Show the benefit in 6-NDFL for each period of using the loan. Letter of the Ministry of Finance dated March 18, 2016 N 03-04-07/15279.

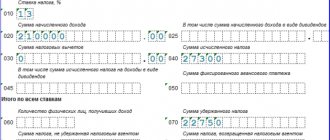

In Sect. 1 fill out a separate block of lines 010 - 050.

In line 020, indicate the financial benefit calculated for the entire reporting period, and in line 040, the personal income tax calculated from it.

In line 070, include personal income tax on financial benefits, withheld from the beginning of the year until the end of the reporting period. This amount is usually less than the calculated personal income tax from line 040. This happens because personal income tax from financial benefits for the last month of the period is withheld in the next quarter.

In line 080 personal income tax from financial benefits, include only in 6-personal income tax for the year. Indicate in it personal income tax on financial benefits, calculated on December 31, which you cannot withhold until the end of the current year. Letter from the Federal Tax Service dated January 27, 2017 N BS-4-11/ [email protected]

In Sect. 2 fill out as many blocks of lines 100 - 140 as the number of times you transferred personal income tax from financial benefits in the last quarter of the reporting period. In each of them, indicate:

- in line 100 - the last day of the month for which the benefit is calculated;

- in line 110 - the date of personal income tax withholding;

- in line 120 - the next business day after the deduction.

Matvygoda for December and personal income tax from it in section. 2 do not show it either in 6-NDFL for the year in which the benefit was accrued, or in 6-NDFL for the 1st quarter of the next year. Letter of the Federal Tax Service dated January 27, 2017 N BS-4-11/ [email protected]

If you paid the borrower a salary or other income on the last day of the reporting period: in line 070, include the personal income tax withheld from all financial benefits for the period, i.e. the entire amount of personal income tax from financial benefits from line 040; show the financial benefit, personal income tax with which you transferred on the last day of the quarter in section. 2 for the next quarter. For example, there is no need to show in 6-personal income tax for the 1st quarter of 2022 a financial benefit, the personal income tax from which was transferred on March 29. After all, the deadline for paying tax under Art. 226 of the Tax Code in this case - 04/01/2019. Show this mathematical benefit in section. 2 6-personal income tax for the first half of 2022. Example. Matvygoda in 6-personal income tax for the 1st quarter and half of 2022

Interest-free loan of 30,000 rubles. issued to the employee on 02/01/2019.

| Period | Matvygoda, rub. | Personal income tax with financial benefits, rub. (gr. 2 x 35%) | Personal income tax withholding date |

| 1 | 2 | 3 | 4 |

| February | 114,73 | 40 | 06.03.2019 |

| March | 131,73 | 46 | 05.04.2019 |

| 1st quarter | 246,46 | 86 | — |

| April | 127,48 | 45 | 06.05.2019 |

| May | 131,73 | 46 | 06.06.2019 |

| June | 127,48 | 45 | 05.07.2019 |

| Half year | 633,15 | 222 | — |

In total, for February - June, personal income tax was withheld from financial benefits - 177 rubles. (40 RUR + 46 RUR + 45 RUR + 46 RUR).

These amounts are reflected:

in 6-NDFL for the 1st quarter:

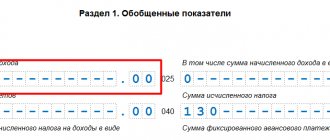

in 6-NDFL for the half-year:

Material benefit in 6-NDFL

Form 6-NDFL (Excel)

Samples of filling out 6-NDFL: for the 1st quarter of 2022, for 6 months of 2022, for 9 months of 2018, for the entire year 2022

View instructions for filling out the form

Income in the form of financial benefits for a citizen is generated in the following cases:

1) Savings on interest for using borrowed funds.

May occur under the following conditions (law dated November 27, 2017 No. 333-FZ):

- the loan was received from a legal entity (IP) that is interdependent in relation to the citizen or acts as the employer of this individual, and the employment relationship between the parties is formalized;

- such savings are in fact financial assistance or a type of reciprocal fulfillment of the obligations of an organization (IP) to a citizen, including remuneration for goods (services, work) supplied (rendered) by an individual.

