Adjustment of 6-NDFL may be necessary if the tax agent makes errors in the Calculation. Responsibility for shortcomings in this reporting form lies with the person performing the functions of a tax agent (for example, an employer) - penalties for the agent’s errors do not apply to taxpayers (recipients of income). If inaccurate information is found in the submitted calculation, you must promptly make changes to the document, because if the error is discovered by the tax inspector during a desk audit, it will not be possible to avoid a fine.

Errors in 6-NDFL

When calculating personal income tax, an accountant may make minor technical shortcomings or significant errors, which result in a distortion of the amount of the tax liability. If a violation of control ratios is detected, incl. inter-documentary (for similar indicators in 6-NDFL and 2-NDFL), the tax office will send the employer a request for clarification. If inaccurate information is reflected in the income tax calculation, at the next stage a “clarification” is submitted for 6-NDFL in accordance with the requirements of Art. Tax Code of the Russian Federation.

What violations occur most often when submitting the Calculation:

- errors that caused an overstatement or understatement of the tax amount, incorrect application of the personal income tax rate, etc.;

- indication of an incorrect number of personnel - this parameter can be checked by comparing the number of 2-NDFL certificates submitted to the tax authority for the same annual period;

- the amount of income or tax in the calculation differs from the amount of income accruals and personal income tax based on the results of all 2-NDFL certificates submitted to the Federal Tax Service;

- discrepancies in the amount of dividend payments during inter-documentary reconciliation of 6-NDFL and 2-NDFL;

- typos, errors on the title page of the report (incorrect TIN, name, etc.), in which the calculation will not be accepted by the Federal Tax Service.

How to submit a revised (adjustment) calculation correctly

The algorithm for submitting an adjustment calculation is not fundamentally different from providing the primary version of the document. However, there are a number of important features that characterize this procedure.

When preparing clarification on 6-NDFL, you need to keep in mind that:

- The update is submitted in the form that was used in the tax period for which the primary document was sent (clause 5 of Article 81 of the Tax Code of the Russian Federation).

The form of form 6-NDFL was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. However, it was amended by order of the Federal Tax Service dated October 15, 2020 No. ММВ-7-11/ [email protected] The updated form will come into force starting with reporting for the first quarter of 2022. The main change in it is the combination of forms 6-NDFL and 2-NDFL in one document.

- For a company with 10 employees or more, the 6-NDFL update, as well as the primary version of the calculation, is submitted electronically.

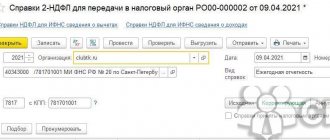

- The 6-NDFL adjustment is filled out in full, as if the primary calculation was sent to the Federal Tax Service. However, the title page of the clarification form must contain the correction number - 001, 002, etc.

Thus, clarification on 6-NDFL can be submitted to the Federal Tax Service, and more than once. And in some cases it is even provided in several copies at the same time. Let's study in more detail when exactly.

6-NDFL adjustment - how to do it?

If inaccurate data is identified in the Income Tax Calculation, it must be adjusted for the period in which the error first appeared. Since 6-NDFL in section 1 reflects accrual data cumulatively from the beginning of the tax year, it may be necessary to provide “clarifications” for several reporting periods.

Adjustment 6-NDFL is compiled according to the form template that was in effect at the time the initial report was submitted.

How to correct 6-NDFL if the error is the incorrect reflection of the checkpoint or OKTMO code in the primary report? In this case, it is necessary to draw up two new Calculations (the recommendation is given in the Letter of the Federal Tax Service dated August 12, 2016 No. GD-4-11/14772):

- re-make the primary Calculation with the adjustment number “000”, all entered indicators and the correct checkpoints, OKTMO;

- provide an updated Calculation with the adjustment code “001” and the initially specified incorrect details (KPP, OKTMO), but with zero numerical indicators, this action will cancel the previously submitted erroneous reporting.

If, after submitting the report, errors are found in 6-NDFL, how to correct the incorrect amounts in the initial calculation? Here you need to follow the following algorithm:

- a new report is filled out for the period in which the deficiency was detected, but with the correct data;

- the title page contains the correction number in a three-digit numeric format, for example, “001”, if the “clarification” is submitted for the first time for a specific time interval; There you must also indicate which period is being adjusted (line “Submission period (code)” and “Tax period (year)”);

- Next, you need to enter the correct data into the calculation sections, that is, fill out the report again, putting in the correct information instead of the erroneous information; Moreover, all data is entered in full, and not just those that are corrected.

Deadlines for filing 6-NDFL and responsibility for failure to submit

Form 6-NDFL is a type of tax return that all employers who are participants in business activities are required to submit.

Declaration 6-NDFL was introduced by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7–11/

The following persons are required to submit a 6-NDFL report:

- individual entrepreneurs;

- commercial and government organizations;

- individuals who have labor relations with citizens of our country, but are not individual entrepreneurs (lawyers, notaries, etc.).

Notaries as employers are also tax agents required to file a 6-NDFL declaration

The document is drawn up for all citizens who received income from the tax agent:

- earnings under employment contracts;

- remuneration under civil contracts;

- dividends, etc.

