a month.

- The same thing has to be done when it turns out to be more than 12 months - they are converted into a year.

- The calculation of labor time intervals is carried out in calendar order.

For information: nowadays there are programs for automatic calculations. Their algorithm takes into account the above rules. Download for viewing and printing:

Calculation formula

The day of dismissal is included in the calculations.

The following formula is used for calculations:

- StS = OKDn / 30 days, where:

- StS - insurance experience;

- OKDN - the total number of days when a person officially worked, taking into account preferential ones.

For reference: the old-age insurance pension in 2022 is assigned to people who have had at least 10 years of experience, in 2020 - 11 years.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Periods counted in the insurance period

Article 16 of Law No. 27-FZ lists all periods of time that are included in insurance. These include, in particular, the following intervals:

- Work under an employment agreement.

- Carrying out activities under a civil contract:

- civil service;

- service in civil and municipal bodies;

- service in the army and equivalent government institutions;

- Temporary disability due to illness.

- Care period:

- for a newborn up to one and a half years old (in total no more than 6);

- for a disabled child;

- for a disabled person of group 1;

- for an elderly citizen who has crossed the 80-year-old threshold.

- Status registered with employment authorities.

- Participation in paid community work.

- For rehabilitated persons - time spent under arrest and serving a sentence.

- The period of voluntary transfer of contributions to the Pension Fund by a person who is not included in the compulsory insurance system.

- The period during which the individual who entered the compulsory insurance system voluntarily paid contributions for the applicant.

- Living with a military spouse in an area where employment in the specialty is impossible, including abroad.

Attention: the specified preferential periods of time will be taken into account in the StS if the person worked officially before they began or after completion (Article 11 of Law No. 400-FZ). All other periods will not be included in the length of service.

For the self-employed population (individual entrepreneurs, notaries, etc.), the insurance period will include the time period during which contributions to the Pension Fund were transferred.

Social insurance experience

The periods of payment of social insurance contributions form the main part of the insurance period taken into account when calculating benefits:

- Maternity benefit.

- Temporary disability benefit.

Depending on the length of the insurance period, the amount of benefits is determined:

- up to 5 years of experience - the benefit is determined as 60% of average earnings;

- experience from 5 to 8 years - 80% of average earnings;

- 8 years of experience or more - 100% of average earnings.

When calculating sick leave payments, there is also a limitation of 6 months of insurance experience: less than this period, benefits are accrued in an amount not exceeding the minimum wage.

Unlike pension insurance, with social insurance the length of service does not include periods of work under the GPC. There are other discrepancies between these types of insurance experience. For example, social insurance does not take into account periods of official unemployment, unjustified detention, etc.

Rules for calculating and confirming work experience

As the deadline for pension payments approaches, many future pensioners are concerned about the issue of calculating length of service, which affects the size of the pension. This article will be a useful information resource that will help improve the competence of citizens of the Russian Federation in the matter of calculating and confirming length of service. The period of insurance coverage, in addition to the size of the pension, affects and is used to calculate sick leave and when calculating the employee’s vacation. In this article we will look at the rules for calculating and confirming the length of service of employees in 2022.

What is the difference between work experience and insurance experience?

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

seniority is the length of periods of work;

length of service is taken into account when determining the right to certain types of pensions;

The length of service is counted towards the insurance period for receiving a pension.

insurance period – duration of periods of work;

the insurance period is taken into account when determining the right to an insurance pension and its amount;

During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation.

How is an employee's length of service calculated?

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

| Seniority | Insurance experience |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

What periods of an employee’s activity are taken into account when calculating length of service?

In Art. 20 of Federal Law No. 166-FZ states that if the assignment of a pension requires work experience of a certain duration, it includes periods of work and other socially useful activities that are counted in the insurance period required to receive a labor pension.

In accordance with Art. 11 and art. 12 of Federal Law No. 400-FZ of December 28, 2013, the insurance period includes the following periods:

- work periods;

- the period of military service, as well as other service equivalent to it;

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- period of receiving unemployment benefits;

- period of participation in paid public works;

- the period of relocation or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

- the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Rules for calculating the insurance period for assigning an insurance pension

Calculation and confirmation of insurance experience is based on the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for the establishment of insurance pensions” (with amendments and additions).

According to this document, the calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years (clause 47).

Thus, when calculating length of service, all days worked are taken into account, which are gradually converted into months worked, which, in turn, are converted into years worked:

30 days = 1 month

12 months = 1 year

“Special” periods when calculating length of service

When calculating the insurance period, it is necessary to pay attention to “special” periods:

| Periods | Inclusion/non-inclusion in the insurance period |

| Periods taken into account when establishing a pension in accordance with the legislation of a foreign state | |

| Periods of activity of persons who independently provide themselves with work, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors, periods of work for individuals (groups of individuals ) according to contracts | Included in the insurance period subject to payment of insurance premiums |

| Period of childcare by both parents | Each parent’s insurance record includes no more than 6 years of care, if they do not coincide in time or care is provided for different children. |

| The period of receiving compulsory social insurance benefits during temporary disability | Included in the insurance period regardless of the payment of mandatory payments for this period |