In this case, the amount of interest established under the loan agreement:

- equals 0 (interest-free loan);

- below 2/3 of the discount rate of the Central Bank of the Russian Federation in effect at the time of receiving a loan in rubles;

- less than 9% per annum for loans in foreign currency.

The difference between the amount of interest specified in the agreement and the amount of interest calculated based on the threshold established by the Tax Code of the Russian Federation is taxed.

Interest savings received from:

- from transactions with bank cards issued by credit institutions of the Russian Federation during the interest-free period of use;

- from using loans issued for the purchase or construction of housing;

- from using loans issued for on-lending of “housing” loans.

Savings on interest from “housing” loans are not subject to income tax only if the taxpayer has a confirmed right to a property deduction.

2) Benefits from the purchase of products (services, works) under a GPC agreement from related parties at prices below market prices. In such a situation, the difference between the sale and market price of the subject of the transaction is taxed.

3) Benefits from purchasing securities at a price below the market price.

Income is generated if securities are received free of charge or purchased at a price below the market price. The difference between the market price of securities and the costs of their purchase is taxed.

Mat. benefits are taxed at the following rates:

| Type of material benefit | Percentage tax rate, % | |

| for residents | for non-residents | |

| Interest savings | 35 | 30 |

| Purchase of goods (services, works), securities | 13 | |

Therefore, for the amount of benefit taxed at a rate other than 13%, it is necessary to fill out a separate block from lines 010-050 of section 1.

If the tax agent was unable to withhold tax on a material benefit during the year (the person who received the benefit was not paid cash income), then line 080 of Section 1 should be completed in the annual calculation.

Dates of receipt of income, withholding and payment of tax on financial benefits:

| Section line 2 of form 6-NDFL | date |

| 100 | Acquisition of securities, products (services, works) |

| The last day of each month during the loan term under the loan agreement from 01/01/2016 | |

| 110 | The nearest day of payment of income in monetary terms |

| 120 | Next day after payment day |

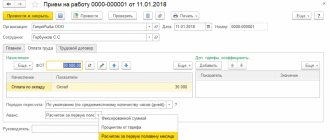

Example:

01/10/2018 employee of Energia LLC Petrov A.K. received an interest-bearing loan in the amount of 280,000 rubles. at 3% per annum. The loan repayment deadline is January 10, 2019. Dates for receiving income in the form of financial benefits – 01/31/2018, 02/28/2018, 03/31/2018, etc. The discount rate of the Central Bank of the Russian Federation is 7.75% (conditionally).

02/09/2018 Petrov received a salary for February. On the same day, the accounting department calculated and paid personal income tax.

The amount of financial benefits for January was: 349.04 rubles. (280,000 * (7.75/100 * 2/3 – 3/100)/ 365 * 21). Personal income tax – 122 rubles.

03/07/2017 – salary for February was issued. Benefit for February: 465.39 rubles. (280,000 * (7.75/100 * 2/3 – 3/100) / 365 * 28). Personal income tax – 163 rubles.

Benefit for March – 515.25 rubles. (280,000 * (7.75/100 * 2/3 – 3/100) / 365 * 31). The operation will be reflected in section 2 of form 6-NDFL for the first half of 2022.

Reflection of the transaction in the form for the 1st quarter of 2022:

| Section 2 | |

| 31.01.2018 | 28.02.2018 |

| 09.02.2018 | 07.03.2018 |

| 12.02.2018 | 12.03.2018 |

| RUB 349.04 | RUB 465.39 |

| 122 rub. | 163 rub. |

We have selected for you the best offers for individual entrepreneurs and LLCs on opening a current account.

Opening a current account at Tinkoff Bank

- 6 months free for new individual entrepreneurs and small businesses (LLC).

- Opening in 1 day.

- Integration with online accounting (automatic calculation of the simplified tax system, UTII, insurance premiums).

- 6% on account balance.

Apply for account registration in 9 minutes

Opening a current account at Tochka Bank

- Free opening of a current account.

- 3 months of free service.

- 7% per annum on the balance every month.

Apply for account registrationbest mobile bank 2015, 2016, 2017

Opening a current account at Vostochny Bank

- 3 months free.

- Overdraft immediately after opening.

- Online account registration.

Apply for business loan account registration immediately after opening the account

Opening a current account at Otkritie Bank

- Free opening of a current account.