Table: structure of the 6-NDFL declaration

| Name | Content |

| Title page | The title page displays the following information:

|

| Section I | The section records the final amount of accrued tax for a certain period and the number of individuals who received income. |

| Section II | The dates and amounts of income actually received and personal income tax withheld are reflected. |

The tax agent details are recorded on the title page.

Declaration 6-NDFL provides information on whether taxpayers pay personal income tax in full and on time. The absence of employees for a business entity implies that there is no need to file 6-NDFL. However, in this case, a report with zero indicators is often submitted.

The tax office may not have information that an organization or individual entrepreneur is not a tax agent, and will wait for the receipt of the 6-NDFL calculation. And if it is not received within a certain period, then penalties will follow.

In this case, the business entity can do the following:

- inform the tax service in writing that he is not required to submit a 6-NDFL report;

- submit a report with zero indicators.

Payers have the opportunity to submit a zero report in order to avoid various kinds of problems with the Federal Tax Service

Reporting is submitted quarterly. The deadline for submission is the last day of the month following the reporting quarter. As in all similar cases, the rule is used to postpone the reporting day if it falls on a weekend or holiday. The deadline for submitting annual reports is the last day of the month of the first quarter of the reporting year.

The legislation sets deadlines for filing tax returns 6-NDFL

If taxpayers do not submit a declaration or do not meet the stipulated deadlines, they will be subject to penalties in the amount of 1 thousand rubles. for a month of delay.

Failure to submit a 6-NDFL report on time will result in fines, the amount of which will depend on the number of months of delay.

The report will not be accepted at all in the following situations:

- the title page contains incorrect details of the tax agent (TIN, name, full name);

- The Federal Tax Service code is indicated incorrectly;

- The reporting period code is incorrect.

If a business entity delays submitting reports for more than 10 days, then the regulatory authorities may block its current account.

Declaration 6-NDFL is submitted to the tax authorities:

- for individual entrepreneurs - at their place of residence;

- for organizations - at their location.

Adjusting the 6-NDFL report using an example

After submitting the annual Calculation 6-NDFL for 2022, a discrepancy was identified between the Calculation and the 2-NDFL certificates regarding the amounts of accrued income and income tax (both calculated and withheld). 6-NDFL data showed underestimated amounts of the enterprise's tax obligations to the budget (the amount of income was indicated as 660,000 rubles, the calculated tax was 85,800 rubles). It turned out that the accountant did not take into account when compiling the semi-annual 6-personal income tax the payment to the dismissed employee made on June 19, 2018 (income in the amount of 77,800 rubles and tax in the amount of 10,114 rubles).

In this regard, you will have to submit an updated 6-NDFL for six months, 9 months and a year. At the same time, in the semi-annual report, the amendments will be in sections 1 and 2, and in subsequent periods the adjustments will affect only section 1 (increasing the value of lines 020, 040 and 070).

Here is the procedure for processing 6-NDFL for the six months, taking into account corrections:

- correction number “001” is indicated on the title page;

- period code – “31” (half-year), tax period – “2018”;

- in line 020 of the primary report there was an income amount of 660,000 rubles, it must be replaced with the value of 737,800 rubles. (660,000 + 77,800);

- in line 040 the original tax amount is 85,800 rubles, you should indicate the correct value - 95,914 rubles. (85,800 + 10,114);

- in line 070 72,800 rubles were indicated, you need to enter 82,914 rubles. (72,800 + 10,114);

- in section 2, you should fill out an additional block - in columns 100 and 110 you need to show the date of payment of the calculation to the resigning employee and tax withholding (06/19/2018), in field 120 the due date for paying the tax (06/20/2018) is entered, in field 130 the amount not previously taken into account is entered income (77,800), and line 140 records the withheld tax (RUB 10,114).

For what period is the clarifying form drawn up?

According to generally accepted rules, a revised report is prepared for the same period as the previous version containing errors. For example, if an accountant finds a blot on the form for the 1st quarter of 2018, he needs to provide the tax authorities with information for the same three months.

When compiling corrections for fiscal authorities, it is necessary to take into account that the data is taken on an accrual basis. This means that if an adjustment to 6-NDFL is submitted for the 1st quarter of 2022, incorrect information may also be contained in the forms for subsequent periods: for half a year, nine months. To avoid penalties from the Federal Tax Service, you need to submit reports for each of the specified quarters.

6-NDFL adjustment - fines

If the tax agent independently identifies the presence of inaccurate data in the income tax calculation before the deadline for submitting such reports for a specific period, or before the tax authorities discover this, filing a clarifying form will not entail the accrual of penalties. If the error is identified by Federal Tax Service inspectors as a result of a desk audit, it will be considered unreliable information, for which the business entity will be fined in the amount of 500 rubles. Such a penalty for submitting false information to the tax authority is provided for by the norms of paragraph 1 of Art. 126.1 Tax Code of the Russian Federation.

If the report was not accepted by the inspectorate and, after corrections, is submitted again as a primary report, this must be done within the time allotted for filing 6-NDFL for the corresponding period, otherwise you may receive a fine in the amount of 1000 rubles for late submission of the report.

for each overdue month, including incomplete ones (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.