- Service 0 rub. per month.

- Online registration.

Apply for account registrationspecial offers from AmoCRM, Tilda, Shiptor, Insales

Opening a current account at VTB Bank

- Free opening of a current account.

- Free service for 3 months.

- Online registration.

- Transfers and cash transactions 0 rub.

Apply for account registration cash transfers 0 rub. commission

Often, employees turn to their employer asking for an interest-free loan. If management meets halfway and issues funds with minimal interest or no interest at all, then the borrower has a material benefit due to savings on interest. The employer (tax agent) has the obligation to withhold and transfer income tax and, in addition, the data must be included in the 6-NDFL report. How to correctly reflect personal income tax on material benefits in 6-personal income tax will be discussed below.

Results

Material benefits can be of different types (from savings on interest, when purchasing goods and services and securities at a price below the market price).

To fill out 6-NDFL when reflecting material benefits, additional calculations will be required to determine its value and the amount of tax corresponding to it. MV may be subject to rates that differ from the generally accepted rates. To correctly fill out 6-NDFL with data on MV, it is important to correctly determine the date of receipt of income corresponding to the financial benefit and the deadline for transferring personal income tax from it. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection in the 6-NDFL report

The benefit and the tax on it are shown in both sections of the report. We remind you that section 1 is compiled on an accrual basis - from the beginning of the calendar year to the end of the reporting/tax period. And in section 2 only those transactions that occurred in the last 3 months of the reporting period are shown.

In section 1, lines 010 (tax rate) and 020 (amount of accrued income) must be completed. Since the rate for financial benefits differs from the tax rate for wages, you will have to reflect the data in Section 1 in a separate block.

An employee is included in the final line 060 only once, despite the fact that income and tax indicators can be included in lines 010-050 twice (if both salary and financial benefits are accrued).

If the tax was withheld during the reporting period, lines 010, 020, 040, 060, 070 of the form are filled in.

If there was no tax withholding, line 070 is not filled in.

Material benefit in 6-NDFL: example of filling

03/01/2019 working at Mega LLC Kilin A.V. entered into an interest-free loan agreement for 1 year and received funds in the amount of 100,000 rubles. For March 03/31/2019, a financial benefit was accrued. Let’s assume that the key rate of the Central Bank as of March 1, 2019 is 7.75%.

04/10/2019 Kilin A.V. receives wages for March, from which he has, incl. personal income tax is withheld and immediately transferred to the budget.

Calculation of material benefits for March:

100,000 x (2/3 x 7.75%): 365 x 31 = 438.82 (rub.), where

100000 – loan amount,

2/3 – the established limit on the Central Bank rate for calculating financial benefits,

7.75% – current Central Bank rate,

365 - number of days of the contract validity period,

31 calendar days in March 2022.

Personal income tax = 438.82 x 35% = 154 rubles.

We will show the reflection of transactions for the March financial benefit in section 1 (6-personal income tax for the 1st quarter), if the tax was not withheld in the reporting period. Since the tax on financial benefits was not withheld in March, line 070 and section 2 (regarding financial benefits) will remain blank.

Sample of filling out form 6-NDFL for the 1st quarter (rate 35%):

If the accrual of financial benefits took place in the last month of the reporting period, and the personal income tax amount was not withheld and, accordingly, transferred, then for this month lines 100-140 of section 2 are not filled out. The deduction will be reflected in the report of the next period.

Reflection of material benefits in 6-NDFL - example

Let's continue the previous example. Matveygoda continued to be accrued to the employee in the 2nd quarter:

- For April – 424.66 rubles. (personal income tax 35% - 149 rubles);

- For May – 438.82 rubles. (personal income tax 35% - 154 rubles);

- For June – 424.66 rubles. (personal income tax 35% - 149 rubles).

The salary for June was paid in July, so it will not be included in section 2. The data in Section 1 is reflected on an accrual basis from the beginning of the year.

How material benefits will be reflected in 6-NDFL - an example of a half-year report will be as follows:

Date of receipt of income if there is material benefit

The organization, in order to develop a new line of activity, borrowed money from an individual (resident of the Russian Federation) in February. The answer to this question is contained in the recently published letter of the Federal Tax Service of Russia dated 06/08/16 No. that the calculation of 6-NDFL is completed on the reporting date (respectively, on March 31, June 30, September 30, December 31). Section 1 of the calculation is compiled on an accrual basis for the first quarter, half a year, nine months and a year.

As of the date of filling out the calculation, the company had not yet withheld personal income tax from the benefit, so it did not reflect this tax in line 070. In section 1, the company filled out the benefits as in sample 52.

If interest on a loan provided to an individual was accrued in the first quarter of 2022, but will be paid only in the second quarter of 2022, then this operation is reflected in lines 020, 040 of section 1 of the calculation in form 6-NDFL for the first quarter of 2022.

In the next section, we will dwell on the nuances of filling out line 100, reflecting the date of receipt of income in a situation with CF.

How is this concept revealed?

This is the profit of an individual that arises from borrowed relationships. If an employee and an employer enter into such a relationship, then it is the employee who receives additional income.

Consequently, the employer is responsible for calculating and withholding income tax from the employee, as well as reflecting this information in the statements for employees in Form 6 of personal income tax. Tax agents are required to do this!

In Art. 212 of the Tax Code of the Russian Federation describes cases when a person may have additional income. This:

- Saving on interest on a loan or loan received from an employer. At the same time, the employer can be either an individual entrepreneur or a legal entity. Savings arise if the loan is issued at interest, where the rate is lower than 2/3 of the key rate of the Central Bank of the Russian Federation on the repayment date, or the loan must be interest-free;

- when purchasing securities at a price below the market price;

- when purchasing goods and services from persons who are classified as interdependent.

The material benefit is precisely the difference that arises between the “normal” and applied terms of the transaction. You must pay tax on this income at a tax rate of 35%. The employer must do this by calculating the amount of tax, calculating the amount of profit and paying it to the budget. All this information must be correctly reflected in the report.

On a note! To correctly fill out the report, it is necessary to correctly determine the date the employee received income, as well as the date of calculation and withholding of personal income tax.

The moment when the employee received additional income in the form of material benefits is reflected in line 100 of the report. This point is recognized:

- The day of purchase of a product or service from a counterparty who has the status of an interdependent party from its buyer;

- the day on which the price of securities was paid. This is relevant if the payment occurred after the ownership of these papers was registered;

- the last day of each calendar month during the entire term of the loan agreement.

When does material gain arise?

Material benefit (MB) represents income received by an individual (Article 212 of the Tax Code of the Russian Federation):

- from saving on interest for the use of borrowed funds issued to him by a legal entity or individual entrepreneur at a low interest rate;

- purchase of securities (securities) at a price below the market price;

- acquisition of goods (works, services) from interdependent persons.

Read more about each of these types of income here.

ConsultantPlus experts spoke in detail about the nuances of personal income tax taxation of material benefits. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

How to fill out a report correctly

Additional profit received under a loan agreement between an employer and an employee must be reflected throughout the entire period of validity of this agreement under all taxation systems. And since the report is submitted quarterly, profits are also reflected quarterly.

In section 1 of the report, you must separately fill in lines 010 – 050. To do this:

- Line 020 indicates the amount of funds received by a specific employee in a given reporting period. Amounts are indicated for subsequent periods on an accrual basis;

- line 040 indicates the amount of personal income tax calculated from material benefits;

- in line 070 you must indicate the value where personal income tax is included on income received, withheld from the beginning of the calendar year until the end of the current reporting period for the entire period of use. Typically this value is lower than what is indicated on line 040;

- line 080 indicates personal income tax for the year, which is calculated on 31/12 of the current year, but cannot be withheld this year.

Now you need to correctly reflect the material benefit and correctly fill out all the lines of section 2. You must indicate:

- In line 100, the last day of the calendar month when the employee received income;

- in line 110 the day on which the tax was withheld;

- in line 120 – the next date after the withholding.

On a note! The income received by the employee in December and the tax accrued on it do not need to be shown in reporting either for the current year or in the 1st quarter of the next calendar year.

How to reflect last year’s salary issued in January in form 6-NDFL

If in January you paid your employees wages for December last year, in Form 6-NDFL for the first quarter of 2016, reflect it like this. Do not include the December salary in the calculation of indicators on lines 020 and 030 of section 1. After all, it is considered received on December 31, that is, it refers to last year (clause 2 of Article 223 of the Tax Code of the Russian Federation). In section 2, fill out a separate block for this payment. In line 100, write down 12/31/2015, in line 110 - the date when the last part of the salary for December was issued and personal income tax was withheld. On line 120, enter the day after the payment date. In lines 130 and 140, reflect the accrued salary for December and personal income tax on it. You can view a sample of a fully completed form 6-NDFL on the website of the electronic magazine “Simplified” e.26-2.ru. To do this, go to the “Forms” section and type “example of filling out 6-NDFL” in the search bar. You can print the report or download it to your computer. Once you have completed your report, check yourself. The control ratios that tax authorities will use are given in a letter from the Federal Tax Service of Russia @.

Example of filling out a report

For clarity, reflecting material benefits in 6 personal income tax, an example of filling out the report is given below:

Employee P. In the 1st quarter, he received income under a loan agreement:

- January – 854 rubles;

- February – 726 rubles;

- March – 698 rubles.

Tax was charged on material benefits:

- January – 854 * 35% = 299.8 rubles;

- February – 254.1 ruble;

- March – 244.3 rubles.

The monthly salary of this employee is 45,000 rubles. Payment occurs every month - on the 07th. He receives no other income. Therefore, salary taxes for January can only be withheld in February. The same thing happens every subsequent month.

The information is reflected as follows:

Section 1 for January:

- 100 – December 31, 2016;

- 110 – 07. 01. 2017;

- 120 – 08. 01. 2022.

Section 2 for January:

- 130 – 45 000;

- 140 – 5,850 (personal income tax withheld from salary and financial benefits).

Section 1 for February:

- 100 – 31. 01. 2017;

- 110 – 07. 02. 2017;

- 120 – 08. 02. 2022.

Section 2 for February:

- 130 – 45 854;

- 140 – 6 149, 8.

Section 1 for March:

- 100 – 28. 02. 2017;

- 110 – 07. 03. 2017;

- 120 – 08. 03. 2022.

Section 2 for March:

- 130 – 45 726;

- 140 – 6 104, 1.

The remaining information on material benefits in 6 personal income taxes will already be reflected in the report for the 1st half of the year and for 9 months. A sample report is presented below.

Since the lender is a legal entity, that is, an employer, it is imperative to conclude an agreement in writing. The fact that the loan is interest-free must also be stated in it. Otherwise, tax authorities may calculate interest equal to the key rate, taking into account the provisions of the Central Bank of the Russian Federation. Then the tax consequences will arise for the employer.

Situation No. 3. You paid your salary for March in April, that is, in a different quarter

Which may raise questions.

The salary for March is considered to be actually received on the 31st day of this month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). And if you gave money to employees not in March, but in April, then the dates of tax withholding and transfer go beyond the first quarter. And it is unclear how then to reflect the March salary in the 6-NDFL form for this period.

How to fill it out correctly.

In form 6-NDFL for the first quarter, include the accrued amount in the calculation of the indicator on line 020 of section 1. Show deductions related to this salary in line 030. In line 040, write down the amount of personal income tax calculated on all income for the first quarter. But in line 070, do not reflect the tax on the March salary issued in April. This is explained in letters from the Federal Tax Service of Russia @ and dated 02/12/2016 No. BS-3-11/*****@*** The fact is that at the end of the quarter you have not yet withheld personal income tax on these incomes. In addition, do not show wages for March issued in April in section 2 of form 6-NDFL for the first quarter. Tax officials note that data about it will need to be recorded in a separate block of section 2 of form 6-NDFL for the six months.

Please note: if you fill out the form this way, the amount of income for all lines 130 of section 2 of the report for the first quarter will not coincide with the indicator in line 020 of section 1. This may raise questions from inspectors, but you can explain to them that you are acting in accordance with clarifications of the Federal Tax Service of Russia. And you do not reflect in section 2 the March salary paid in the second quarter.

And in form 6-NDFL for the six months, you will reflect your salary for March in two sections. After all, in section 1 of form 6-NDFL you enter the indicators determined by the cumulative total from the beginning of the year. And in section 2, enter only data for the last three months of the reporting period (letter from the Federal Tax Service of Russia @).

Important circumstance

In section 1 of form 6-NDFL you reflect the indicators determined on an accrual basis from the beginning of the year. And in section 2 - data for the last three months of the reporting period (letter of the Federal Tax Service of Russia dated January 1, 2001 No. BS-3-11 / [email protected] ).

Example 3. How to reflect in form 6-NDFL a salary for March issued in April

It employs 6 workers. Salary information for the first quarter of 2016 is given in the table below.

Table Salary data for the first quarter of 2016

We will show how an accountant fills out form 6-NDFL for the first quarter, if the organization did not pay any income other than wages to individuals.

In line 020 of section 1, the accountant will write down 470,000 rubles, in line 030 - 21,000 rubles. Line 040 will contain the calculated personal income tax on the entire salary for the first quarter - 58,370 rubles. And in line 070 only the tax withheld from payments for January and February is 38,480 rubles. (RUB 18,590 + RUB 19,890). And section 2 will reflect only the payment of wages for January and February. A fragment of form 6-NDFL is shown on the right.

Situation No. 5. You issued an interest-free loan to an employee

Which may raise questions.

You, as a tax agent, withhold personal income tax from material benefits on an interest-free loan (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation). And you calculate the tax on this income at a rate of not 13, but 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation). Since 2016, a new rule has been in force: you must accrue material benefits and personal income tax on it on the last day of each month when the employee used borrowed funds (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). And it is unclear exactly what amounts to write down in this case in form 6-NDFL.

How to fill it out correctly.

Complete separate sections 1 and 2 for income taxed at a rate of 35%. These include material benefits from interest-free loans. Indicate income in the form of material benefits in line 020, and in line 040 - the calculated tax. You will fill out lines 060 - 090 only in the first section 1 for the organization as a whole. In line 100 of section 2, write down the date of receipt of income - the last day of the month (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). And in line 110 - the date when you withheld personal income tax from the next cash payment to the employee. And material benefits can be calculated using the formula:

If the loan is interest-free, substitute 0 for the loan rate. And the refinancing rate from the beginning of the year is equal to the key rate and is equal to 11% (Instruction of the Central Bank of the Russian Federation dated December 11, 2015 and information of the Central Bank of the Russian Federation dated July 31, 2015).

On a note

Income that is subject to personal income tax at a rate of 35 or 15% is reflected in separate sections 1 and 2 of form 6-NDFL (clause 3.2 of the Filling Out Procedure).

We emphasize once again that material benefits must be calculated and personal income tax must be calculated on it on the last day of each month when the employee used borrowed funds.

Example 5. How to reflect material benefits from an interest-free loan in the calculation of 6-NDFL

issued an interest-free loan to an employee in the amount of 100,000 rubles on March 1, 2016. On March 31, 2016, the accountant calculated income in the form of material benefits. Its amount was 621.13 rubles. (RUB 100,000 × 2/3 × 11%: 366 days × × 31 days). Personal income tax in the amount of 217 rubles. (RUB 621.13 × 35%) was withheld on the same day from other payments to the employee.

Let's see how the accountant reflected income in the form of material benefits in the calculation of 6-NDFL. No other income taxed at a rate of 35% was paid.

The accountant will fill out separate sections 1 and 2 in form 6-NDFL for income taxed at a rate of 35%. In line 010 of section 1 he will enter a rate of 35%, in line 020 - 621.13 rubles, in lines 040 and 070 - 217 rubles. And in section 2 it will indicate in lines 100 and 110 - 03/31/2016, in line 120 it will be 04/01/2016. In lines 130 and 140, the accountant will put 621.13 rubles. and 217 rub. A completed fragment of form 6-NDFL is shown above.

Nuances requiring special attention

Section 2 in form 6-NDFL consists of separate blocks of lines 100-140. In each, you reflect data on payments that have the same receipt date and personal income tax withholding date, as well as the tax payment deadline. If payments to employees have different dates and deadlines, you fill out separate blocks for them.

Payments that are subject to personal income tax, if they exceed the limit, you reflect in form 6-NDFL. And those remunerations that are not subject to personal income tax, regardless of the amount, do not include in the report.

If you paid your salary for March in April, write it down in Form 6-NDFL for the first quarter only in section 1. In section 2 you will reflect it in the half-year report.